Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help FUDICI! nition At the end of 2002, Graylevy Machining, hired Mary Lou Morris to manage one of its troubled divisions. Mary Lou had

Please help

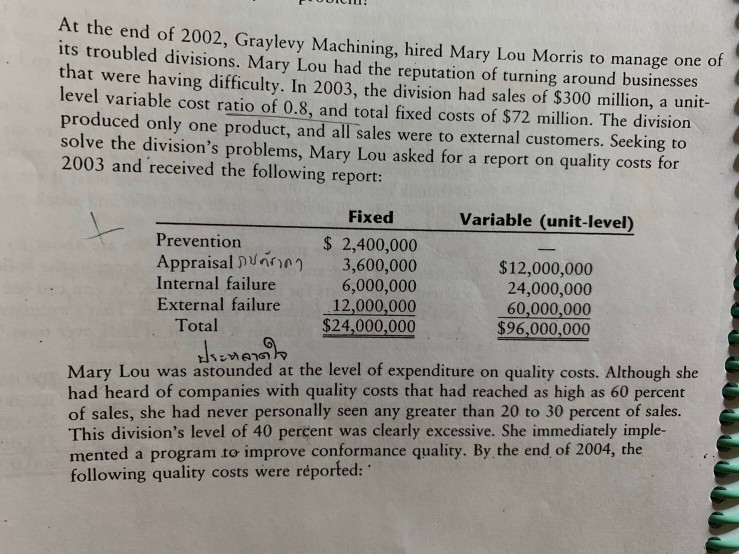

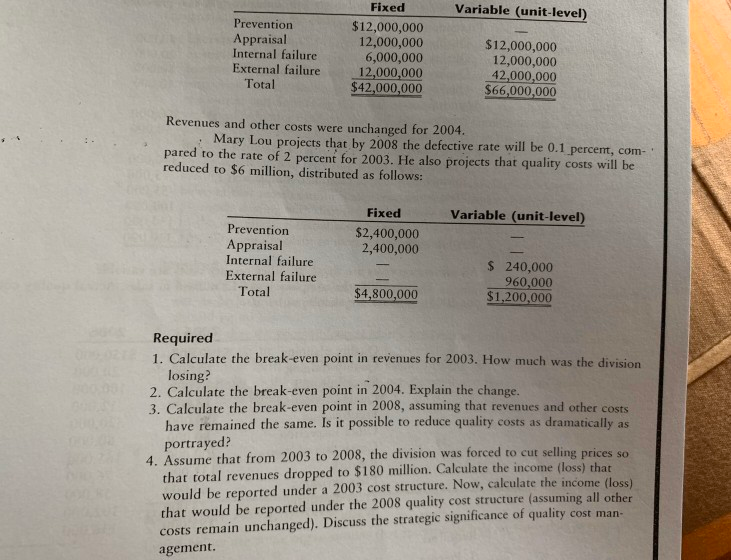

FUDICI! nition At the end of 2002, Graylevy Machining, hired Mary Lou Morris to manage one of its troubled divisions. Mary Lou had the reputation of turning around businesses that were having difficulty. In 2003, the division had sales of $300 million, a unit- level variable cost ratio of 0.8, and total fixed costs of $72 million. The division produced only one product, and all sales were to external customers. Seeking to solve the division's problems, Mary Lou asked for a report on quality costs for 2003 and received the following report: Fixed Variable (unit-level) Prevention $ 2,400,000 Appraisal 3,600,000 $12,000,000 Internal failure 6,000,000 24,000,000 External failure 12,000,000 60,000,000 $24,000,000 $96,000,000 Mary Lou was astounded at the level of expenditure on quality costs. Although she had heard of companies with quality costs that had reached as high as 60 percent of sales, she had never personally seen any greater than 20 to 30 percent of sales. This division's level of 40 percent was clearly excessive. She immediately imple- mented a program to improve conformance quality. By the end of 2004, the following quality costs were reported: Total Variable (unit-level) Prevention Appraisal Internal failure External failure Total Fixed $12,000,000 12,000,000 6,000,000 12,000,000 $42,000,000 $12,000,000 12,000,000 42,000,000 $66,000,000 Revenues and other costs were unchanged for 2004. Mary Lou projects that by 2008 the defective rate will be 0.1 percent, com pared to the rate of 2 percent for 2003. He also projects that quality costs will be reduced to $6 million, distributed as follows: Variable (unit-level) Fixed $2,400,000 2,400,000 Prevention Appraisal Internal failure External failure Total $ 240,000 960,000 $1,200,000 $4,800,000 Required 1. Calculate the break-even point in revenues for 2003. How much was the division losing? 2. Calculate the break-even point in 2004. Explain the change. 3. Calculate the break-even point in 2008, assuming that revenues and other costs have remained the same. Is it possible to reduce quality costs as dramatically as portrayed? 4. Assume that from 2003 to 2008, the division was forced to cut selling prices so that total revenues dropped to $180 million. Calculate the income (loss) that would be reported under a 2003 cost structure. Now, calculate the income (loss that would be reported under the 2008 quality cost structure (assuming all other costs remain unchanged). Discuss the strategic significance of quality cost man agementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started