Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! I dont know the formulas to plug into the cells in excel. Thank you. Parker, Incorporated produces one model of mountain bike. Partial

please help! I dont know the formulas to plug into the cells in excel. Thank you.

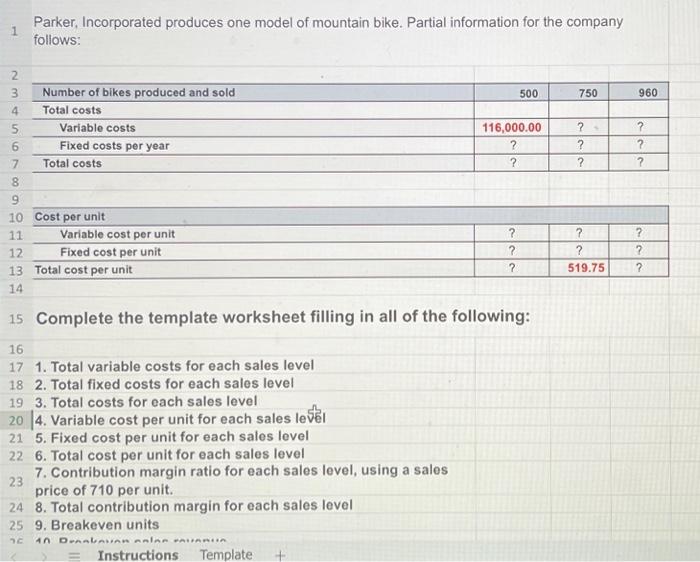

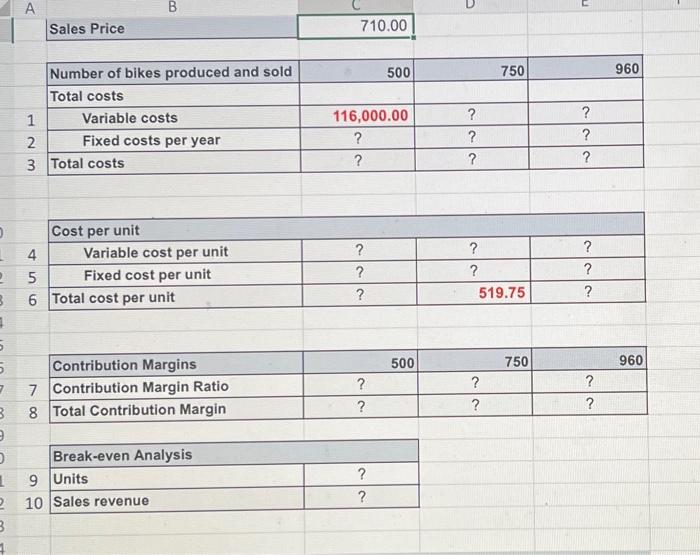

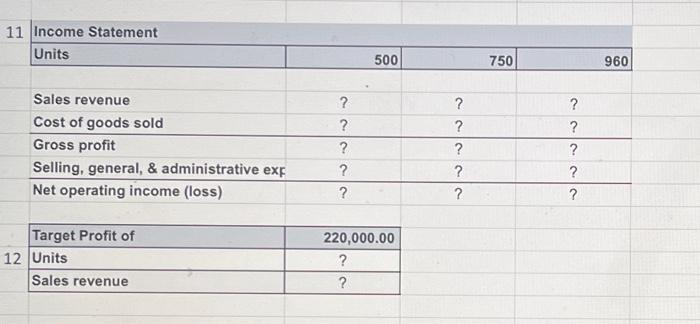

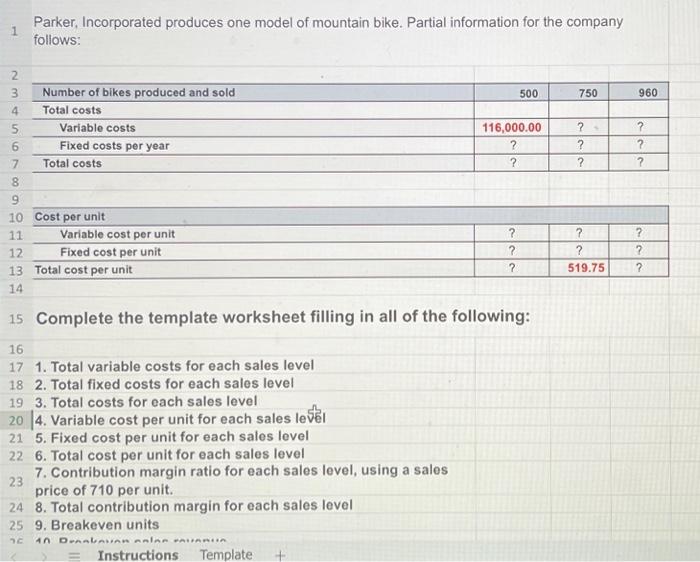

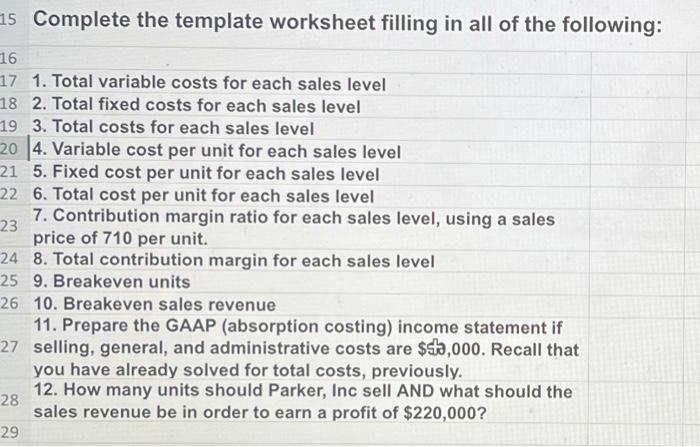

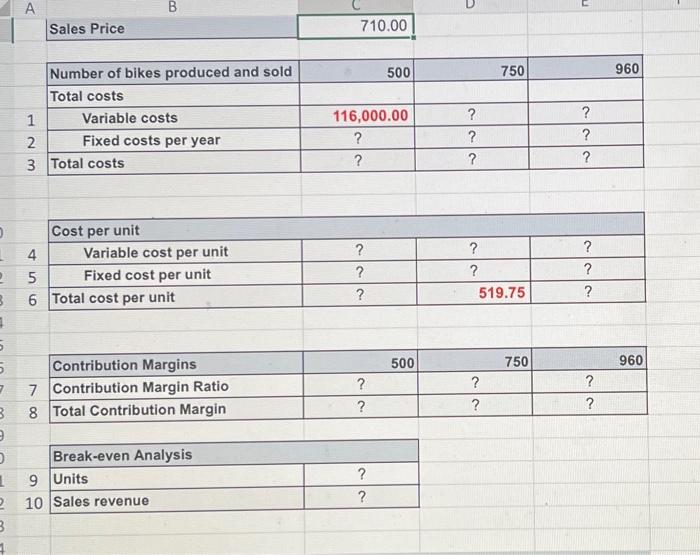

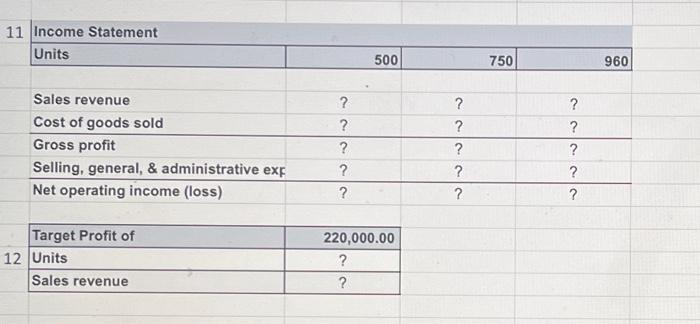

Parker, Incorporated produces one model of mountain bike. Partial information for the company follows: Complete the template worksheet filling in all of the following: 1. Total variable costs for each sales level 2. Total fixed costs for each sales level 3. Total costs for each sales level 4. Variable cost per unit for each sales level| 5. Fixed cost per unit for each sales level 6. Total cost per unit for each sales level 7. Contribution margin ratio for each sales level, using a sales price of 710 per unit. 8. Total contribution margin for each sales level 9. Breakeven units Complete the template worksheet filling in all of the following: 1. Total variable costs for each sales level 2. Total fixed costs for each sales level 3. Total costs for each sales level 4. Variable cost per unit for each sales level 5. Fixed cost per unit for each sales level 6. Total cost per unit for each sales level 7. Contribution margin ratio for each sales level, using a sales price of 710 per unit. 8. Total contribution margin for each sales level 9. Breakeven units 10. Breakeven sales revenue 11. Prepare the GAAP (absorption costing) income statement if 27 selling, general, and administrative costs are $5,000. Recall that you have already solved for total costs, previously. 12. How many units should Parker, Inc sell AND what should the sales revenue be in order to earn a profit of $220,000 ? A B 710.00 Sales Price 710.00 1 \begin{tabular}{|c|c|c|c|} \hline Number of bikes produced and sold & 500 & 750 & 960 \\ \hline \multicolumn{4}{|l|}{ Total costs } \\ \hline Variable costs & 116,000.00 & ? & ? \\ \hline Fixed costs per year & ? & ? & ? \\ \hline Total costs & ? & ? & ? \\ \hline \end{tabular} 3 Total costs Cost per unit 4 5 6 Total Variable cost per unit Fixed cost per unit ? ? ? 519.75 ? \begin{tabular}{|c|c|c|c|} \hline Contribution Margins & 500 & 750 & 960 \\ \hline Contribution Margin Ratio & ? & ? & ? \\ \hline Total Contribution Margin & ? & ? & ? \\ \hline \end{tabular} Break-even Analysis 9 \begin{tabular}{|l|l|} \hline Units & ? \\ \hline Sales revenue & ? \\ \hline \end{tabular} 11 Income Statement \begin{tabular}{|c|c|c|c|} \hline Units & 500 & 750 & 960 \\ \hline & . & & \\ \hline Sales revenue & ? & ? & ? \\ \hline Cost of goods sold & ? & ? & ? \\ \hline Gross profit & ? & ? & ? \\ \hline Selling, general, \& administrative exf & ? & ? & ? \\ \hline Net operating income (loss) & ? & ? & ? \\ \hline \end{tabular} 12 \begin{tabular}{|l|c|} \hline Target Profit of & 220,000.00 \\ \hline Units & ? \\ \hline Sales revenue & ? \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started