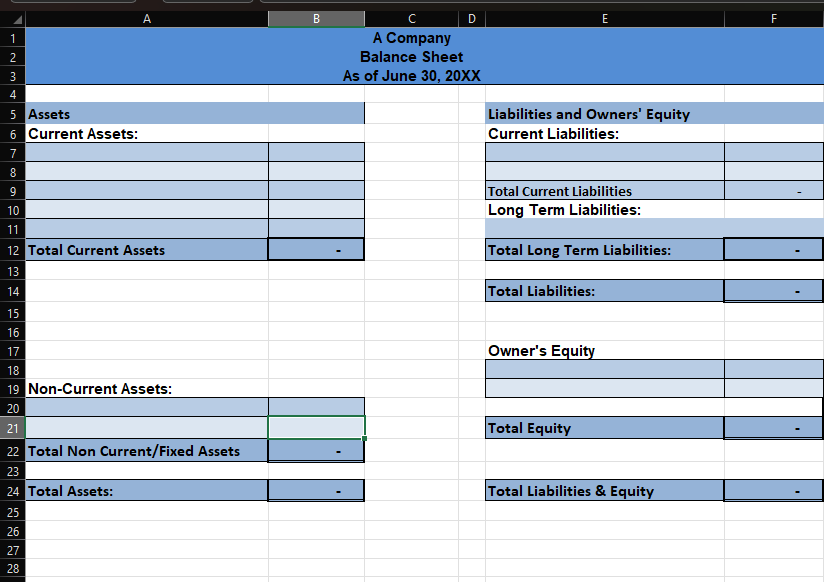

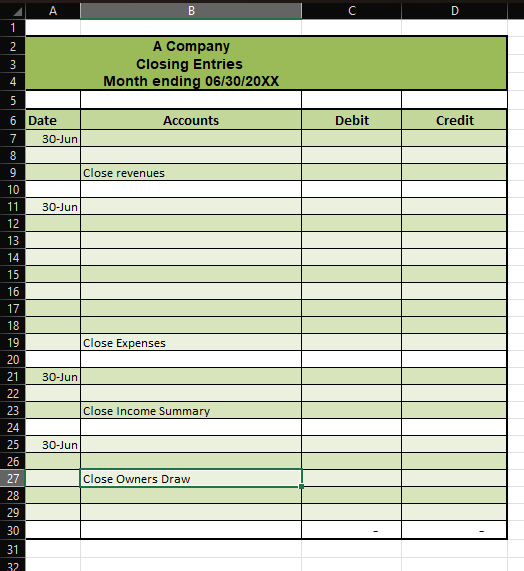

Please help! Here is all the information I have which should help with completing the last few things i need.

Here is what I need help with

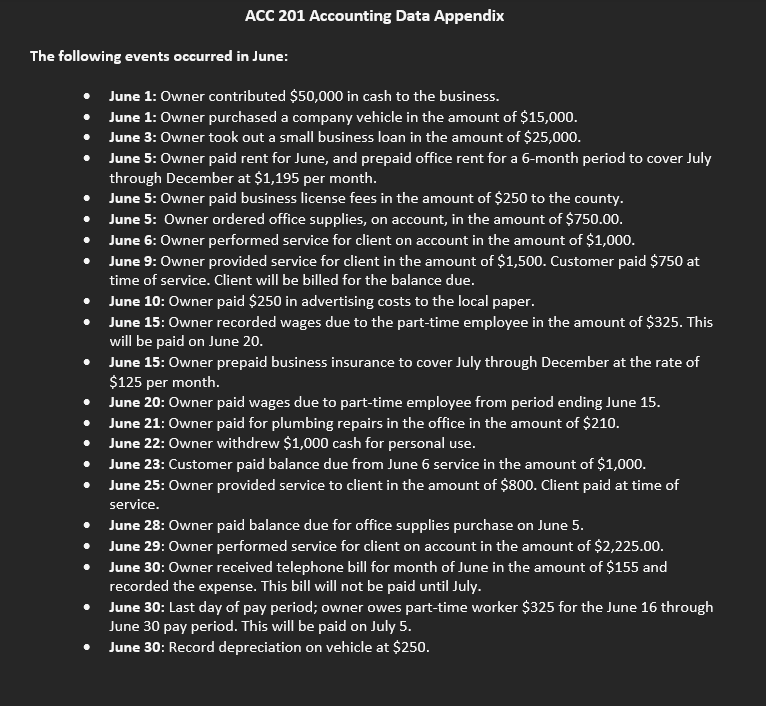

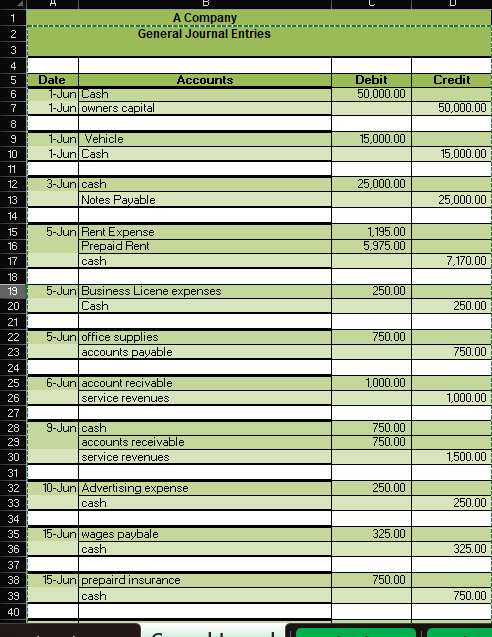

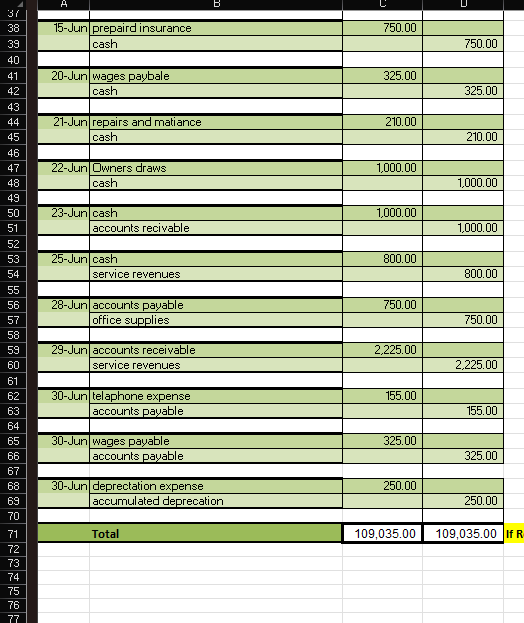

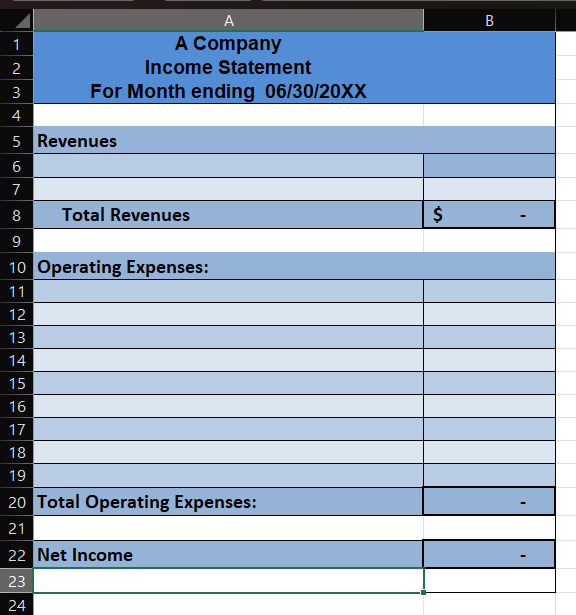

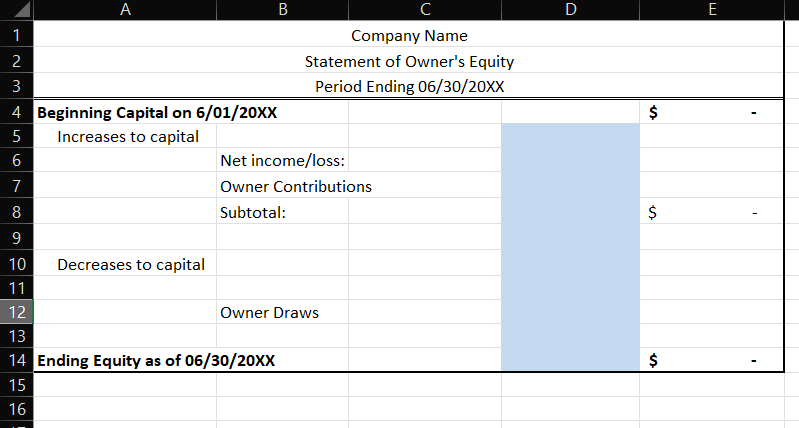

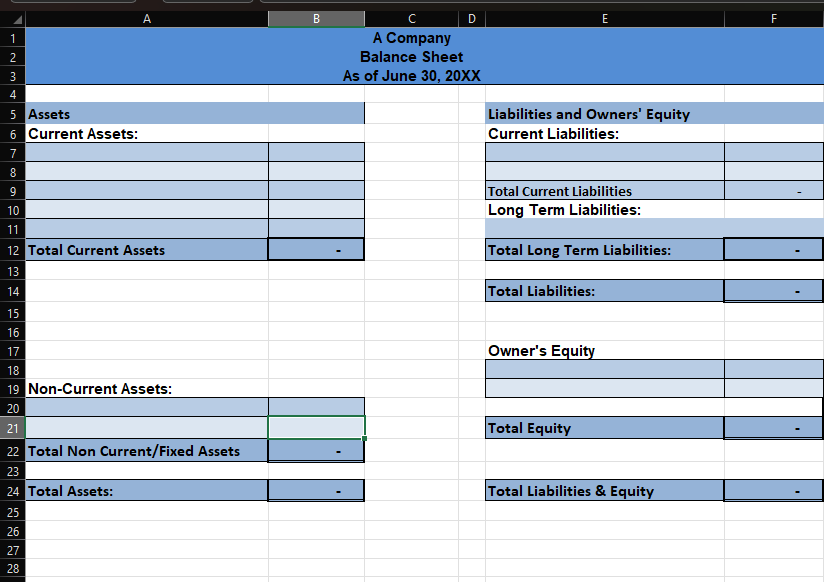

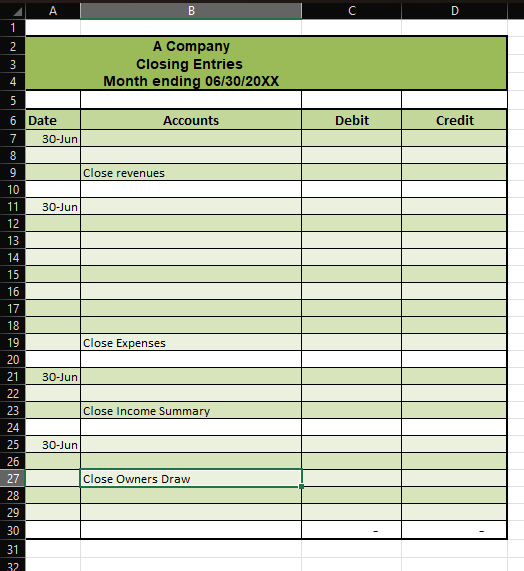

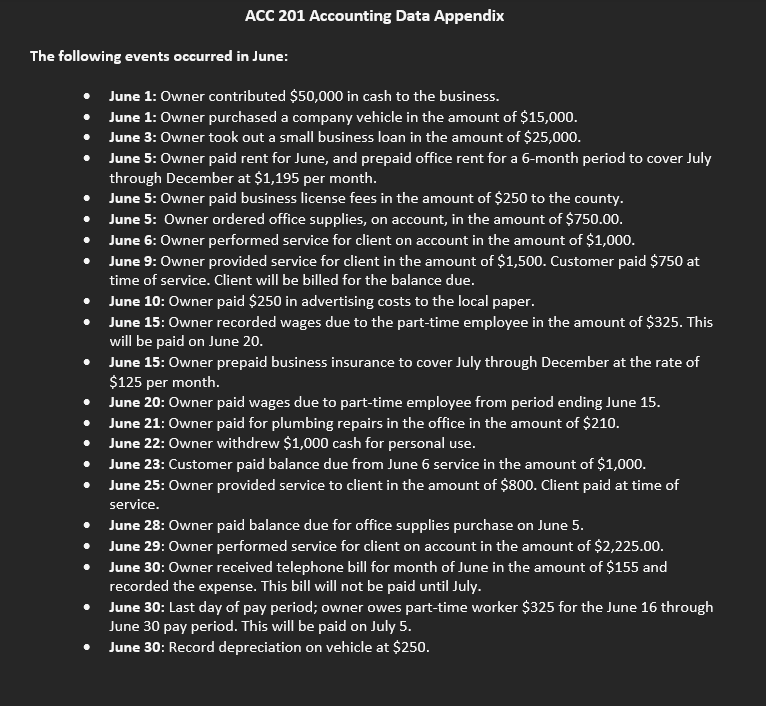

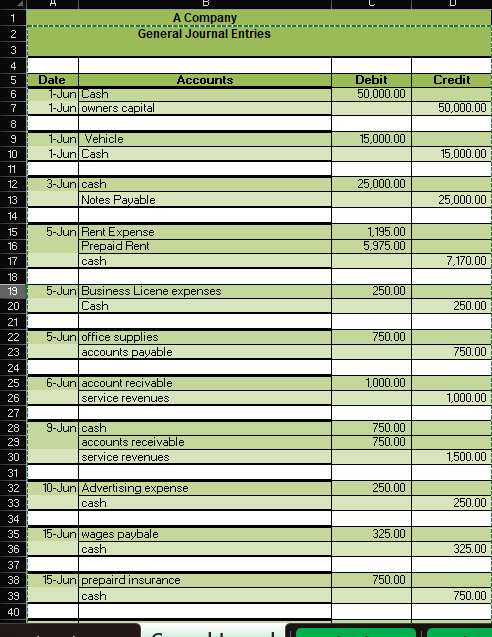

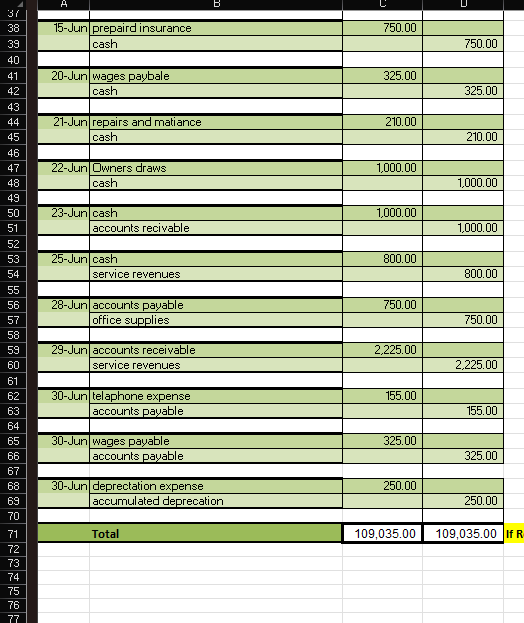

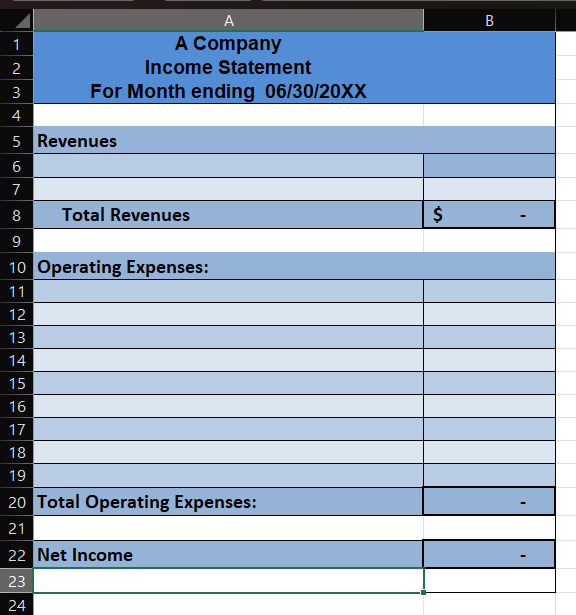

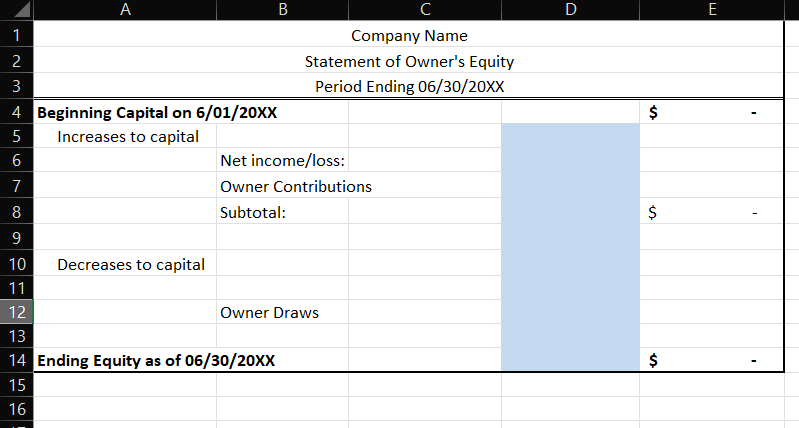

\begin{tabular}{|c|c|c|} \hline & A & B \\ \hline 1 & A Company & \\ \hline 2 & Income Statement & \\ \hline 3 & For Month ending 06/30/20XX & \\ \hline 4 & & \\ \hline 5 & Revenues & \\ \hline 6 & & \\ \hline 7 & & \\ \hline 8 & Total Revenues & $ \\ \hline 9 & & \\ \hline 10 & Operating Expenses: & \\ \hline 11 & & \\ \hline 12 & & \\ \hline 13 & & \\ \hline 14 & & \\ \hline 15 & & \\ \hline 16 & & \\ \hline 17 & & \\ \hline 18 & & \\ \hline 19 & & \\ \hline 20 & Total Operating Expenses: & - \\ \hline 21 & & \\ \hline 22 & Net Income & - \\ \hline 23 & & \\ \hline \end{tabular} ACC 201 Accounting Data Appendix The following events occurred in June: - June 1: Owner contributed $50,000 in cash to the business. - June 1: Owner purchased a company vehicle in the amount of $15,000. - June 3: Owner took out a small business loan in the amount of $25,000. - June 5: Owner paid rent for June, and prepaid office rent for a 6-month period to cover July through December at \$1,195 per month. - June 5: Owner paid business license fees in the amount of $250 to the county. - June 5: Owner ordered office supplies, on account, in the amount of $750.00. - June 6: Owner performed service for client on account in the amount of $1,000. - June 9: Owner provided service for client in the amount of $1,500. Customer paid $750 at time of service. Client will be billed for the balance due. - June 10: Owner paid \$250 in advertising costs to the local paper. - June 15: Owner recorded wages due to the part-time employee in the amount of \$325. This will be paid on June 20 . - June 15: Owner prepaid business insurance to cover July through December at the rate of $125 per month. - June 20: Owner paid wages due to part-time employee from period ending June 15. - June 21: Owner paid for plumbing repairs in the office in the amount of $210. - June 22: Owner withdrew \$1,000 cash for personal use. - June 23: Customer paid balance due from June 6 service in the amount of $1,000. - June 25: Owner provided service to client in the amount of $800. Client paid at time of service. - June 28: Owner paid balance due for office supplies purchase on June 5. - June 29: Owner performed service for client on account in the amount of \$2,225.00. - June 30: Owner received telephone bill for month of June in the amount of \$155 and recorded the expense. This bill will not be paid until July. - June 30: Last day of pay period; owner owes part-time worker $325 for the June 16 through June 30 pay period. This will be paid on July 5 . - June 30: Record depreciation on vehicle at $250. \begin{tabular}{|c|c|c|} \hline & A & B \\ \hline 1 & A Company & \\ \hline 2 & Income Statement & \\ \hline 3 & For Month ending 06/30/20XX & \\ \hline 4 & & \\ \hline 5 & Revenues & \\ \hline 6 & & \\ \hline 7 & & \\ \hline 8 & Total Revenues & $ \\ \hline 9 & & \\ \hline 10 & Operating Expenses: & \\ \hline 11 & & \\ \hline 12 & & \\ \hline 13 & & \\ \hline 14 & & \\ \hline 15 & & \\ \hline 16 & & \\ \hline 17 & & \\ \hline 18 & & \\ \hline 19 & & \\ \hline 20 & Total Operating Expenses: & - \\ \hline 21 & & \\ \hline 22 & Net Income & - \\ \hline 23 & & \\ \hline \end{tabular} ACC 201 Accounting Data Appendix The following events occurred in June: - June 1: Owner contributed $50,000 in cash to the business. - June 1: Owner purchased a company vehicle in the amount of $15,000. - June 3: Owner took out a small business loan in the amount of $25,000. - June 5: Owner paid rent for June, and prepaid office rent for a 6-month period to cover July through December at \$1,195 per month. - June 5: Owner paid business license fees in the amount of $250 to the county. - June 5: Owner ordered office supplies, on account, in the amount of $750.00. - June 6: Owner performed service for client on account in the amount of $1,000. - June 9: Owner provided service for client in the amount of $1,500. Customer paid $750 at time of service. Client will be billed for the balance due. - June 10: Owner paid \$250 in advertising costs to the local paper. - June 15: Owner recorded wages due to the part-time employee in the amount of \$325. This will be paid on June 20 . - June 15: Owner prepaid business insurance to cover July through December at the rate of $125 per month. - June 20: Owner paid wages due to part-time employee from period ending June 15. - June 21: Owner paid for plumbing repairs in the office in the amount of $210. - June 22: Owner withdrew \$1,000 cash for personal use. - June 23: Customer paid balance due from June 6 service in the amount of $1,000. - June 25: Owner provided service to client in the amount of $800. Client paid at time of service. - June 28: Owner paid balance due for office supplies purchase on June 5. - June 29: Owner performed service for client on account in the amount of \$2,225.00. - June 30: Owner received telephone bill for month of June in the amount of \$155 and recorded the expense. This bill will not be paid until July. - June 30: Last day of pay period; owner owes part-time worker $325 for the June 16 through June 30 pay period. This will be paid on July 5 . - June 30: Record depreciation on vehicle at $250