please help!!

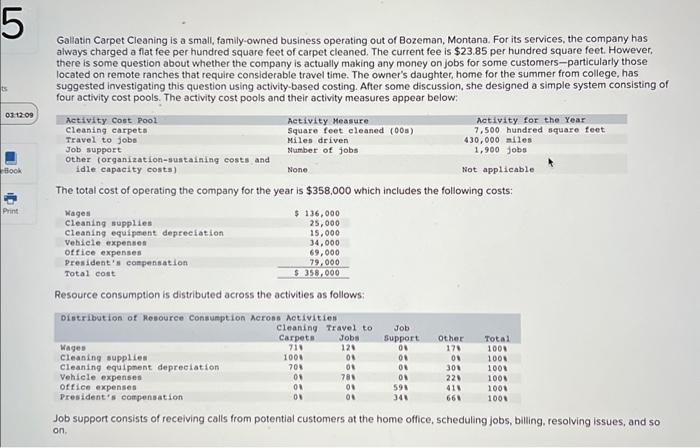

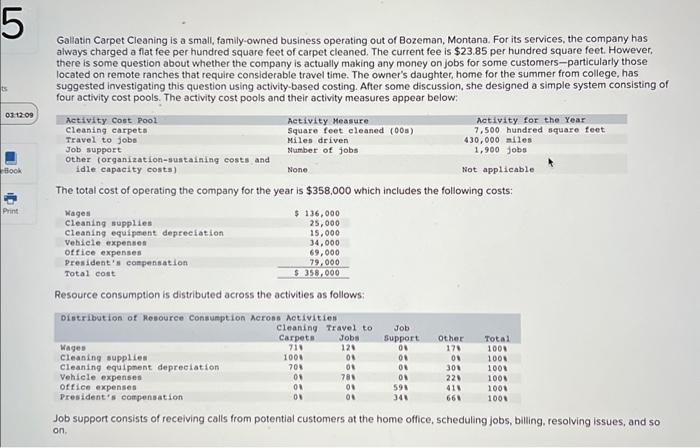

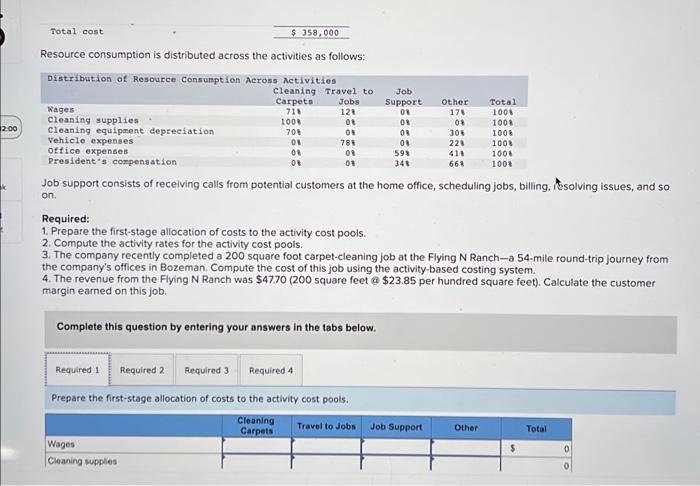

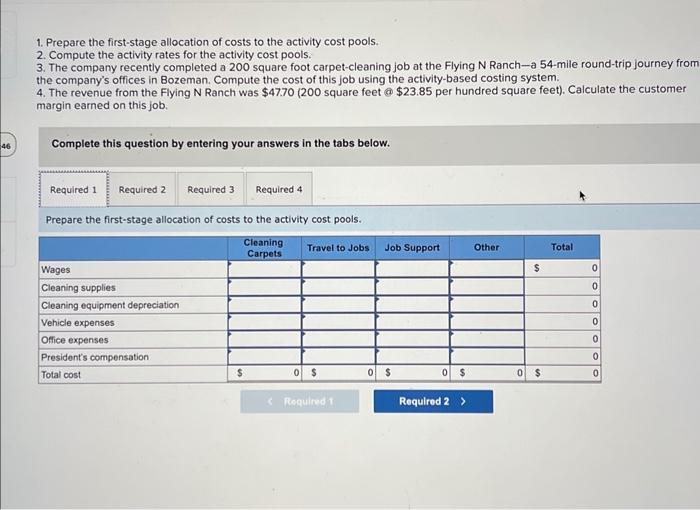

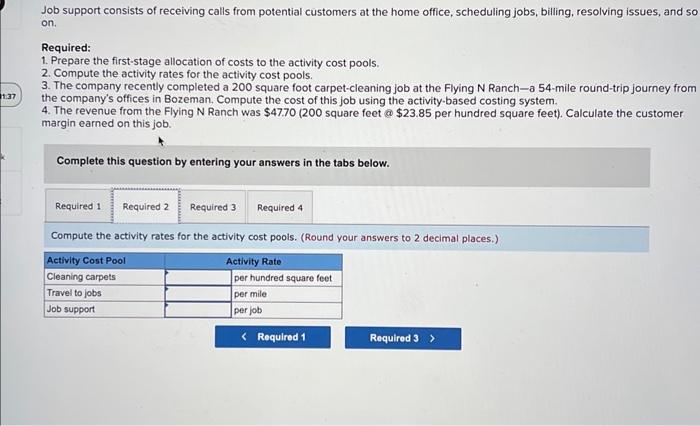

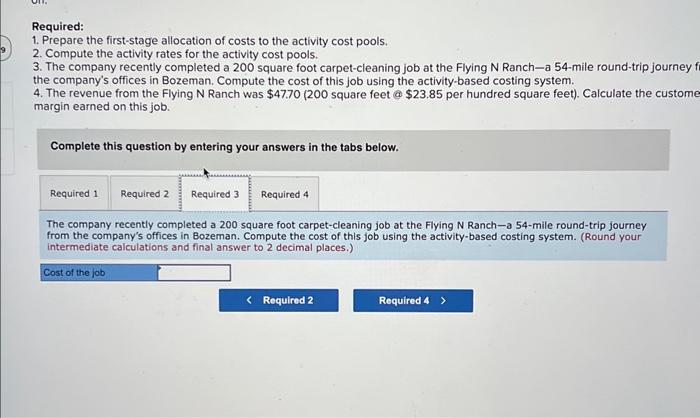

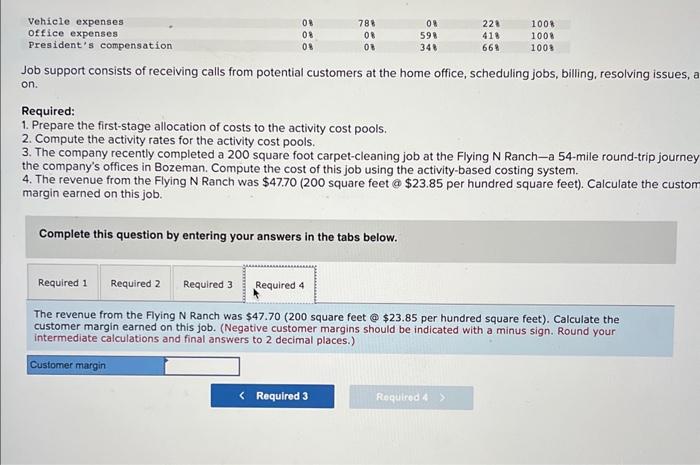

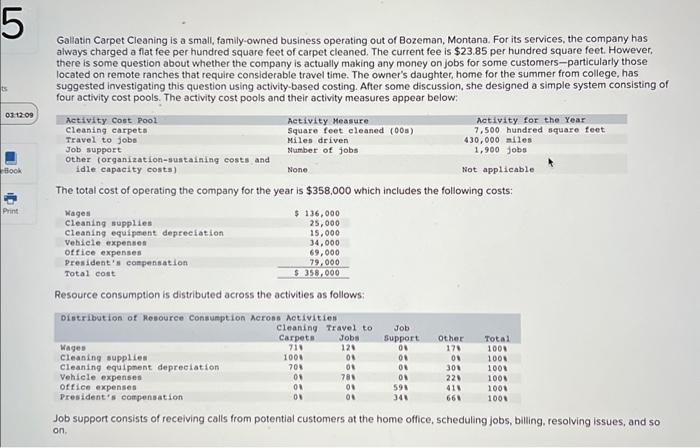

Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $23.85 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: The total cost of operating the company for the year is $358,000 which includes the following costs: Resource consumption is distributed across the activities as follows: Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, and so on. Resource consumption is distributed across the activities as follows: Job support consists of recelving calls from potential customers at the home office, scheduling jobs, billing. thsolving issues, and so on. Required: 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 54 -mile round-trip journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Flying N Ranch was $47.70 (200 square feet a$23.85 per hundred square feet). Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. Prepare the first-stage allocation of costs to the activity cost pools. 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 54 -mile round-trip journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Flying N Ranch was $47.70 (200 square feet @ $23.85 per hundred square feet). Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. Prepare the first-stage allocation of costs to the activity cost pools. Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, and sc on. Required: 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 54 -mile round-trip journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Flying N Ranch was $47.70 (200 square feet @$23.85 per hundred square feet). Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. Compute the activity rates for the activity cost poois. (Round your answers to 2 decimal places.) Required: 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 54-mile round-trip journey the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Flying N Ranch was $47.70 (200 square feet @$23.85 per hundred square feet). Calculate the custom margin earned on this job. Complete this question by entering your answers in the tabs below. The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 54-mile round-trip journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. (Round your intermediate calculations and final answer to 2 decimal places.) Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, on. Required: 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 54 -mile round-trip journey the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Flying N Ranch was $47.70 (200 square feet @ $23.85 per hundred square feet). Calculate the custom margin earned on this job. Complete this question by entering your answers in the tabs below. The revenue from the Flying N Ranch was $47.70 (200 square feet @ $23.85 per hundred square feet). Calculate the customer margin earned on this job. (Negative customer margins should be indicated with a minus sign. Round your intermediate calculations and final answers to 2 decimal places.)