Please help! I cannot figure out what the unrealized gain/loss would be for year 2 & year 3. I also don't understand the other submissions. I'm not sure what info you need.

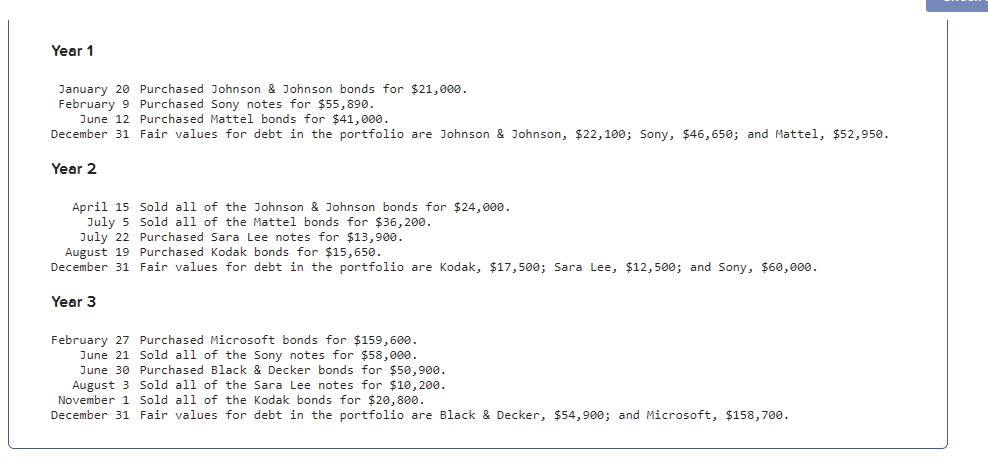

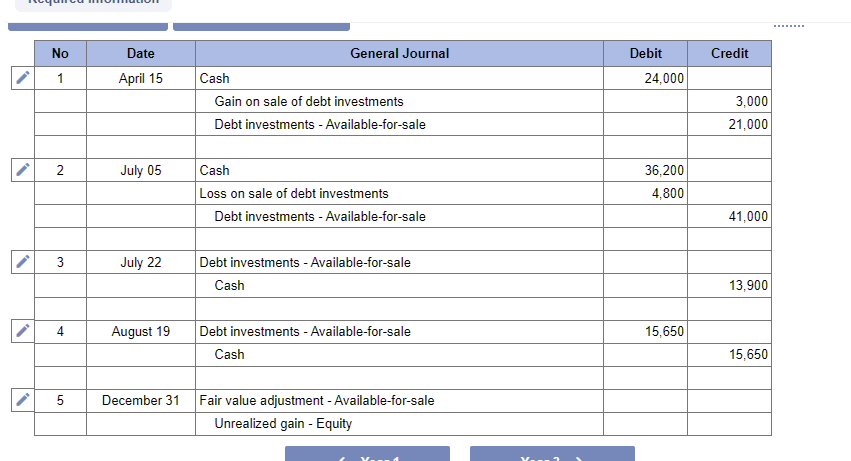

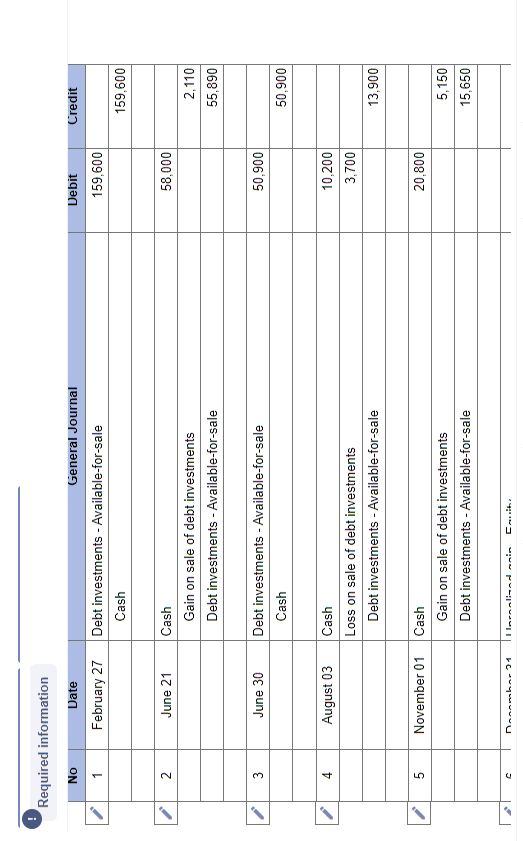

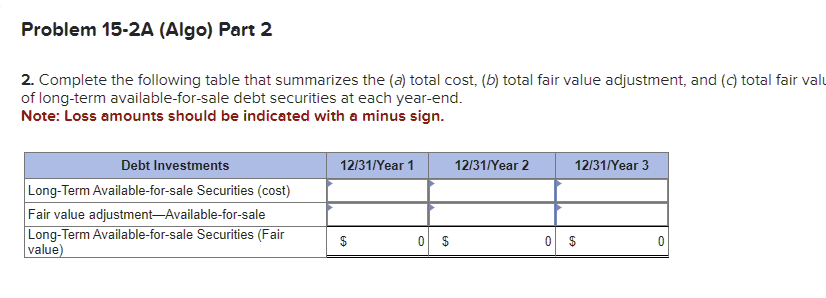

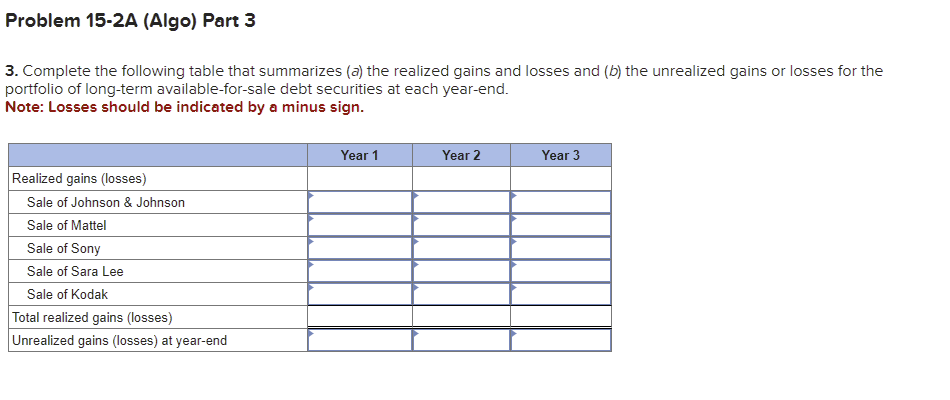

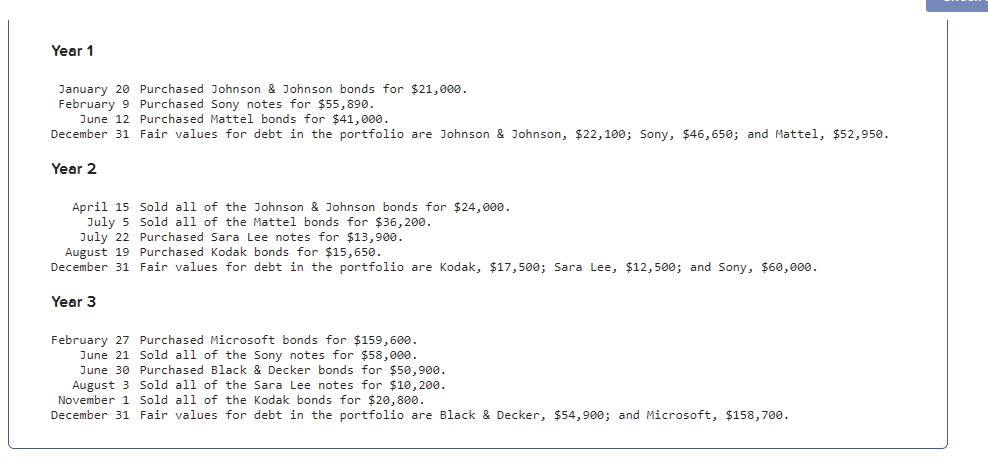

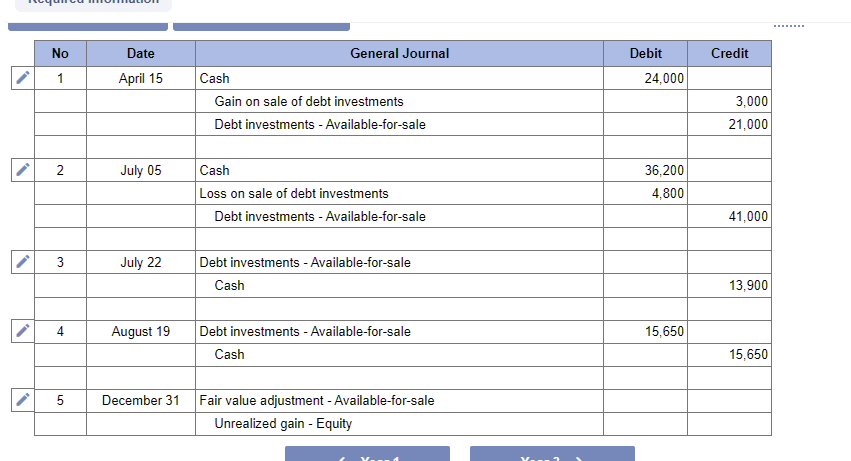

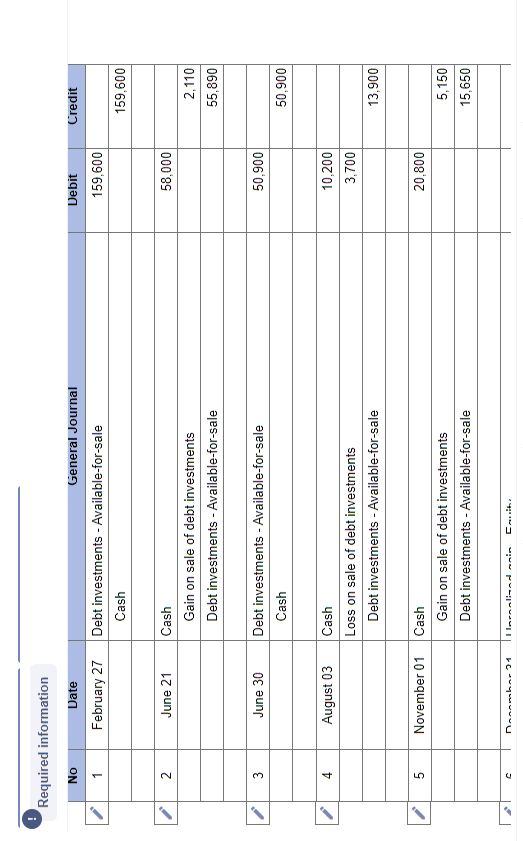

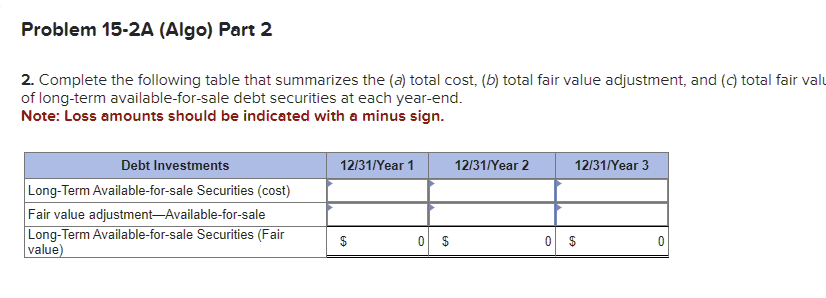

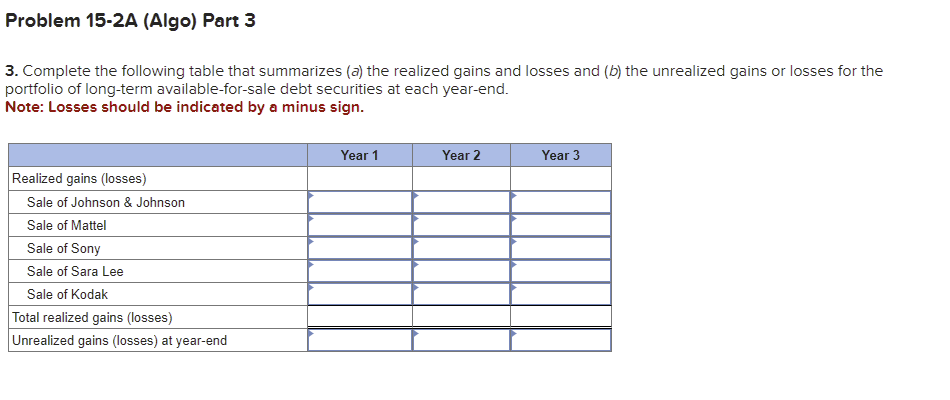

Year 1 January 20 Purchased Johnson \& Johnson bonds for $21,000. February 9 Purchased Sony notes for $55,890. June 12 Purchased Mattel bonds for $41,000. December 31 Fair values for debt in the portfolio are Johnson \& Johnson, $22,100; Sony, $46,650; and Mattel, $52,950. Year 2 April 15 Sold all of the Johnson \& Johnson bonds for $24,000. July 5 sold all of the Mattel bonds for $36,200. July 22 Purchased Sara Lee notes for $13,900. August 19 Purchased Kodak bonds for $15,650. December 31 Fair values for debt in the portfolio are Kodak, $17,500; Sara Lee, $12,500; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $159,600. June 21 Sold all of the Sony notes for $58,000. June 30 Purchased Black \& Decker bonds for $50,900. August 3 Sold all of the Sara Lee notes for $10,200. November 1 Sold all of the Kodak bonds for $20,800. December 31 Fair values for debt in the portfolio are Black \& Decker, $54,900; and Microsoft, $158,700. Required information 2. Complete the following table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair val of long-term available-for-sale debt securities at each year-end. Note: Loss amounts should be indicated with a minus sign. 3. Complete the following table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale debt securities at each year-end. Note: Losses should be indicated by a minus sign. Year 1 January 20 Purchased Johnson \& Johnson bonds for $21,000. February 9 Purchased Sony notes for $55,890. June 12 Purchased Mattel bonds for $41,000. December 31 Fair values for debt in the portfolio are Johnson \& Johnson, $22,100; Sony, $46,650; and Mattel, $52,950. Year 2 April 15 Sold all of the Johnson \& Johnson bonds for $24,000. July 5 sold all of the Mattel bonds for $36,200. July 22 Purchased Sara Lee notes for $13,900. August 19 Purchased Kodak bonds for $15,650. December 31 Fair values for debt in the portfolio are Kodak, $17,500; Sara Lee, $12,500; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $159,600. June 21 Sold all of the Sony notes for $58,000. June 30 Purchased Black \& Decker bonds for $50,900. August 3 Sold all of the Sara Lee notes for $10,200. November 1 Sold all of the Kodak bonds for $20,800. December 31 Fair values for debt in the portfolio are Black \& Decker, $54,900; and Microsoft, $158,700. Required information 2. Complete the following table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair val of long-term available-for-sale debt securities at each year-end. Note: Loss amounts should be indicated with a minus sign. 3. Complete the following table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale debt securities at each year-end. Note: Losses should be indicated by a minus sign