please help!!!

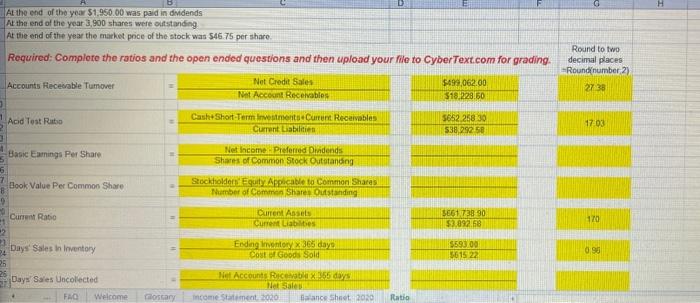

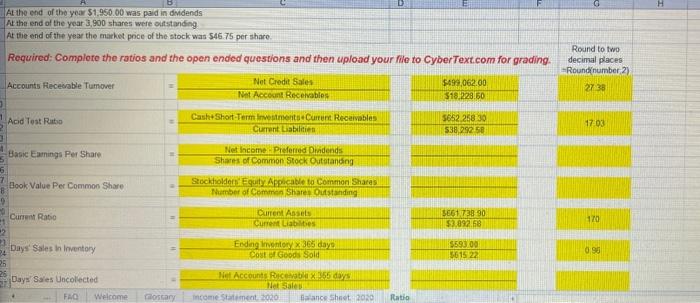

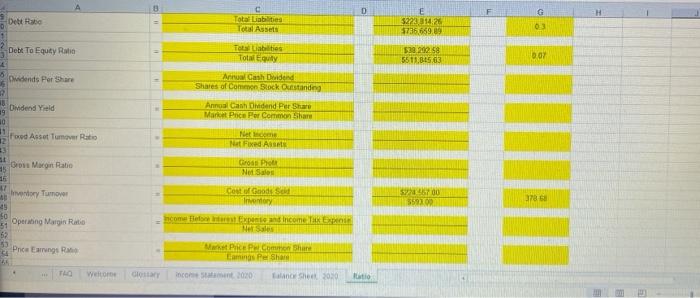

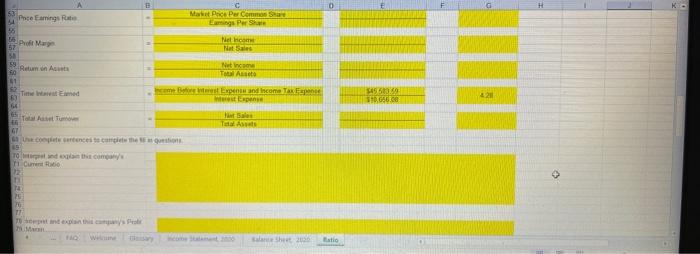

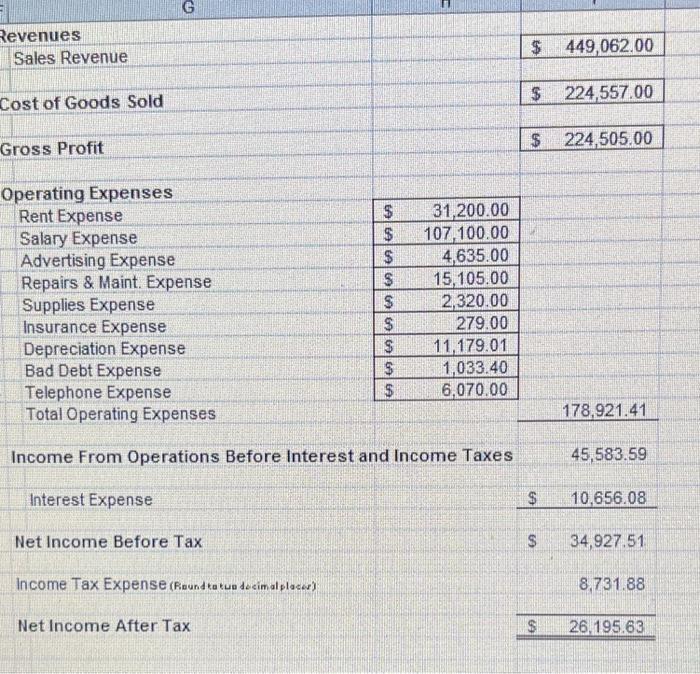

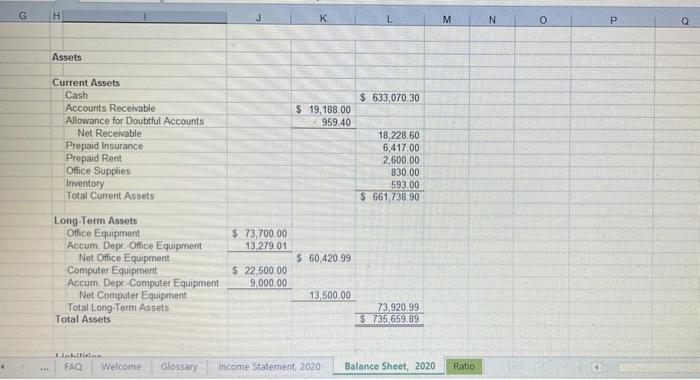

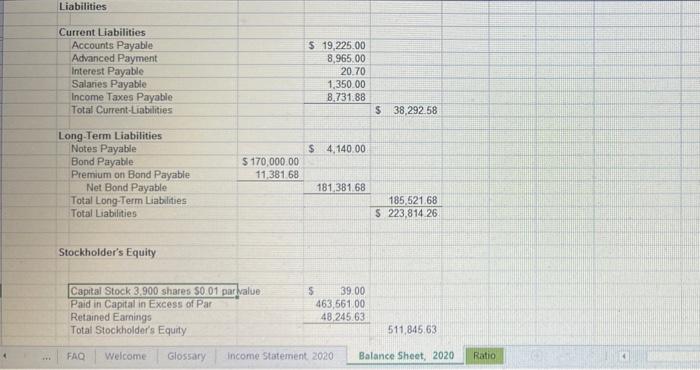

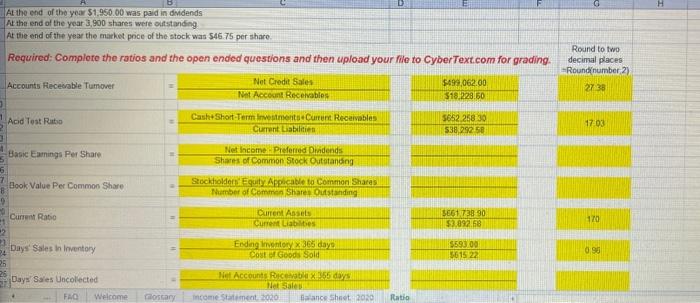

H At the end of the year $1.950.00 was paid in dividends At the end of the year 3.900 shares were outstanding At the end of the year the market price of the stock was $46.75 per share Required: Complete the ratios and the open ended questions and then upload your file to CyberText.com for grading. Round to two decimal places Round number 2) 2738 Accounts Recevable Tumover Net Credit Sales Nat Account Receivable $499,062.00 $18.228.50 Acid Test Ratio Cash+Short-Term Investments Current Receivables Current Labin 5652 25830 538.292 58 17:03 Net Income Preferred Didends Shares of Common Stock Outstanding 5 Basic Earnings Per Share 6 7 Book Value Per Common Share B 9 Current Ratio StockholdersEquity Applicable to common Shares Number of Common Share outstanding Current Assets Current Liabilities 5861738 90 $3.892.68 170 Ending livets x 365 days Cost of Goods Sold $593 00 5615 22 0.93 Days Sales in Inventory 24 25 225 Days Sales Uncollected FAG Welcome Net Accounts Rice 55 Net Sales come Statement 2020 Balance Sheet 2020 Glossary Ratio D G H Dettato Total Liabilities Total Assets E $223,014 5735 659.00 03 Debt To Equity Ratio Total Liabilities Total Ewy 529.212.58 5511.05.03 0.07 5 Dividends Per Share Annual Cash Dividend Shares of Common Stock Outstanding Annual Canh Dividend Per Share Market Pace Por Common Share 18 9 Dividend Yield 30 12 Food Asset Tumor Ratio Net son Net Fixed As Gross Door Ne Sais SI 25 G Megint Ratio 16 Bory Tumor 45 50 Operating Margin Ratio 00 5592.00 2786 Cost of Goods wory income expense and income Ness 53 Price Earns 4 TO PEP.Com Share Camings Per Shad Weito Gotary incont 2020 Lanche 2030 Ito Pne aming Rate 55 Mart Pace Per Common Seat Eigs Per San 57 Notes 59 so Return Austa TA nem Epe com a 155239 SE GOED 42 Tin West med 66 Tovun Title Total concesto came to To the com T1 Current 25 inter IM Shit Eatio G Revenues Sales Revenue $ 449,062.00 $ 224,557,00 Cost of Goods Sold $ 224,505.00 Gross Profit Operating Expenses Rent Expense Salary Expense Advertising Expense Repairs & Maint. Expense Supplies Expense Insurance Expense Depreciation Expense Bad Debt Expense Telephone Expense Total Operating Expenses $ $ $ $ $ $ $ 31,200.00 107,100.00 4,635.00 15,105.00 2,320.00 279.00 11,179.01 1,033.40 6,070.00 178,921.41 Income From Operations Before Interest and Income Taxes 45,583.59 Interest Expense $ 10,656.08 Net Income Before Tax S 34,927.51 Income Tax Expense (Roundtatue decimal plaer) 8,731.88 Net Income After Tax $ 26.195.63 G H M N o Assets $ 633,070 30 $ 19,188.00 959.40 Current Assets Cash Accounts Receivable Allowance for Doubtful Accounts Net Receivable Prepaid Insurance Prepaid Rent Office Supplies Inventory Total Current Assets 18, 228,60 6,417.00 2,600.00 830.00 593.00 $ 661,738.90 $ 73,700.00 13,279.01 $ 60,420.99 Long Term Assets Office Equipment Accum. Dept. Office Equipment Net Office Equipment Computer Equipment Accum Depr Computer Equipment Net Computer Equipment Total Long-Term Assets Total Assets $ 22,500.00 9,000.00 13,500.00 73.920.99 $ 735 659.89 LA FAQ Welcome Glossary * Income Statement 2020 Balance Sheet, 2020 Ratio Liabilities Current Liabilities Accounts Payable Advanced Payment Interest Payable Salanes Payable Income Taxes Payable Total Current-Liabilities $ 19,225.00 8,965.00 20.70 1,350.00 8.731.88 $ 38,292.58 $ 4.140.00 Long-Term Liabilities Notes Payable Bond Payable Premium on Bond Payable Net Bond Payable Total Long-Term Liabilities Total Liabilities $ 170,000.00 11,381 68 181 381 68 185,521.68 S 223,814 26 Stockholder's Equity Capital Stock 3.900 shares So 01 par value Paid in Capital in Excess of Par Retained Earnings Total Stockholder's Equity 5 39.00 463,661 00 48,245.63 511,845,63 FAQ Welcome Glossary FIE income Statement 2020 Balance Sheet, 2020 Ratio