Answered step by step

Verified Expert Solution

Question

1 Approved Answer

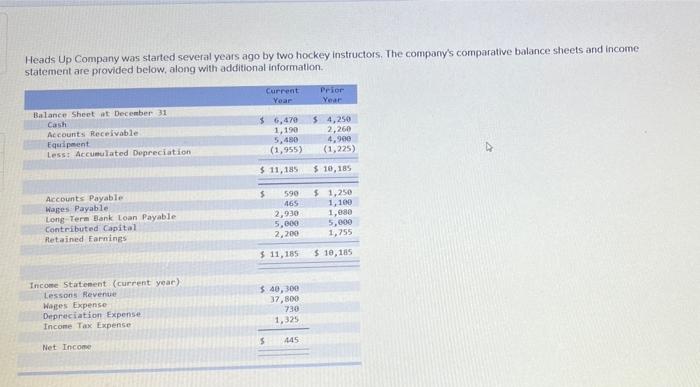

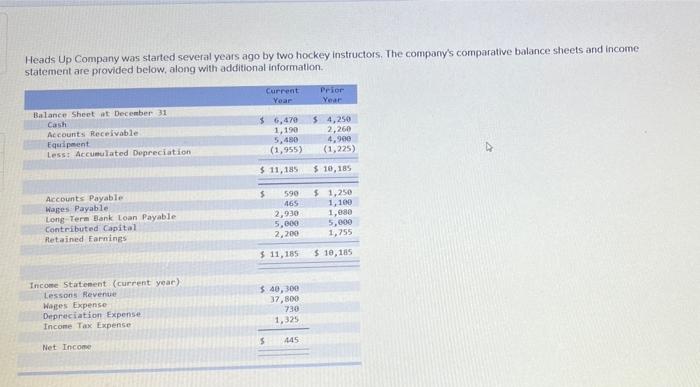

please help Heads Up Company was started several years ago by two hockey instructors. The company's comparative balance sheets and income statement are provided below,

please help

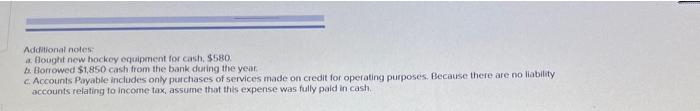

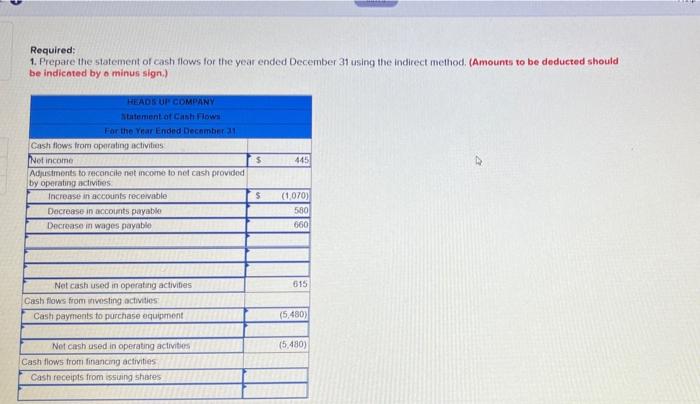

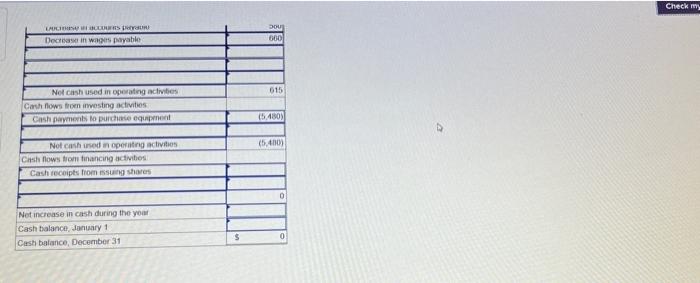

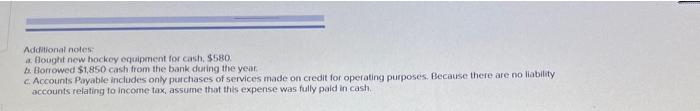

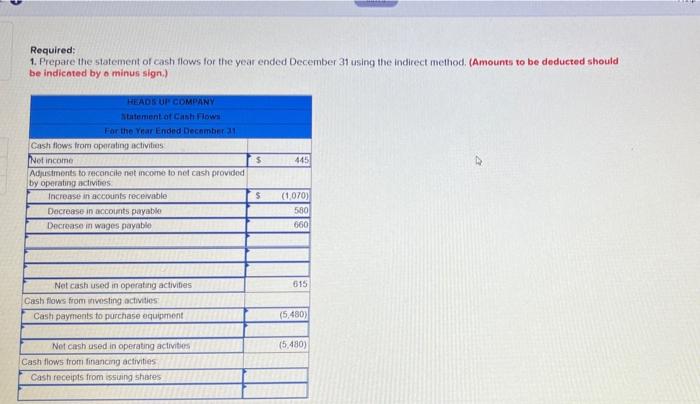

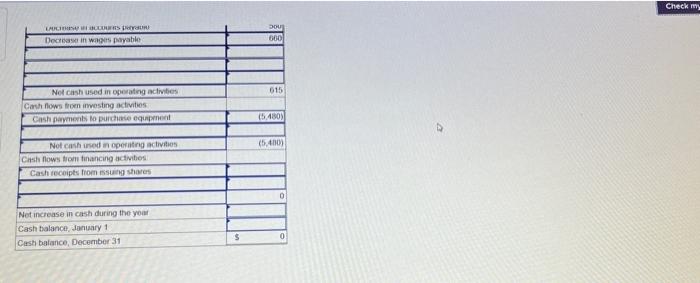

Heads Up Company was started several years ago by two hockey instructors. The company's comparative balance sheets and income statement are provided below, along with additional information Balance Sheet at December 31 Cash Accounts Receivable Equipment Less: Accumulated Depreciation Current Prior Year Yeae $ 6,470 $4,250 1,190 2,260 5,450 4.900 (1,225) $ 11,185 $ 10,185 $ Accounts Payable Hages Payable Long Term Bank Loan Payable Contributed Capital Retained Earnings 590 465 2,930 5,000 2,200 $1,250 1,100 1,630 5,000 1,755 $ 11,185 $ 10,185 Income Statement (current year) Lessons Revenue Wapes Expense Depreciation Expense Income Tax Expense $ 40,300 37,500 730 1.325 5 445 Net Income Additional notes Bought new hockey equipment for cash, $580 11. Borrowed $1,850 cash from the bank during the year c. Accounts Payable includes only purchases of services made on credit for operating purposes. Because there are no liability accounts relating to income tax assume that this expense was fully paid in cash Required: 1. Prepare the statement of cash flows for the year ended December 31 using the Indirect method. (Amounts to be deducted should be indicated by o minus sign) $ HEADS UP COMPANY statement of Cash Flow For the Year Ended December 31 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by Operating activities Increase in accounts receivable Decrease in accounts payable Decrease in wages payable 445 $ (1.070) 580 660 615 Net cash used in operating activities Cash flows from svesting activities Cash payments to purchase equipment (5.480) 15,480) Not cash used in operating activities Cash flows from financing activities Cash receipts from issuing shates Check my LABLES Decrease in wages payable 300 60 615 Nof chish used in operating activities Cash flows from investing activities Cash payments to purchase (1480) (5.400) Not cash used in operating activities Cash flows from financing activos Cash receipts from issuing shoes 0 Net increase in cash during the your Cash balance, January 1 Cash balance, December 31 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started