Please help I am lost. I`m not how to answer a, b or c

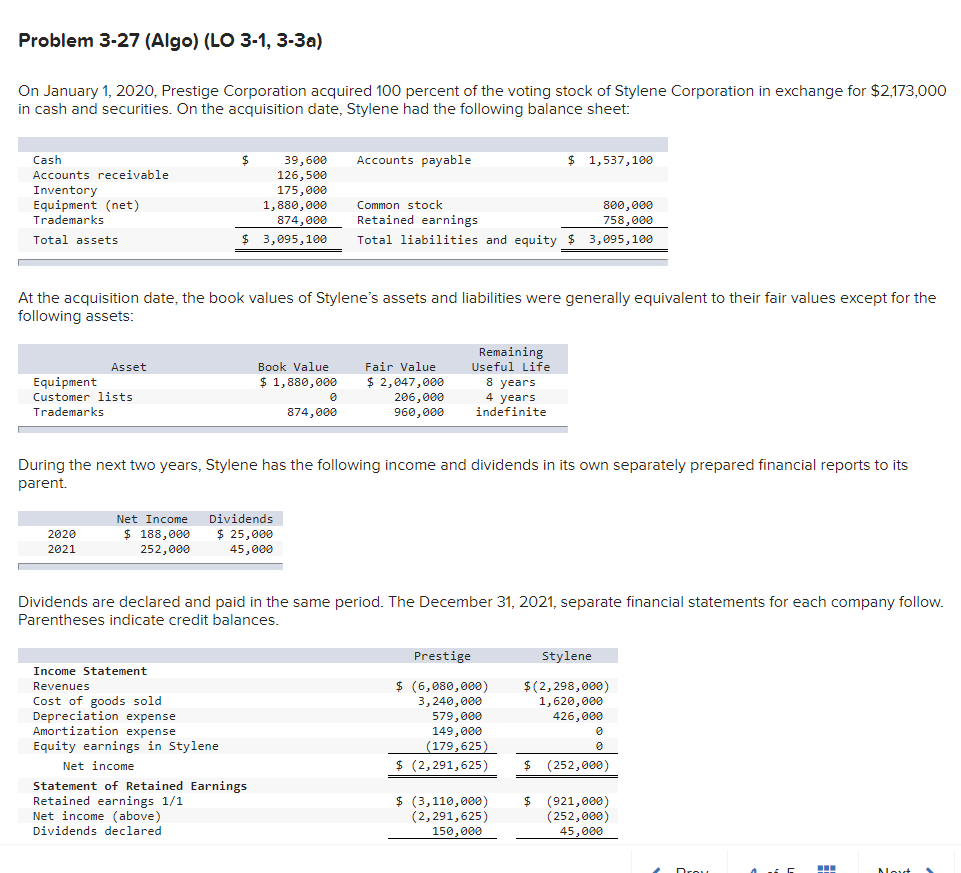

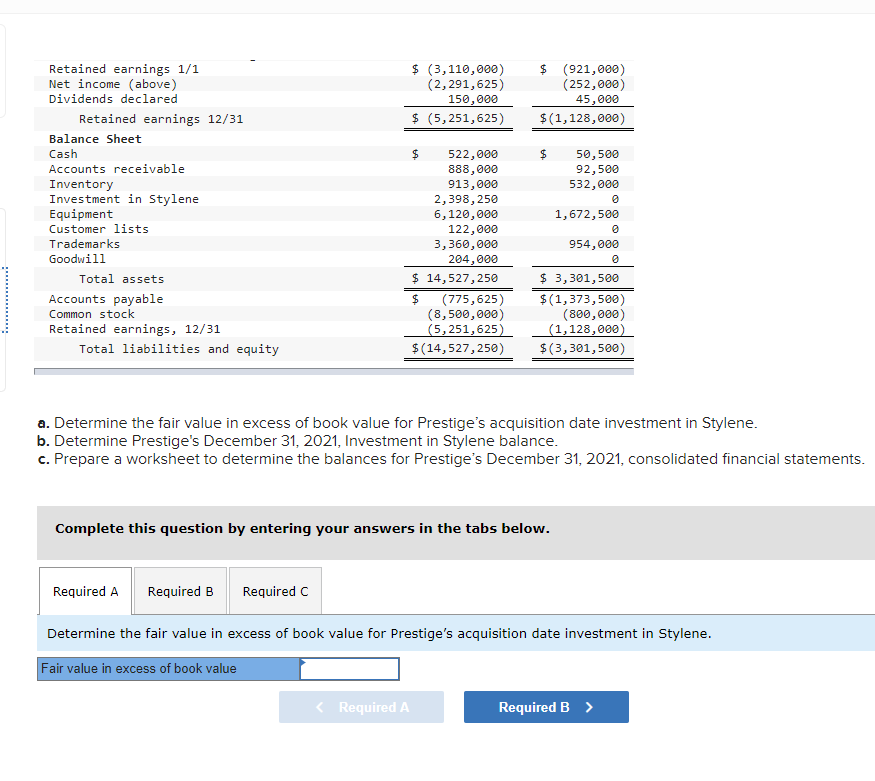

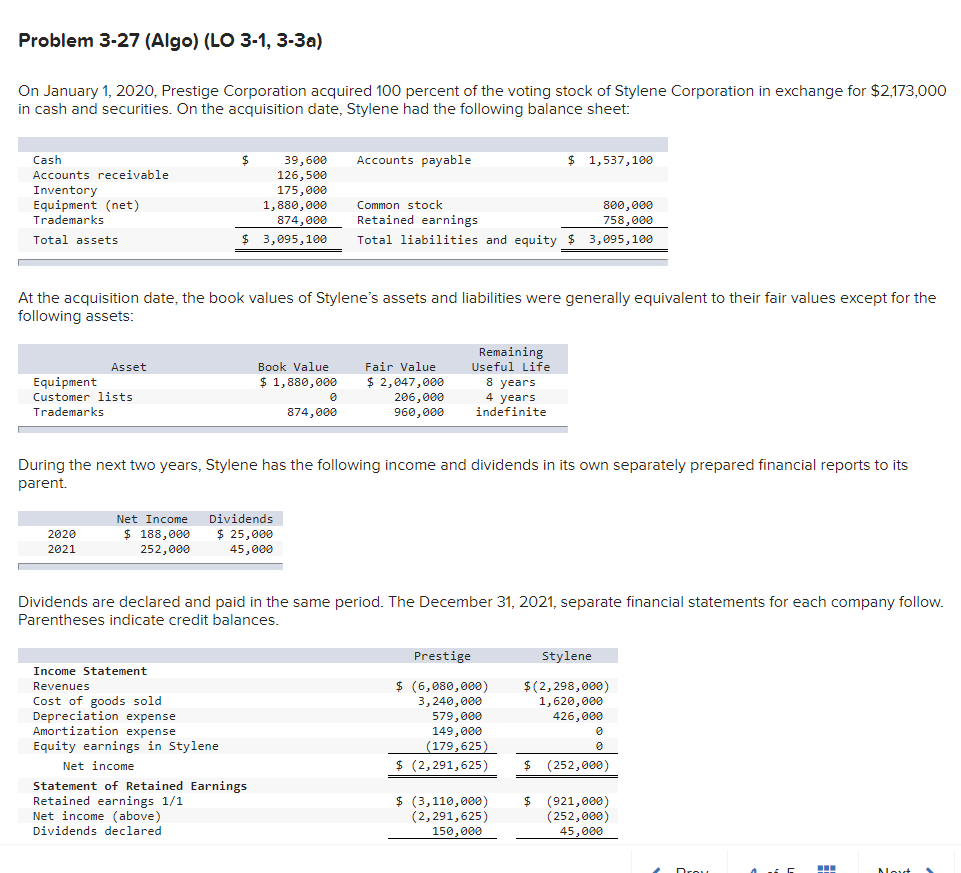

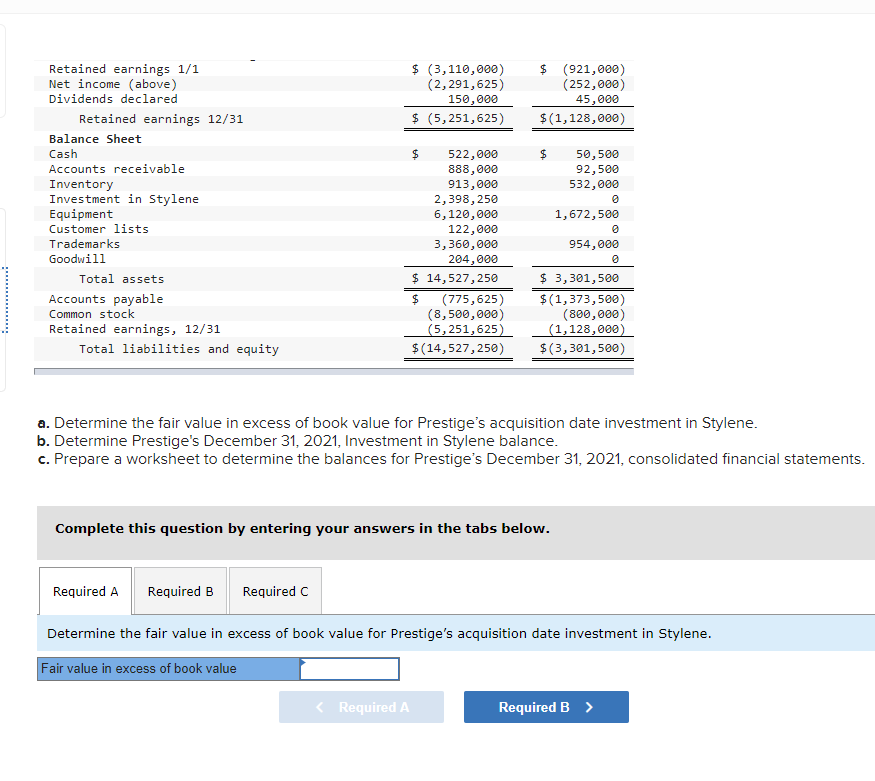

Problem 3-27 (Algo) (LO 3-1, 3-3a) On January 1, 2020, Prestige Corporation acquired 100 percent of the voting stock of Stylene Corporation in exchange for $2,173,000 in cash and securities. On the acquisition date, Stylene had the following balance sheet: Accounts payable $ 1,537,100 Cash Accounts receivable Inventory Equipment (net) Trademarks Total assets $ 39,600 126,500 175,000 1,880,000 874,000 $ 3,095, 100 Common stock 800,000 Retained earnings 758,000 Total liabilities and equity $ 3,095,100 At the acquisition date, the book values of Stylene's assets and liabilities were generally equivalent to their fair values except for the following assets: Book Value $ 1,880,000 Asset Equipment Customer lists Trademarks Fair Value $ 2,047,000 206,000 960,000 Remaining Useful Life 8 years 4 years indefinite 874,000 During the next two years, Stylene has the following income and dividends in its own separately prepared financial reports to its parent. 2020 2021 Net Income $ 188,000 252,000 Dividends $ 25,000 45,000 Dividends are declared and paid in the same period. The December 31, 2021, separate financial statements for each company follow. Parentheses indicate credit balances. Prestige Stylene $(2,298,000) 1,620,000 426,000 Income Statement Revenues Cost of goods sold Depreciation expense Amortization expense Equity earnings in Stylene Net income Statement of Retained Earnings Retained earnings 1/1 Net income (above) Dividends declared $ (6,080,000) 3,240,000 579,000 149,000 (179,625) $ (2,291,625) $ (252,000) $ $ (3,110,000) (2,291,625) 150,000 (921,000) (252,000) 45,000 $ (3,110,000) (2,291,625) 150,000 $ (5,251,625) $ (921,000) (252,000) 45,000 $(1,128,000) $ 50,500 92,500 532,000 Retained earnings 1/1 Net income (above) Dividends declared Retained earnings 12/31 Balance Sheet Cash Accounts receivable Inventory Investment in Stylene Equipment Customer lists Trademarks Goodwill Total assets Accounts payable Common stock Retained earnings, 12/31 Total liabilities and equity 1,672,500 954,000 $ 522,000 888,000 913,000 2,398, 250 6,120,000 122,000 3,360,000 204,000 $ 14,527,250 $ (775,625) (8,500,000) (5,251,625) $(14,527,250) $ 3,301,500 $(1,373,500) (800,000) (1,128,000) $(3,301,500) a. Determine the fair value in excess of book value for Prestige's acquisition date investment in Stylene. b. Determine Prestige's December 31, 2021, Investment in Stylene balance. c. Prepare a worksheet to determine the balances for Prestige's December 31, 2021, consolidated financial statements. Complete this question by entering your answers in the tabs below. Required a Required B Required C Determine the fair value in excess of book value for Prestige's acquisition date investment in Stylene. Fair value in excess of book value