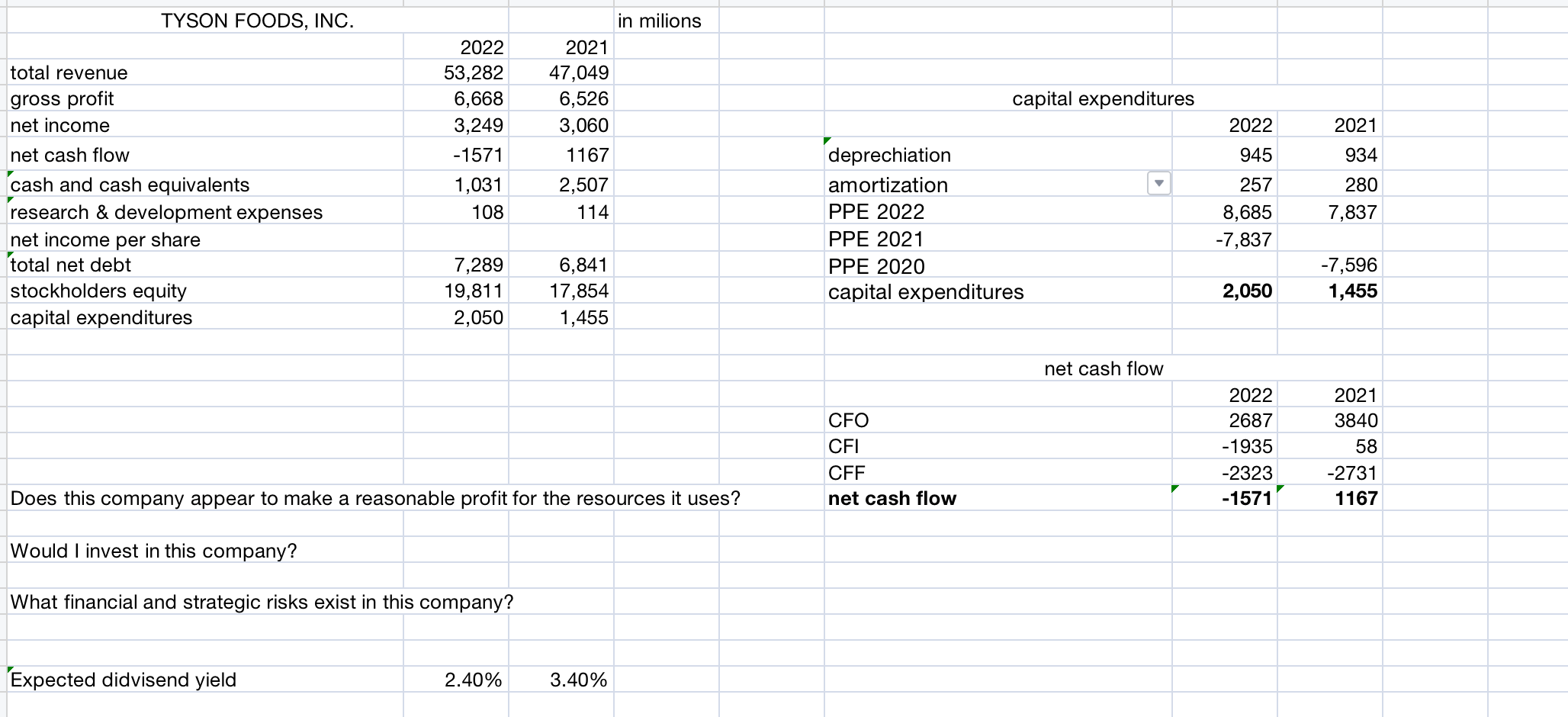

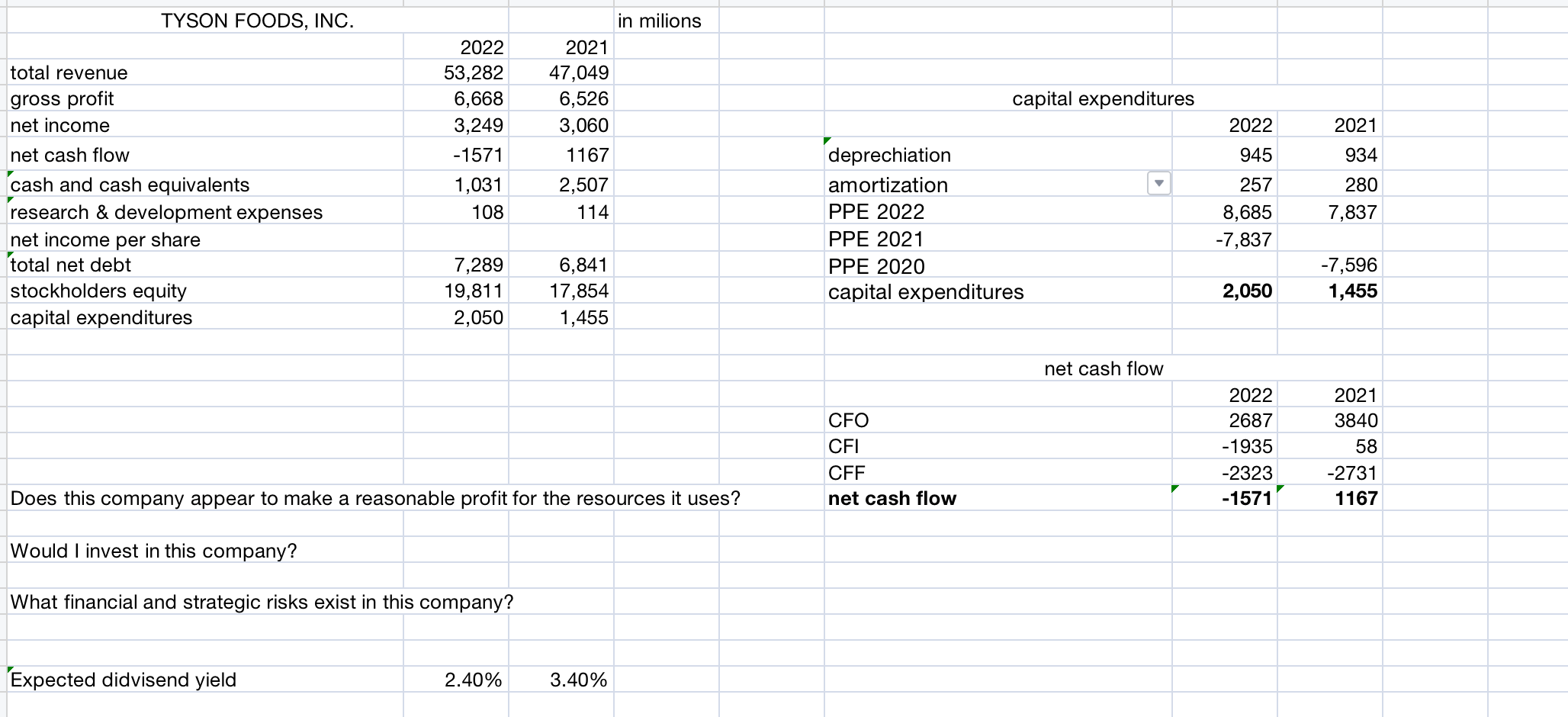

Please help i am missing net income per share.

This is my work please double check and i am having difficulties figuring out net income per share. Thank you

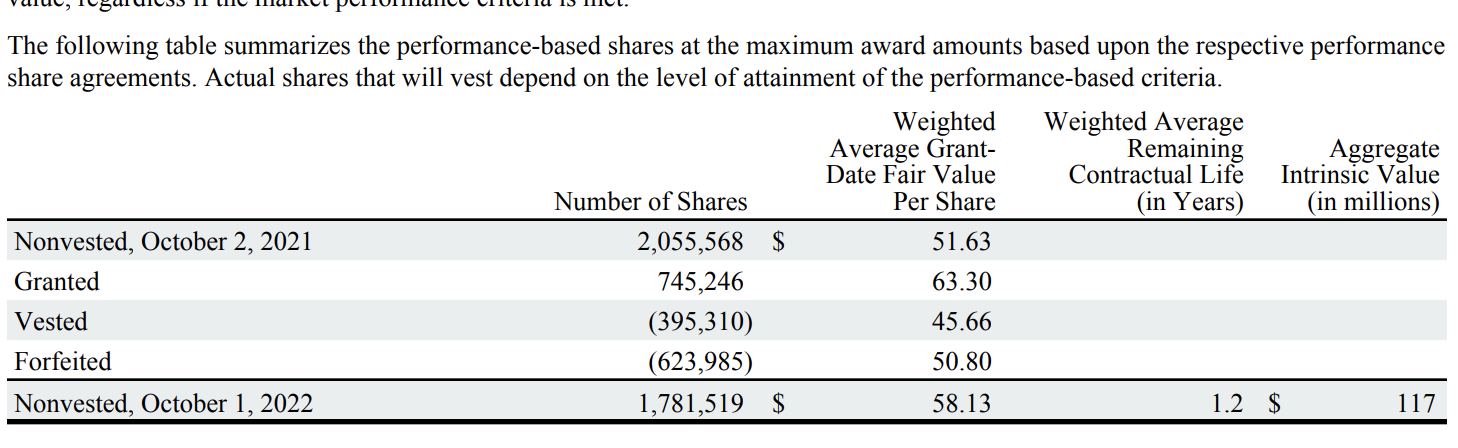

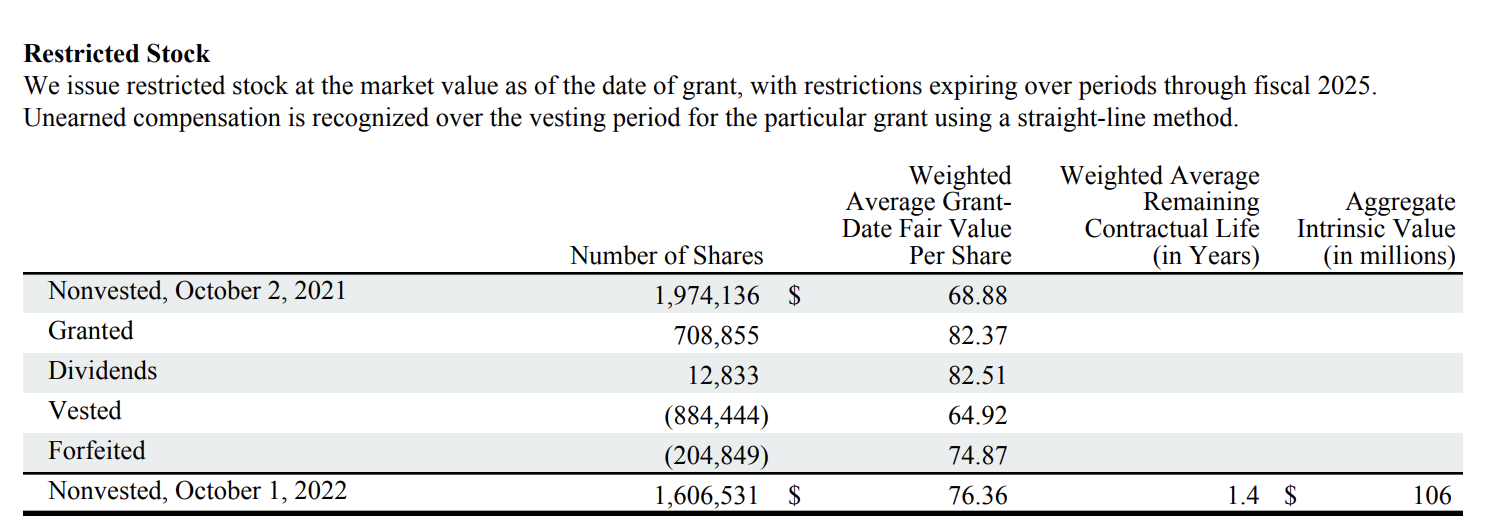

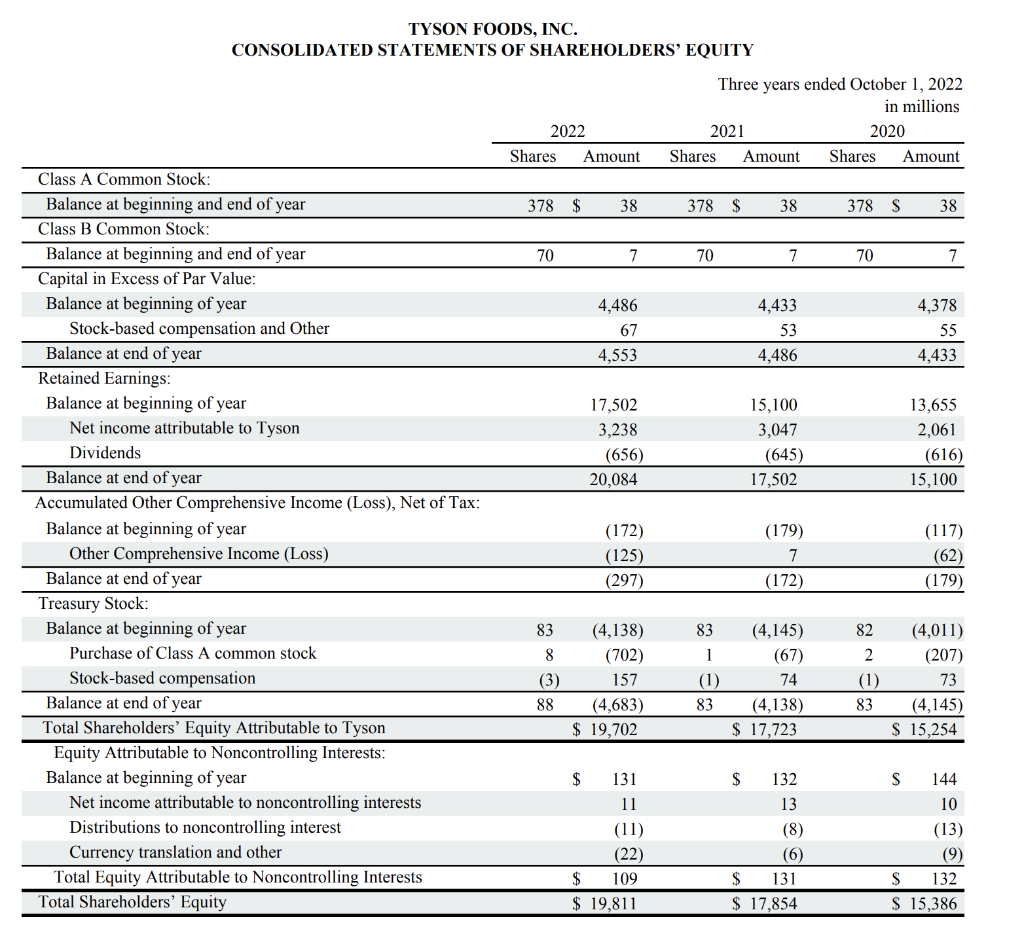

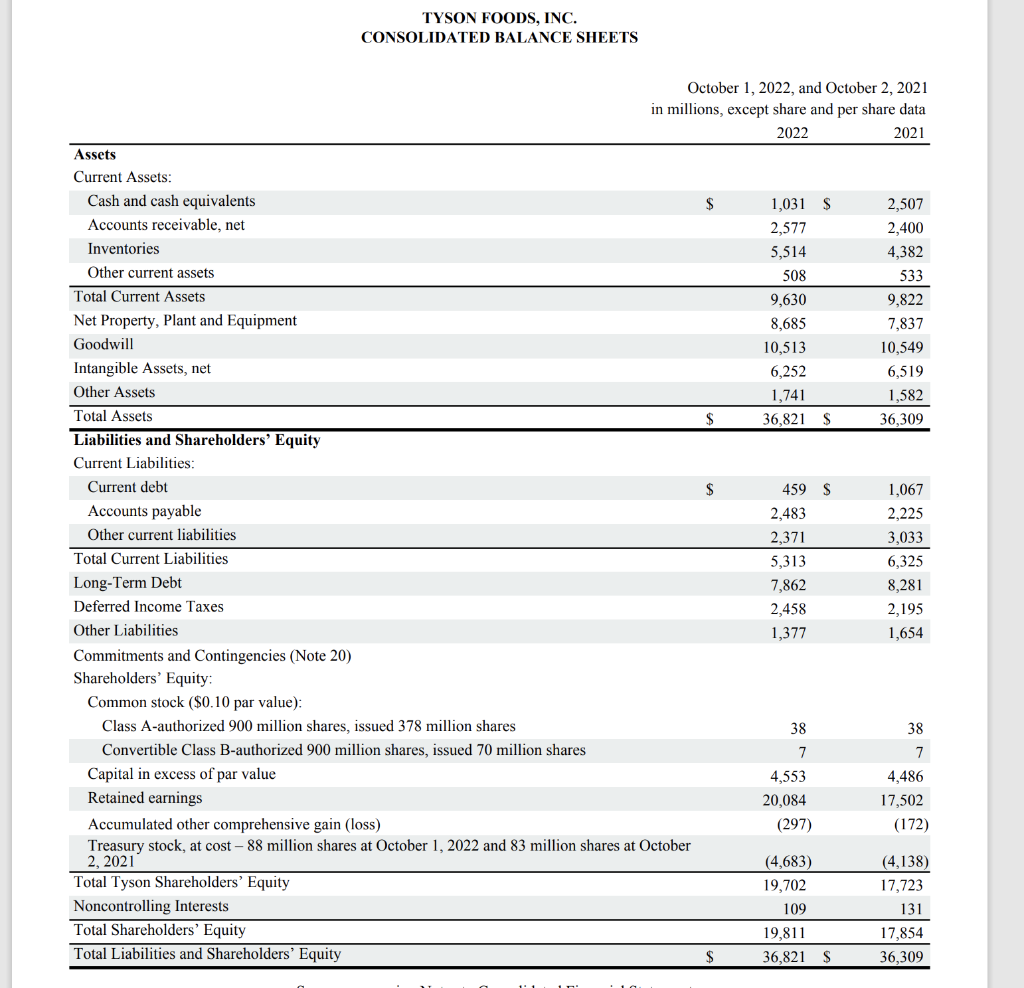

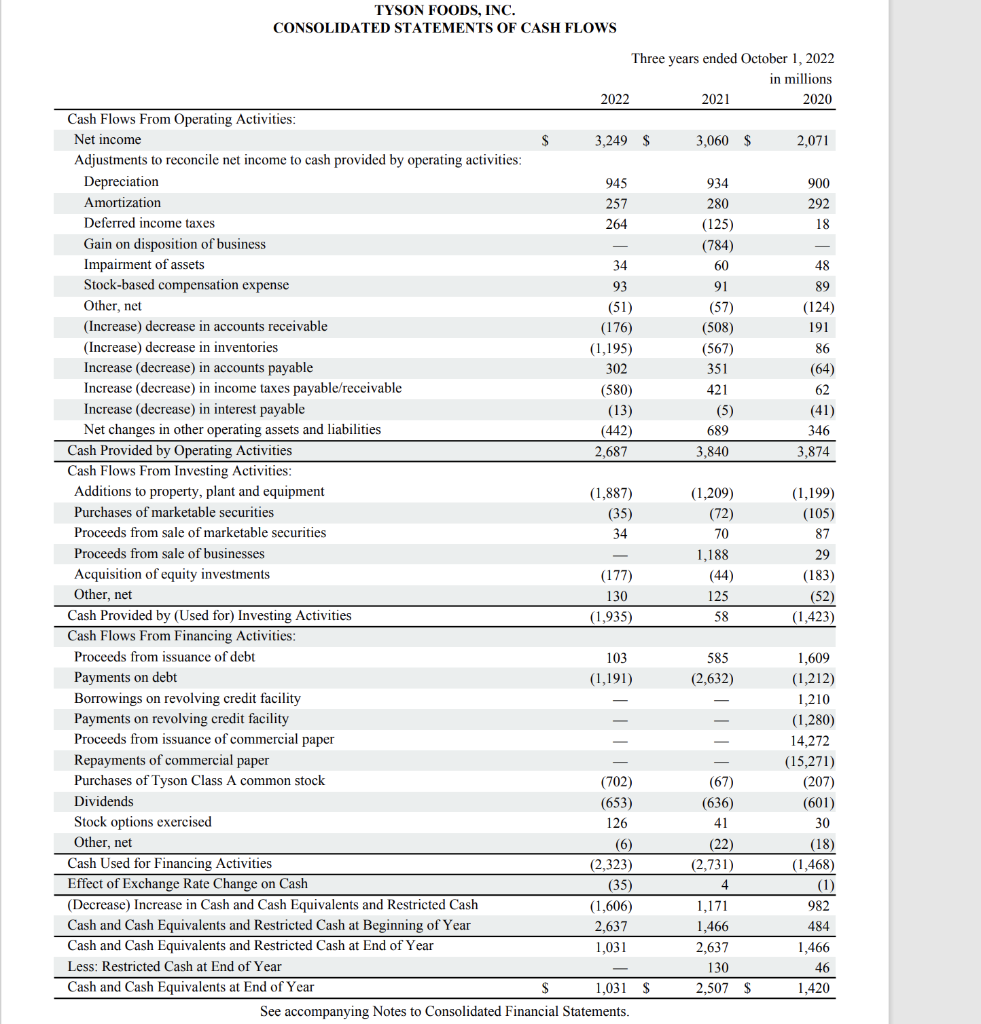

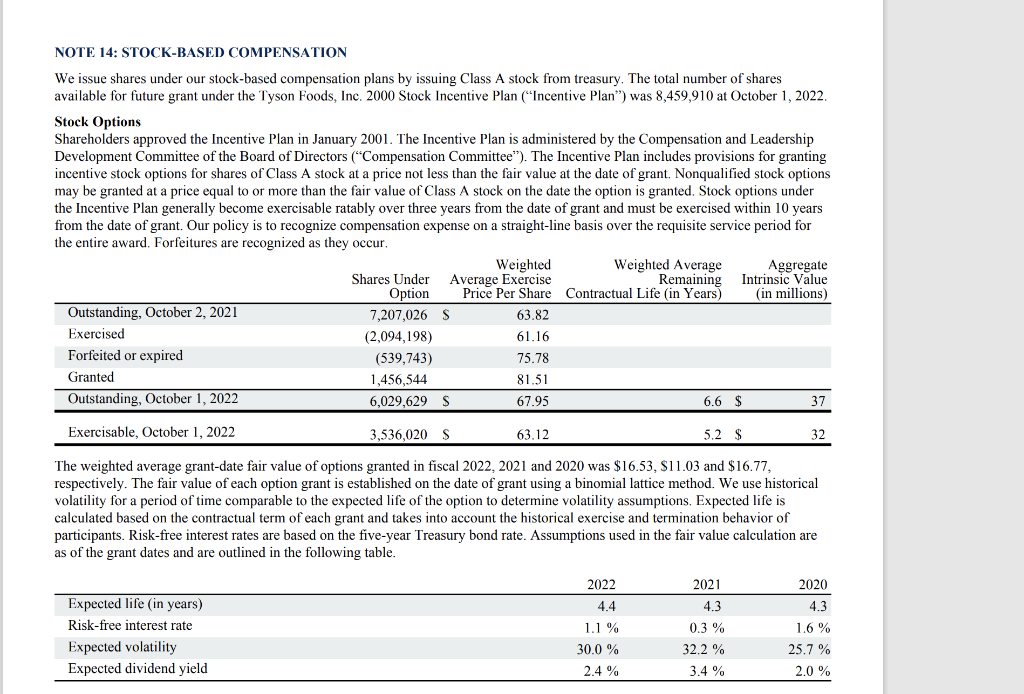

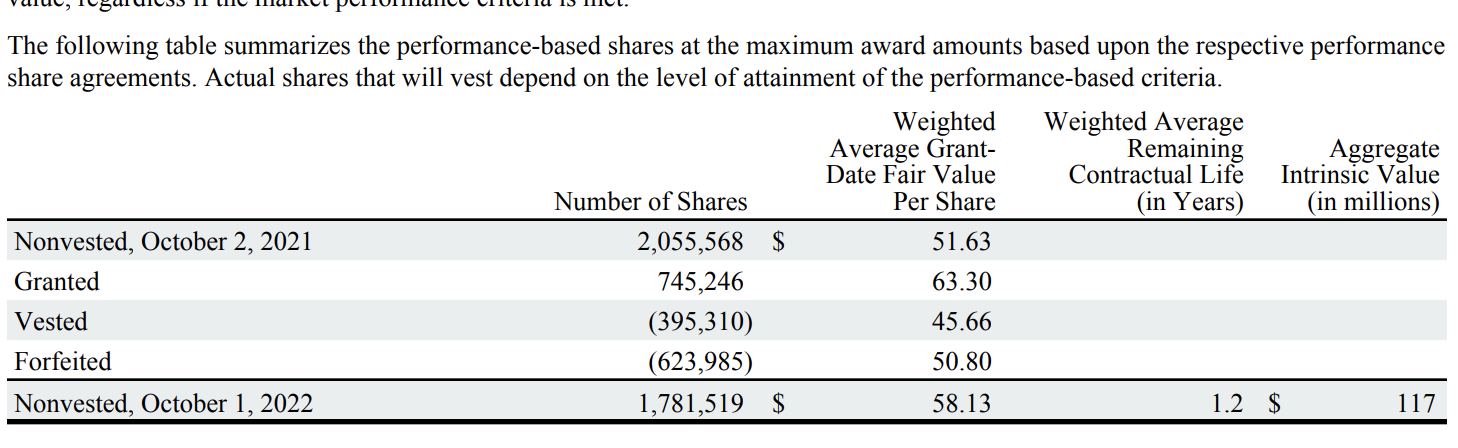

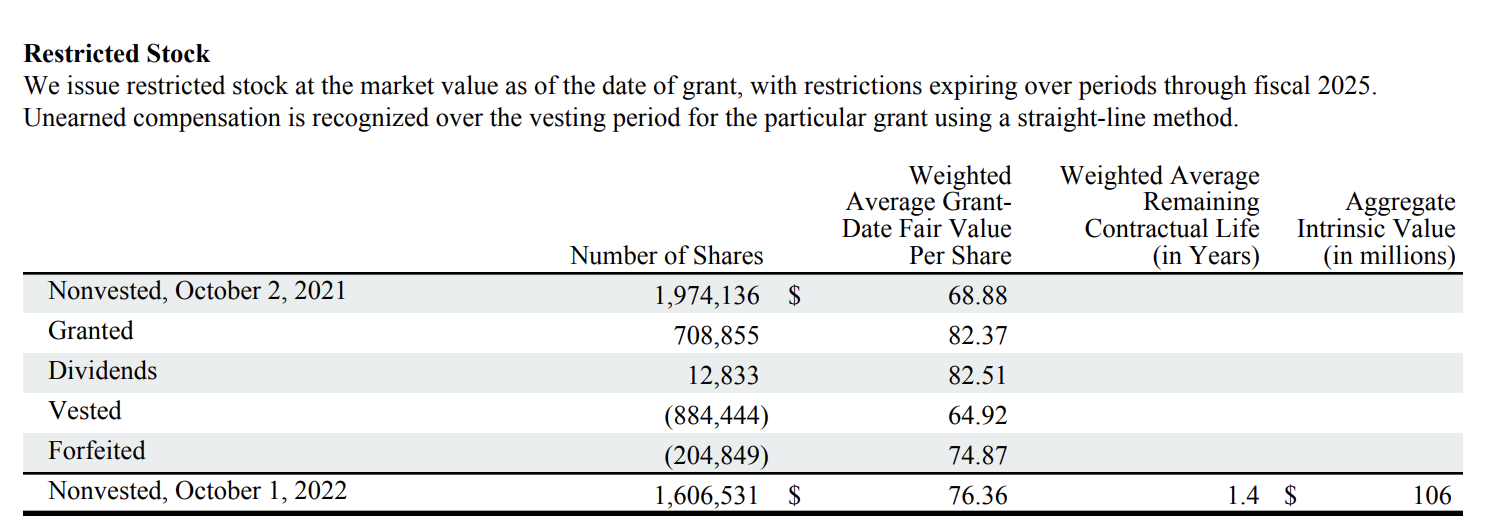

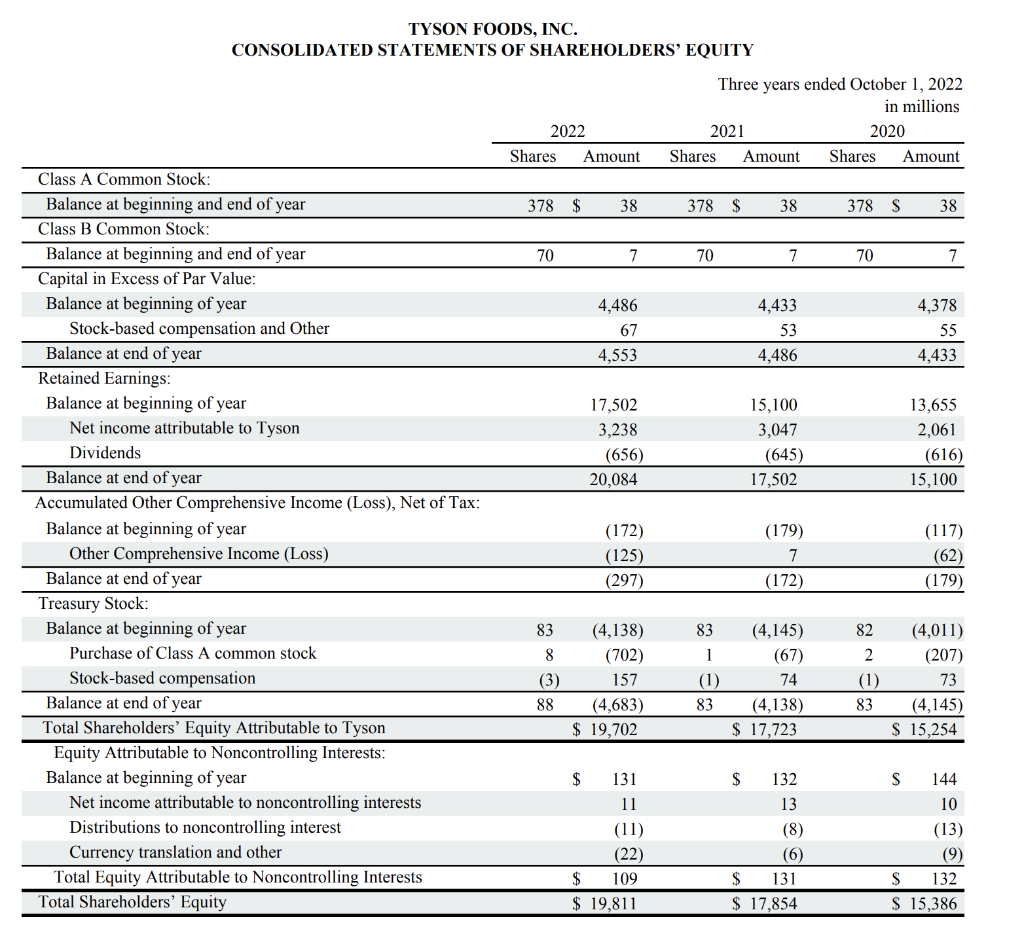

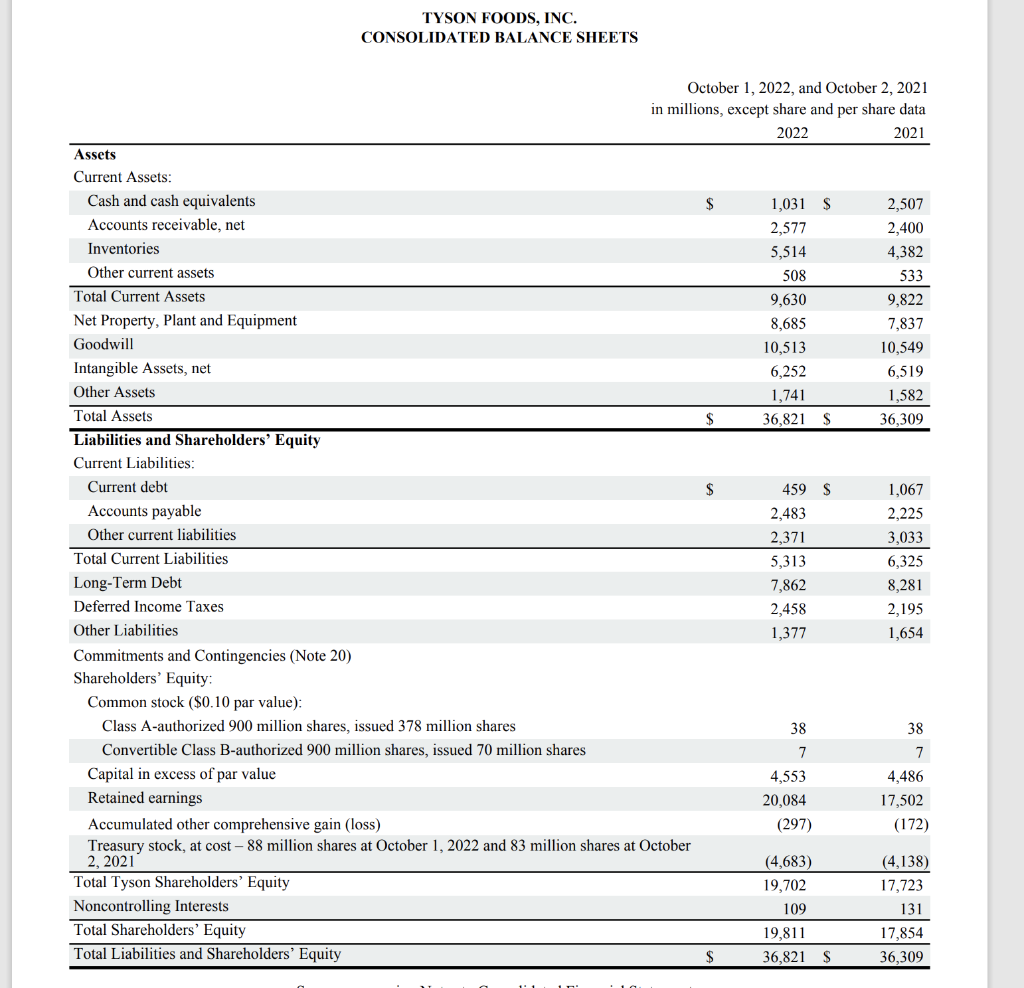

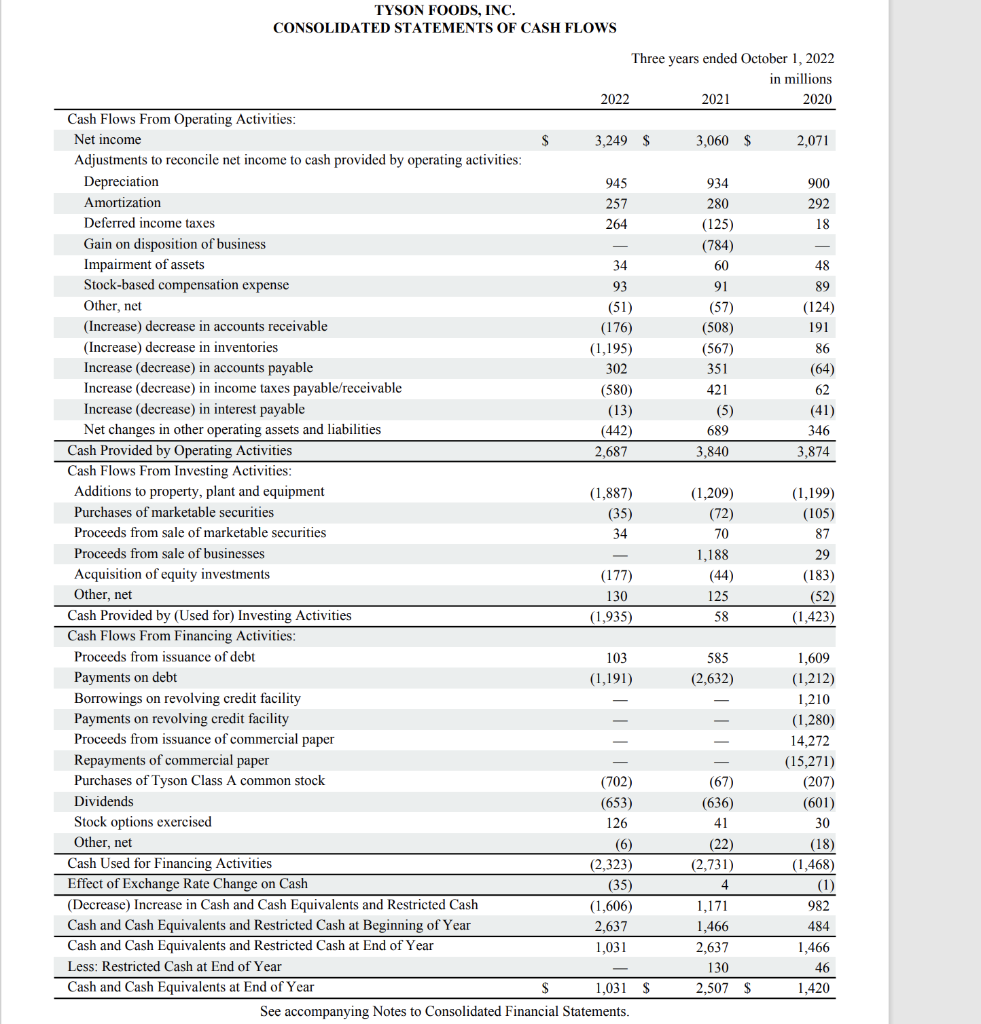

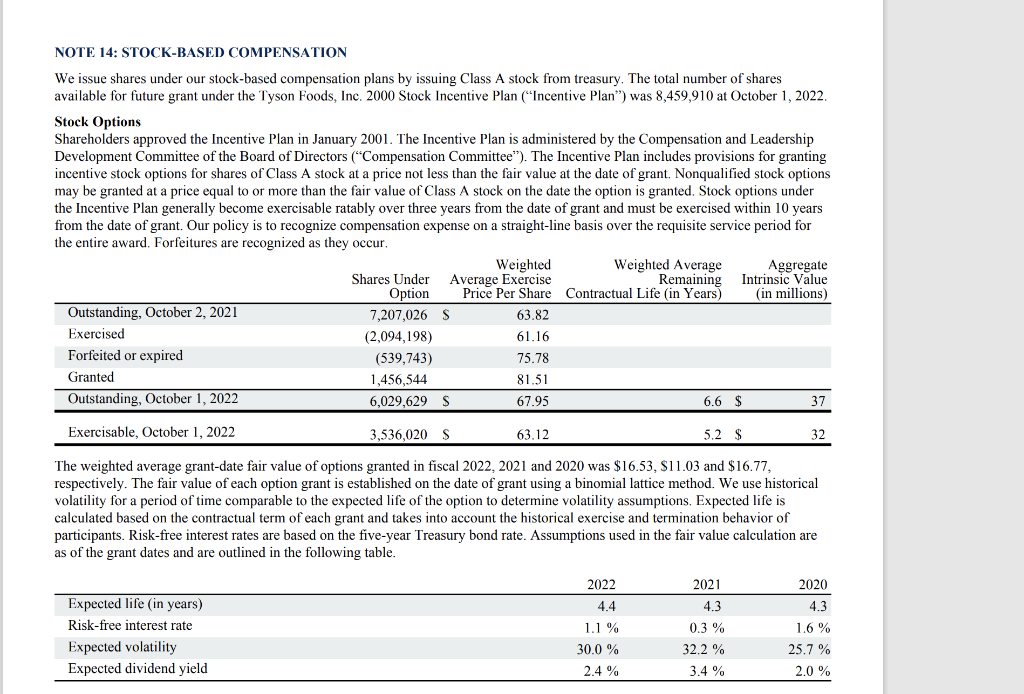

The following table summarizes the performance-based shares at the maximum award amounts based upon the respective performance share agreements. Actual shares that will vest depend on the level of attainment of the performance-based criteria. Restricted Stock We issue restricted stock at the market value as of the date of grant, with restrictions expiring over periods through fiscal 2025. Unearned compensation is recognized over the vesting period for the particular grant using a straight-line method. TYSON FOODS, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Three years ended October 1, 2022 TYSON FOODS, INC. TYSON FOODS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Three years ended October 1, 2022 in millions See accompanying Notes to Consolidated Financial Statements. NOTE 14: STOCK-BASED COMPENSATION We issue shares under our stock-based compensation plans by issuing Class A stock from treasury. The total number of shares available for future grant under the Tyson Foods, Inc. 2000 Stock Incentive Plan ("Incentive Plan") was 8,459,910 at October 1, 2022. Stock Options Shareholders approved the Incentive Plan in January 2001. The Incentive Plan is administered by the Compensation and Leadership Development Committee of the Board of Directors ("Compensation Committee"). The Incentive Plan includes provisions for granting incentive stock options for shares of Class A stock at a price not less than the fair value at the date of grant. Nonqualified stock options may be granted at a price equal to or more than the fair value of Class A stock on the date the option is granted. Stock options under the Incentive Plan generally become exercisable ratably over three years from the date of grant and must be exercised within 10 years from the date of grant. Our policy is to recognize compensation expense on a straight-line basis over the requisite service period for the entire award. Forfeitures are recognized as they occur. The weighted average grant-date fair value of options granted in fiscal 2022, 2021 and 2020 was $16.53,$11.03 and $16.77, respectively. The fair value of each option grant is established on the date of grant using a binomial lattice method. We use historical volatility for a period of time comparable to the expected life of the option to determine volatility assumptions. Expected life is calculated based on the contractual term of each grant and takes into account the historical exercise and termination behavior of participants. Risk-free interest rates are based on the five-year Treasury bond rate. Assumptions used in the fair value calculation are as of the grant dates and are outlined in the following table. Would I invest in this company? What financial and strategic risks exist in this company? Expected didvisend yield 2.40%3.40%