Answered step by step

Verified Expert Solution

Question

1 Approved Answer

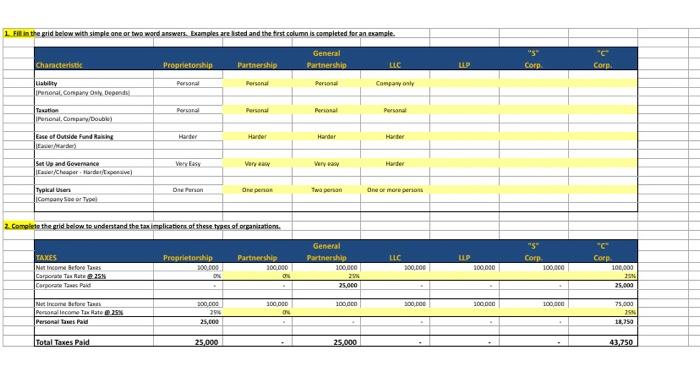

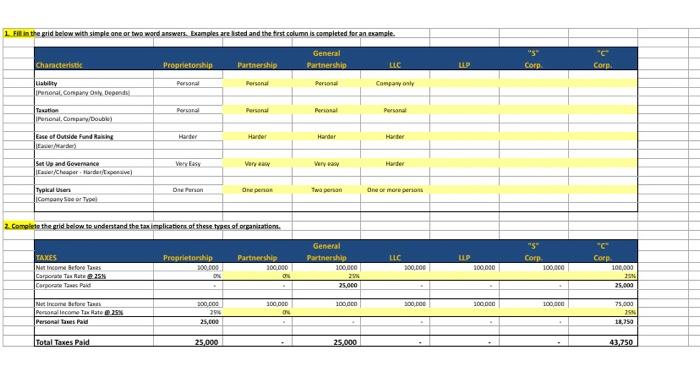

Please help, I have no idea what to do here it is the first homework assignment for FIN 304 1 Flinthe grid below with simple

Please help, I have no idea what to do here

it is the first homework assignment for FIN 304

1 Flinthe grid below with simple one or two word answers. Examples are listed and the test column is completed for an example. General Partnership "5 Corp Characterist Proprietorship Partnership LLC LLP Corp Peroral Personal Personal Copoly Liability penonat Company Oy Depind Per Personal Personal Personal Taxation irenonal. Comparou Ease of Outside Fund Raise Harter Harter Harder Hariter Set Up and Governance CasterCheaper depende Very Easy Very Wery way Harder DP One per Two per One or more per Typical is Company Sour Trpel 2. Complete the grid below to understand the tax implications of these pes af organisation, LLC ULP Proprietorship 200.00 Partnership 100.000 General Partnership 100,000 2 25.000 Corp. 100.000 200,000 TAXES NetBefore Tass Carport Tax Rate 25 Corporate Tanes Paid 100.000 Corp. 100,000 20 25.000 300 DDD 100 DOO 300 DO 100 DOO 100,000 75,000 Nur Before Tanas Portokallcome Tax Rato 25% Personal tas Pad 100 000 2016 25,000 1.750 Total Taxes Pald 25,000 25,000 43,750 1 Flinthe grid below with simple one or two word answers. Examples are listed and the test column is completed for an example. General Partnership "5 Corp Characterist Proprietorship Partnership LLC LLP Corp Peroral Personal Personal Copoly Liability penonat Company Oy Depind Per Personal Personal Personal Taxation irenonal. Comparou Ease of Outside Fund Raise Harter Harter Harder Hariter Set Up and Governance CasterCheaper depende Very Easy Very Wery way Harder DP One per Two per One or more per Typical is Company Sour Trpel 2. Complete the grid below to understand the tax implications of these pes af organisation, LLC ULP Proprietorship 200.00 Partnership 100.000 General Partnership 100,000 2 25.000 Corp. 100.000 200,000 TAXES NetBefore Tass Carport Tax Rate 25 Corporate Tanes Paid 100.000 Corp. 100,000 20 25.000 300 DDD 100 DOO 300 DO 100 DOO 100,000 75,000 Nur Before Tanas Portokallcome Tax Rato 25% Personal tas Pad 100 000 2016 25,000 1.750 Total Taxes Pald 25,000 25,000 43,750 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started