Answered step by step

Verified Expert Solution

Question

1 Approved Answer

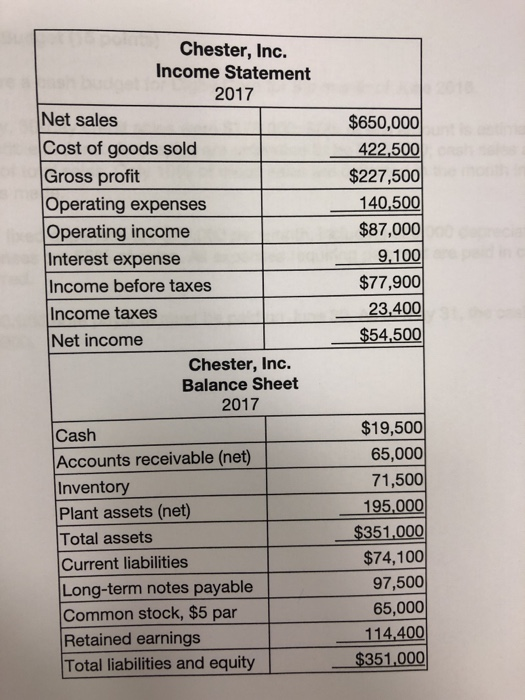

Please help I posted the Income Statement and Balance sheet. I believe I have to use these to complete these questions? Financial Statement Analysis Chesters

Please help I posted the Income Statement and Balance sheet. I believe I have to use these to complete these questions?

Financial Statement Analysis

Chesters financial data are shown below. No additional shares of common stock were issued during the year. The December 31 at market price per share is $49.50. Cash dividends of $19,500 were paid during the year. Calculate the following ratios for the company .

Net profit margin:

Gross profit margin:

Return on Assets:

Return on Equity:

Earnings per share:

Price Earnings Ratio:

Dividend yield:

Times interest earned:

Inventory turnover:

Receivables Turnover:

Debt to Equity:

Equity Multiplier:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started