please help

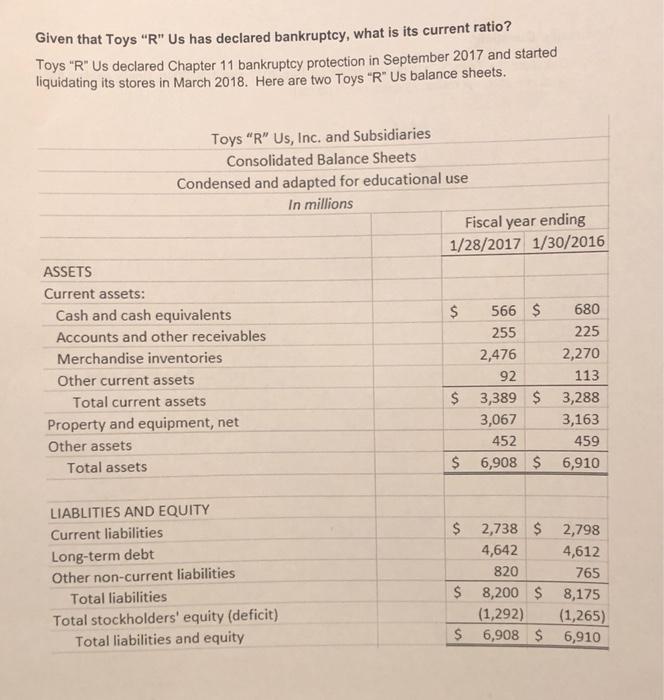

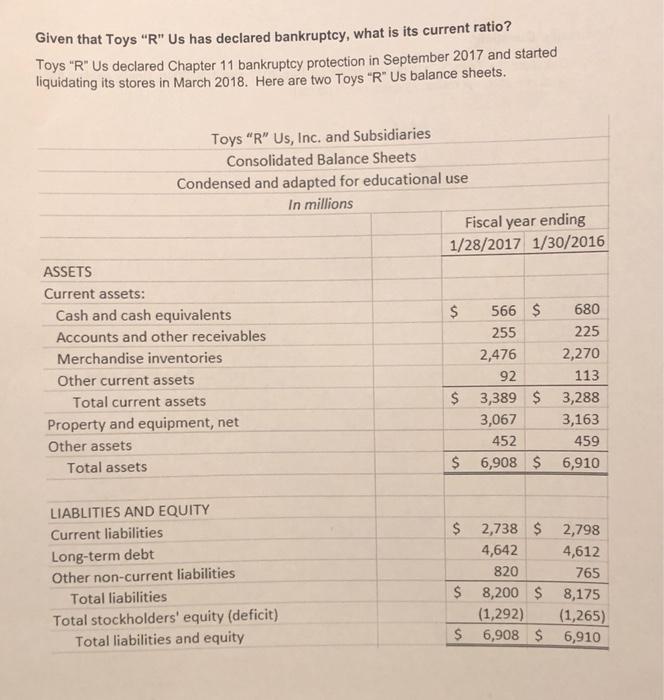

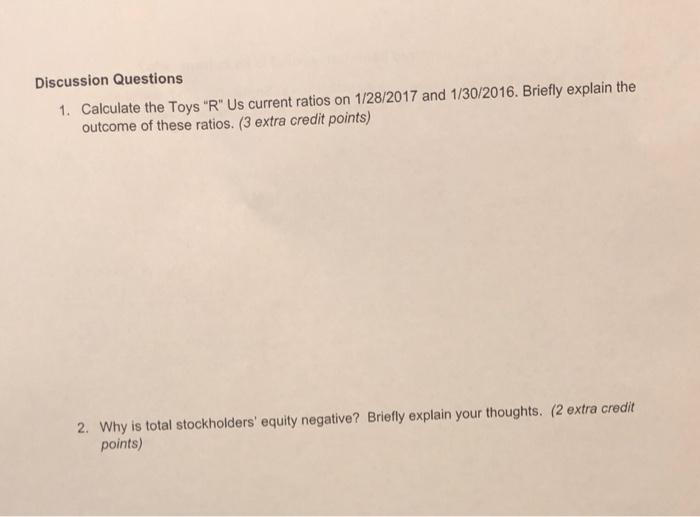

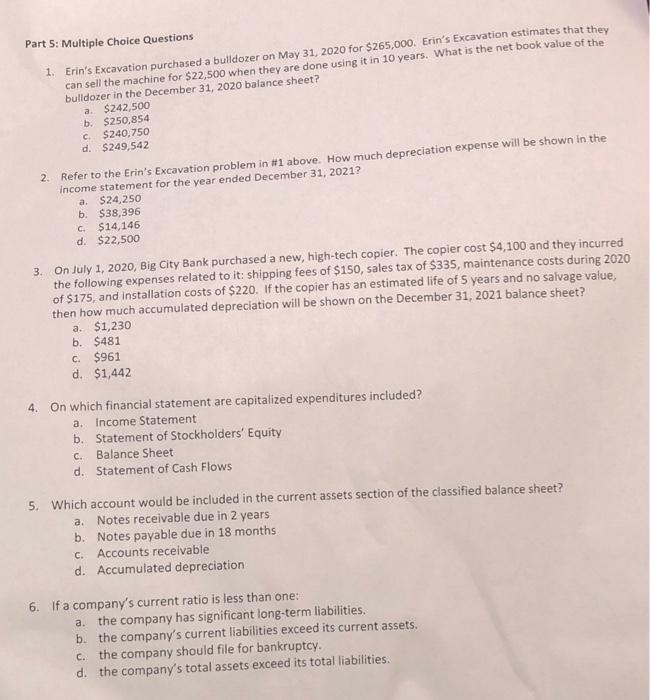

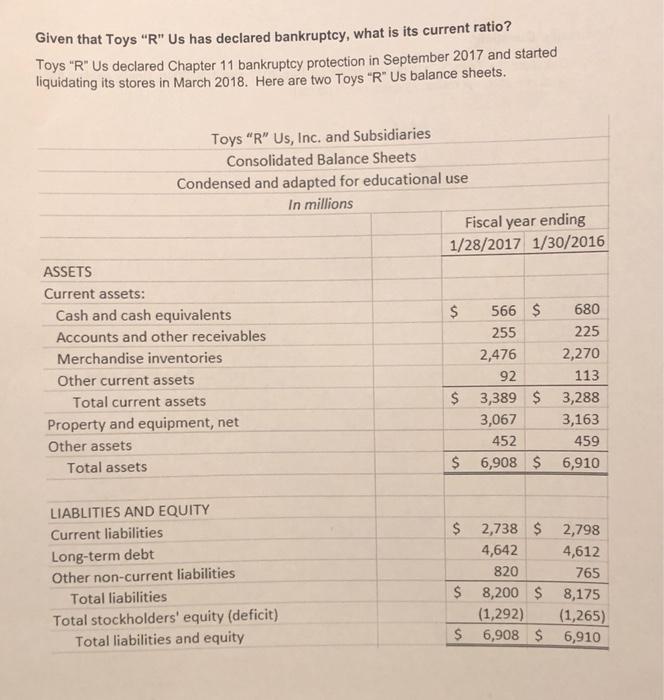

Given that Toys R Us has declared bankruptcy, what is its current ratio? Toys "R"Us declared Chapter 11 bankruptcy protection in September 2017 and started liquidating its stores in March 2018. Here are two Toys"R"Us balance sheets. Toys "R" Us, Inc. and Subsidiaries Consolidated Balance Sheets Condensed and adapted for educational use In millions Fiscal year ending 1/28/2017 1/30/2016 ASSETS Current assets: Cash and cash equivalents $ 566 $ 680 Accounts and other receivables 255 225 Merchandise inventories 2,476 2,270 Other current assets 92 113 Total current assets $ 3,389 $ 3,288 Property and equipment, net 3,067 3,163 Other assets 452 Total assets $ 6,908 $ 6,910 459 LIABLITIES AND EQUITY Current liabilities Long-term debt Other non-current liabilities Total liabilities Total stockholders' equity (deficit) Total liabilities and equity $ 2,738 $ 2,798 4,642 4,612 820 765 $ 8,200 $ 8,175 (1,292) (1,265) $ 6,908 $ 6,910 Discussion Questions 1. Calculate the Toys"R" Us current ratios on 1/28/2017 and 1/30/2016. Briefly explain the outcome of these ratios. (3 extra credit points) 2. Why is total stockholders' equity negative? Briefly explain your thoughts. (2 extra credit points) Part 5: Multiple Choice Questions 1. Erin's Excavation purchased a bulldozer on May 31, 2020 for $265,000. Erin's Excavation estimates that they can sell the machine for $22,500 when they are done using it in 10 years. What is the net book value of the bulldozer in the December 31, 2020 balance sheet? a. $242,500 b. $250,854 $240,750 d. $249,542 c 2. Refer to the Erin's Excavation problem in #1 above. How much depreciation expense will be shown in the income statement for the year ended December 31, 2021? a $24,250 b $38,396 $14,146 d $22,500 C 3. On July 1, 2020, Big City Bank purchased a new, high-tech copier. The copier cost $4,100 and they incurred the following expenses related to it: shipping fees of $150, sales tax of $335, maintenance costs during 2020 of $175, and installation costs of $220. If the copier has an estimated life of 5 years and no salvage value, then how much accumulated depreciation will be shown on the December 31, 2021 balance sheet? a. $1,230 b. $481 $961 d. $1,442 C. 4. On which financial statement are capitalized expenditures included? a. Income Statement b. Statement of Stockholders' Equity Balance Sheet d. Statement of Cash Flows C. 5. Which account would be included in the current assets section of the classified balance sheet? a. Notes receivable due in 2 years b. Notes payable due in 18 months c. Accounts receivable d. Accumulated depreciation 6. If a company's current ratio is less than one: a. the company has significant long-term liabilities. b. the company's current liabilities exceed its current assets. the company should file for bankruptcy. d. the company's total assets exceed its total liabilities. C