Answered step by step

Verified Expert Solution

Question

1 Approved Answer

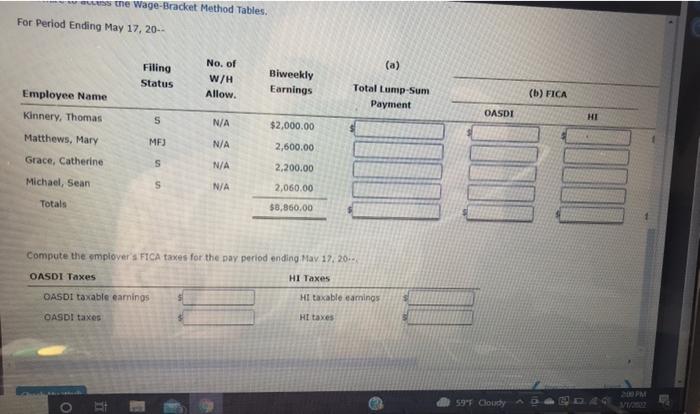

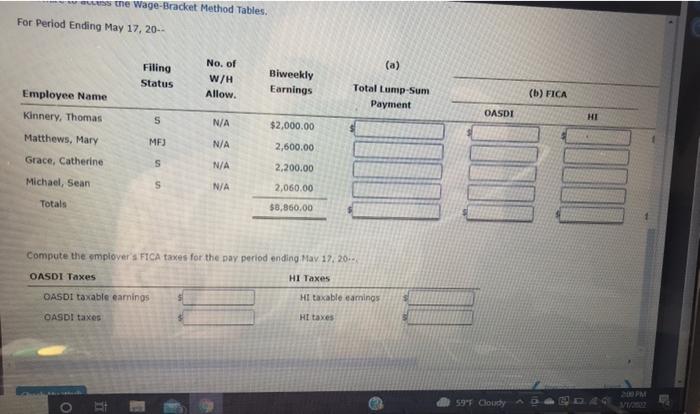

please help! i do not understand the Wage-Bracket Method Tables For Period Ending May 17, 20-- (a) Filing Status No. W/A Allow Biweekly Earnings Employee

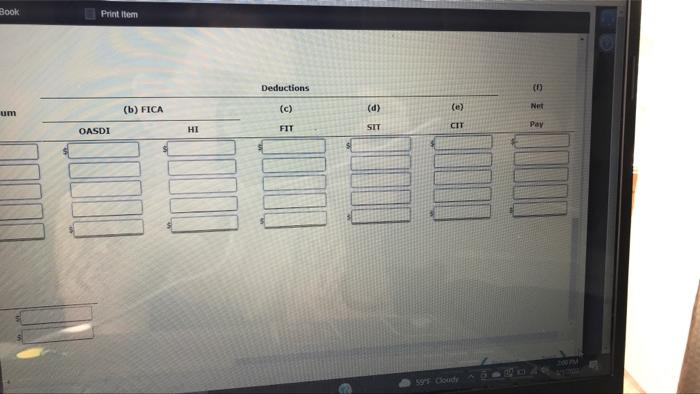

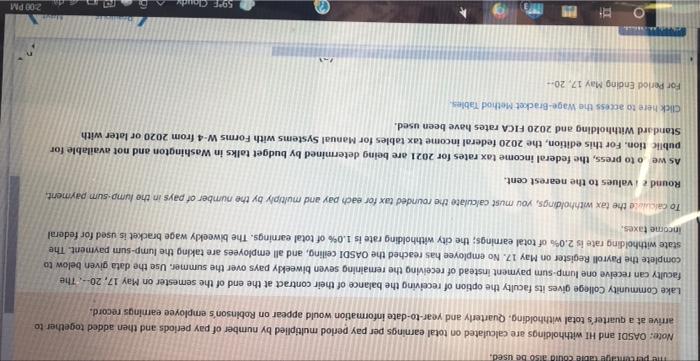

please help! i do not understand

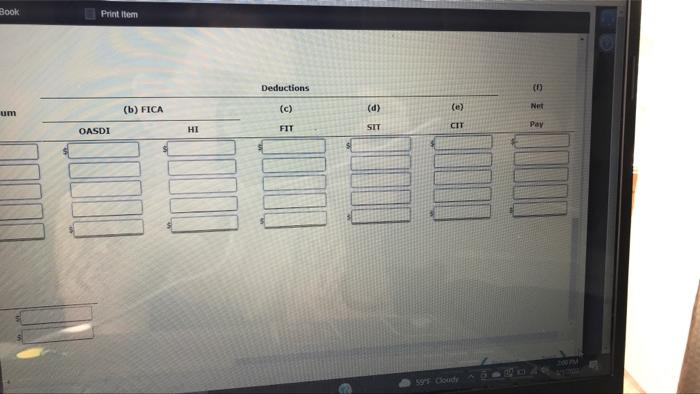

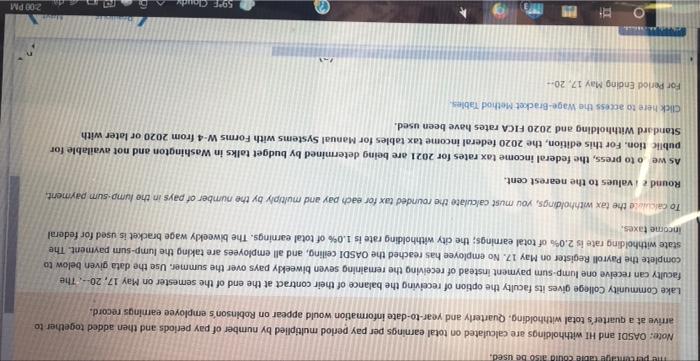

the Wage-Bracket Method Tables For Period Ending May 17, 20-- (a) Filing Status No. W/A Allow Biweekly Earnings Employee Name Total Lump-Sum Payment (b) FICA Kinnery, Thomas OASDI HI S N/A $2,000.00 Matthews, Mary MF) N/A 2,600.00 Grace, Catherine S N/A 2,200.00 Michael, Sean S N/A Totals 2,060.00 $8,860.00 Compute the emplover's FICA taxes for the pay period ending May 17, 20.. OASDI Taxes HI Taxes Ht taxable earings DASDI taxable earnings CASDI taxes Ht taxes o O 55" oudy Book Print item Deductions 00 (c) (b) FICA (d) (e) Net um OASDI FIT CIT Pay SIT HI 5 Couch me purgere could be used, Note: OASDI and Ht withholdings are calculated on total earnings per pay period multiplied by number of pay periods and then added together to arrive at a quarter's total withholding, Quarterly and year-to-date information would appear on Robinson's employee earnings record. Lake Community College gives its faculty the option of receiving the balance of their contract at the end of the semester on May 17, 20 - The faculty can receive one lump sum payment instead of receiving the remaining seven biweekly pays over the summer. Use the data given below to complete the Payroll Register on May 17. No employee has reached the OASDI ceiling, and all employees are taking the lump-sum payment. The state withholding rate is 2.0% of total earnings; the city withholding rate is 1.0% of total earnings. The biweekly wage bracket is used for federal income taxes. To calculuse the tax withholdings, you must calculate the rounded tax for each pay and multiply by the number of pays in the lumo sum payment, Round values to the nearest cent. As we o to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for public tion. For this edition, the 2020 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used. Click here to access the Wage-Bracket Method Tables For Period Ending May 17, 20- 59 2.00 PM the Wage-Bracket Method Tables For Period Ending May 17, 20-- (a) Filing Status No. W/A Allow Biweekly Earnings Employee Name Total Lump-Sum Payment (b) FICA Kinnery, Thomas OASDI HI S N/A $2,000.00 Matthews, Mary MF) N/A 2,600.00 Grace, Catherine S N/A 2,200.00 Michael, Sean S N/A Totals 2,060.00 $8,860.00 Compute the emplover's FICA taxes for the pay period ending May 17, 20.. OASDI Taxes HI Taxes Ht taxable earings DASDI taxable earnings CASDI taxes Ht taxes o O 55" oudy Book Print item Deductions 00 (c) (b) FICA (d) (e) Net um OASDI FIT CIT Pay SIT HI 5 Couch me purgere could be used, Note: OASDI and Ht withholdings are calculated on total earnings per pay period multiplied by number of pay periods and then added together to arrive at a quarter's total withholding, Quarterly and year-to-date information would appear on Robinson's employee earnings record. Lake Community College gives its faculty the option of receiving the balance of their contract at the end of the semester on May 17, 20 - The faculty can receive one lump sum payment instead of receiving the remaining seven biweekly pays over the summer. Use the data given below to complete the Payroll Register on May 17. No employee has reached the OASDI ceiling, and all employees are taking the lump-sum payment. The state withholding rate is 2.0% of total earnings; the city withholding rate is 1.0% of total earnings. The biweekly wage bracket is used for federal income taxes. To calculuse the tax withholdings, you must calculate the rounded tax for each pay and multiply by the number of pays in the lumo sum payment, Round values to the nearest cent. As we o to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for public tion. For this edition, the 2020 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used. Click here to access the Wage-Bracket Method Tables For Period Ending May 17, 20- 59 2.00 PM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started