Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP! I HAVE NO IDEA WHAT IM DOING! prepare a cash budget for the firm for its first twelve months operation. Management 475: Cash

PLEASE HELP! I HAVE NO IDEA WHAT IM DOING!

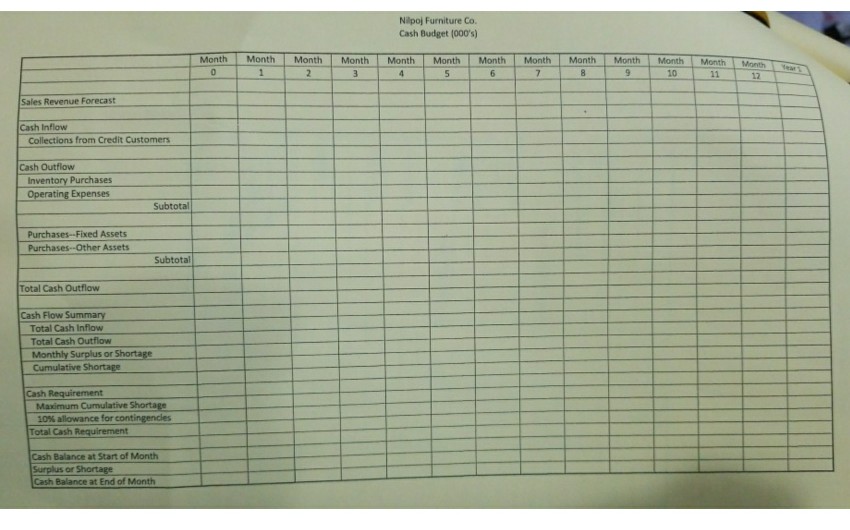

prepare a cash budget for the firm for its first twelve months operation.

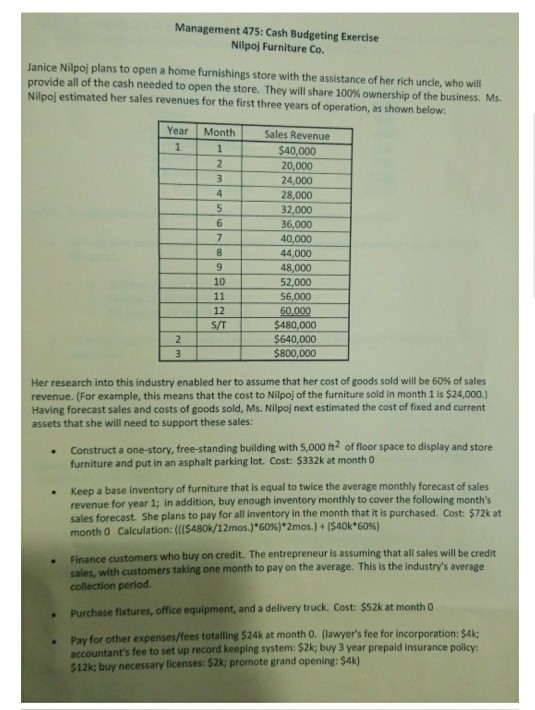

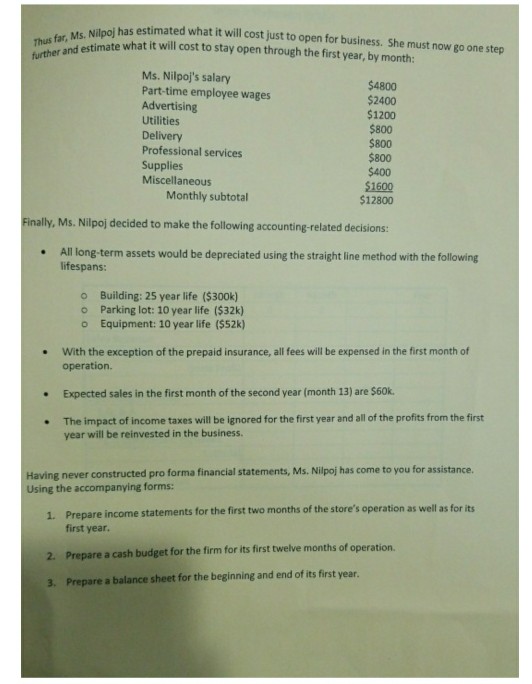

Management 475: Cash Budgeting Exercise Nilpoj Furniture Co. Janice Nilpoj plans to open a home furnishings store with the assistance of her rich uncle, who will provide all of the cash needed to open the store. They will share 100% ownership of the business. Ms. Nilpoj estimated her sales revenues for the first three years of operation, as shown below Year Month Sales Revenue 1 1 $40,000 20,000 24,000 28,000 32,000 36,000 40,000 44,000 48,000 52,000 56,000 10 12 S/T $480,000 $640,000 $800,000 Her research into this industry enabled her to assume that her cost of goods sold will be 60% of sales revenue. (For example, this means that the cost to Nilpoj of the furniture sold in month 1 is $24,000.] Having forecast sales and costs of goods sold, Ms. Nilpoj next estimated the cost of fixed and current assets that she will need to support these sales: Construct a one-story, free-standing building with 5,000 ft2 of floor space to display and store furniture and put in an asphalt parking lot. Cost: $332k at month O Keep a base inventory of furniture that is equal to twice the average monthly forecast of sales revenue for year 1; in addition, buy enough inventory monthly to cover the following month's sales forecast. She plans to pay for all inventory in the month that it is purchased. Cost: $72k at month 0 Calculation: ((($480k/12mos)"60%).2mos.) + ($40k"60%) . Finance customers who buy on credit. The entrepreneur is assuming that all sales will be credit sales, with customers taking one month to pay on the average. This is the industry's average collection period. . Purchase fixtures, office equipment, and a delivery truck. Cost: $52k at month 0 Pay for other expenses/fees totalling $24k at month O. (lawyer's fee for incorporation: $Ak; accountant's fee to set up record keeping system: $2k; buy 3 year prepaid insurance policy: $12k; buy necessary licenses: $2k; promote grand opening: $4k)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started