please help! have posted multiple times and keep getting "not clear images"

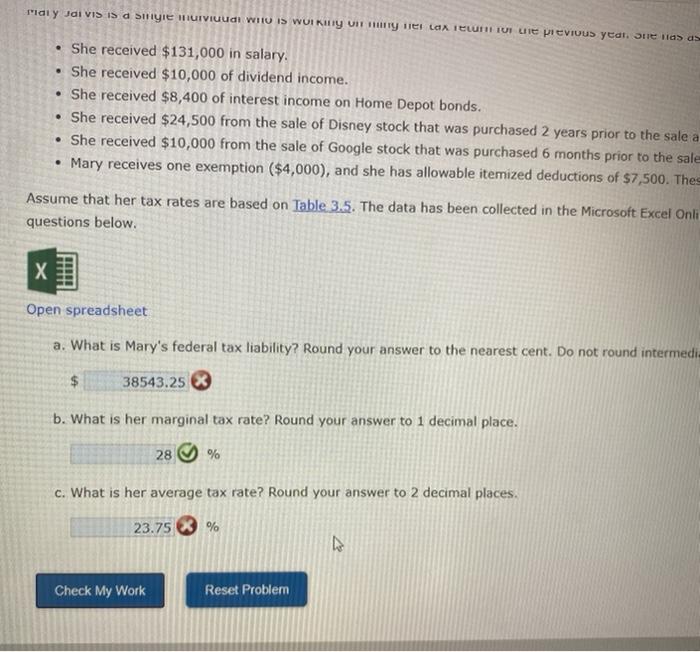

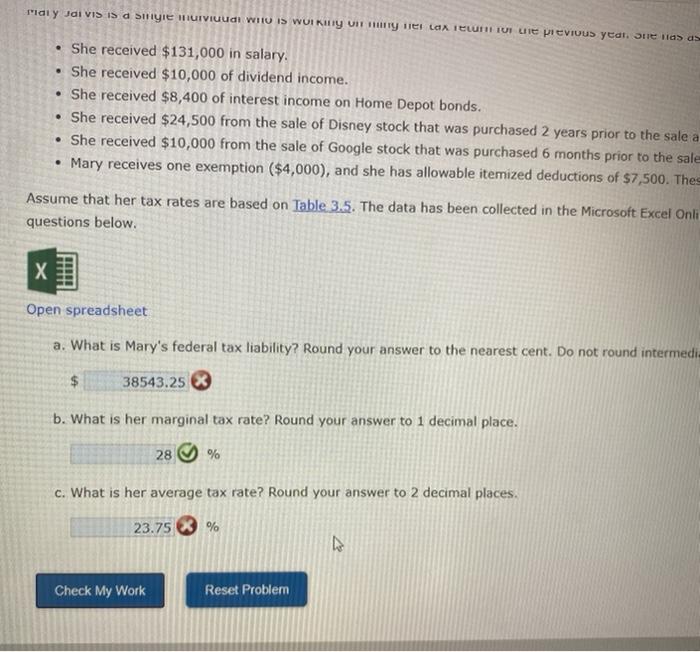

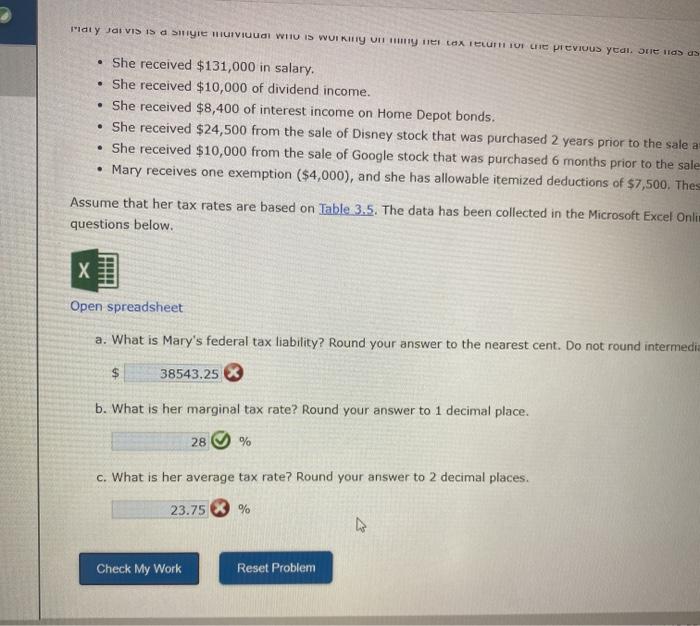

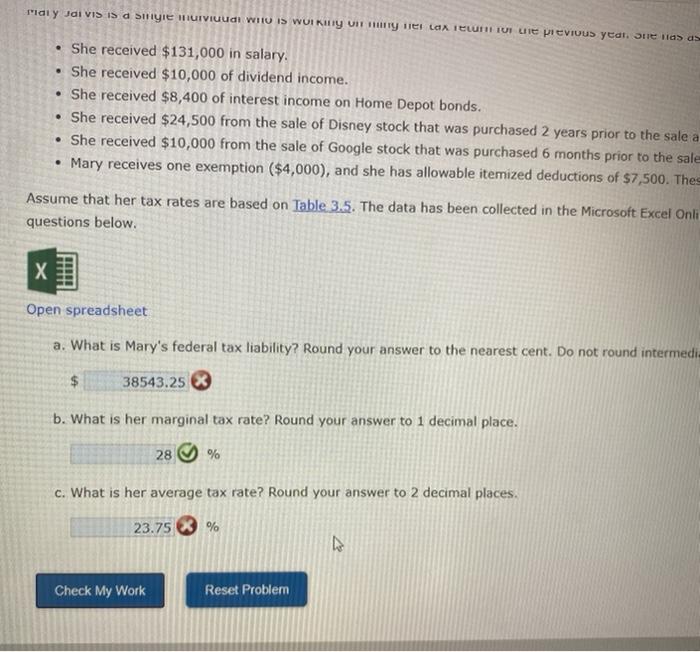

mialy JCI VIS IS a Siry Muviuudi WHO IS WUIKY UITTY Her Lax II TOT CE previous year. Juevas as . She received $131,000 in salary. She received $10,000 of dividend income. She received $8,400 of interest income on Home Depot bonds. She received $24,500 from the sale of Disney stock that was purchased 2 years prior to the sale a She received $10,000 from the sale of Google stock that was purchased 6 months prior to the sale Mary receives one exemption ($4,000), and she has allowable itemized deductions of $7,500. Thes Assume that her tax rates are based on Table 3.5. The data has been collected in the Microsoft Excel Onli questions below. X Open spreadsheet a. What is Mary's federal tax liability? Round your answer to the nearest cent. Do not round intermedi- $ 38543.25 X b. What is her marginal tax rate? Round your answer to 1 decimal place. 28 % c. What is her average tax rate? Round your answer to 2 decimal places. 23.75 % Check My Work Reset Problem D sonal taxes ary Tax Table for Single Individuals Taxable income dend Income Test Income Stock Sale Stock Cost Stock Sale Stock Cost sonal Exemption Red Deductions cable Tax Rate on Dividends & LT Capital Gains $10,000.00 $8.400.00 $24 500.00 $5,400.00 $10.000.00 $4 600.00 $4,000.00 $7,500.00 15.00% Percentage Amount Paid on Excess on Base over Bose $0.00 $0.00 10004 $9 725.00 $922.50 15.00% $37.450.00 55.15625 25.00% $90.750 00 $18.481.25 28 00 $189,750 00 $16.075.25 33 00 $411 500.00 $119.40125 35 004 $413 200.00 $119.996 25 3980 Calculation of Federal Tax Liability ulation of Taxable income Formules MNA UNA NA ANA ANA Test Incomo Capital Gains ome before Exemption and Deductions Sonial Exemption zod Doductions axable income before Dividends & LT Capital Gains es on Taxablo Income Before Dividends & LT Capital Gains. Liability on Base of Bracket Liability on Excess over Base Kon Taxable income before Dividends & LT Capital Gains ENA Sheet1 + on Mode: Automatic Workbook Statistics Type here to searc "iaty Jas VIS IS Smye Huviuudi WIIU IS WUI RIITY VI HITy Te Lox I ELUT 10CHE PREVIOUS ytai. De as a . She received $131,000 in salary. She received $10,000 of dividend income. She received $8,400 of interest income on Home Depot bonds. She received $24,500 from the sale of Disney stock that was purchased 2 years prior to the sale a She received $10,000 from the sale of Google stock that was purchased 6 months prior to the sale Mary receives one exemption ($4,000), and she has allowable itemized deductions of $7,500. Thes Assume that her tax rates are based on Table 3.5. The data has been collected in the Microsoft Excel Onli questions below. X Open spreadsheet a. What is Mary's federal tax liability? Round your answer to the nearest cent. Do not round intermedia $ 38543.25 b. What is her marginal tax rate? Round your answer to 1 decimal place. 28 % c. What is her average tax rate? Round your answer to 2 decimal places. 23.75 % Check My Work Reset