Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help!!! Gain on the sale of an arrowhead collection (acquired as an investment at different times but all pieces have been held for more

Please help!!!

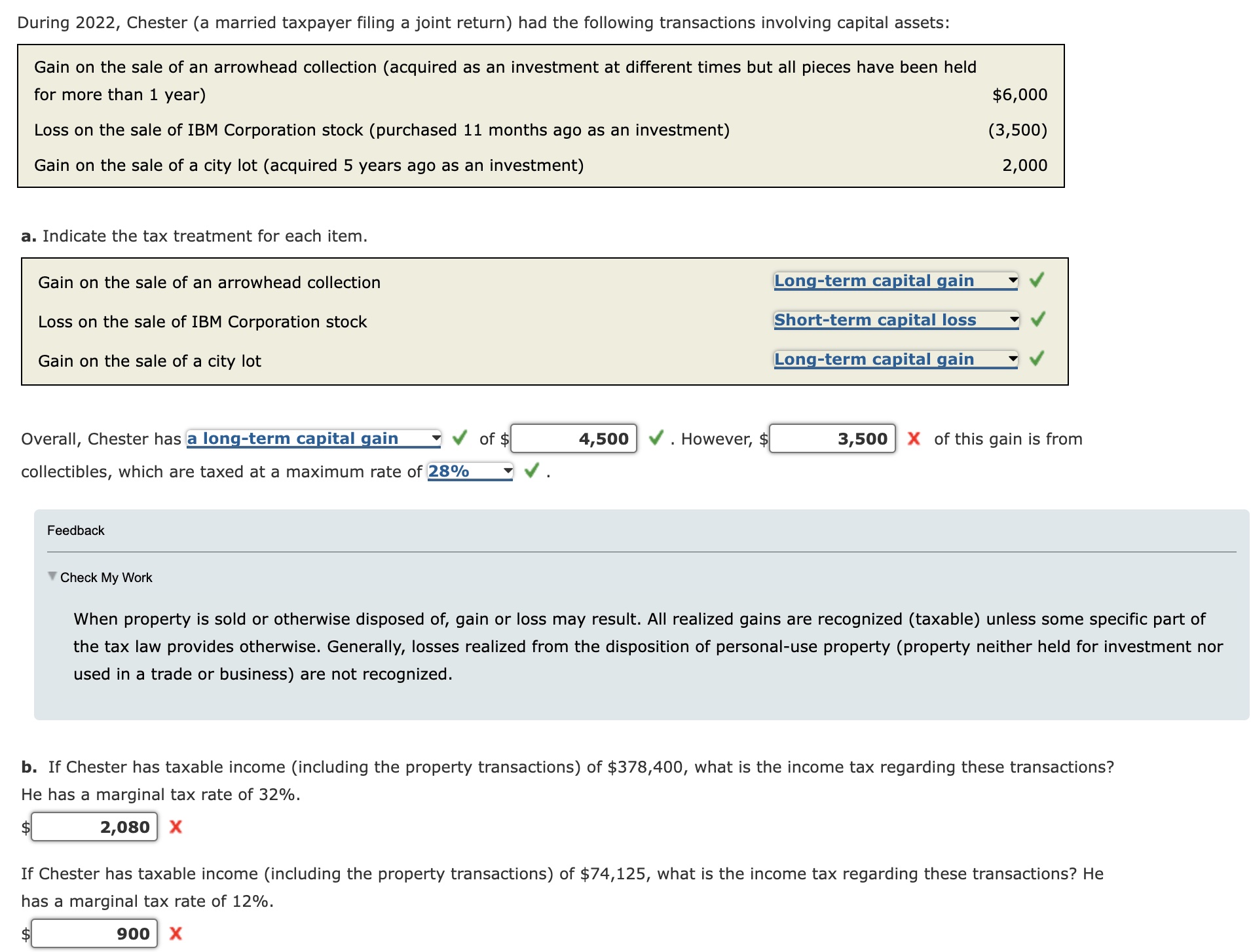

Gain on the sale of an arrowhead collection (acquired as an investment at different times but all pieces have been held for more than 1 year) $6,000(3,500)2,000 a. Indicate the tax treatment for each item. Gain on the sale of an arrowhead collection Loss on the sale of IBM Corporation stock Gain on the sale of a city lot Overall, Chester has of $ . However, $ X of this gain is from collectibles, which are taxed at a maximum rate of Feedback Check My Work When property is sold or otherwise disposed of, gain or loss may result. All realized gains are recognized (taxable) unless some specific part of the tax law provides otherwise. Generally, losses realized from the disposition of personal-use property (property neither held for investment nor used in a trade or business) are not recognized. b. If Chester has taxable income (including the property transactions) of $378,400, what is the income tax regarding these transactions? He has a marginal tax rate of 32%. $ X If Chester has taxable income (including the property transactions) of $74,125, what is the income tax regarding these transactions? He has a marginal tax rate of 12%. $ XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started