Question

Please HELP!!!! I am confused with the procedures of each picture. The Course Project consists of 10 Requirements for you to complete. The Course Project

Please HELP!!!!

I am confused with the procedures of each picture.

The Course Project consists of 10 Requirements for you to complete. The Course Project is due at the end of Module 9. See the Course Project page for details and due date information. All of the information you need to complete the Course Project is located in the workbook provided on the Course Project page.

There are eight worksheets in the workbook you will need to complete.

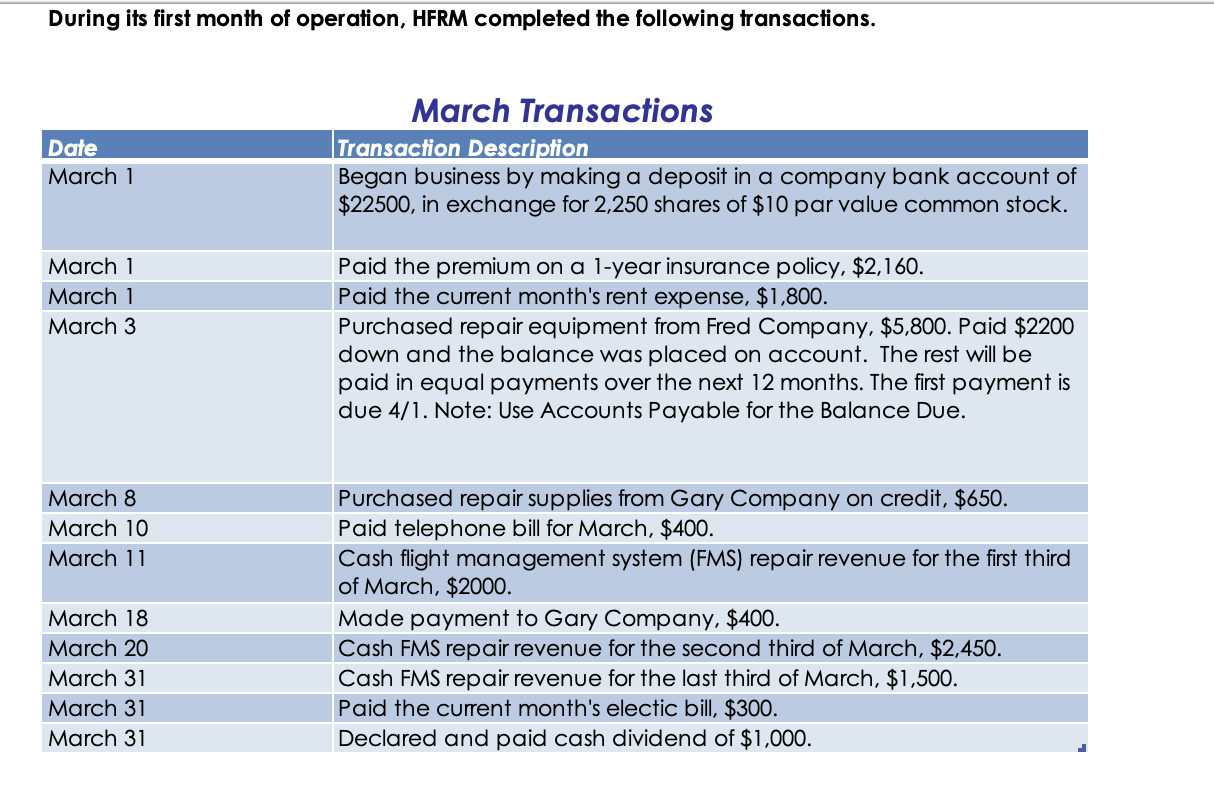

- A list of March transactions.

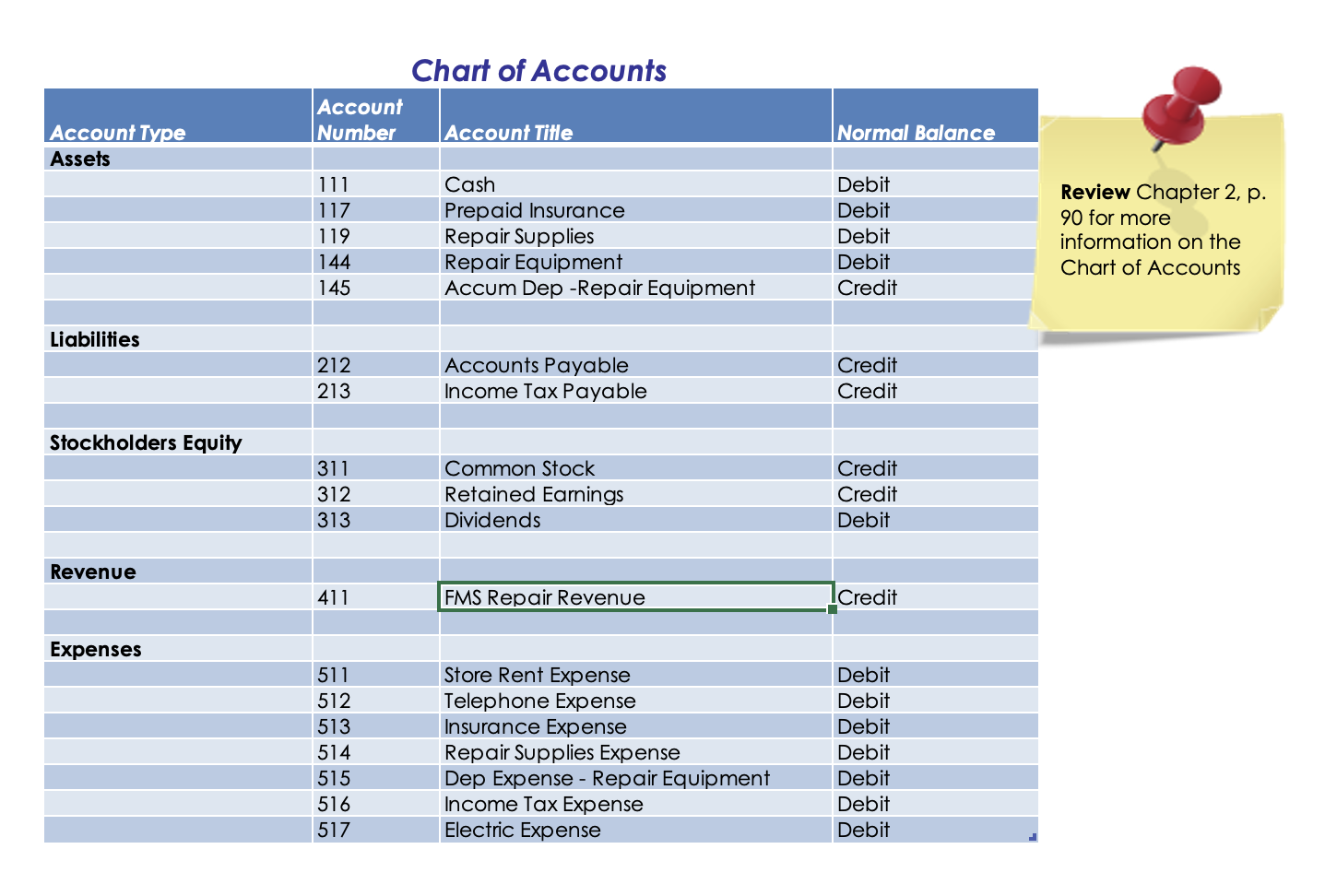

- A Chart of Accounts reference sheet.

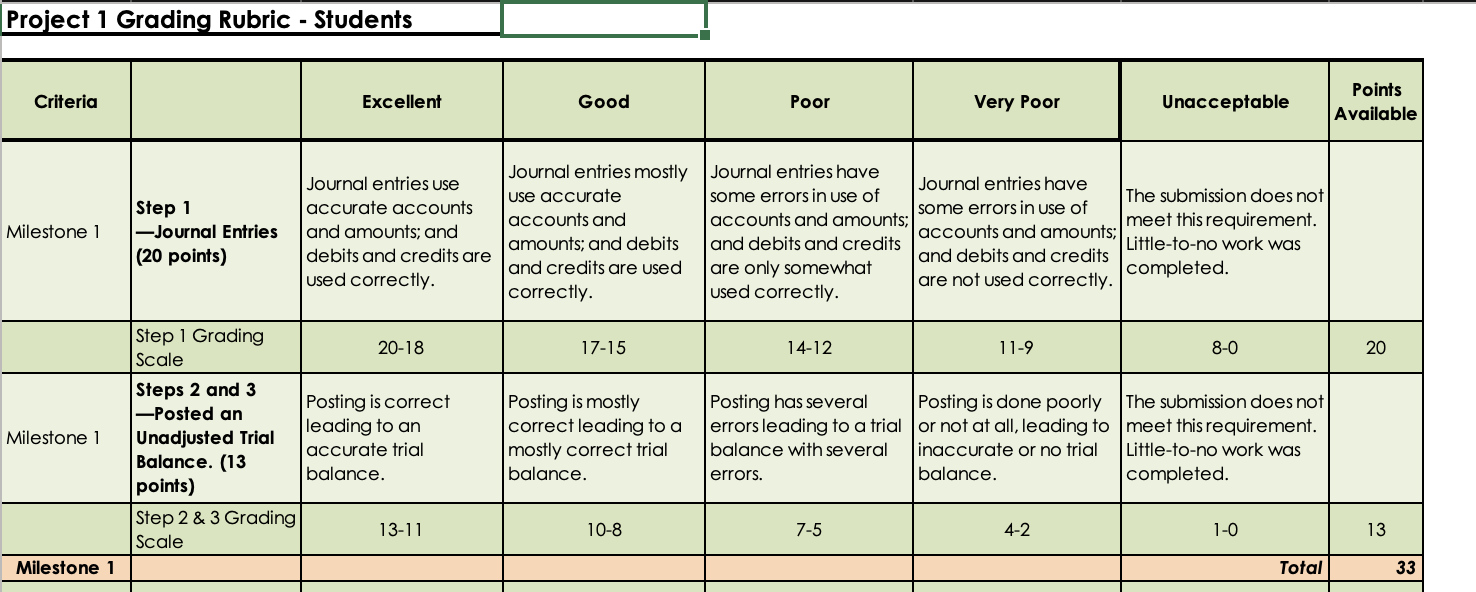

- A Grading Rubric to help explain what is expected.

- Each worksheet has the Check Figures embedded as a comment.

In this module, you will submit Milestone 1 and include project requirements 1-3.

You will continue to use the same workbook for all 3 milestones. You do not need to download a new copy for Milestones 2 or 3. When you submit Milestone 3, all sheets in your workbook will be complete.

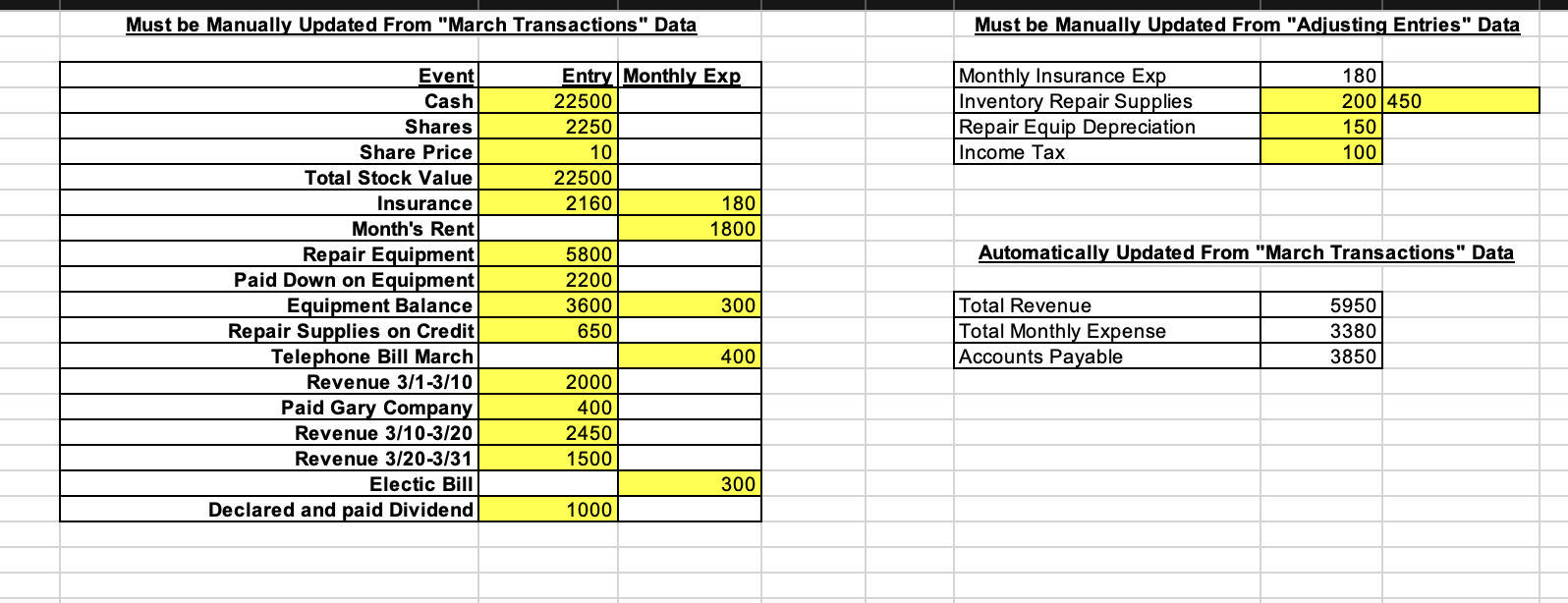

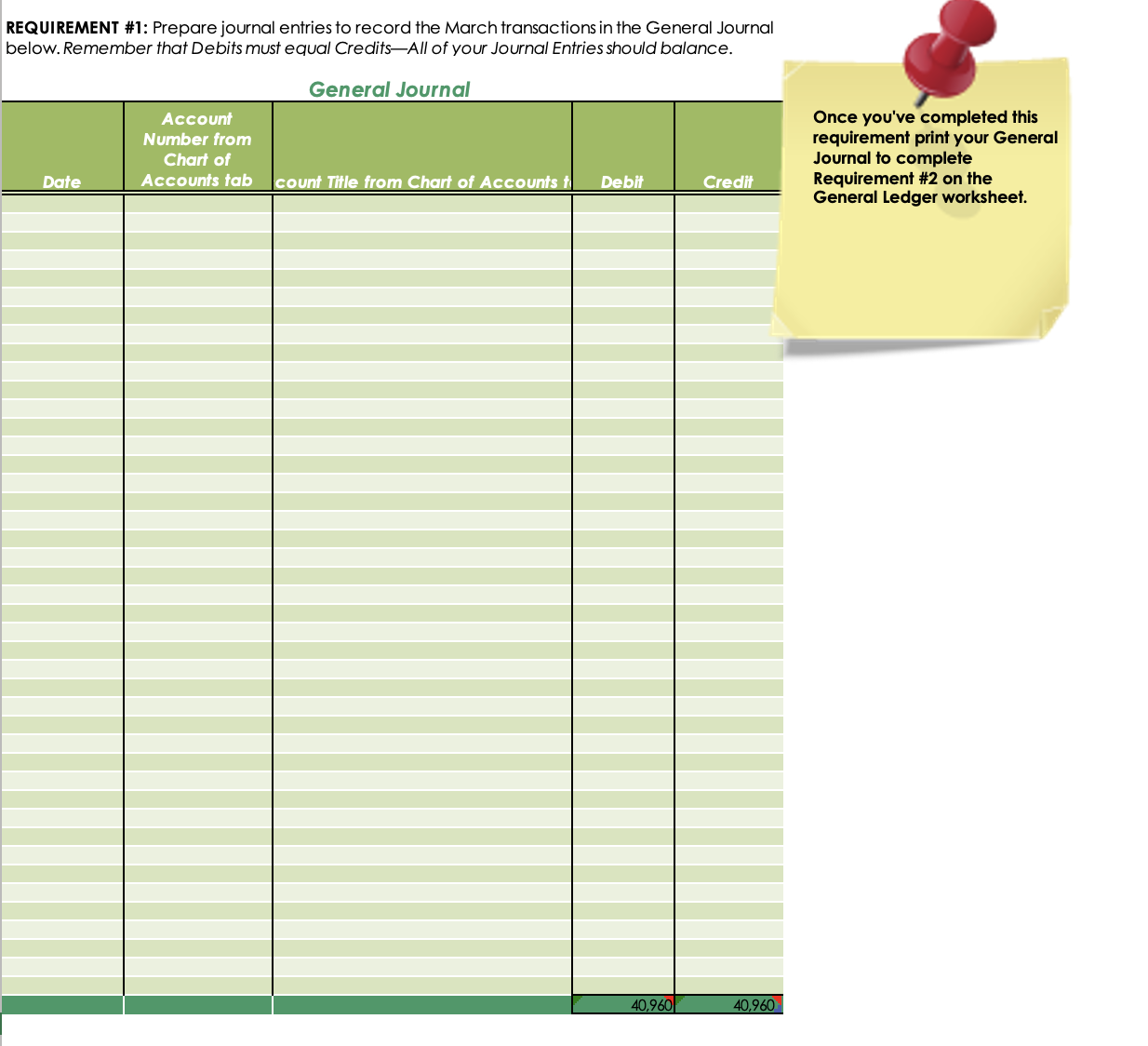

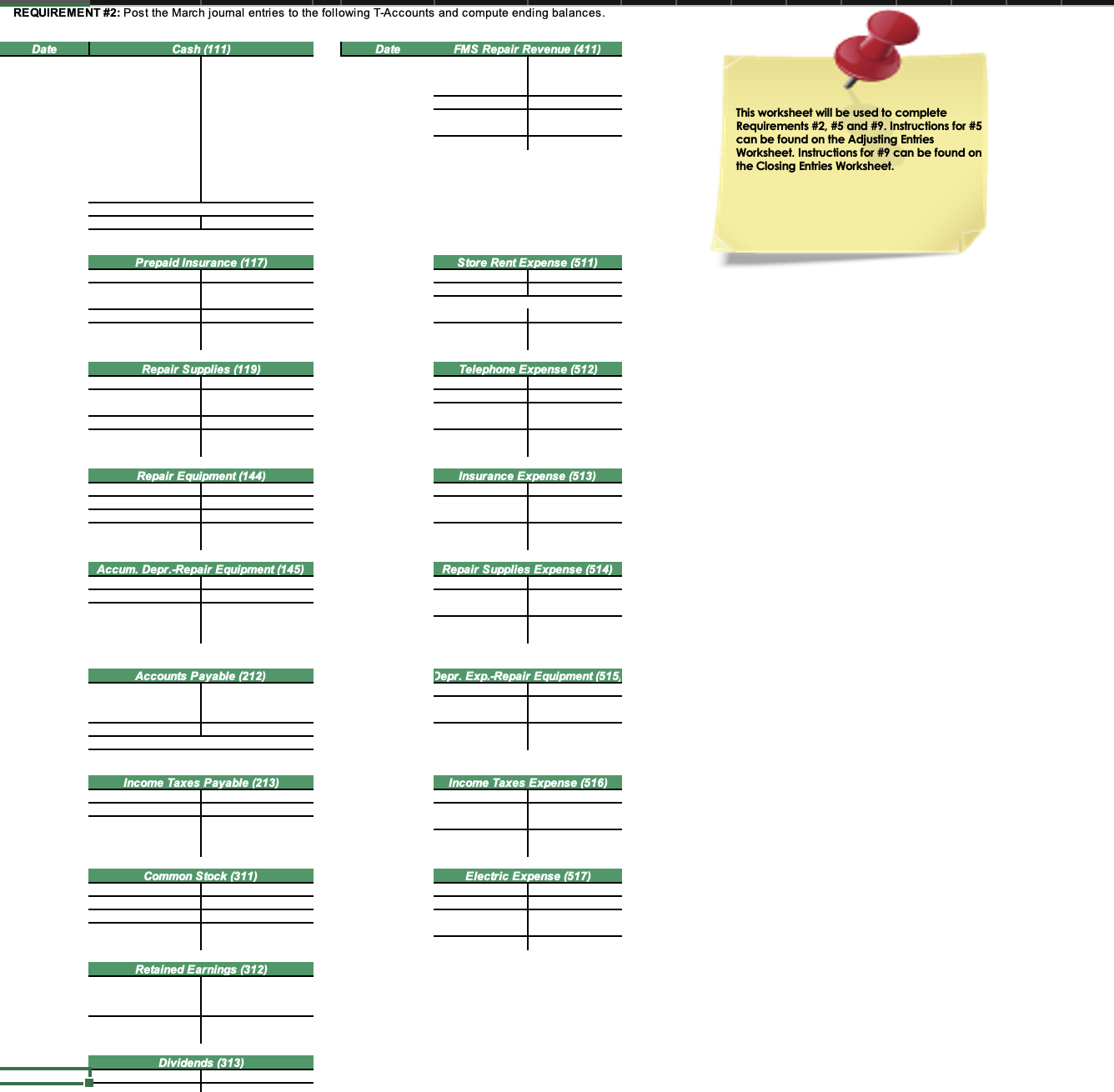

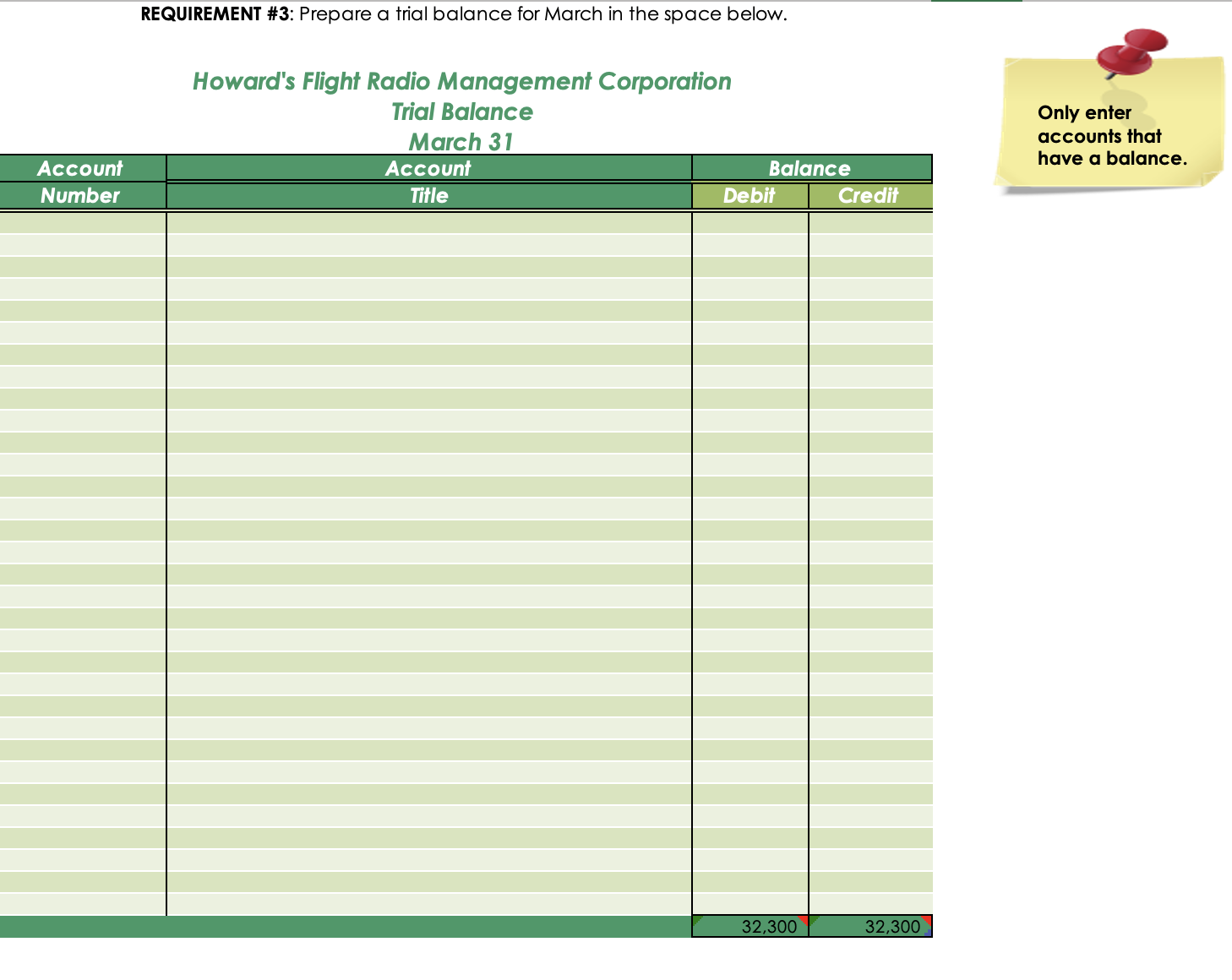

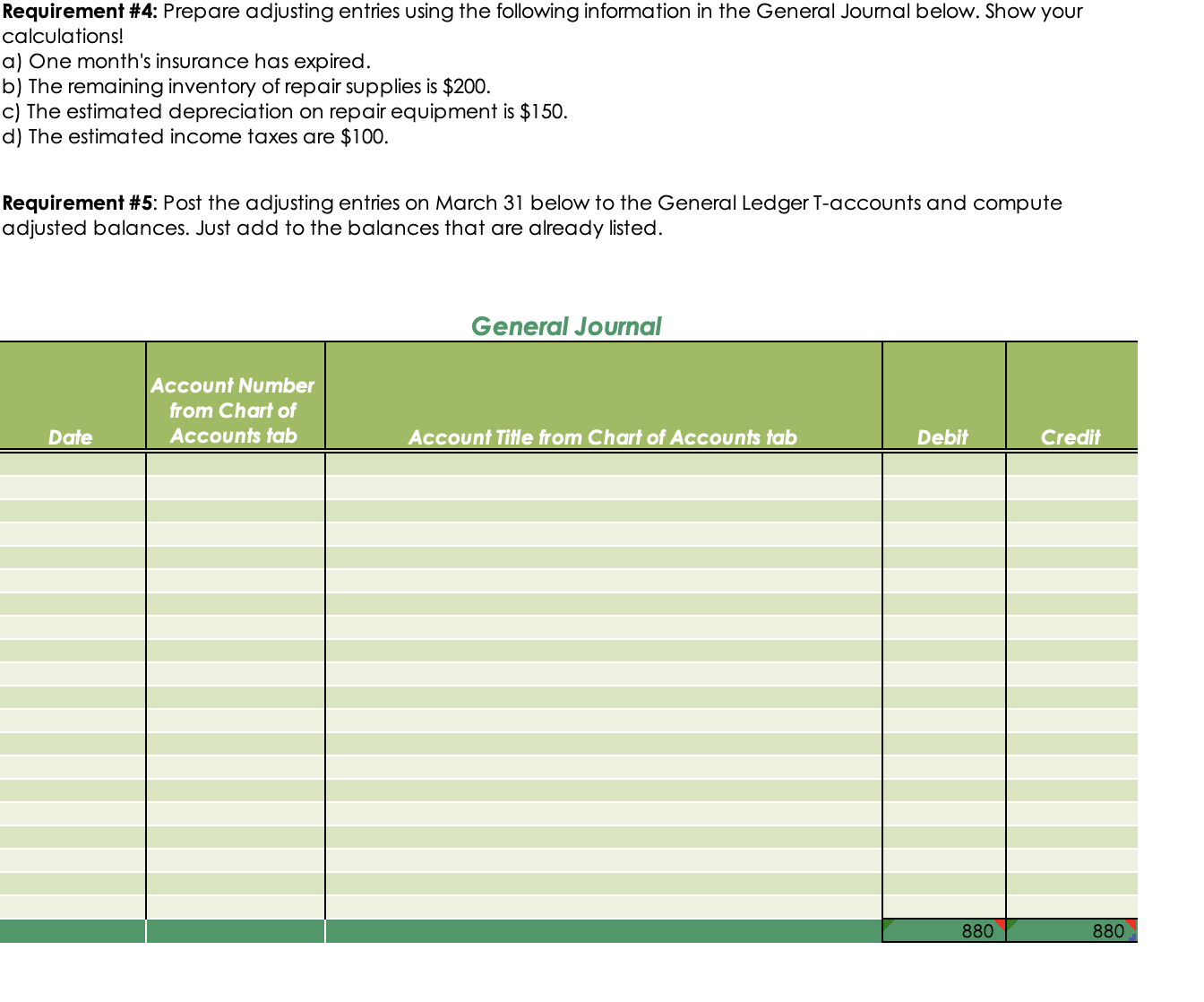

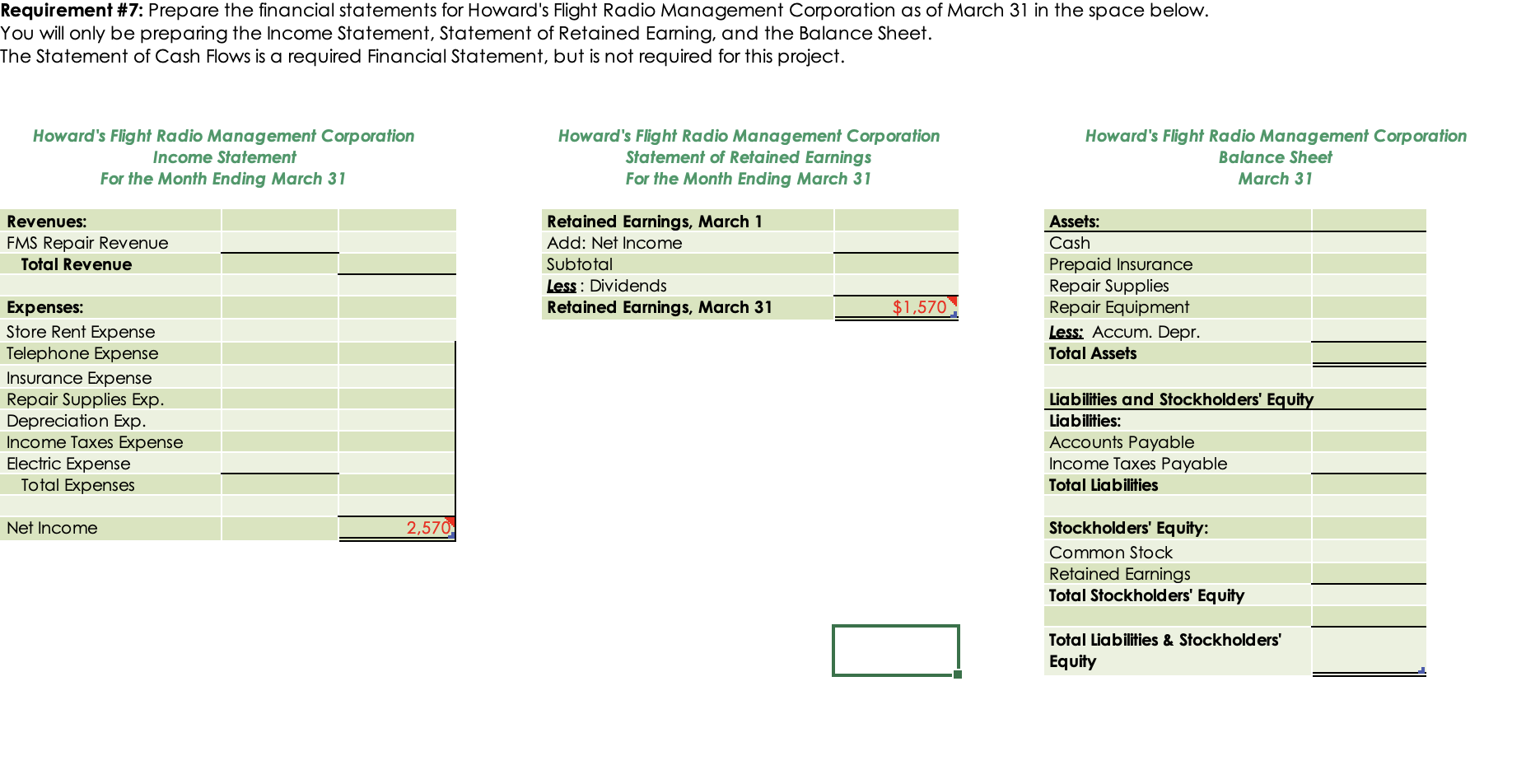

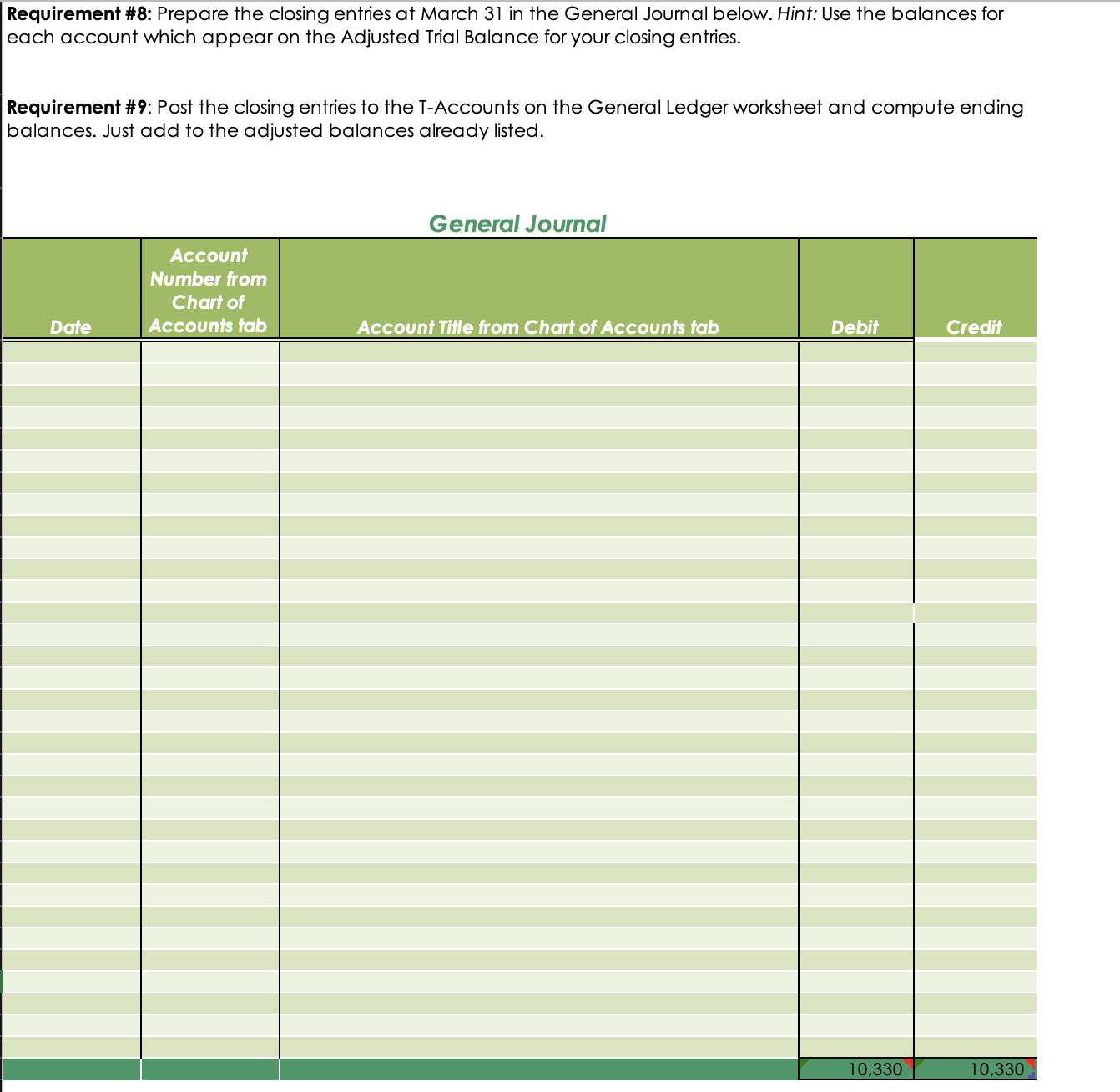

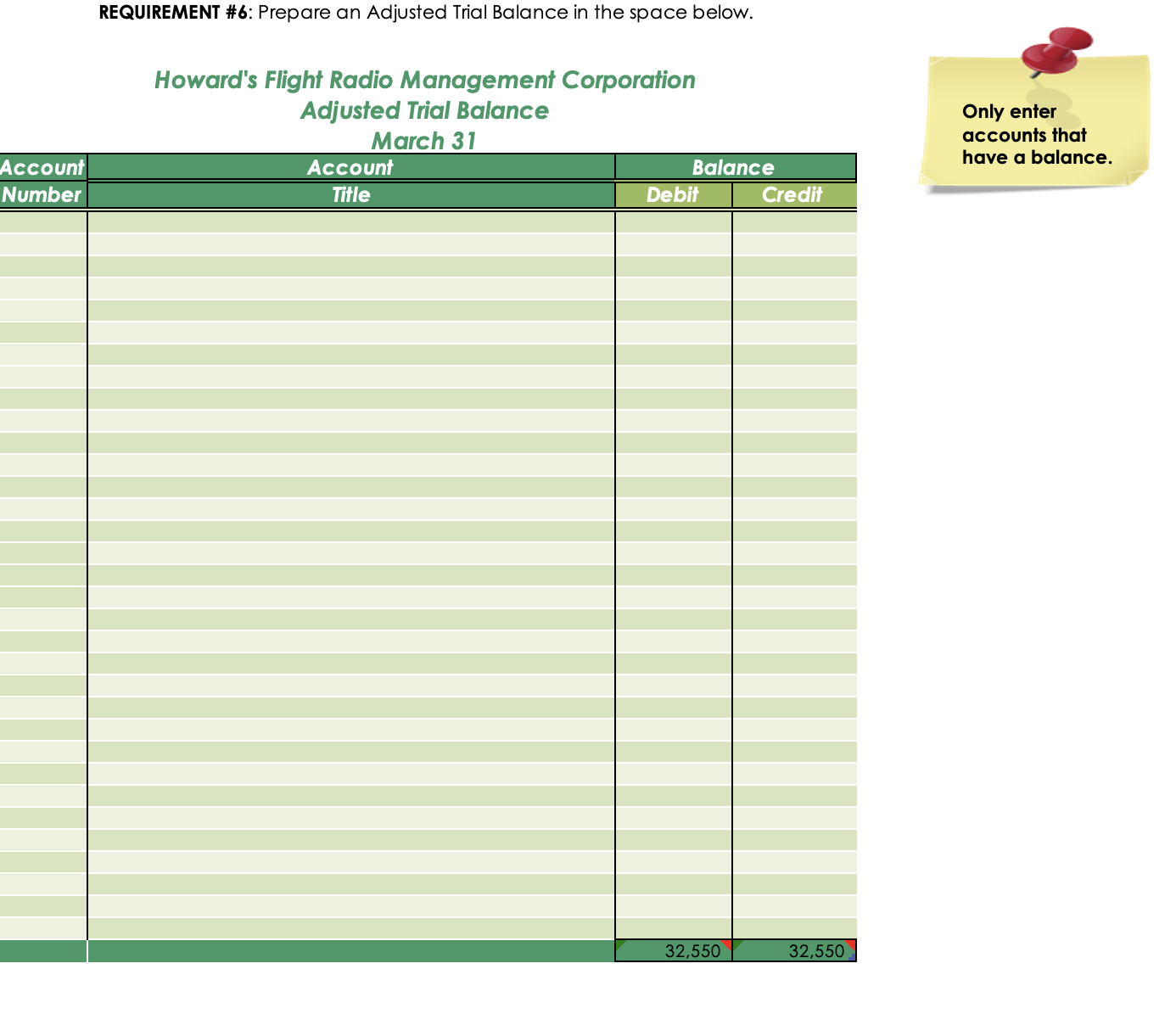

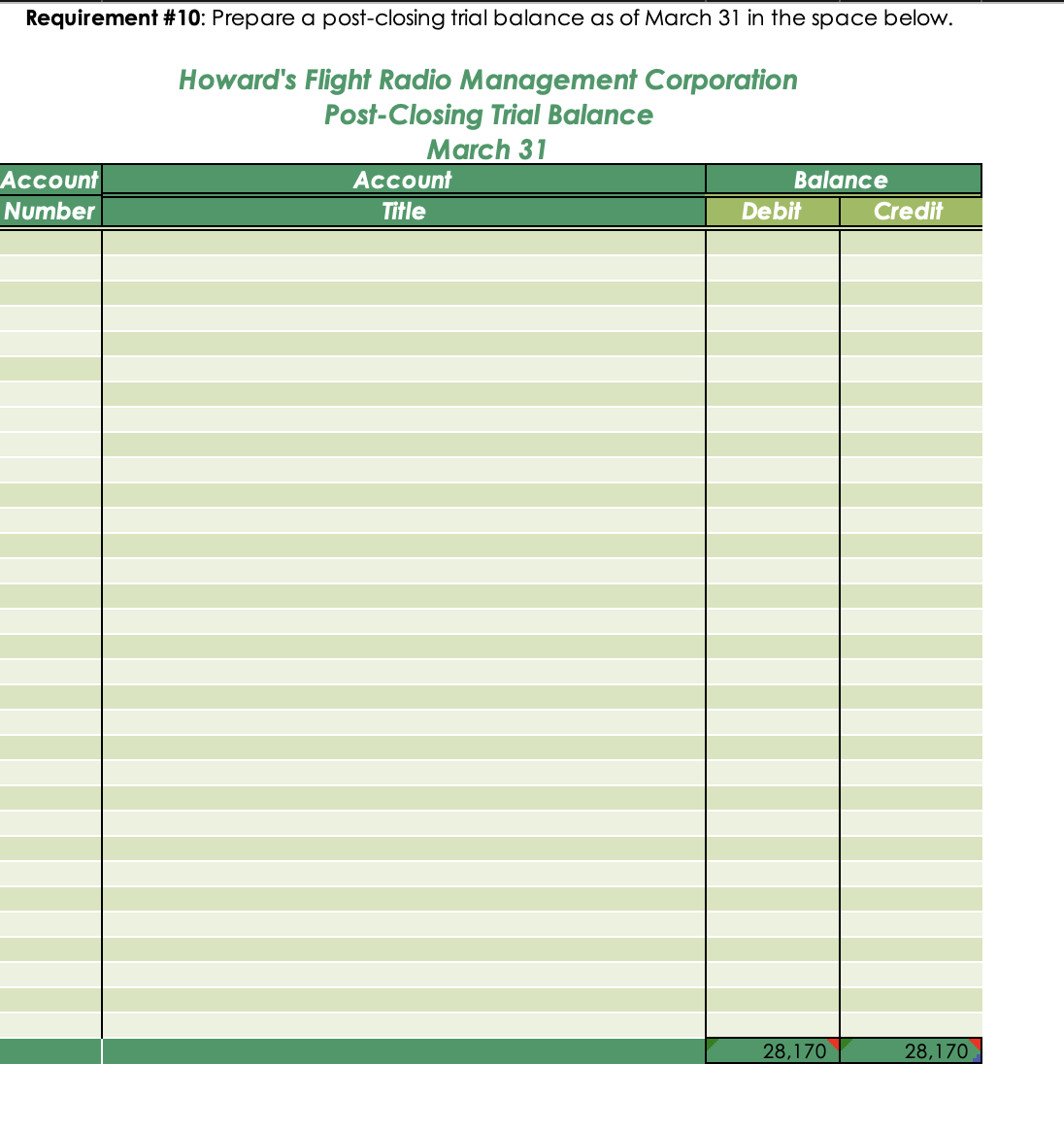

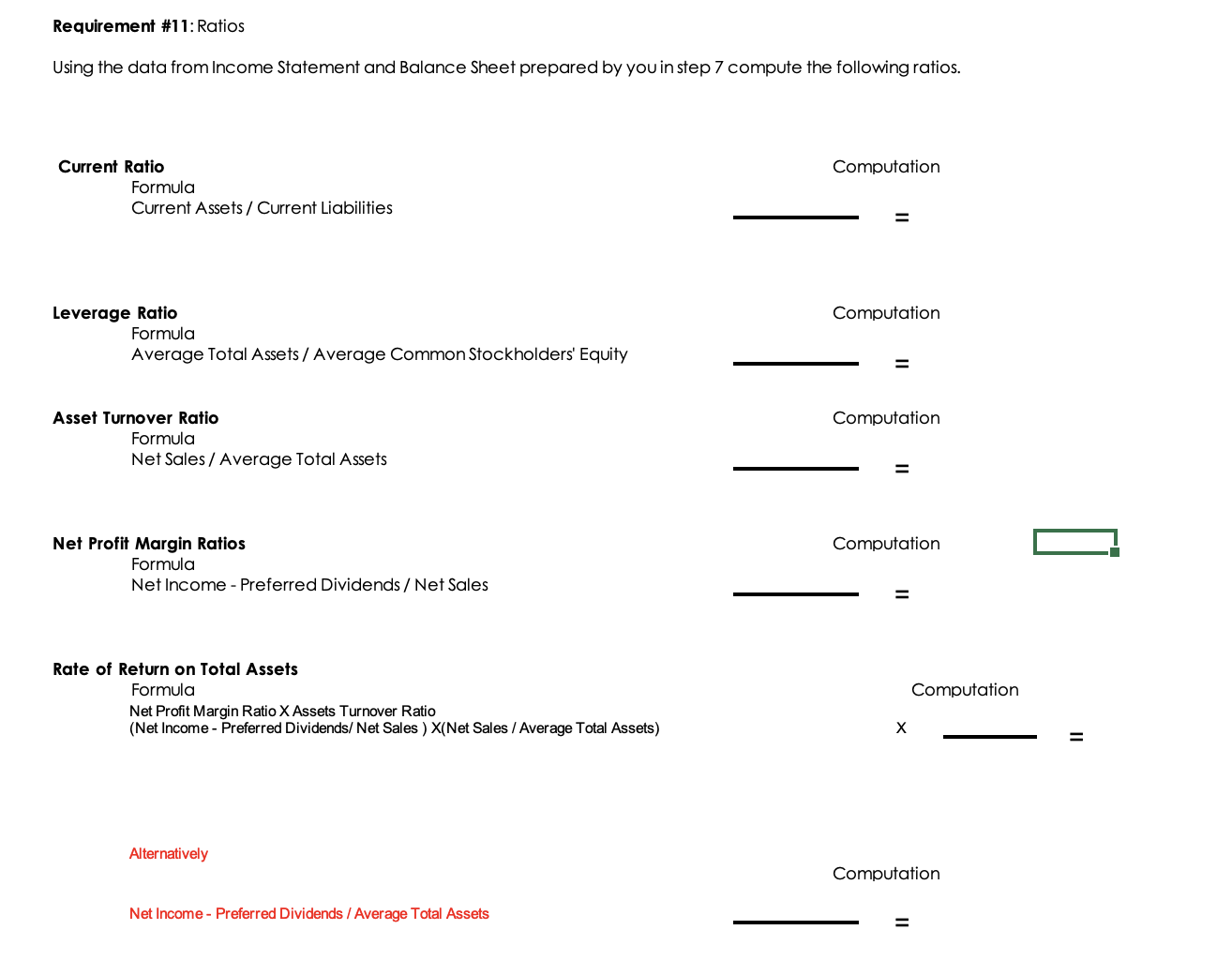

Chart of Accounts Review Chapter 2, p. 90 for more information on the Chart of Accounts REQUIREMENT \#6: Prepare an Adjusted Trial Balance in the space below. Howard's Flight Radio Management Corporation Requirement \# 10: Prepare a post-closing trial balance as of March 31 in the space below. Please enter what each of the ratio results from Spreadsheet 11 mean for the company. Requirement \#11: Ratios Requirement \#8: Prepare the closing entries at March 31 in the General Journal below. Hint: Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement \#9: Post the closing entries to the T-Accounts on the General Ledger worksheet and compute ending palances. Just add to the adjusted balances already listed. REQUIREMENT \#3: Prepare a trial balance for March in the space below. Howard's Flight Radio Management Corporation Project 1 Grading Rubric - Students During its first month of operation, HFRM completed the following transactions. Requirement \#4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. o) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $150. d) The estimated income taxes are $100. Requirement \#5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. REQUIREMENT \#1: Prepare journal entries to record the March transactions in the General Journal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. Ganaral InIIrnal Once you've completed this requirement print your General Journal to complete Requirement \#2 on the General Ledger worksheet. Must be Manually Updated From "March Transactions" Data \begin{tabular}{|r|r|r|} \hline Event & Entry & Monthly Exp \\ \hline Cash & 22500 & \\ \hline Shares & 2250 & \\ \hline Share Price & 10 & \\ \hline Total Stock Value & 22500 & 180 \\ \hline Insurance & 2160 & 1800 \\ \hline Month's Rent & & \\ \hline Repair Equipment & 5800 & 300 \\ \hline Paid Down on Equipment & 2200 & \\ \hline Equipment Balance & 3600 & \\ \hline Repair Supplies on Credit & 650 & \\ \hline Telephone Bill March & & \\ \hline Revenue 3/1-3/10 & 2000 & \\ \hline Paid Gary Company & 400 & \\ \hline Revenue 3/10-3/20 & 2450 & \\ \hline Revenue 3/20-3/31 & 1500 & \\ \hline Electic Bill & & \\ \hline Declared and paid Dividend & 1000 & \\ \hline \end{tabular} Must be Manually Updated From "Adjusting Entries" Data \begin{tabular}{|l|r|l|} \hline Monthly Insurance Exp & 180 & \\ \hline Inventory Repair Supplies & 200 & 450 \\ \hline Repair Equip Depreciation & 150 & \multicolumn{1}{|l|}{} \\ \hline Income Tax & 100 & \multicolumn{1}{|l}{} \\ \cline { 1 - 2 } \end{tabular} Automatically Updated From "March Transactions" Data \begin{tabular}{|l|r|} \hline Total Revenue & 5950 \\ \hline Total Monthly Expense & 3380 \\ \hline Accounts Payable & 3850 \\ \hline \end{tabular} equirement \#7: Prepare the financial statements for Howard's Flight Radio Management Corporation as of March 31 in the space below. 'ou will only be preparing the Income Statement, Statement of Retained Earning, and the Balance Sheet. he Statement of Cash Flows is a required Financial Statement, but is not required for this project. REQUIR Date This worksheet will be used to complete Requirements \#2, \#5 and \#9. Instructions for \#5 can be found on the Adjusting Entries Worksheet. Instructions for \#9 can be found on the Closing Entries Worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started