Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help i am stuck. I wrote the answers for each box to the right... thank you! ps.. CTRL + or - to zoom Blake

Please help i am stuck. I wrote the answers for each box to the right... thank you! ps.. CTRL + or - to zoom

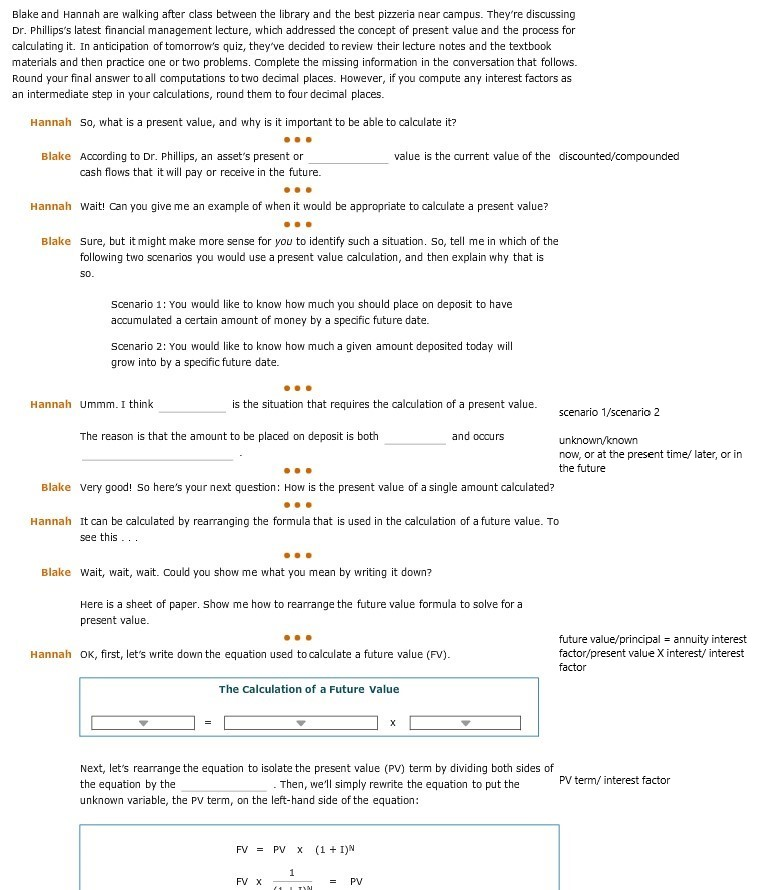

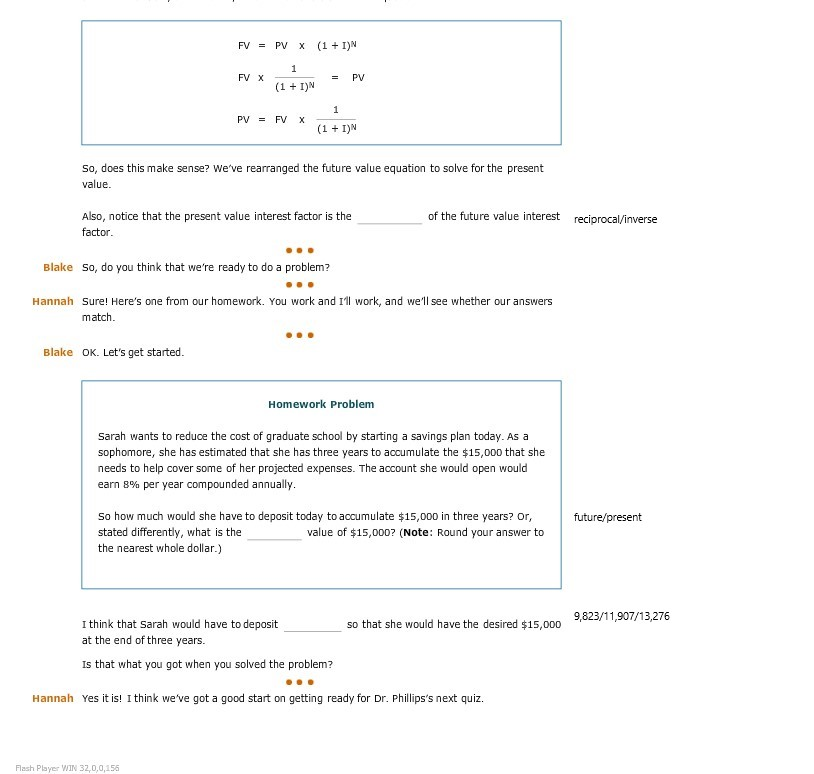

Blake and Hannah are walking after class between the library and the best pizzeria near campus. They're discussing Dr. Phillips's latest financial management lecture, which addressed the concept of present value and the process for calculating it. In anticipation of tomorrow's quiz, they've decided to review their lecture notes and the textbook materials and then practice one or two problems. Complete the missing information in the conversation that follows. Round your final answer to all computations to two decimal places. However, if you compute any interest factors as an intermediate step in your calculations, round them to four decimal places Hannah So, what is a present value, and why is it important to be able to calculate it? Blake According to Dr. Phillips, an asset's present or value is the current value of the discounted/compounded cash flows that it will pay or receive in the future. Hannah wait! Can you give me an example of when it would be appropriate to calculate a present value? Blake Sure, but it might make more sense for you to identify such a situation. So, tell me in which of the following two scenarios you would use a present value calculation, and then explain why that is S0 Scenario 1: You would like to know how much you should place on deposit to have accumulated a certain amount of money by a specific future date. Scenario 2: You would like to know how much a given amount deposited today will grow into by a specific future date. Hannah Ummm. I think is the situation that requires the calculation of a present value. scenario 1/scenario 2 The reason is that the amount to be placed on deposit is both and occurs now, or at the present time later, or in the future Blake very good! So here's your next question: How is the present value of a single amount calculated? Hannah It can be calculated by rearranging the formula that is used in the calculation of a future value. To see this Blake Wait, wait, wait. Could you show me what you mean by writing it down? Here is a sheet of paper. Show me how to rearrange the future value formula to solve for a present value. future value/principal annuity interest factor/present value X interest/ interest factor Hannah OK, first, let's write down the equation used to calculate a future value (FV) The Calculation of a Future Value Next, let's rearrange the equation to isolate the present value (PV) term by dividing both sides of the equation by the unknown variable, the PV term, on the left-hand side of the equation: PV term/ interest factor Then, we'll simply rewrite the equation to put the FV = PV x (1 + 1)N (1 I)N So, does this make sense? ve rearranged the future value equation to solve for the present of the future value interest reciprocal/inverse Also, notice that the present value interest factor is the factor Blake So, do you think that we're ready to do a problem? Hannah Sure! Here's one from our homework. You work and I work, and we'll see whether our answers match Blake OK. Let's get started Homework Problem Sarah wants to reduce the cost of graduate school by starting a savings plan today. As a sophomore, she has estimated that she has three years to accumulate the $15,000 that she needs to help cover some of her projected expenses. The account she would open would earn 8% per year compounded annually So how much would she have to deposit today to accumulate $15,000 in three years? Or, stated differently, what is the the nearest whole dollar.) value of $15,000? (Note: Round your answer to 9,823/11,907/13,276 so that she would have the desired $15,000 I think that Sarah would have to deposit at the end of three years. Is that what you got when you solved the problem? Hannah Yes it is! I think we've got a good start on getting ready for Dr. Phillips's next quiz. Flash Player WIN 32,0,0,156Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started