Please help, I got this far now I am stuck

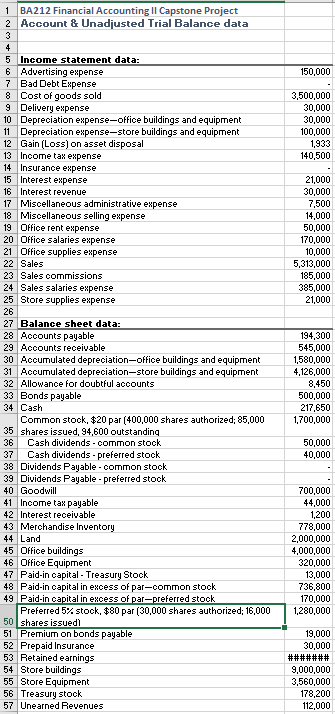

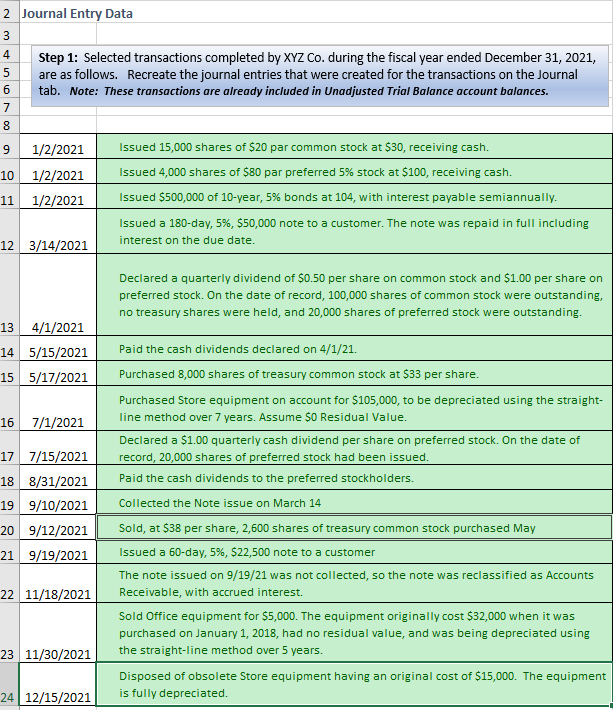

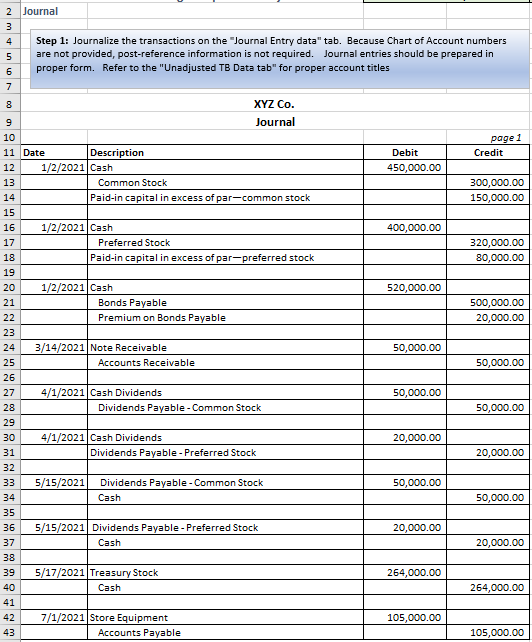

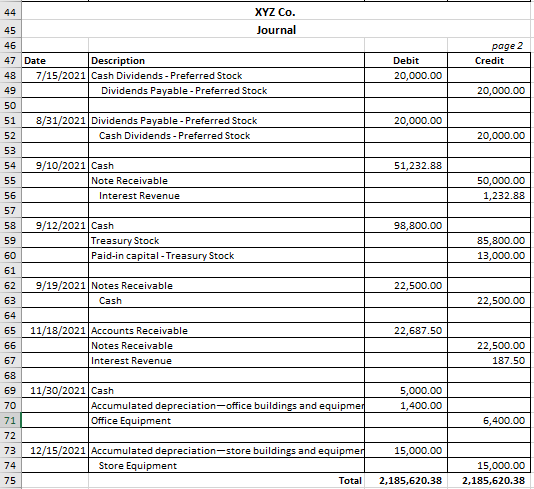

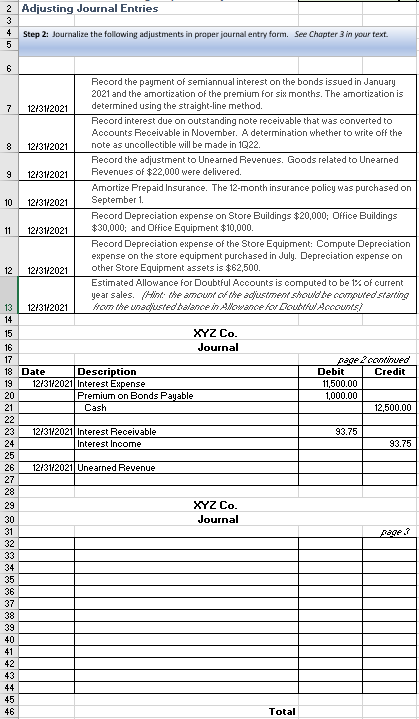

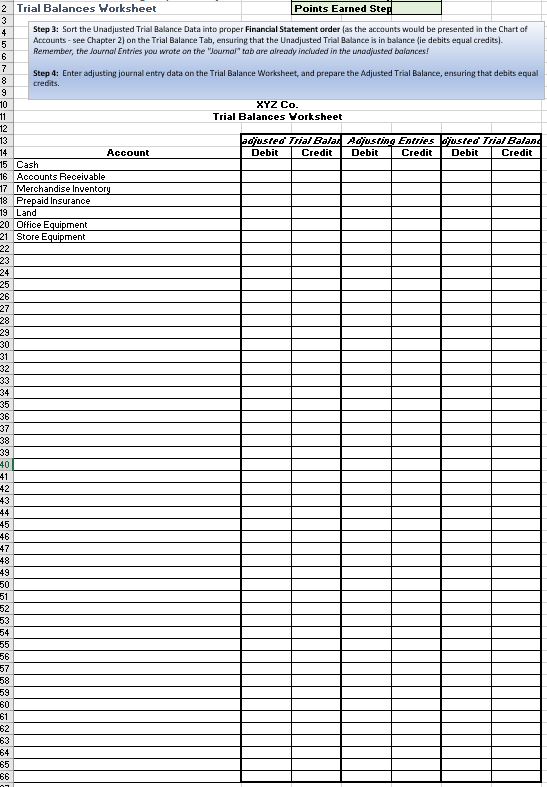

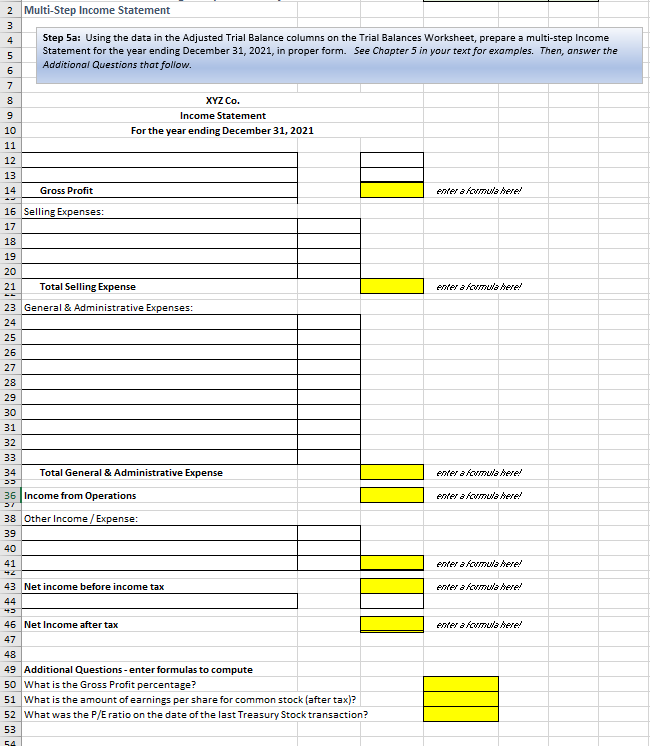

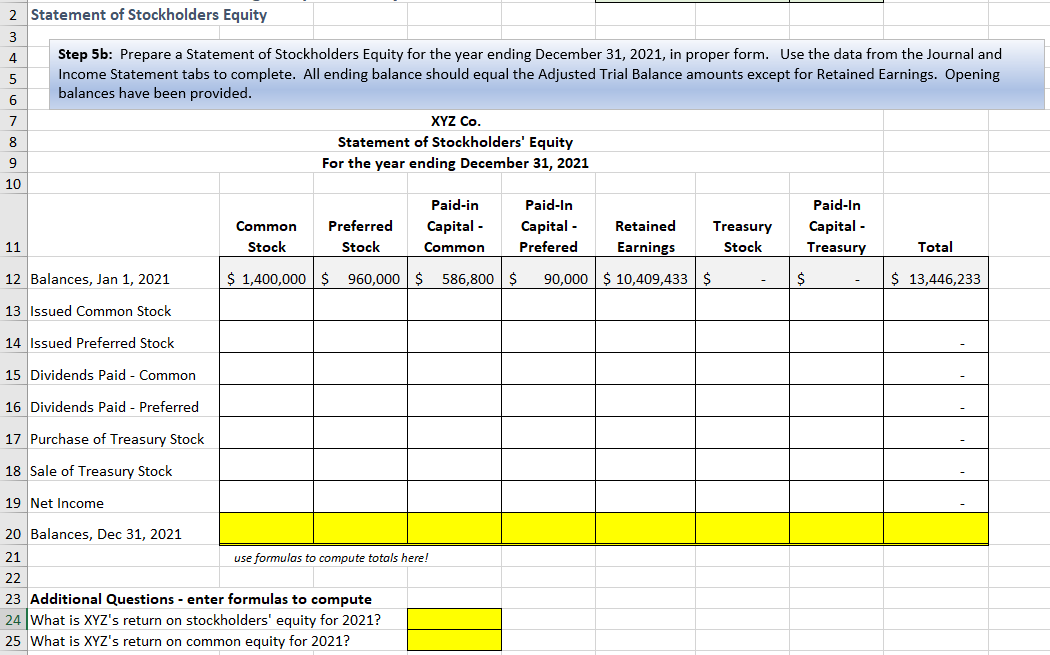

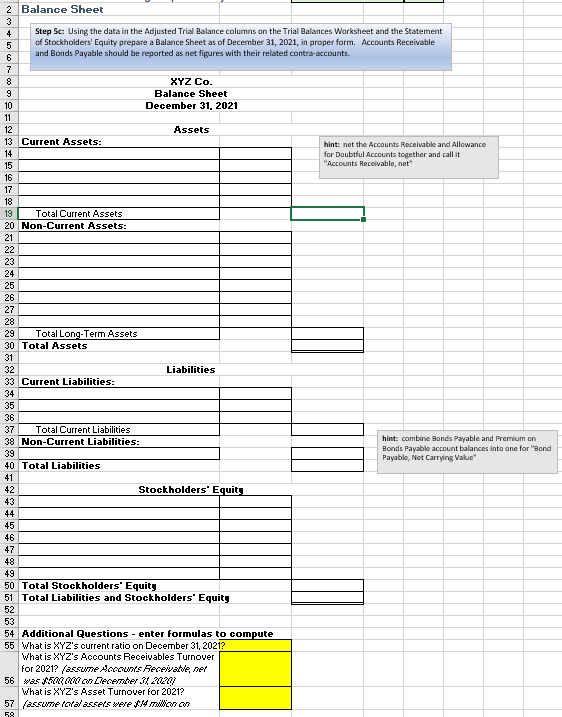

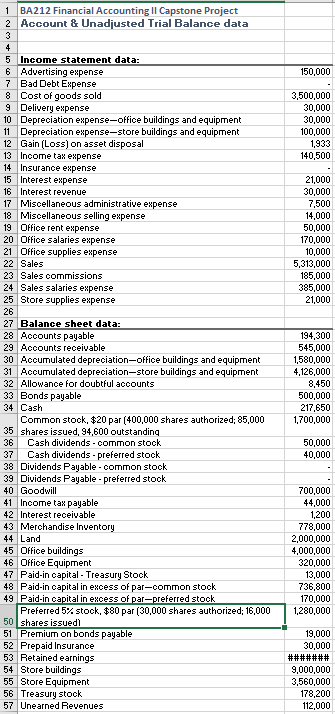

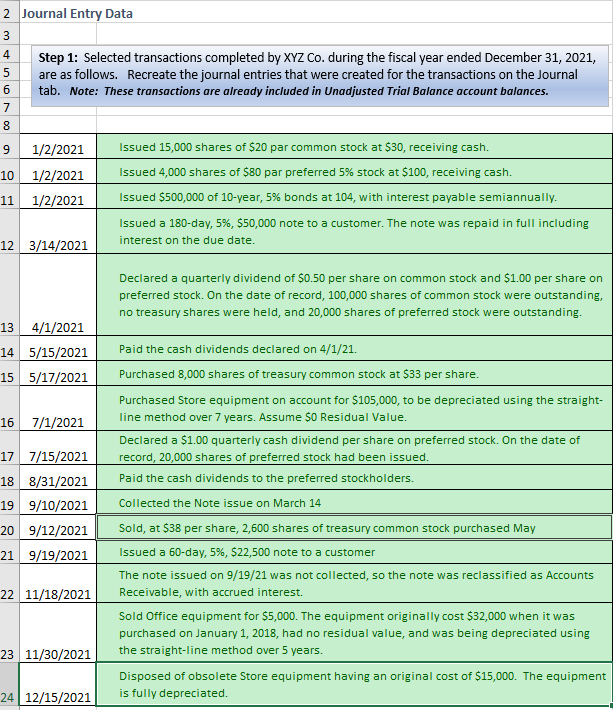

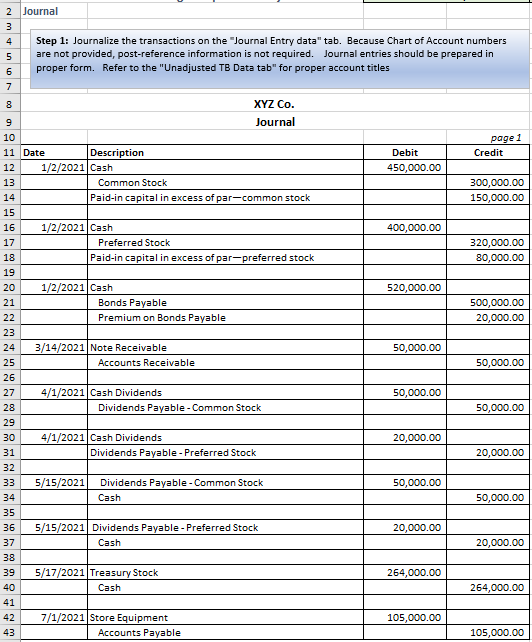

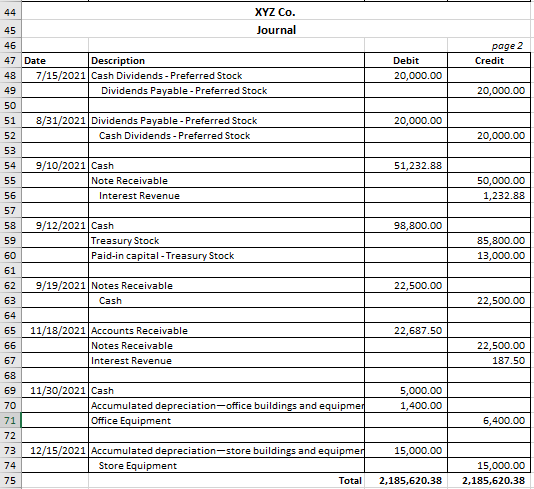

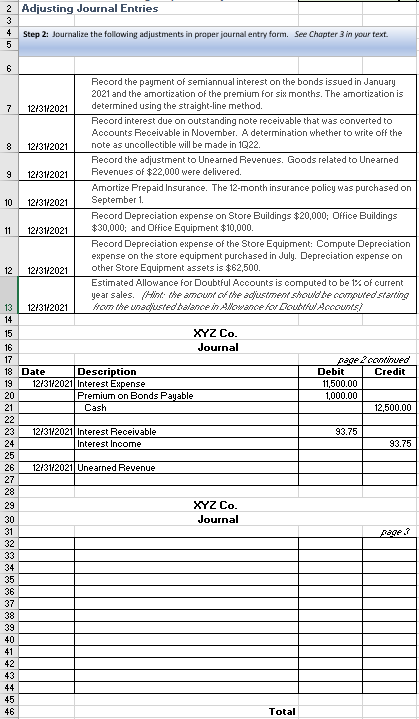

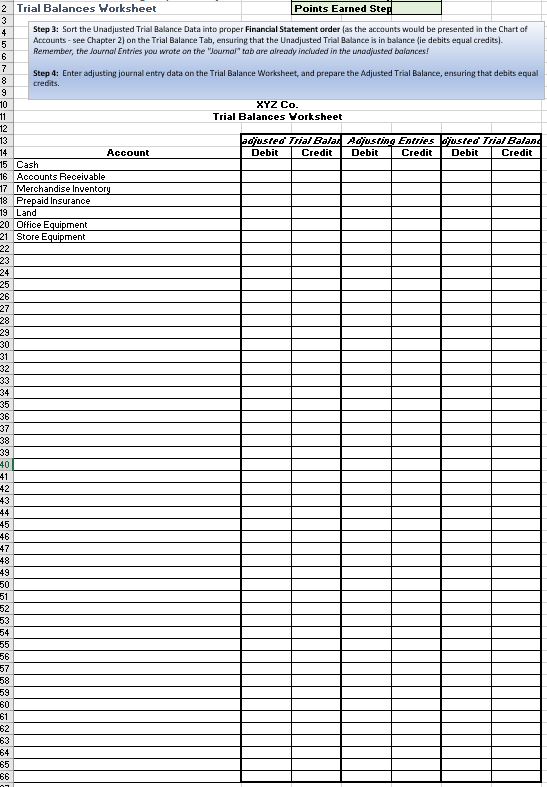

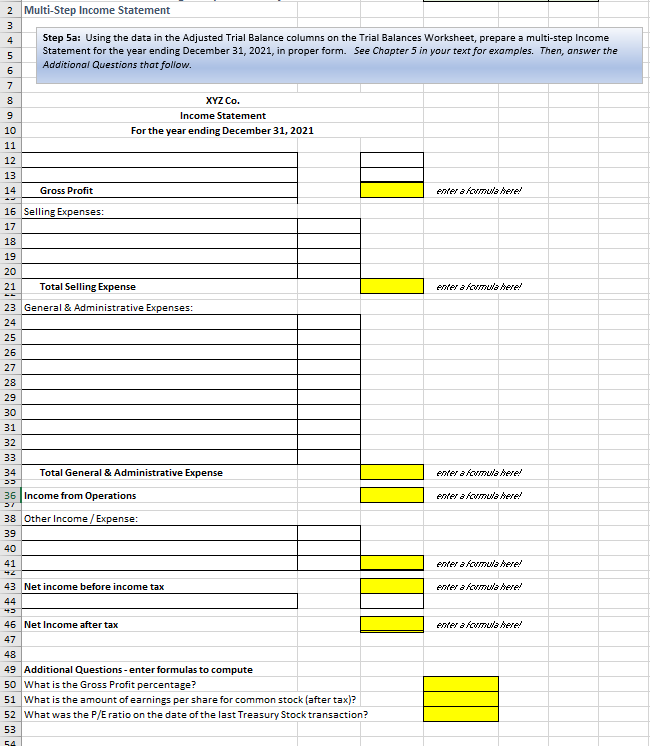

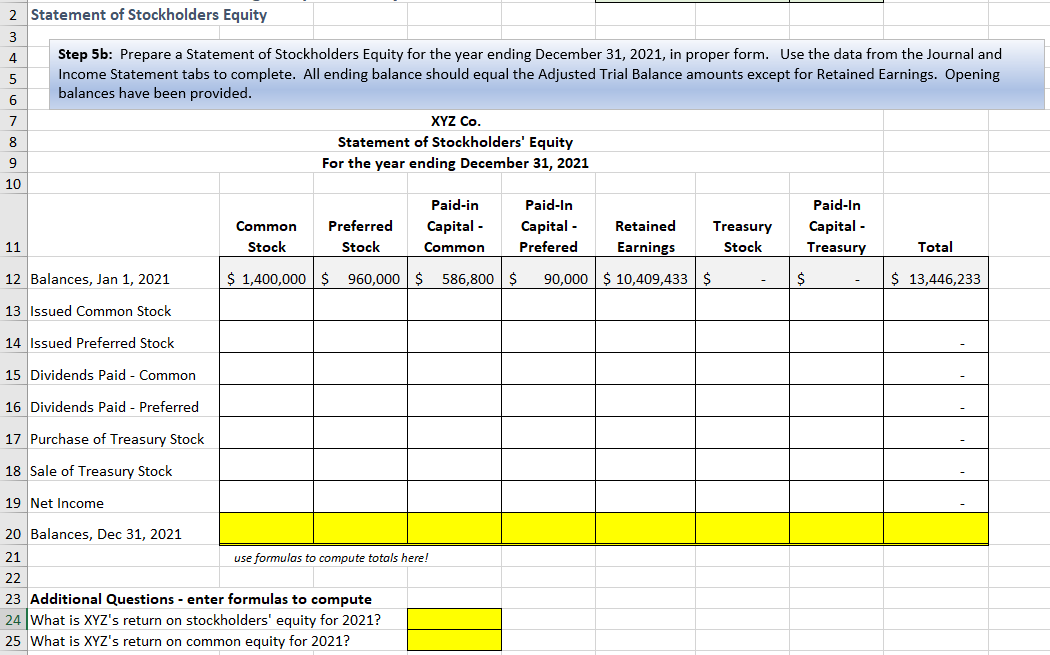

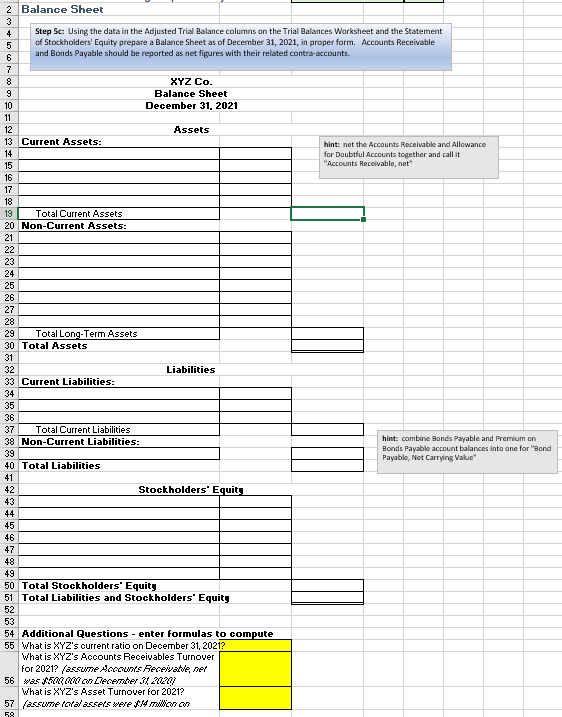

1 BA212 Financial Accounting II Capstone Project Account & Unadjusted Trial Balance data 2 3 4 5 Income statement data: 6 Advertising expense 7 Bad Debt Expense 8 Cost of goods sold Delivery expense 9 10 Depreciation expense-office buildings and equipment 11 Depreciation expense-store buildings and equipment Gain (Loss) on asset disposal 12 13 Income tax expense 14 Insurance expense 15 Interest expense 16 Interest revenue 17 Miscellaneous administrative expense 18 Miscellaneous selling expense 19 Office rent expense 20 Office salaries expense 21 Office supplies expense 22 Sales 23 Sales commissions 24 Sales salaries expense 25 Store supplies expense 26 27 Balance sheet data: 28 Accounts payable 29 Accounts receivable 30 Accumulated depreciation-office buildings and equipment 31 Accumulated depreciation-store buildings and equipment 32 Allowance for doubtful accounts 33 Bonds payable 34 Cash Common stock, $20 par (400,000 shares authorized; 85,000 35 shares issued, 94,600 outstanding 36 Cash dividends common stock 37 Cash dividends - preferred stock 38 Dividends Payable common stock 39 Dividends Payable preferred stock 40 Goodwill 41 Income tax payable 42 Interest receivable 43 Merchandise Inventory 44 Land 45 Office buildings 46 Office Equipment 47 Paid-in capital - Treasury Stock 48 Paid-in capital in excess of par-common stock 49 Paid-in capital in excess of par-preferred stock Preferred 5% stock, $80 par (30,000 shares authorized; 16,000 50 shares issued 51 Premium on bonds payable 52 Prepaid Insurance 53 Retained earnings 54 Store buildings 55 Store Equipment 56 Treasury stock 57 Unearned Revenues 150,000 3,500,000 30,000 30,000 100,000 1,933 140,500 21,000 30,000 7,500 14,000 50,000 170,000 10,000 5,313,000 185,000 385,000 21,000 194,300 545,000 1,580,000 4,126,000 8,450 500,000 217,650 1,700,000 50,000 40,000 700,000 44,000 1,200 778,000 2,000,000 4,000,000 320,000 13,000 736,800 170,000 1,280,000 19,000 30,000 ####### 9,000,000 3,560,000 178,200 112,000 2 Journal Entry Data Step 1: Selected transactions completed by XYZ Co. during the fiscal year ended December 31, 2021, are as follows. Recreate the journal entries that were created for the transactions on the Journal tab. Note: These transactions are already included in Unadjusted Trial Balance account balances. 9 Issued 15,000 shares of $20 par common stock at $30, receiving cash. 1/2/2021 10 1/2/2021 Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. 11 1/2/2021 Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. Issued a 180-day, 5%, $50,000 note to a customer. The note was repaid in full including interest on the due date. 12 3/14/2021 Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. 13 4/1/2021 14 5/15/2021 Paid the cash dividends declared on 4/1/21. 15 5/17/2021 Purchased 8,000 shares of treasury common stock at $33 per share. Purchased Store equipment on account for $105,000, to be depreciated using the straight- line method over 7 years. Assume $0 Residual Value. 16 7/1/2021 Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. 17 7/15/2021 18 8/31/2021 Paid the cash dividends to the preferred stockholders. 19 9/10/2021 Collected the Note issue on March 14 20 9/12/2021 Sold, at $38 per share, 2,600 shares of treasury common stock purchased May 21 9/19/2021 Issued a 60-day, 5%, $22,500 note to a customer The note issued on 9/19/21 was not collected, so the note was reclassified as Accounts Receivable, with accrued interest. 22 11/18/2021 Sold Office equipment for $5,000. The equipment originally cost $32,000 when it was purchased on January 1, 2018, had no residual value, and was being depreciated using the straight-line method over 5 years. 23 11/30/2021 Disposed of obsolete Store equipment having an original cost of $15,000. The equipment is fully depreciated. 24 12/15/2021 3456780 2 Journal 3 4 5 Step 1: Journalize the transactions on the "Journal Entry data" tab. Because Chart of Account numbers are not provided, post-reference information is not required. Journal entries should be prepared in proper form. Refer to the "Unadjusted TB Data tab" for proper account titles 6 7 8 XYZ Co. 9 Journal 10 page 1 Credit 11 Date Description Debit 12 1/2/2021 Cash 450,000.00 13 Common Stock 300,000.00 14 Paid-in capital in excess of par-common stock 150,000.00 15 16 1/2/2021 Cash 400,000.00 17 Preferred Stock 320,000.00 18 Paid-in capital in excess of par-preferred stock 80,000.00 19 20 1/2/2021 Cash 520,000.00 21 Bonds Payable 500,000.00 22 Premium on Bonds Payable 20,000.00 23 24 3/14/2021 Note Receivable 50,000.00 25 Accounts Receivable 50,000.00 26 27 4/1/2021 Cash Dividends 50,000.00 28 Dividends Payable - Common Stock 50,000.00 29 30 4/1/2021 Cash Dividends 20,000.00 31 Dividends Payable - Preferred Stock 20,000.00 32 33 5/15/2021 50,000.00 Dividends Payable - Common Stock Cash 34 50,000.00 35 36 5/15/2021 Dividends Payable - Preferred Stock 20,000.00 37 Cash 20,000.00 38 39 5/17/2021 Treasury Stock 264,000.00 40 Cash 264,000.00 41 42 7/1/2021 Store Equipment 105,000.00 43 105,000.00 Accounts Payable 44 45 46 47 Date Description 48 7/15/2021 Cash Dividends - Preferred Stock 49 Dividends Payable - Preferred Stock 50 51 8/31/2021 Dividends Payable - Preferred Stock 52 Cash Dividends - Preferred Stock 53 54 9/10/2021 Cash 55 Note Receivable 56 Interest Revenue 57 58 9/12/2021 Cash 59 Treasury Stock 60 Paid-in capital-Treasury Stock 61 62 9/19/2021 Notes Receivable 63 Cash 64 65 11/18/2021 Accounts Receivable 66 Notes Receivable 67 Interest Revenue 68 69 11/30/2021 Cash 70 Accumulated depreciation-office buildings and equipmer Office Equipment 71 72 73 12/15/2021 Accumulated depreciation-store buildings and equipmer 74 Store Equipment 75 Total XYZ Co. Journal Debit 20,000.00 20,000.00 51,232.88 98,800.00 22,500.00 22,687.50 5,000.00 1,400.00 15,000.00 2,185,620.38 page 2 Credit 20,000.00 20,000.00 50,000.00 1,232.88 85,800.00 13,000.00 22,500.00 22,500.00 187.50 6,400.00 15,000.00 2,185,620.38 2 Adjusting Journal Entries 3 4 Step 2: Journalize the following adjustments in proper journal entry form. See Chapter 3 in your text. 5 Record the payment of semiannual interest on the bonds issued in January 2021 and the amortization of the premium for six months. The amortization is determined using the straight-line method. 12/31/2021 Record interest due on outstanding note receivable that was converted to Accounts Receivable in November. A determination whether to write off the note as uncollectible will be made in 1022. 12/31/2021 Record the adjustment to Unearned Revenues. Goods related to Unearned Revenues of $22,000 were delivered. 12/31/2021 Amortize Prepaid Insurance. The 12-month insurance policy was purchased on September 1. 12/31/2021 Record Depreciation expense on Store Buildings $20,000; Office Buildings $30,000; and Office Equipment $10,000. 12/31/2021 Record Depreciation expense of the Store Equipment: Compute Depreciation expense on the store equipment purchased in July. Depreciation expense on other Store Equipment assets is $62,500. 12/31/2021 Estimated Allowance for Doubtful Accounts is computed to be 1% of current year sales. (Hint: the amount of the adjustment should be computed starting from the unadjusted balance in Allowance for Doubtful Accounts) 12/31/2021 XYZ Co. Journal page 2 continued Credit Description 12/31/2021 Interest Expense 12,500.00 12/31/2021 Interest Receivable Interest Income 93.75 12/31/2021 Unearned Revenue 6 7 8 9 10 11 12 13 14 15 16 17 18 Date 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 Premium on Bonds Payable Cash XYZ Co. Journal Total Debit 11,500.00 1,000.00 93.75 2 Trial Balances Worksheet Points Earned Step 3 4 5 Step 3: Sort the Unadjusted Trial Balance Data into proper Financial Statement order (as the accounts would be presented in the Chart of Accounts-see Chapter 2) on the Trial Balance Tab, ensuring that the Unadjusted Trial Balance is in balance (ie debits equal credits). Remember, the Journal Entries you wrote on the "Journal" tab are already included in the unadjusted balances! 6 7 8 Step 4: Enter adjusting journal entry data on the Trial Balance Worksheet, and prepare the Adjusted Trial Balance, ensuring that debits equal credits. 9 10 XYZ Co. 11 Trial Balances Worksheet 12 adjusted Trial Balai Adjusting Entries Debit Credit Debit djusted Trial Baland Debit Credit Account Credit 13 14 15 Cash 16 Accounts Receivable 17 Merchandise Inventory 18 Prepaid Insurance 19 Land 20 Office Equipment 21 Store Equipment 22 23 24 25 26 27 28 29 -30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 282885 53 54 55 56 57 58 8228328%: 59 60 61 62 63 64 65 66 07 2 Multi-Step Income Statement 3 4 Step 5a: Using the data in the Adjusted Trial Balance columns on the Trial Balances Worksheet, prepare a multi-step Income Statement for the year ending December 31, 2021, in proper form. See Chapter 5 in your text for examples. Then, answer the Additional Questions that follow. 5 6 XYZ Co. Income Statement For the year ending December 31, 2021 enter a formula here! enter a formula here! enter a formula here! enter a formula here! enter a formula here! enter a formula here! enter a formula here! 7 8 9 10 11 12 13 14 Gross Profit 16 Selling Expenses: 17 18 19 20 21 Total Selling Expense 23 General & Administrative Expenses: 24 25 26 27 28 29 30 31 32 33 34 33 36 Income from Operations 37 38 Other Income / Expense: 39 40 41 42 43 Net income before income tax 44 43 46 Net Income after tax 47 48 49 Additional Questions-enter formulas to compute 50 What is the Gross Profit percentage? 51 What is the amount of earnings per share for common stock (after tax)? 52 What was the P/E ratio on the date of the last Treasury Stock transaction? 53 54 Total General & Administrative Expense 2 Statement of Stockholders Equity 3 4 Step 5b: Prepare a Statement of Stockholders Equity for the year ending December 31, 2021, in proper form. Use the data from the Journal and Income Statement tabs to complete. All ending balance should equal the Adjusted Trial Balance amounts except for Retained Earnings. Opening balances have been provided. 5 6 7 XYZ Co. 8 Statement of Stockholders' Equity For the year ending December 31, 2021 9 10 Paid-in Paid-In Paid-In Capital - Common Stock Preferred Stock Capital - Capital - Common Prefered Retained Earnings Treasury Stock 11 Treasury Total 12 Balances, Jan 1, 2021 - $ 1,400,000 $ 960,000 $ 586,800 $ 90,000 $10,409,433 $ $ 13,446,233 13 Issued Common Stock 14 Issued Preferred Stock 15 Dividends Paid - Common 16 Dividends Paid - Preferred 17 Purchase of Treasury Stock 18 Sale of Treasury Stock 19 Net Income 20 Balances, Dec 31, 2021 21 use formulas to compute totals here! 22 23 Additional Questions - enter formulas to compute 24 What is XYZ's return on stockholders' equity for 2021? 25 What is XYZ's return on common equity for 2021? $ 2 Balance Sheet 3 4 5 Step Sc: Using the data in the Adjusted Trial Balance columns on the Trial Balances Worksheet and the Statement of Stockholders' Equity prepare a Balance Sheet as of December 31, 2021, in proper form. Accounts Receivable and Bonds Payable should be reported as net figures with their related contra-accounts. 6 7 8 9 XYZ Co. Balance Sheet December 31, 2021 10 11 12 Assets 13 Current Assets: 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Total Assets 31 32 Liabilities 33 Current Liabilities: 34 35 36 37 Total Current Liabilities 38 Non-Current Liabilities: 39 40 Total Liabilities 41 42 Stockholders' Equity 43 44 45 46 47 48 49 50 Total Stockholders' Equity 51 Total Liabilities and Stockholders' Equity 52 53 54 Additional Questions enter formulas to compute 55 What is XYZ's current ratio on December 31, 2021? What is XYZ's Accounts Receivables Turnover for 2021? (assume Accounts Receivable, net 56 was $500,000 on December 31, 2020). What is XYZ's Asset Turnover for 2021? 57 (assume total assets were $14 million on 58 Total Current Assets Non-Current Assets: Total Long-Term Assets hint: net the Accounts Receivable and Allowance for Doubtful Accounts together and call it "Accounts Receivable, net" hint: combine Bonds Payable and Premium on Bonds Payable account balances into one for "Bond Payable, Net Carrying Value" 1 BA212 Financial Accounting II Capstone Project Account & Unadjusted Trial Balance data 2 3 4 5 Income statement data: 6 Advertising expense 7 Bad Debt Expense 8 Cost of goods sold Delivery expense 9 10 Depreciation expense-office buildings and equipment 11 Depreciation expense-store buildings and equipment Gain (Loss) on asset disposal 12 13 Income tax expense 14 Insurance expense 15 Interest expense 16 Interest revenue 17 Miscellaneous administrative expense 18 Miscellaneous selling expense 19 Office rent expense 20 Office salaries expense 21 Office supplies expense 22 Sales 23 Sales commissions 24 Sales salaries expense 25 Store supplies expense 26 27 Balance sheet data: 28 Accounts payable 29 Accounts receivable 30 Accumulated depreciation-office buildings and equipment 31 Accumulated depreciation-store buildings and equipment 32 Allowance for doubtful accounts 33 Bonds payable 34 Cash Common stock, $20 par (400,000 shares authorized; 85,000 35 shares issued, 94,600 outstanding 36 Cash dividends common stock 37 Cash dividends - preferred stock 38 Dividends Payable common stock 39 Dividends Payable preferred stock 40 Goodwill 41 Income tax payable 42 Interest receivable 43 Merchandise Inventory 44 Land 45 Office buildings 46 Office Equipment 47 Paid-in capital - Treasury Stock 48 Paid-in capital in excess of par-common stock 49 Paid-in capital in excess of par-preferred stock Preferred 5% stock, $80 par (30,000 shares authorized; 16,000 50 shares issued 51 Premium on bonds payable 52 Prepaid Insurance 53 Retained earnings 54 Store buildings 55 Store Equipment 56 Treasury stock 57 Unearned Revenues 150,000 3,500,000 30,000 30,000 100,000 1,933 140,500 21,000 30,000 7,500 14,000 50,000 170,000 10,000 5,313,000 185,000 385,000 21,000 194,300 545,000 1,580,000 4,126,000 8,450 500,000 217,650 1,700,000 50,000 40,000 700,000 44,000 1,200 778,000 2,000,000 4,000,000 320,000 13,000 736,800 170,000 1,280,000 19,000 30,000 ####### 9,000,000 3,560,000 178,200 112,000 2 Journal Entry Data Step 1: Selected transactions completed by XYZ Co. during the fiscal year ended December 31, 2021, are as follows. Recreate the journal entries that were created for the transactions on the Journal tab. Note: These transactions are already included in Unadjusted Trial Balance account balances. 9 Issued 15,000 shares of $20 par common stock at $30, receiving cash. 1/2/2021 10 1/2/2021 Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. 11 1/2/2021 Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. Issued a 180-day, 5%, $50,000 note to a customer. The note was repaid in full including interest on the due date. 12 3/14/2021 Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. 13 4/1/2021 14 5/15/2021 Paid the cash dividends declared on 4/1/21. 15 5/17/2021 Purchased 8,000 shares of treasury common stock at $33 per share. Purchased Store equipment on account for $105,000, to be depreciated using the straight- line method over 7 years. Assume $0 Residual Value. 16 7/1/2021 Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. 17 7/15/2021 18 8/31/2021 Paid the cash dividends to the preferred stockholders. 19 9/10/2021 Collected the Note issue on March 14 20 9/12/2021 Sold, at $38 per share, 2,600 shares of treasury common stock purchased May 21 9/19/2021 Issued a 60-day, 5%, $22,500 note to a customer The note issued on 9/19/21 was not collected, so the note was reclassified as Accounts Receivable, with accrued interest. 22 11/18/2021 Sold Office equipment for $5,000. The equipment originally cost $32,000 when it was purchased on January 1, 2018, had no residual value, and was being depreciated using the straight-line method over 5 years. 23 11/30/2021 Disposed of obsolete Store equipment having an original cost of $15,000. The equipment is fully depreciated. 24 12/15/2021 3456780 2 Journal 3 4 5 Step 1: Journalize the transactions on the "Journal Entry data" tab. Because Chart of Account numbers are not provided, post-reference information is not required. Journal entries should be prepared in proper form. Refer to the "Unadjusted TB Data tab" for proper account titles 6 7 8 XYZ Co. 9 Journal 10 page 1 Credit 11 Date Description Debit 12 1/2/2021 Cash 450,000.00 13 Common Stock 300,000.00 14 Paid-in capital in excess of par-common stock 150,000.00 15 16 1/2/2021 Cash 400,000.00 17 Preferred Stock 320,000.00 18 Paid-in capital in excess of par-preferred stock 80,000.00 19 20 1/2/2021 Cash 520,000.00 21 Bonds Payable 500,000.00 22 Premium on Bonds Payable 20,000.00 23 24 3/14/2021 Note Receivable 50,000.00 25 Accounts Receivable 50,000.00 26 27 4/1/2021 Cash Dividends 50,000.00 28 Dividends Payable - Common Stock 50,000.00 29 30 4/1/2021 Cash Dividends 20,000.00 31 Dividends Payable - Preferred Stock 20,000.00 32 33 5/15/2021 50,000.00 Dividends Payable - Common Stock Cash 34 50,000.00 35 36 5/15/2021 Dividends Payable - Preferred Stock 20,000.00 37 Cash 20,000.00 38 39 5/17/2021 Treasury Stock 264,000.00 40 Cash 264,000.00 41 42 7/1/2021 Store Equipment 105,000.00 43 105,000.00 Accounts Payable 44 45 46 47 Date Description 48 7/15/2021 Cash Dividends - Preferred Stock 49 Dividends Payable - Preferred Stock 50 51 8/31/2021 Dividends Payable - Preferred Stock 52 Cash Dividends - Preferred Stock 53 54 9/10/2021 Cash 55 Note Receivable 56 Interest Revenue 57 58 9/12/2021 Cash 59 Treasury Stock 60 Paid-in capital-Treasury Stock 61 62 9/19/2021 Notes Receivable 63 Cash 64 65 11/18/2021 Accounts Receivable 66 Notes Receivable 67 Interest Revenue 68 69 11/30/2021 Cash 70 Accumulated depreciation-office buildings and equipmer Office Equipment 71 72 73 12/15/2021 Accumulated depreciation-store buildings and equipmer 74 Store Equipment 75 Total XYZ Co. Journal Debit 20,000.00 20,000.00 51,232.88 98,800.00 22,500.00 22,687.50 5,000.00 1,400.00 15,000.00 2,185,620.38 page 2 Credit 20,000.00 20,000.00 50,000.00 1,232.88 85,800.00 13,000.00 22,500.00 22,500.00 187.50 6,400.00 15,000.00 2,185,620.38 2 Adjusting Journal Entries 3 4 Step 2: Journalize the following adjustments in proper journal entry form. See Chapter 3 in your text. 5 Record the payment of semiannual interest on the bonds issued in January 2021 and the amortization of the premium for six months. The amortization is determined using the straight-line method. 12/31/2021 Record interest due on outstanding note receivable that was converted to Accounts Receivable in November. A determination whether to write off the note as uncollectible will be made in 1022. 12/31/2021 Record the adjustment to Unearned Revenues. Goods related to Unearned Revenues of $22,000 were delivered. 12/31/2021 Amortize Prepaid Insurance. The 12-month insurance policy was purchased on September 1. 12/31/2021 Record Depreciation expense on Store Buildings $20,000; Office Buildings $30,000; and Office Equipment $10,000. 12/31/2021 Record Depreciation expense of the Store Equipment: Compute Depreciation expense on the store equipment purchased in July. Depreciation expense on other Store Equipment assets is $62,500. 12/31/2021 Estimated Allowance for Doubtful Accounts is computed to be 1% of current year sales. (Hint: the amount of the adjustment should be computed starting from the unadjusted balance in Allowance for Doubtful Accounts) 12/31/2021 XYZ Co. Journal page 2 continued Credit Description 12/31/2021 Interest Expense 12,500.00 12/31/2021 Interest Receivable Interest Income 93.75 12/31/2021 Unearned Revenue 6 7 8 9 10 11 12 13 14 15 16 17 18 Date 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 Premium on Bonds Payable Cash XYZ Co. Journal Total Debit 11,500.00 1,000.00 93.75 2 Trial Balances Worksheet Points Earned Step 3 4 5 Step 3: Sort the Unadjusted Trial Balance Data into proper Financial Statement order (as the accounts would be presented in the Chart of Accounts-see Chapter 2) on the Trial Balance Tab, ensuring that the Unadjusted Trial Balance is in balance (ie debits equal credits). Remember, the Journal Entries you wrote on the "Journal" tab are already included in the unadjusted balances! 6 7 8 Step 4: Enter adjusting journal entry data on the Trial Balance Worksheet, and prepare the Adjusted Trial Balance, ensuring that debits equal credits. 9 10 XYZ Co. 11 Trial Balances Worksheet 12 adjusted Trial Balai Adjusting Entries Debit Credit Debit djusted Trial Baland Debit Credit Account Credit 13 14 15 Cash 16 Accounts Receivable 17 Merchandise Inventory 18 Prepaid Insurance 19 Land 20 Office Equipment 21 Store Equipment 22 23 24 25 26 27 28 29 -30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 282885 53 54 55 56 57 58 8228328%: 59 60 61 62 63 64 65 66 07 2 Multi-Step Income Statement 3 4 Step 5a: Using the data in the Adjusted Trial Balance columns on the Trial Balances Worksheet, prepare a multi-step Income Statement for the year ending December 31, 2021, in proper form. See Chapter 5 in your text for examples. Then, answer the Additional Questions that follow. 5 6 XYZ Co. Income Statement For the year ending December 31, 2021 enter a formula here! enter a formula here! enter a formula here! enter a formula here! enter a formula here! enter a formula here! enter a formula here! 7 8 9 10 11 12 13 14 Gross Profit 16 Selling Expenses: 17 18 19 20 21 Total Selling Expense 23 General & Administrative Expenses: 24 25 26 27 28 29 30 31 32 33 34 33 36 Income from Operations 37 38 Other Income / Expense: 39 40 41 42 43 Net income before income tax 44 43 46 Net Income after tax 47 48 49 Additional Questions-enter formulas to compute 50 What is the Gross Profit percentage? 51 What is the amount of earnings per share for common stock (after tax)? 52 What was the P/E ratio on the date of the last Treasury Stock transaction? 53 54 Total General & Administrative Expense 2 Statement of Stockholders Equity 3 4 Step 5b: Prepare a Statement of Stockholders Equity for the year ending December 31, 2021, in proper form. Use the data from the Journal and Income Statement tabs to complete. All ending balance should equal the Adjusted Trial Balance amounts except for Retained Earnings. Opening balances have been provided. 5 6 7 XYZ Co. 8 Statement of Stockholders' Equity For the year ending December 31, 2021 9 10 Paid-in Paid-In Paid-In Capital - Common Stock Preferred Stock Capital - Capital - Common Prefered Retained Earnings Treasury Stock 11 Treasury Total 12 Balances, Jan 1, 2021 - $ 1,400,000 $ 960,000 $ 586,800 $ 90,000 $10,409,433 $ $ 13,446,233 13 Issued Common Stock 14 Issued Preferred Stock 15 Dividends Paid - Common 16 Dividends Paid - Preferred 17 Purchase of Treasury Stock 18 Sale of Treasury Stock 19 Net Income 20 Balances, Dec 31, 2021 21 use formulas to compute totals here! 22 23 Additional Questions - enter formulas to compute 24 What is XYZ's return on stockholders' equity for 2021? 25 What is XYZ's return on common equity for 2021? $ 2 Balance Sheet 3 4 5 Step Sc: Using the data in the Adjusted Trial Balance columns on the Trial Balances Worksheet and the Statement of Stockholders' Equity prepare a Balance Sheet as of December 31, 2021, in proper form. Accounts Receivable and Bonds Payable should be reported as net figures with their related contra-accounts. 6 7 8 9 XYZ Co. Balance Sheet December 31, 2021 10 11 12 Assets 13 Current Assets: 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Total Assets 31 32 Liabilities 33 Current Liabilities: 34 35 36 37 Total Current Liabilities 38 Non-Current Liabilities: 39 40 Total Liabilities 41 42 Stockholders' Equity 43 44 45 46 47 48 49 50 Total Stockholders' Equity 51 Total Liabilities and Stockholders' Equity 52 53 54 Additional Questions enter formulas to compute 55 What is XYZ's current ratio on December 31, 2021? What is XYZ's Accounts Receivables Turnover for 2021? (assume Accounts Receivable, net 56 was $500,000 on December 31, 2020). What is XYZ's Asset Turnover for 2021? 57 (assume total assets were $14 million on 58 Total Current Assets Non-Current Assets: Total Long-Term Assets hint: net the Accounts Receivable and Allowance for Doubtful Accounts together and call it "Accounts Receivable, net" hint: combine Bonds Payable and Premium on Bonds Payable account balances into one for "Bond Payable, Net Carrying Value