Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help I have no idea how to do this question. Download monthly adjusted close price data for Apple and Google (Alphabet Inc.). for the

Please help I have no idea how to do this question.

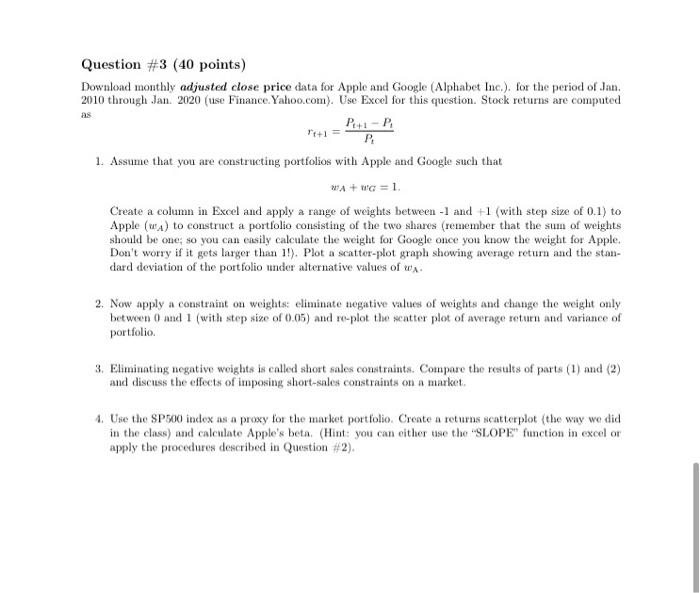

Download monthly adjusted close price data for Apple and Google (Alphabet Inc.). for the period of Jan.

2010 through Jan. 2020 (use Finance.Yahoo.com). Use Excel for this question. Stock returns are computed

as

rt+1 =

Pt+1 Pt

Pt

1. Assume that you are constructing portfolios with Apple and Google such that

wA + wG = 1.

Create a column in Excel and apply a range of weights between -1 and +1 (with step size of 0.1) to

Apple (wA) to construct a portfolio consisting of the two shares (remember that the sum of weights

should be one; so you can easily calculate the weight for Google once you know the weight for Apple.

Dont worry if it gets larger than 1!). Plot a scatter-plot graph showing average return and the stan-

dard deviation of the portfolio under alternative values of wA.

2. Now apply a constraint on weights: eliminate negative values of weights and change the weight only

between 0 and 1 (with step size of 0.05) and re-plot the scatter plot of average return and variance of

portfolio.

3. Eliminating negative weights is called short sales constraints. Compare the results of parts (1) and (2)

and discuss the effects of imposing short-sales constraints on a market.

4. Use the SP500 index as a proxy for the market portfolio. Create a returns scatterplot (the way we did

in the class) and calculate Apples beta.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started