Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help, I entered some answers but im not sure if they are correct. please answer all questions even if i put an answer there

Please help, I entered some answers but im not sure if they are correct. please answer all questions even if i put an answer there already. and provide explanations for answers if possible. thank you

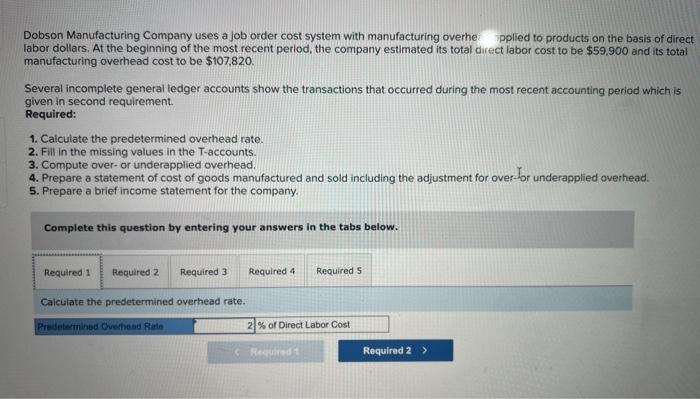

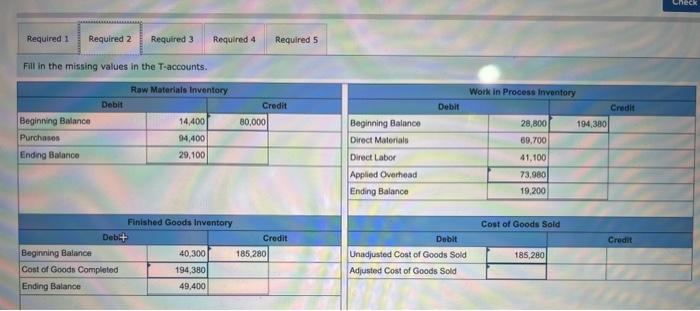

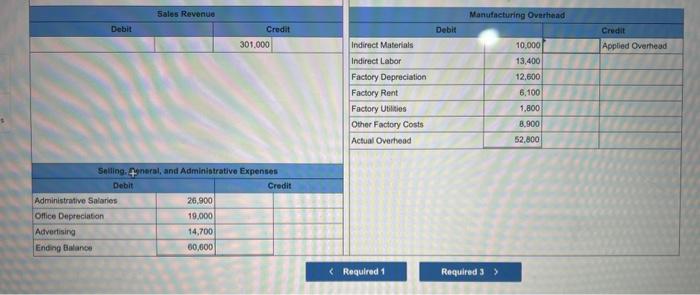

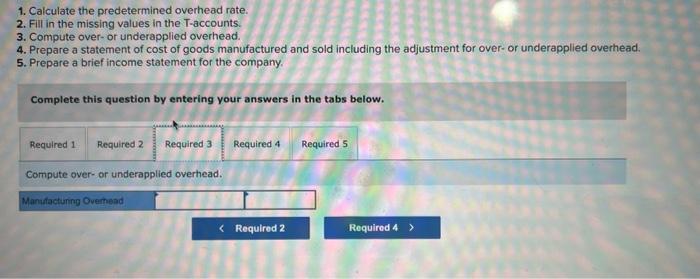

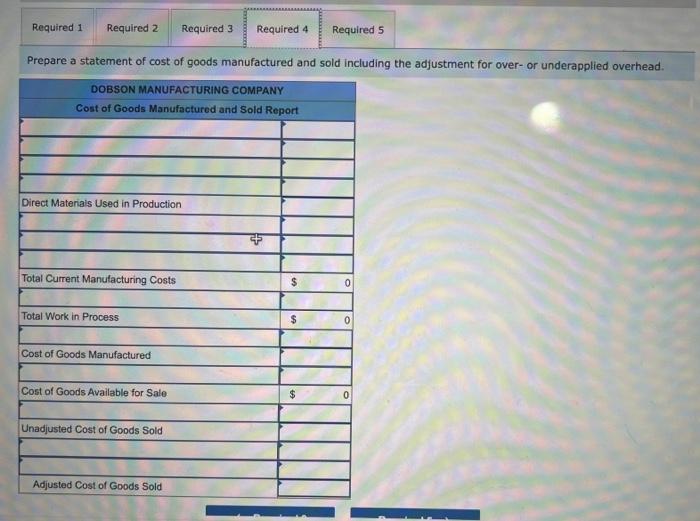

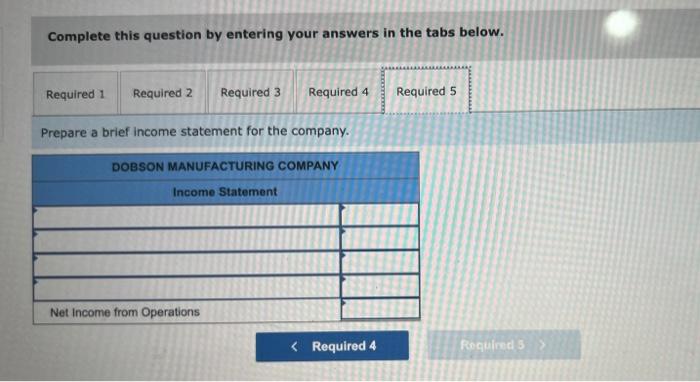

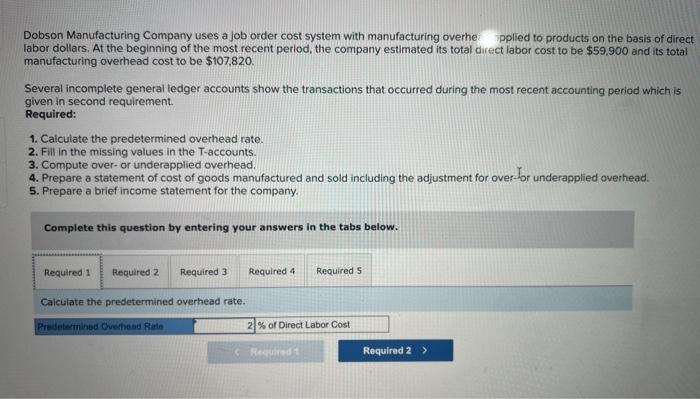

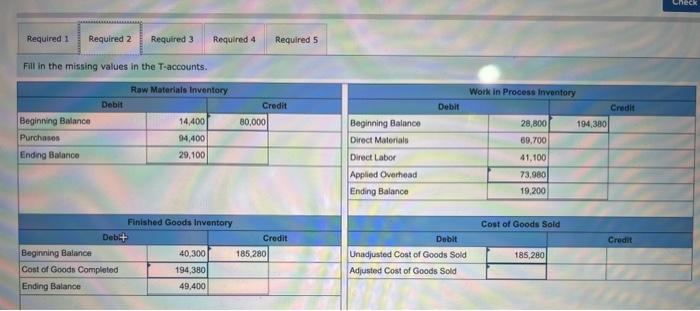

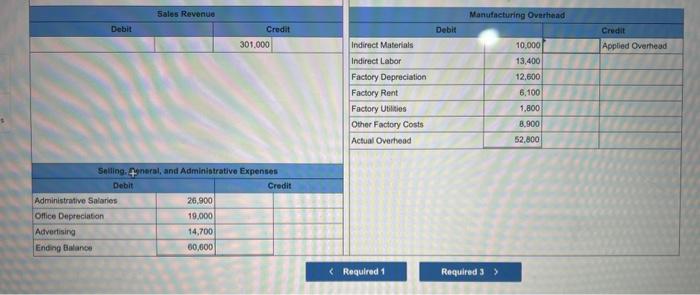

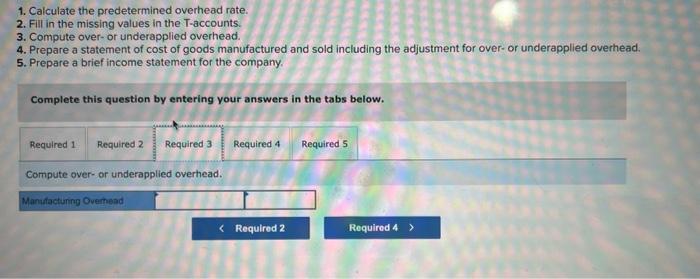

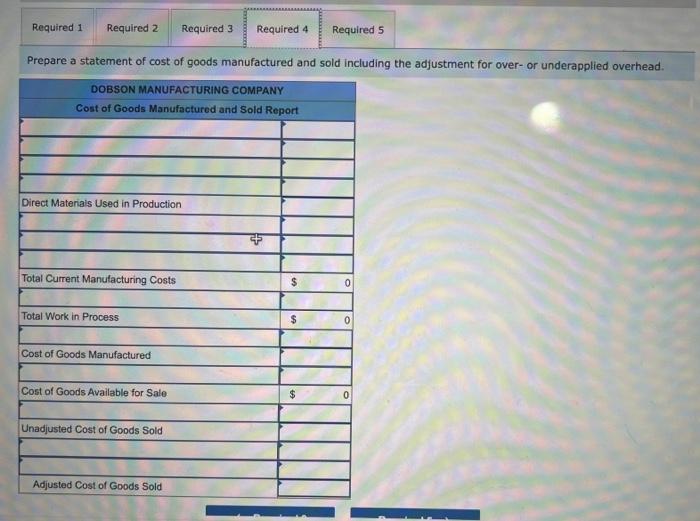

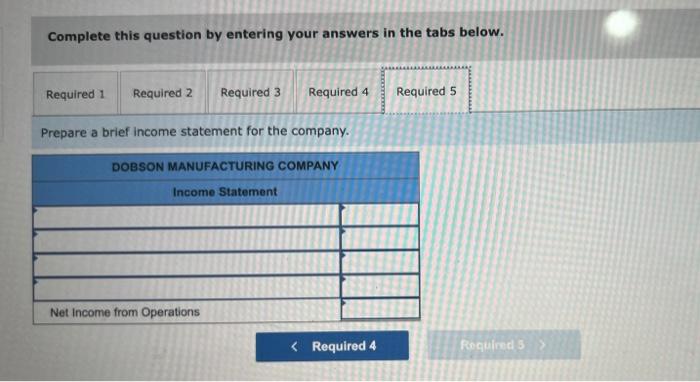

Dobson Manufacturing Company uses a job order cost system with manufacturing overhe: ipplied to products on the basis of direct labor dollars. At the beginning of the most recent period, the company estimated its total direct labor cost to be $59.900 and its total manufacturing overhead cost to be $107,820. Several incomplete general ledger accounts show the transactions that occurred during the most recent accounting period which is given in second requirement. Required: 1. Calculate the predetermined overhead rate. 2. Fill in the missing values in the T-accounts. 3. Compute over- or underapplied overhead. 4. Prepare a statement of cost of goods manufactured and sold including the adjustment for over-for underapplied overhead. 5. Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Calculate the predetermined overhead rate. Fill in the missing values in the T-accounts. 1. Calculate the predetermined overhead rate. 2. Fill in the missing values in the T-accounts. 3. Compute over- or underapplied overhead. 4. Prepare a statement of cost of goods manufactured and sold including the adjustment for over-or underapplied overhead. 5. Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Compute over- or underapplied overhead. 'epare a statement of cost of goods manufactured and sold including the adjustment for over-or underapplied overhead. Complete this question by entering your answers in the tabs below. Prepare a brief income statement for the company. Dobson Manufacturing Company uses a job order cost system with manufacturing overhe: ipplied to products on the basis of direct labor dollars. At the beginning of the most recent period, the company estimated its total direct labor cost to be $59.900 and its total manufacturing overhead cost to be $107,820. Several incomplete general ledger accounts show the transactions that occurred during the most recent accounting period which is given in second requirement. Required: 1. Calculate the predetermined overhead rate. 2. Fill in the missing values in the T-accounts. 3. Compute over- or underapplied overhead. 4. Prepare a statement of cost of goods manufactured and sold including the adjustment for over-for underapplied overhead. 5. Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Calculate the predetermined overhead rate. Fill in the missing values in the T-accounts. 1. Calculate the predetermined overhead rate. 2. Fill in the missing values in the T-accounts. 3. Compute over- or underapplied overhead. 4. Prepare a statement of cost of goods manufactured and sold including the adjustment for over-or underapplied overhead. 5. Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Compute over- or underapplied overhead. 'epare a statement of cost of goods manufactured and sold including the adjustment for over-or underapplied overhead. Complete this question by entering your answers in the tabs below. Prepare a brief income statement for the company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started