Please help I am taking a test. Need answers asap!

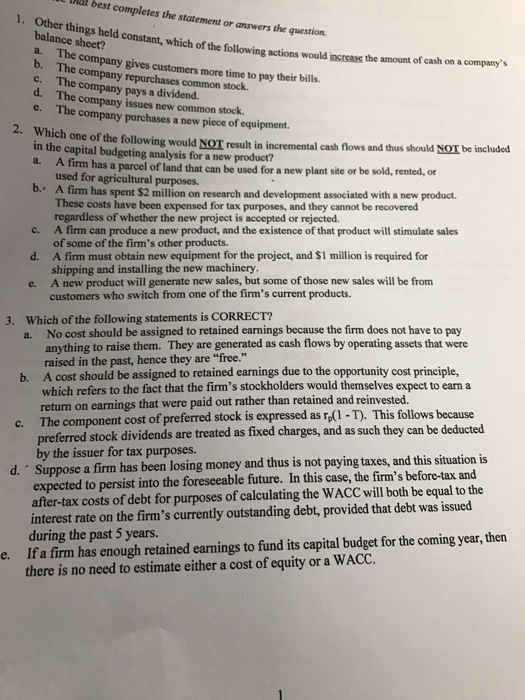

Other things held constant, which of the following actions would increase the amount of cash on a company's balance sheet? The company gives customers more time to pay their bills. The company repurchases common stock. The company pays a dividend. The company issues new common stock. The company purchases a new piece of equipment. Which one of the following would NOT result in incremental cask flows and thus should NOT be included in the capital budgeting analysis for a new product? A firm has a parcel of land that can be used for a new plant sac or be sold, rented, or used for agricultural purposes. A firm has spent $2 million on research and development associated with a new product. These costs have been expensed for tax purposes, and they cannot be recovered regardless of whether the new project is accepted or rejected. A firm can produce a new product, and the existence of that product will stimulate sales of some of the firm's other products. A firm must obtain new equipment for the project, and $1 million is required for shipping and installing the new machinery. A new product will generate new sales, but some of those new sales will be from customers w ho switch from one of the firm's current products. Which of the following statements is CORRECT? No cost should be assigned to retained earnings because the firm does not have to pay anything to raise them. They are generated as cash flows by operating assets that were raised in the past, hence they are "free." A cost should be assigned to retained earnings due to the opportunity cost principle, which refers to the fact that the firm's stockholders would themselves expect to earn a return on earnings that were paid out rather than retained and reinvested. The component cost of preferred stock is expressed as r_p (1 - T). This follows because preferred stock dividends are treated as fixed charges, and as such they can be deducted by the issuer for tax purposes. Suppose a firm has been losing money and thus is not paying taxes, and this situation is expected to persist into the foreseeable future. In this case, the firm's before-tax and after-tax costs of debt for purposes of calculating the WACC will both be equal to the interest rate on the firm's currently outstanding debt, provided that debt was issued during the past 5 years. If a firm has enough retained earnings to fund its capital budget for the coming year, then there is no need to estimate either a cost of equity or a WACC