Answered step by step

Verified Expert Solution

Question

1 Approved Answer

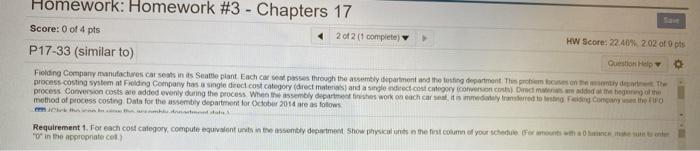

please help!! Homework: Homework #3 - Chapters 17 Score: 0 of 4 pts 2012 (1 complete HW Score: 22.40% 202 of pls P17-33 (similar to)

please help!!

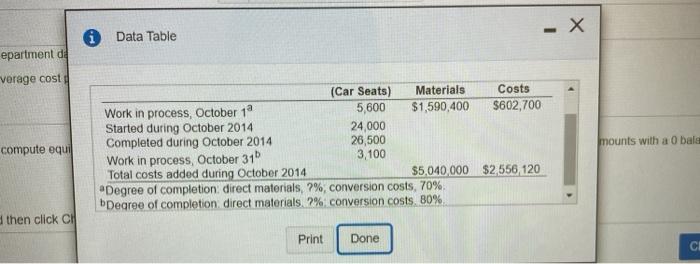

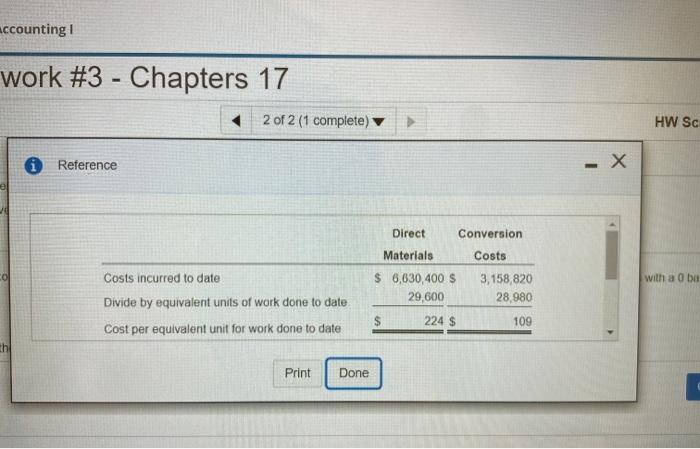

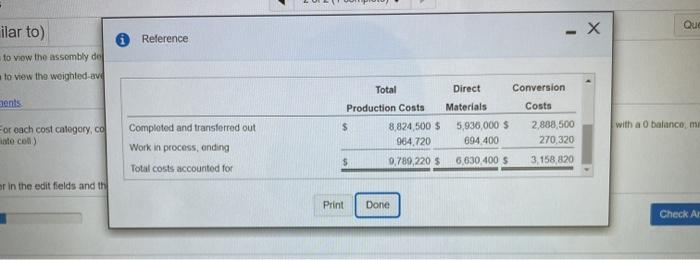

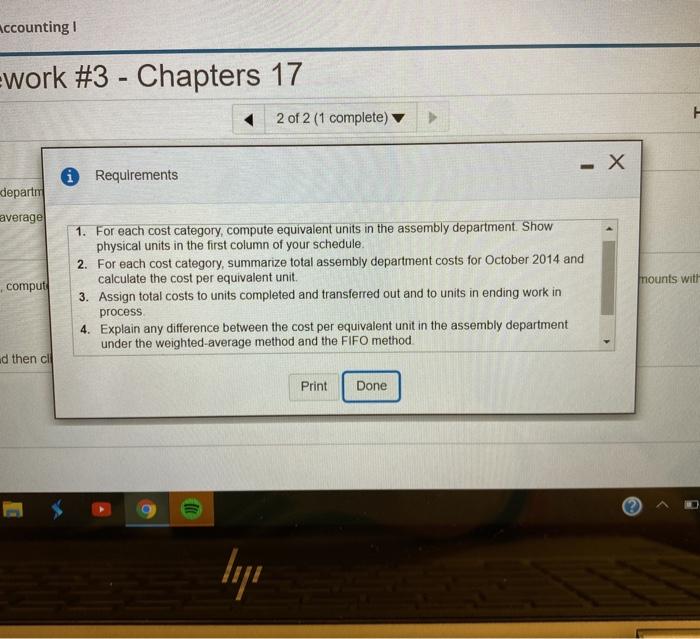

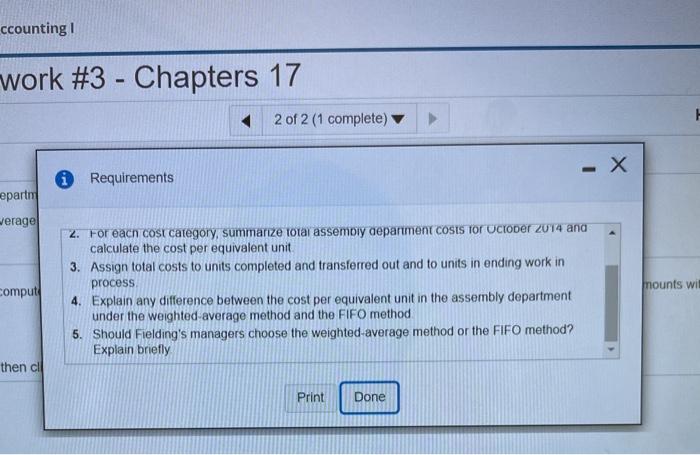

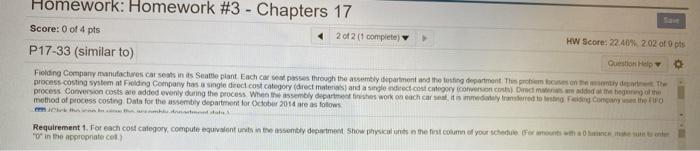

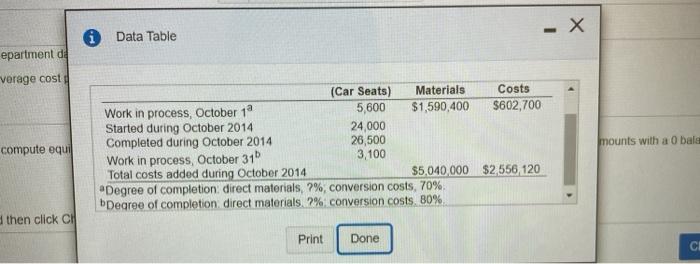

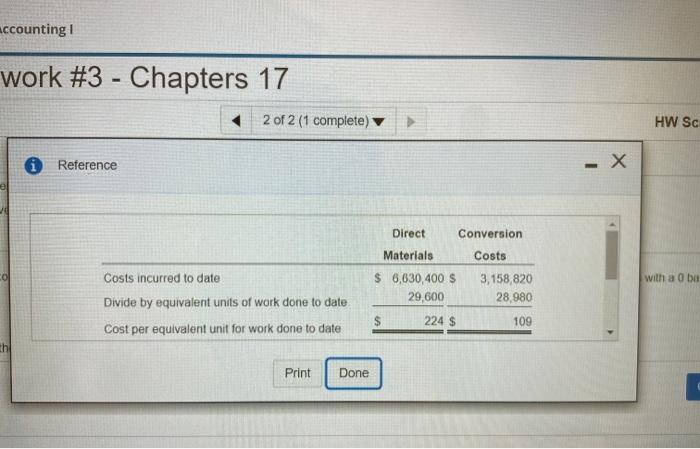

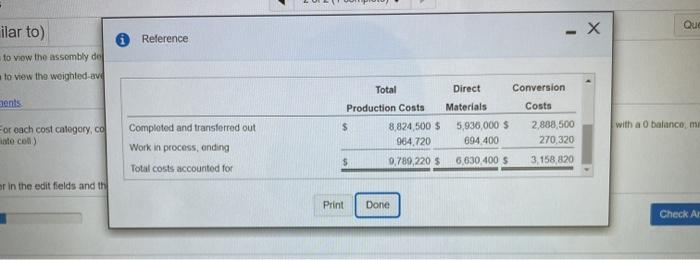

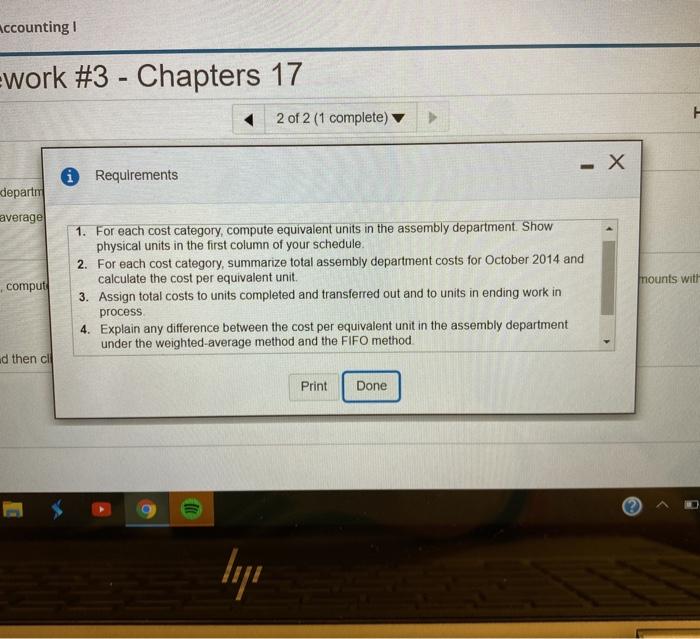

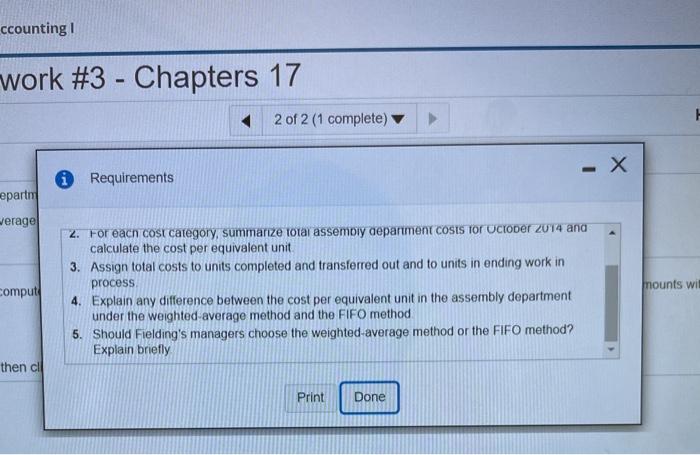

Homework: Homework #3 - Chapters 17 Score: 0 of 4 pts 2012 (1 complete HW Score: 22.40% 202 of pls P17-33 (similar to) Question Help Folding Company manufactures car seats in its Seattle plant. Each co passes through the assembly partment and the lasting department. The proceso de The process costing system at Folding Company has a single del cost category direct materials and a single direct cost category conversion costs Direct madded at the begun the process Conversion costs are added evenly during the process When the assembly department in the work on each castitis means to Congo method of process costing Data for the assembly department for October 2014 as follows Requirement 1. For each cost category, compute equivalent units in the assembly dowment Show physcanso me first column of your schedule for me when in the appropriate col) - X 0 Data Table epartment de verage cost mounts with a 0 bala compute equil (Car Seats) Materials Costs Work in process, October 18 5,600 $1,590,400 $602,700 Started during October 2014 24,000 Completed during October 2014 26,500 Work in process, October 31 3,100 Total costs added during October 2014 $5,040,000 $2556 120 "Degree of completion direct materials, 2%, conversion costs, 70% bDegree of completion direct materials, 2% conversion costs 80% then click CH Print Done CI accounting work #3 - Chapters 17 2 of 2 (1 complete) HW SC Reference Direct Conversion Costs Materials $ 6,630,400 $ 29,600 with a 0 be 3,158,820 28,980 Costs incurred to date Divide by equivalent units of work done to date Cost per equivalent unit for work done to date $ 224 $ 109 thil Print Done ilar to) Que 0 Reference to view the assembly del to view the weighted ave ents For each cost category, co inte coll) Total Production Costs $ 8.824,500 $ 964.720 $ 0,789,220 5 Completed and transferred out Work in process, ending Total costs accounted for with a 0 balanco, mi Direct Conversion Materials Costs 5,936,000 $ 2,888,500 694 400 270,320 6,630 400 5 3,158 820 or in the edit fields and the Print Done Check Al Accounting! Ework #3 - Chapters 17 > H 2 of 2 (1 complete) - X i Requirements departo average nounts with comput 1. For each cost category, compute equivalent units in the assembly department Show physical units in the first column of your schedule 2. For each cost category, summarize total assembly department costs for October 2014 and calculate the cost per equivalent unit. 3. Assign total costs to units completed and transferred out and to units in ending work in process 4. Explain any difference between the cost per equivalent unit in the assembly department under the weighted average method and the FIFO method d then cl Print Done lili ccounting work #3 - Chapters 17 2 of 2 (1 complete) - X i Requirements epartm werage mounts wil comput 2. For each cost category, summarize total assemory department costs for October 2014 and calculate the cost per equivalent unit 3. Assign total costs to units completed and transferred out and to units in ending work in process 4. Explain any difference between the cost per equivalent unit in the assembly department under the weighted average method and the FIFO method 5. Should Fielding's managers choose the weighted average method or the FIFO method? Explain briefly then cl Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started