please help i dont know if im plugging the numbers into the formula wrong or what.

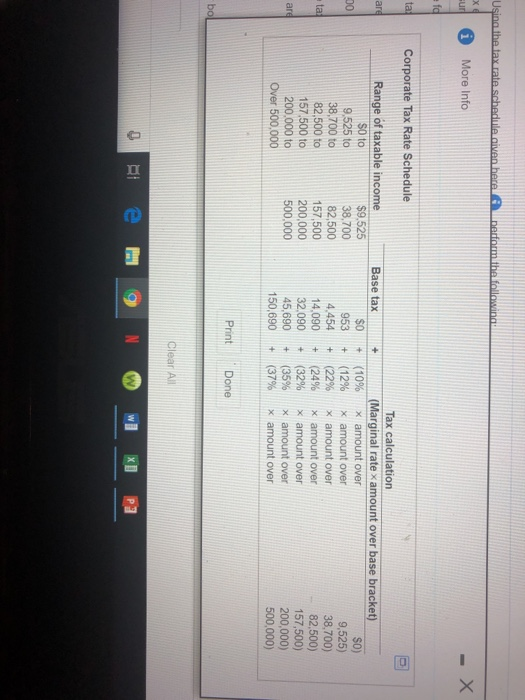

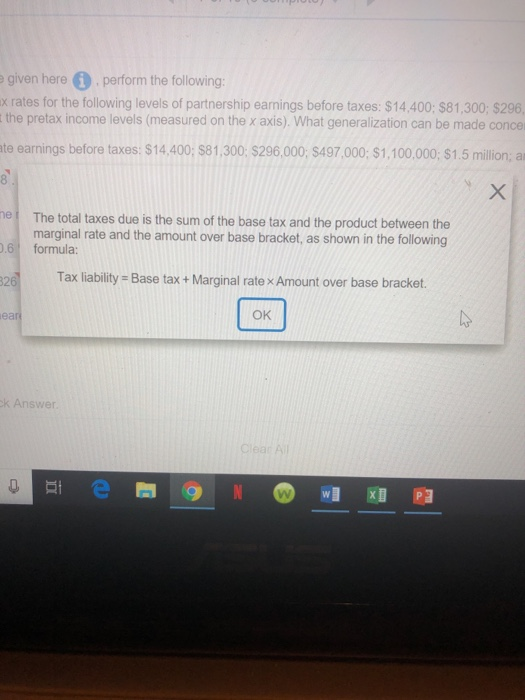

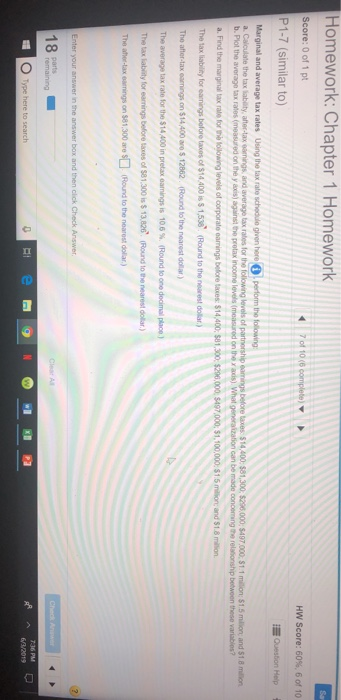

Homework: Chapter 1 Homework Sa Score: 0 of 1 pt 7 of 10 (6 complete) HW Score: 60 % , 6 of 10 P1-7 (similar to) Question Help Marginal and average tax rates Using the tax rate schedule given herei perform the following a. Calculate the tax lablity, after-tax eanings, and average tax rales for the following levels of partnership eamings before taxes $14,400: $81,300, $296,000: $497.000 $1.1 million: $1.5 million and $1.8 milion b. Plot the average tax rates (measured on the y axis) against the protax inoome levels (measured on the x axis) What generaization can be made conceming the relaionship betwoen these variables? a. Find the marginal tax rate for the tolowing levels of corporate eamings before taxes: $14,400; $81,300 $296,000 $497,000, $1,100,000 $1.5 million and $1.8 million The tax liability for eamings bofore taxes of $14,400 is $ 1,538 (Round to the nearest dollar) The after-tax earnings on $14,400 aro $ 12862 (Round to the nearest dollar.) The average tax rate for the $14,400 in pretax eamings is 10.6 %, (Round to one decimal place ) The tax labity for earnings before taxes of $81,300 is $ 13,826 (Round to the nearest dollar.) The atee-tax earnings on S81 300 are S (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer 18 parts Clear Al Check Anpwer remaining 7:36 PM N 6/3/2019 Type here to search I Usina the tax.rate schedule.aiven bere perform the following: 1 More Info ur fo ta Corporate Tax Rate Schedule Tax calculation (Marginal ratex amount over base bracket) $0) 9,525) 38,700) 82,500) 157,500) 200,000) 500,000) are Range of taxable income Base tax + $9,525 38,700 82,500 157,500 200,000 500,000 (10 % (12% (22% (24% (32% (35 % (37% S0 to $0 x amount over D0 9.525 to 38.700 to 82,500 to 157,500 to 200,000 to Over 500,000 953 x amount over 4,454 x amount over ta 14,090 32.090 45,690 150,690 X amount over + x amount over x amount over x amount over are Print Done bo Clear All e X P e given here perform the following: x rates for the following levels of partnership earnings before taxes: $14,400; $81,300; $296, the pretax income levels (measured on the x axis). What generalization can be made concer ate earnings before taxes: $14,400; $81,300: $296,000; $497,000: $1,100,000; $1.5 million; a 8 ne The total taxes due is the sum of the base tax and the product between the marginal rate and the amount over base bracket, as shown in the following 0.6 formula: Tax liability Base tax+ Marginal ratex Amount over base bracket 826 ear OK ck Answer. Clear All W