Answered step by step

Verified Expert Solution

Question

1 Approved Answer

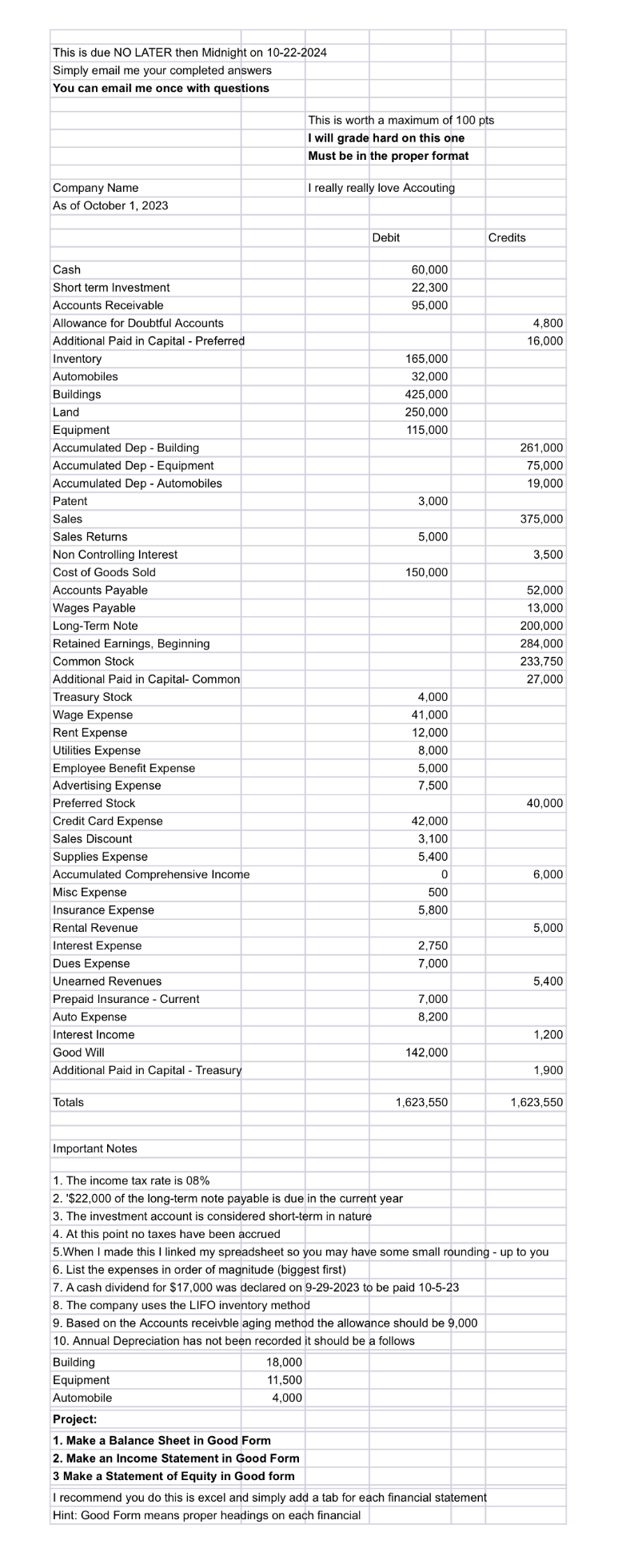

please help. i am not directly a business student and understanding the formatting especially is very difficult for me: Must be in the proper format

please help. i am not directly a business student and understanding the formatting especially is very difficult for me:

Must be in the proper format

Company Name I really really love Accouting

As of October

Debit Credits

Cash

Short term Investment

Accounts Receivable

Allowance for Doubtful Accounts

Additional Paid in Capital Preferred

Inventory

Automobiles

Buildings

Land

Equipment

Accumulated Dep Building

Accumulated Dep Equipment

Accumulated Dep Automobiles

Patent

Sales

Sales Returns

Non Controlling Interest

Cost of Goods Sold

Accounts Payable

Wages Payable

LongTerm Note

Retained Earnings, Beginning

Common Stock

Additional Paid in Capital Common

Treasury Stock

Wage Expense

Rent Expense

Utilities Expense

Employee Benefit Expense

Advertising Expense

Preferred Stock

Credit Card Expense

Sales Discount

Supplies Expense

Accumulated Comprehensive Income

Misc Expense

Insurance Expense

Rental Revenue

Interest Expense

Dues Expense

Unearned Revenues

Prepaid Insurance Current

Auto Expense

Interest Income

Good Will

Additional Paid in Capital Treasury

Totals

Important Notes

The income tax rate is

$ of the longterm note payable is due in the current year

The investment account is considered shortterm in nature

At this point no taxes have been accrued

When I made this I linked my spreadsheet so you may have some small rounding up to you

List the expenses in order of magnitude biggest first

A cash dividend for $ was declared on to be paid

The company uses the LIFO inventory method

Based on the Accounts receivble aging method the allowance should be

Annual Depreciation has not been recorded it should be a follows

Building

Equipment

Automobile

Project:

Make a Balance Sheet in Good Form

Make an Income Statement in Good Form

Make a Statement of Equity in Good form

I recommend you do this is excel and simply add a tab for each financial statement

Hint: Good Form means proper headings on each financial

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started