Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help I don't understand the questions. Thanks Ak-Sential Corporation is a private corporation formed in 2010 for the purpose of selling cookie products to

Please help I don't understand the questions. Thanks

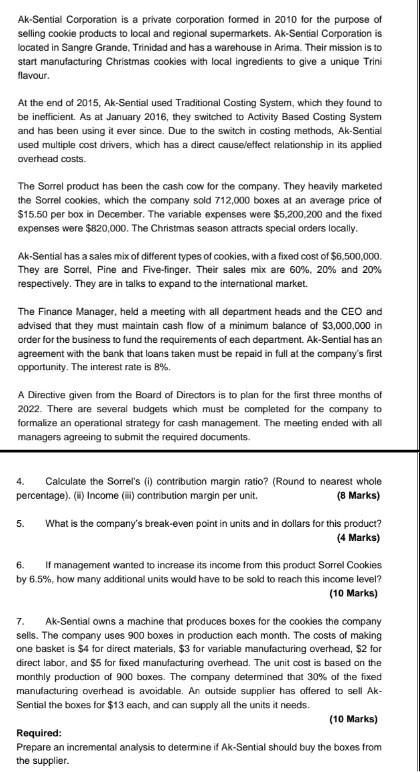

Ak-Sential Corporation is a private corporation formed in 2010 for the purpose of selling cookie products to local and regional supermarkets. Ak-Sential Corporation is located in Sangre Grande, Trinidad and has a warehouse in Arima. Their mission is to start manufacturing Christmas cookies with local ingredients to give a unique Trini flavour. At the end of 2015, Ak-Sential used Traditional Costing System, which they found to be inefficient. As at January 2016, they switched to Activity Based Costing System and has been using it ever since. Due to the switch in costing methods, Ak-Sential used multiple cost drivers, which has a direct cause/effect relationship in its applied overhead costs. The Sorrel product has been the cash cow for the company. They heavily marketed the Sorrel cookies, which the company sold 712,000 boxes at an average price of $15.50 per box in December. The variable expenses were $5,200,200 and the fixed expenses were $820,000. The Christmas season attracts special orders locally. Ak-Sential has a sales mix of different types of cookies, with a fixed cost of $6,500,000. They are Sorrel, Pine and Five-finger. Their sales mix are 60%,20% and 20% respectively. They are in talks to expand to the international market. The Finance Manager, held a meeting with all department heads and the CEO and advised that they must maintain cash flow of a minimum balance of $3,000,000 in order for the business to fund the requirements of each department. Ak-Sential has an agreement with the bank that loans taken must be repaid in full at the company's first opportunity. The interest rate is 8%. A Directive given from the Board of Directors is to plan for the first three months of 2022. There are several budgets which must be completed for the company to formalize an operational strategy for cash management. The meeting ended with all managers agreeing to submit the required documents. 4. Calculate the Sorrel's (i) contribution margin ratio? (Round to nearest whole percentage), (ii) Income (iii) contribution margin per unit. (8 Marks) 5. What is the company's break-even point in units and in dollars for this product? (4 Marks) 6. If management wanted to increase its income from this product Sorrel Cookies by 6.5%, how many additional units would have to be sold to reach this income level? (10 Marks) 7. Ak-Sential owns a machine that produces boxes for the cookies the company sells. The company uses 900 boxes in production each month. The costs of making one basket is $4 for direct materials, $3 for variable manufacturing overhead, $2 for direct labor, and $5 for fixed manufacturing overhead. The unit cost is based on the monthly production of 900 boxes. The company determined that 30% of the fixed manufacturing overhead is avoidable. An outside supplier has offered to sell AkSential the boxes for $13 each, and can supply all the units it needs. Required: (10 Marks) Prepare an incremental analysis to determine if Ak-Sential should buy the boxes from the supplierStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started