Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help!!! i meed this done isn20 minutes! You plan to invest in securities that pay 11.2%, compounded annually. If you invest $5,000 today, how

please help!!! i meed this done isn20 minutes!

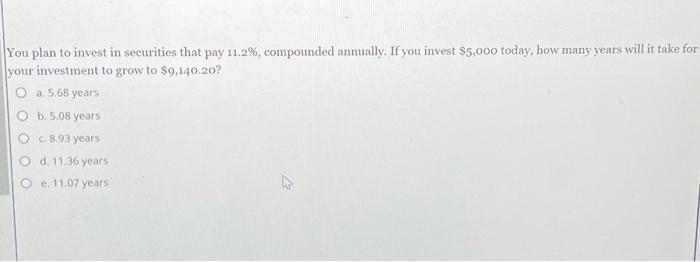

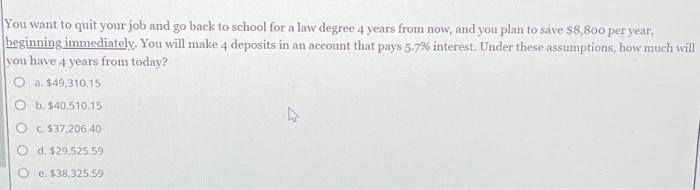

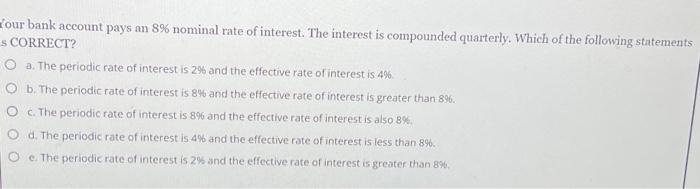

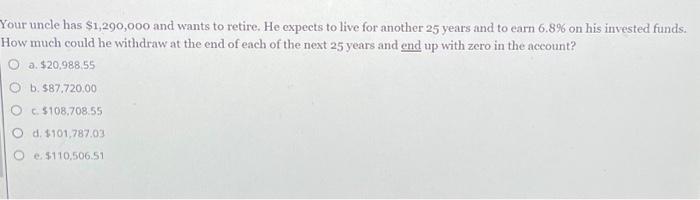

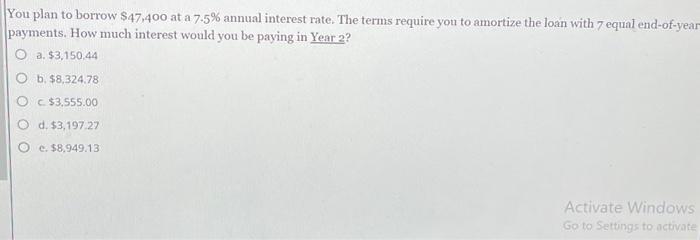

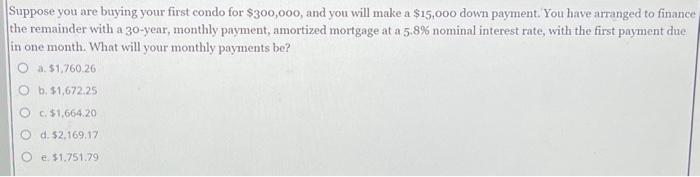

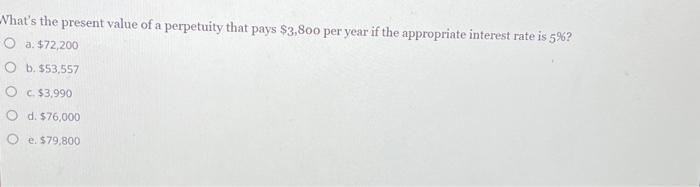

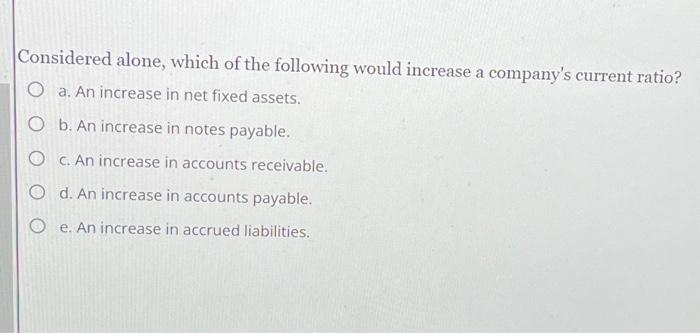

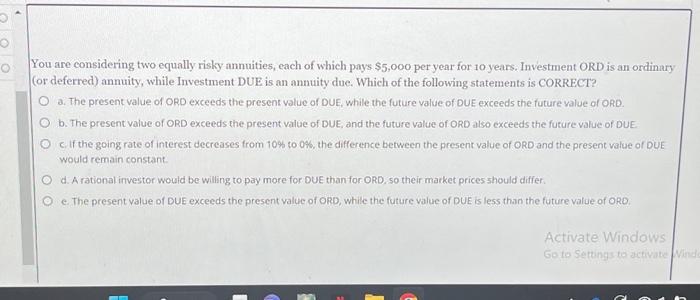

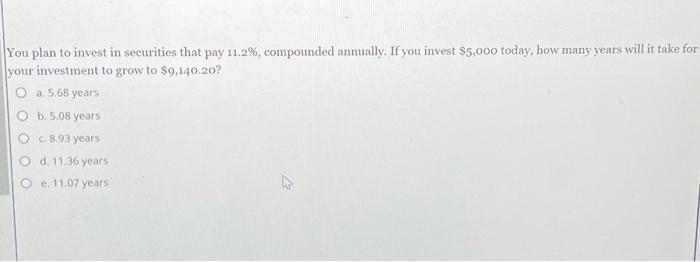

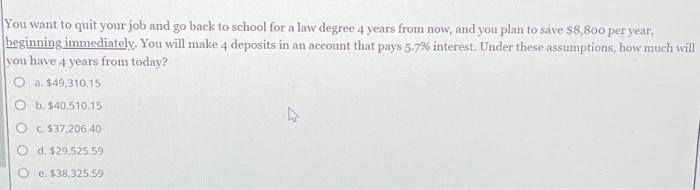

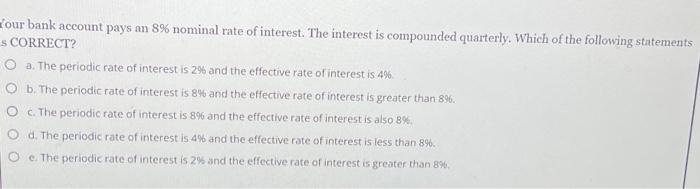

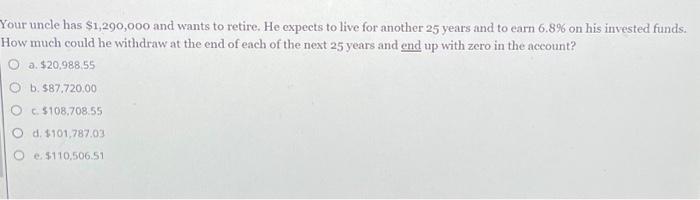

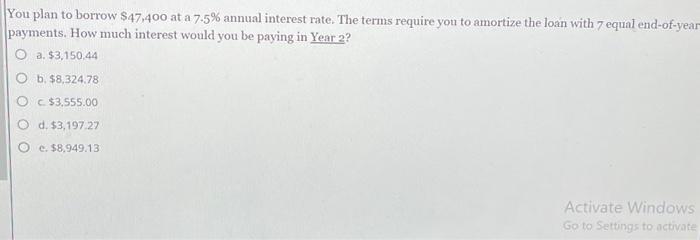

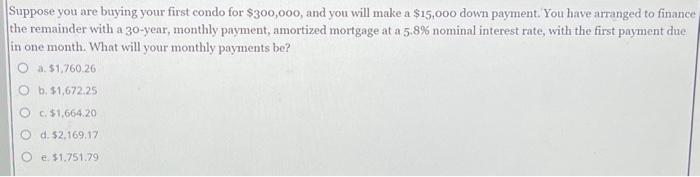

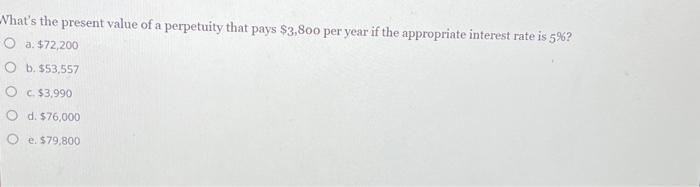

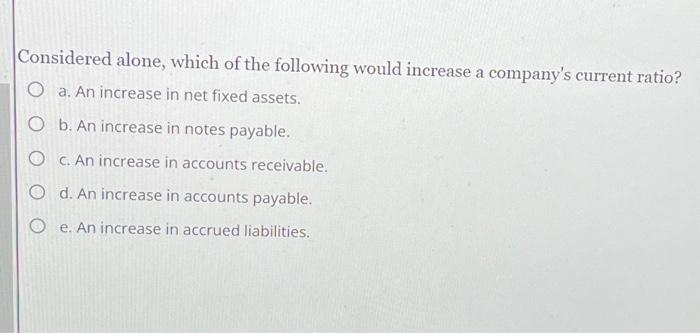

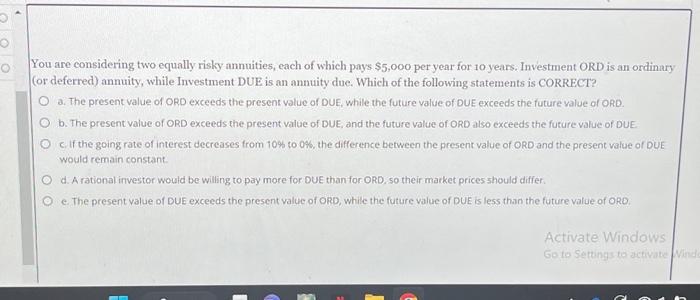

You plan to invest in securities that pay 11.2%, compounded annually. If you invest $5,000 today, how many years will it take for your investment to grow to $9,140.20? a. 5.68 years b. 5.08 years c. 8.93 years d. 11.36 years e. 11.07 years You want to quit your job and go back to school for a law degree 4 years from now, and you plan to sive $8,800 per year, beginning immediately. You will make 4 deposits in an account that pays 5.7% interest. Under these assumptions, how much will you have 4 years from today? a. $49,310,15 b. $40.510.15 c. $37,206,40 d. $29,525.59 c. $38,325.59 our bank account pays an 8% nominal rate of interest. The interest is compounded quarterly. Which of the following statements. S CORRECT? a. The periodic rate of interest is 2% and the effective rate of interest is 4% b. The periodic rate of interest is 8% and the effective rate of interest is greater than 896 . c. The periodic rate of interest is 8% and the effective rate of interest is also 8% d. The periodic rate of interest is 4% and the effective rate of interest is less than 8%. c. The periodic rate of interest is 2% and the effective rate of interest is greater than 8%. Pour uncle has $1,290,000 and wants to retire. He expects to live for another 25 years and to earn 6.8% on his invested funds. How much could he withdraw at the end of each of the next 25 years and end up with zero in the aceount? a. $20,988.55 b. $87.720.00 c. $108.708.55 d. $101,787.03 e. $110.506.51 You plan to borrow $47,400 at a 7.5% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2? a. $3,150,44 b. $8,324.78 c. $3.555.00 d. $3,197.27 e. $8,949.13 Activate Windows Go to Setungs to activate Suppose you are buying your first condo for $300,000, and you will make a $15,000 down payment. You have arranged to finance the remainder with a 30-year, monthly payment, amortized mortgage at a 5.8% nominal interest rate, with the first payment due in one month. What will your monthly payments be? a. $1,760.26 b. $1,672,25 c. 51.664 .20 d. 52,169.17 e. $1.751.79 What's the present value of a perpetuity that pays $3,800 per year if the appropriate interest rate is 5%? a. $72,200 b. $53,557 c. $3,990 d. $76,000 e. $79,800 Considered alone, which of the following would increase a company's current ratio? a. An increase in net fixed assets. b. An increase in notes payable. c. An increase in accounts receivable. d. An increase in accounts payable. e. An increase in accrued liabilities. Tou are considering two equally risky annuities, each of which pays $5,000 per year for 10 years. Investment ORD is an ordinary or deferred) annuity, while Investment DUE is an annuity due. Which of the following statements is CORRECT? a. The present value of ORD exceeds the present value of DUE, while the future value of DUE exceeds the future value of ORD. b. The present value of ORD exceeds the present value of DUE, and the future value of ORD also exceeds the future value of DUE. c. If the going rate of interest decreases from 10% to 0%, the differtnce between the present value of ORD and the present value of DUE would remain constant. d. A rational investor would be willing to pay more for DUE than for ORD. so their market prices should differ e. The present value of DUE exceeds the present value of ORD, while the future value of DUE is less than the future value of ORD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started