Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help, i need to answer 1-3 at the bottom of the page and its due tonight, i need some help The following case is

please help, i need to answer 1-3 at the bottom of the page and its due tonight, i need some help

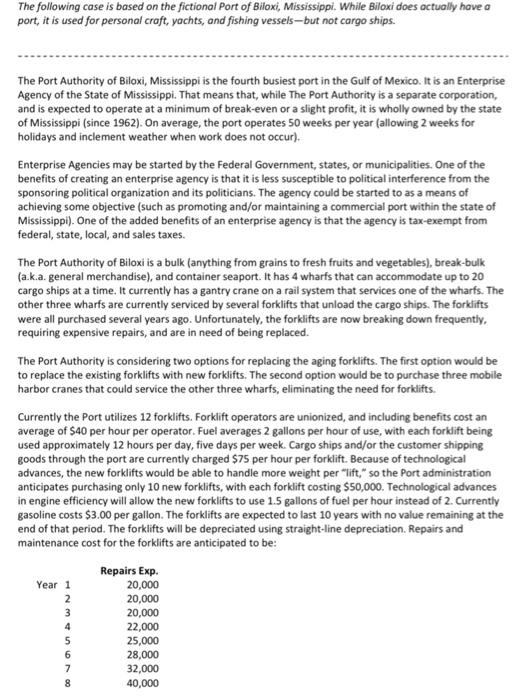

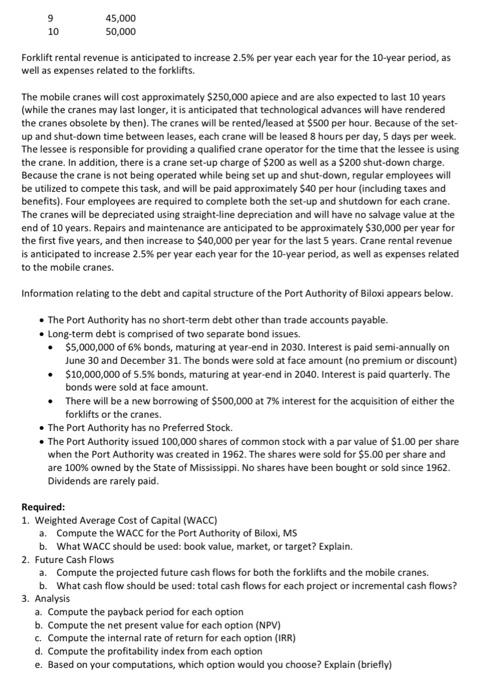

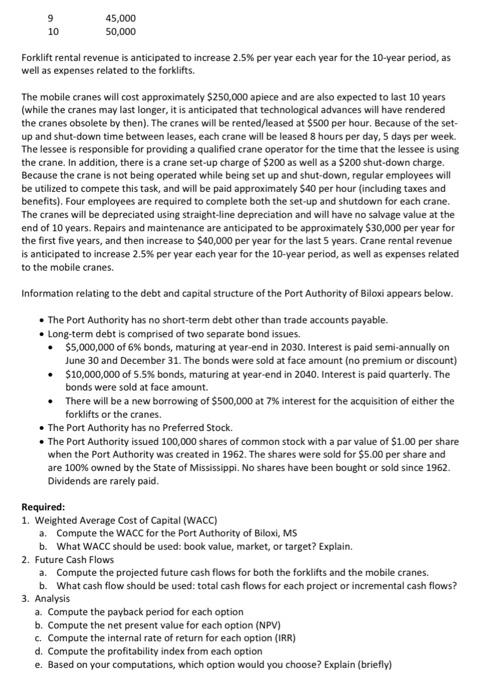

The following case is based on the fictional Port of Biloxi, Mississippi. While Biloxi does actually have a port, it is used for personal craft, yachts, and fishing vessels- but not cargo ships. The Port Authority of Biloxi, Mississippi is the fourth busiest port in the Gulf of Mexico. It is an Enterprise Agency of the State of Mississippi. That means that, while The Port Authority is a separate corporation, and is expected to operate at a minimum of break-even or a slight profit, it is wholly owned by the state of Mississippi (since 1962). On average, the port operates 50 weeks per year (allowing 2 weeks for holidays and inclement weather when work does not occur). Enterprise Agencies may be started by the Federal Government, states, or municipalities. One of the benefits of creating an enterprise agency is that it is less susceptible to political interference from the sponsoring political organization and its politicians. The agency could be started to as a means of achieving some objective (such as promoting and/or maintaining a commercial port within the state of Mississippi) . One of the added benefits of an enterprise agency is that the agency is tax-exempt from federal, state, local, and sales taxes. The Port Authority of Biloxi is a bulk (anything from grains to fresh fruits and vegetables), break-bulk (a.k.a. general merchandise), and container seaport. It has 4 wharfs that can accommodate up to 20 cargo ships at a time. It currently has a gantry crane on a rail system that services one of the wharfs. The other three wharfs are currently serviced by several forklifts that unload the cargo ships. The forklifts were all purchased several years ago. Unfortunately, the forklifts are now breaking down frequently, requiring expensive repairs, and are in need of being replaced. The Port Authority is considering two options for replacing the aging forklifts. The first option would be to replace the existing forklifts with new forklifts. The second option would be to purchase three mobile harbor cranes that could service the other three wharfs, eliminating the need for forklifts. Currently the Port utilizes 12 forklifts. Forklift operators are unionized, and including benefits cost an average of $40 per hour per operator. Fuel averages 2 gallons per hour of use, with each forklift being used approximately 12 hours per day, five days per week. Cargo ships and/or the customer shipping goods through the port are currently charged $75 per hour per forklift. Because of technological advances, the new forklifts would be able to handle more weight per "lift," so the Port administration anticipates purchasing only 10 new forklifts, with each forklift costing $50,000. Technological advances in engine efficiency will allow the new forklifts to use 1.5 gallons of fuel per hour instead of 2. Currently gasoline costs $3.00 per gallon. The forklifts are expected to last 10 years with no value remaining at the end of that period. The forklifts will be depreciated using straight-line depreciation. Repairs and maintenance cost for the forklifts are anticipated to be: Repairs Exp. Year 1 20,000 2 20,000 3 20,000 22,000 25,000 28,000 32,000 40,000 00 OWN 4 5 6 7 8 9 10 45,000 50,000 Forklift rental revenue is anticipated to increase 2.5% per year each year for the 10-year period, as well as expenses related to the forklifts. The mobile cranes will cost approximately $250,000 apiece and are also expected to last 10 years (while the cranes may last longer, it is anticipated that technological advances will have rendered the cranes obsolete by then). The cranes will be rented/leased at $500 per hour. Because of the set- up and shut-down time between leases, each crane will be leased 8 hours per day, 5 days per week. The lessee is responsible for providing a qualified crane operator for the time that the lessee is using the crane. In addition, there is a crane set-up charge of $200 as well as a $200 shut-down charge. Because the crane is not being operated while being set up and shut-down, regular employees will be utilized to compete this task, and will be paid approximately $40 per hour (including taxes and benefits). Four employees are required to complete both the set-up and shutdown for each crane. The cranes will be depreciated using straight-line depreciation and will have no salvage value at the end of 10 years. Repairs and maintenance are anticipated to be approximately $30,000 per year for the first five years, and then increase to $40,000 per year for the last 5 years. Crane rental revenue is anticipated to increase 2.5% per year each year for the 10-year period, as well as expenses related to the mobile cranes. Information relating to the debt and capital structure of the Port Authority of Biloxi appears below. The Port Authority has no short-term debt other than trade accounts payable. . Long-term debt is comprised of two separate bond issues. $5,000,000 of 6% bonds, maturing at year-end in 2030. Interest is paid semi-annually on June 30 and December 31. The bonds were sold at face amount (no premium or discount) $10,000,000 of 5.5% bonds, maturing at year-end in 2040. Interest is paid quarterly. The bonds were sold at face amount. There will be a new borrowing of $500,000 at 7% interest for the acquisition of either the forklifts or the cranes. The Port Authority has no Preferred Stock. The Port Authority issued 100,000 shares of common stock with a par value of $1.00 per share when the Port Authority was created in 1962. The shares were sold for $5.00 per share and are 100% owned by the State of Mississippi. No shares have been bought or sold since 1962. Dividends are rarely paid Required: 1. Weighted Average Cost of Capital (WACC) a. Compute the WACC for the Port Authority of Biloxi, MS b. What WACC should be used: book value, market, or target? Explain. 2. Future Cash Flows a. Compute the projected future cash flows for both the forklifts and the mobile cranes. b. What cash flow should be used: total cash flows for each project or incremental cash flows? 3. Analysis a. Compute the payback period for each option b. Compute the net present value for each option (NPV) c. Compute the internal rate of return for each option (IRR) d. Compute the profitability index from each option e. Based on your computations, which option would you choose? Explain (briefly) The following case is based on the fictional Port of Biloxi, Mississippi. While Biloxi does actually have a port, it is used for personal craft, yachts, and fishing vessels- but not cargo ships. The Port Authority of Biloxi, Mississippi is the fourth busiest port in the Gulf of Mexico. It is an Enterprise Agency of the State of Mississippi. That means that, while The Port Authority is a separate corporation, and is expected to operate at a minimum of break-even or a slight profit, it is wholly owned by the state of Mississippi (since 1962). On average, the port operates 50 weeks per year (allowing 2 weeks for holidays and inclement weather when work does not occur). Enterprise Agencies may be started by the Federal Government, states, or municipalities. One of the benefits of creating an enterprise agency is that it is less susceptible to political interference from the sponsoring political organization and its politicians. The agency could be started to as a means of achieving some objective (such as promoting and/or maintaining a commercial port within the state of Mississippi) . One of the added benefits of an enterprise agency is that the agency is tax-exempt from federal, state, local, and sales taxes. The Port Authority of Biloxi is a bulk (anything from grains to fresh fruits and vegetables), break-bulk (a.k.a. general merchandise), and container seaport. It has 4 wharfs that can accommodate up to 20 cargo ships at a time. It currently has a gantry crane on a rail system that services one of the wharfs. The other three wharfs are currently serviced by several forklifts that unload the cargo ships. The forklifts were all purchased several years ago. Unfortunately, the forklifts are now breaking down frequently, requiring expensive repairs, and are in need of being replaced. The Port Authority is considering two options for replacing the aging forklifts. The first option would be to replace the existing forklifts with new forklifts. The second option would be to purchase three mobile harbor cranes that could service the other three wharfs, eliminating the need for forklifts. Currently the Port utilizes 12 forklifts. Forklift operators are unionized, and including benefits cost an average of $40 per hour per operator. Fuel averages 2 gallons per hour of use, with each forklift being used approximately 12 hours per day, five days per week. Cargo ships and/or the customer shipping goods through the port are currently charged $75 per hour per forklift. Because of technological advances, the new forklifts would be able to handle more weight per "lift," so the Port administration anticipates purchasing only 10 new forklifts, with each forklift costing $50,000. Technological advances in engine efficiency will allow the new forklifts to use 1.5 gallons of fuel per hour instead of 2. Currently gasoline costs $3.00 per gallon. The forklifts are expected to last 10 years with no value remaining at the end of that period. The forklifts will be depreciated using straight-line depreciation. Repairs and maintenance cost for the forklifts are anticipated to be: Repairs Exp. Year 1 20,000 2 20,000 3 20,000 22,000 25,000 28,000 32,000 40,000 00 OWN 4 5 6 7 8 9 10 45,000 50,000 Forklift rental revenue is anticipated to increase 2.5% per year each year for the 10-year period, as well as expenses related to the forklifts. The mobile cranes will cost approximately $250,000 apiece and are also expected to last 10 years (while the cranes may last longer, it is anticipated that technological advances will have rendered the cranes obsolete by then). The cranes will be rented/leased at $500 per hour. Because of the set- up and shut-down time between leases, each crane will be leased 8 hours per day, 5 days per week. The lessee is responsible for providing a qualified crane operator for the time that the lessee is using the crane. In addition, there is a crane set-up charge of $200 as well as a $200 shut-down charge. Because the crane is not being operated while being set up and shut-down, regular employees will be utilized to compete this task, and will be paid approximately $40 per hour (including taxes and benefits). Four employees are required to complete both the set-up and shutdown for each crane. The cranes will be depreciated using straight-line depreciation and will have no salvage value at the end of 10 years. Repairs and maintenance are anticipated to be approximately $30,000 per year for the first five years, and then increase to $40,000 per year for the last 5 years. Crane rental revenue is anticipated to increase 2.5% per year each year for the 10-year period, as well as expenses related to the mobile cranes. Information relating to the debt and capital structure of the Port Authority of Biloxi appears below. The Port Authority has no short-term debt other than trade accounts payable. . Long-term debt is comprised of two separate bond issues. $5,000,000 of 6% bonds, maturing at year-end in 2030. Interest is paid semi-annually on June 30 and December 31. The bonds were sold at face amount (no premium or discount) $10,000,000 of 5.5% bonds, maturing at year-end in 2040. Interest is paid quarterly. The bonds were sold at face amount. There will be a new borrowing of $500,000 at 7% interest for the acquisition of either the forklifts or the cranes. The Port Authority has no Preferred Stock. The Port Authority issued 100,000 shares of common stock with a par value of $1.00 per share when the Port Authority was created in 1962. The shares were sold for $5.00 per share and are 100% owned by the State of Mississippi. No shares have been bought or sold since 1962. Dividends are rarely paid Required: 1. Weighted Average Cost of Capital (WACC) a. Compute the WACC for the Port Authority of Biloxi, MS b. What WACC should be used: book value, market, or target? Explain. 2. Future Cash Flows a. Compute the projected future cash flows for both the forklifts and the mobile cranes. b. What cash flow should be used: total cash flows for each project or incremental cash flows? 3. Analysis a. Compute the payback period for each option b. Compute the net present value for each option (NPV) c. Compute the internal rate of return for each option (IRR) d. Compute the profitability index from each option e. Based on your computations, which option would you choose? Explain (briefly)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started