Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help I have no idea what to do . Thank You ! AO Paragraph Styles Editing Dictate Create and Share Request Adobe PDF Signatures

Please help I have no idea what to do . Thank You !

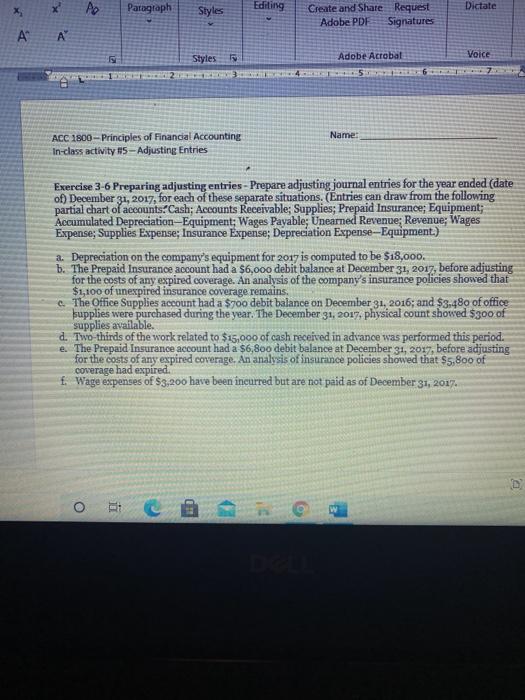

AO Paragraph Styles Editing Dictate Create and Share Request Adobe PDF Signatures A A Adobe Acrobat Voice Styles 2 HERE Name: ACC 1800 - Principles of Financial Accounting In-class activity #5 - Adjusting Entries Exercise 3-6 Preparing adjusting entries - Prepare adjusting journal entries for the year ended (date of) December 31, 2017, for each of these separate situations. (Entries can draw from the following partial chart of accounts Cash; Accounts Receivable; Supplies; Prepaid Insurance; Equipment; Accumulated Depreciation-Equipment; Wages Payable; Unearned Revenue; Revenue; Wages Expense; Supplies Expense; Insurance Expense; Depreciation Expense-Equipment.) 2. Depreciation on the company's equipment for 2017 is computed to be $18,000. b. The Prepaid Insurance account had a $6,000 debit balance at December 31, 2017, before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $1,100 of unexpired insurance coverage remains c. The Office Supplies account had a $700 debit balance on December 31, 2016; and $3,480 of office supplies were purchased during the year. The December 31, 2017, physical count showed $300 of supplies available. d. Two thirds of the work related to $15,000 of cash received in advance was performed this period. e. The Prepaid Insurance account had a $6,800 debit balance at December 31, 2017, before adjusting for the costs of any expired coverage. An analysis of insurance policies showed that $5,800 of coverage had expired." f. Wage expenses of $3,200 have been ineurred but are not paid as of December 31, 2017. o C Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started