Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! i know it looks big, but is just one assignment. I am not sure if I calculated total paid back to the bank,

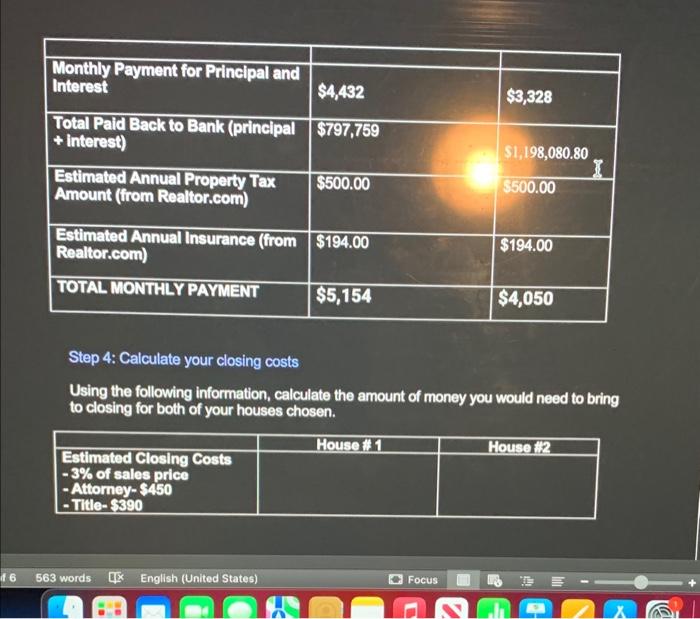

please help! i know it looks big, but is just one assignment. I am not sure if I calculated total paid back to the bank, and dont know how to estimate the closing cost

the closing costs of the houses needs calculated, and total paid back to the bank

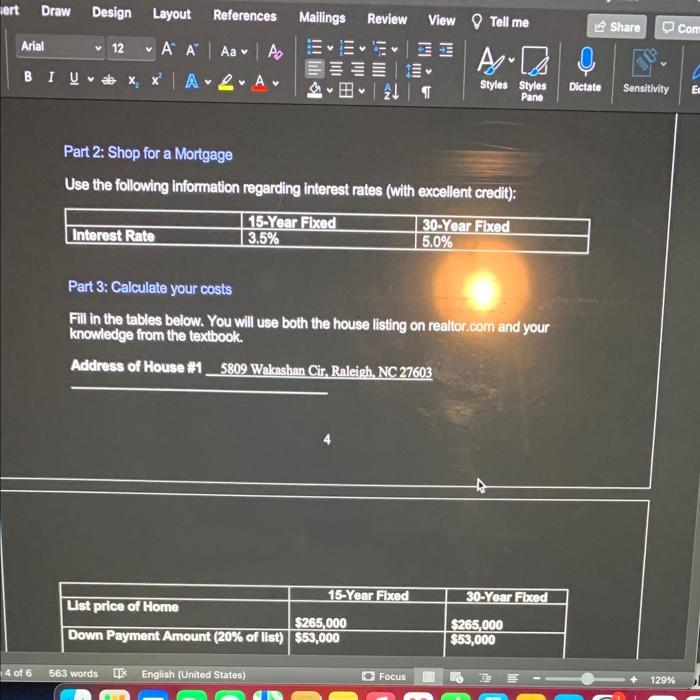

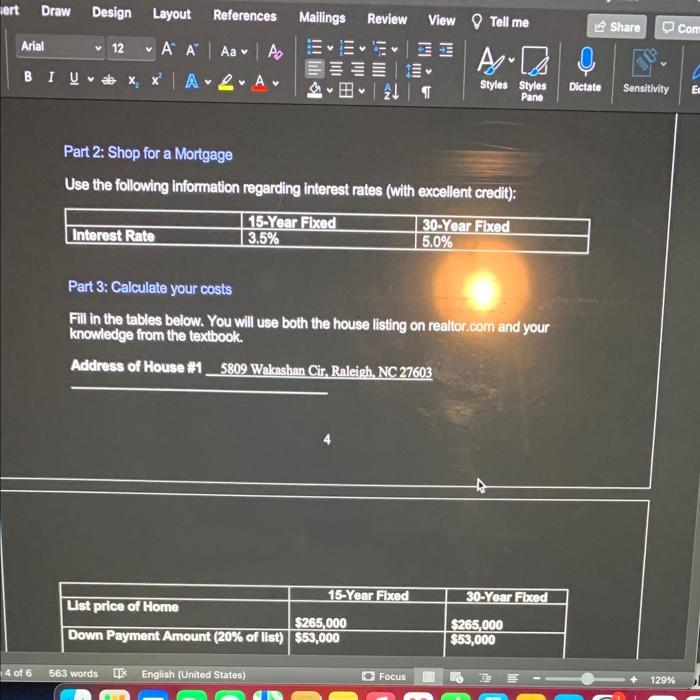

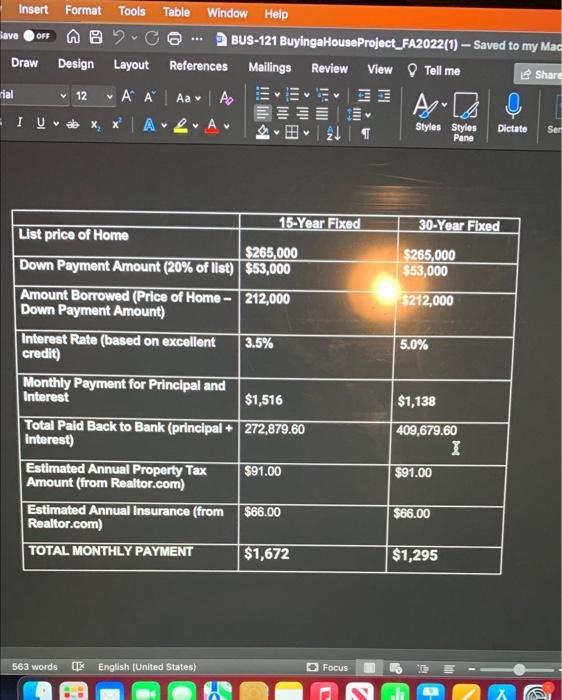

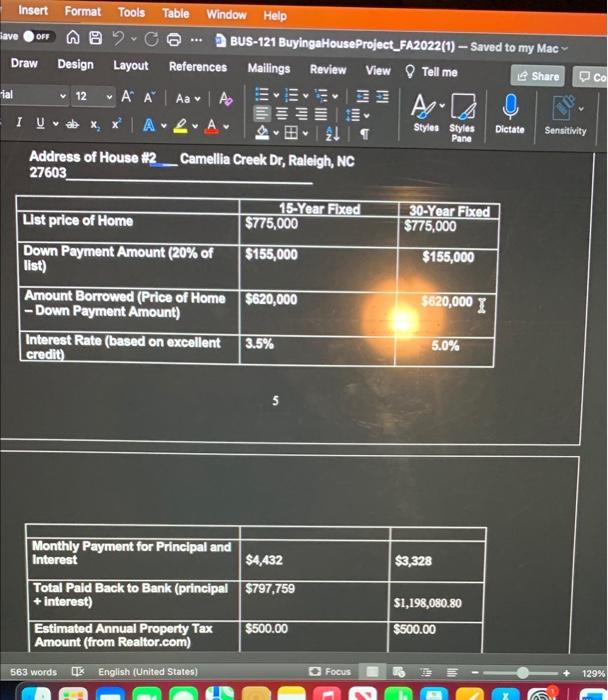

Part 2: Shop for a Mortgage Use the following information regarding interest rates (with excellent credit): Part 3: Calculate your costs Fill in the tables below. You will use both the house listing on realtor.com and your knowledge from the textbook. Address of House 1.4809 Wakashan Cir, Raleigh, NC 27603 \begin{tabular}{|l|l|l|} \hline & \multicolumn{1}{|c|}{ 15-Year Fixed } & 30 -Year Flxed \\ \hline List price of Home & $265,000 & $265,000 \\ \hline Down Payment Amount (20\% of list) & $53,000 & $53,000 \\ \hline Amount Borrowed (Price of Home -Down Payment Amount) & 212,000 & $212,000 \\ \hline Interest Rate (based on excellent credit) & 3.5% & 5.0% \\ \hline Monthly Payment for Principal and Interest & $1,516 & $1,138 \\ \hline Total Paid Back to Bank (principal * Interest) & 272,879.60 & Y \\ \hline Estimated Annual Property Tax Amount (from Realtor.com) & $91.00 & $91.00 \\ \hline Estimated Annual Insurance (from Realtor.com) & $66.00 & $66.00 \\ \hline TOTAL MONTHLY PAYMENT & $1,672 & $1,295 \\ \hline \end{tabular} Address of House 1.2 __ Camellia Creek Dr, Raleigh, NC 27603 \begin{tabular}{|l|l|c|} \hline & \multicolumn{1}{|c|}{15Y Year Fixed } & 30.Year Flxed \\ \hline List price of Home & $775,000 & $775,000 \\ \hline Down Payment Amount ( 20% of list) & $155,000 & $155,000 \\ \hline Amount Borrowed (Price of Home - Down Payment Amount) & $620,000 & \\ \hline Interest Rate (based on excellent credit) & 3.5%,000Z \\ \hline \end{tabular} 5 \begin{tabular}{|l|l|l|} \hline & & \\ \hline Monthly Payment for Principal and Interest & $4,432 & $3,328 \\ \hline Total Pald Back to Bank (principal + interest) & $797,759 & $1,198,080.80 \\ \hline Estimated Annual Property Tax Amount (from Realtor.com) & $500.00 & $500.00 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & & \\ \hline Monthly Payment for Principal and Interest & $4,432 & $3,328 \\ \hline Total Paid Back to Bank (principal + interest) & $797,759 & $1,198,080.80 \\ \hline Estimated Annual Property Tax Amount (from Realtor.com) & $500.00 & $550.00 \\ \hline Estimated Annual Insurance (from Realtor.com) & $194.00 & $194.00 \\ \hline TOTAL MONTHLY PAYMENT & $5,154 & $4,050 \\ \hline \end{tabular} Step 4: Calculate your closing costs Using the following information, calculate the amount of money you would need to bring to closing for both of your houses chosen Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started