please help! i posted these earlier and they were answered wrong.

missing a number here but im going insane trying to figure out what!

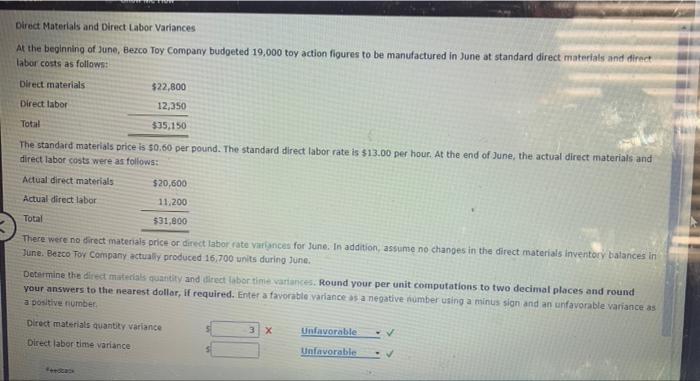

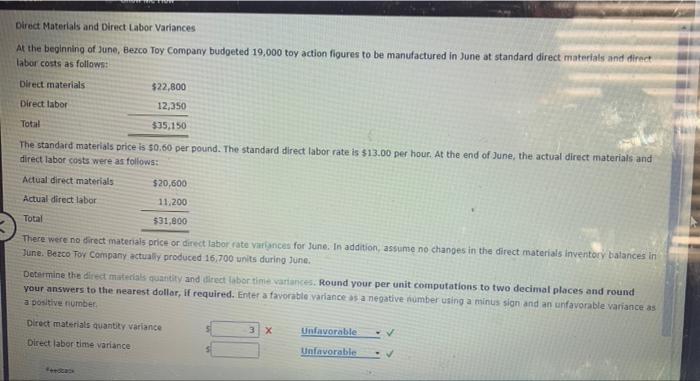

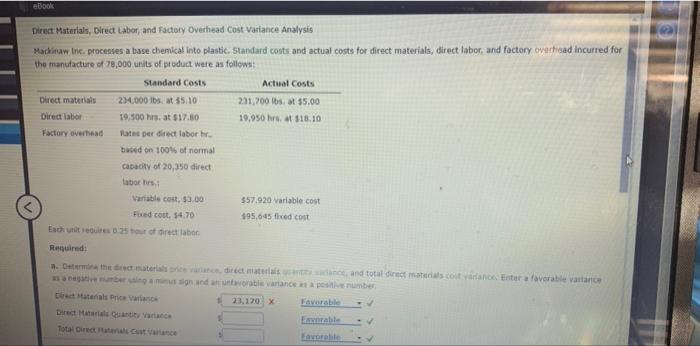

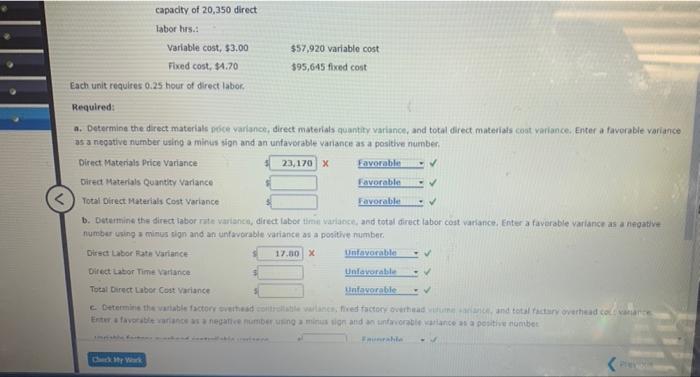

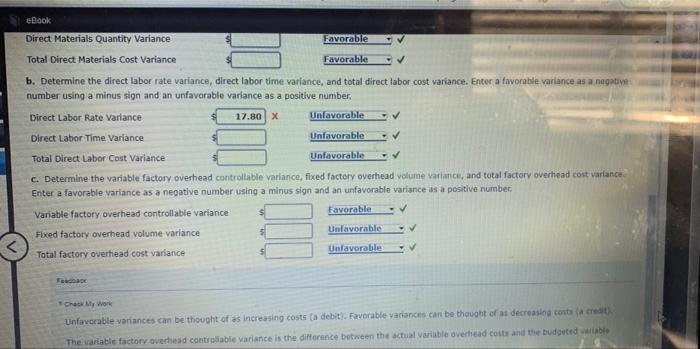

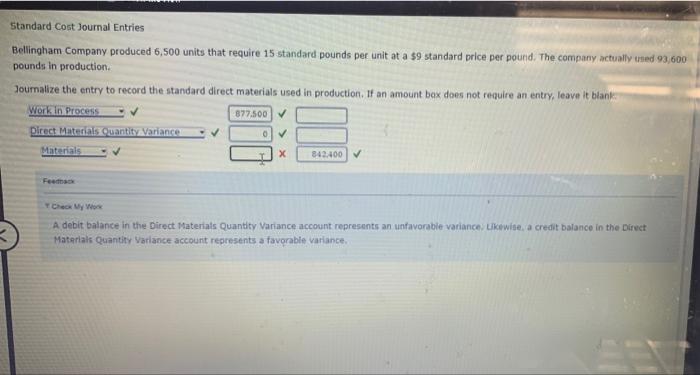

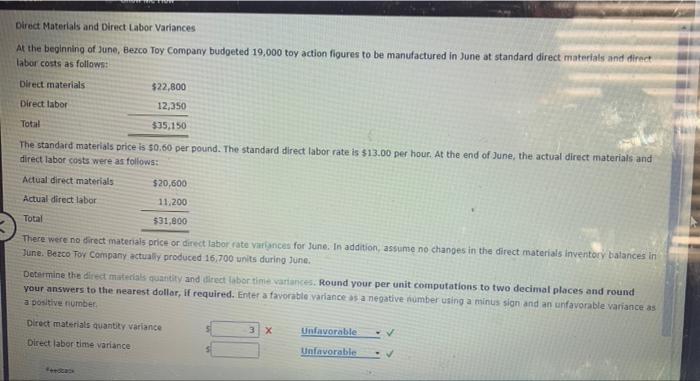

Direct Materials and Direct Labor Variances At the beginning of June, Bezco Toy Company budgeted 19,000 toy action figures to be manufactured in June at standard direct materials and direct labor costs as follows: Direct materials $22,800 12,350 Direct labor Total $35,150 The standard materials price is $0.60 per pound. The standard direct labor rate is $13.00 per hour. At the end of June, the actual direct materials and direct labor costs were as follows: Actual direct materials $20,600 Actual direct labor 11.200 $31,800 Total There were no direct materials price or direct labor rate variances for June. In addition, assume no changes in the direct materials inventory balances in June. Bezco Toy Company actually produced 16,700 units during June. Determine the direct materials quantity and direct labor time variances. Round your per unit computations to two decimal places and round your answers to the nearest dollar, if required. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct materials quantity variance 3 X V Unfavorable Unfavorable Direct labor time variance eBook Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 78,000 units of product were as follows: Standard Costs Actual Costs 231,700 lbs. at $5.00 Direct materials Direct labor 234,000 lbs. at $5.10 19,500 hrs. at $17.80 19,950 hrs. at $18.10 Factory overhead Rates per direct labor hr. based on 100% of normal. capacity of 20,350 direct labor bes.: Variable cost, $3.00 $57.920 variable cost Fixed cost, $4.70 $95,645 fixed cost Each unit requires 0.25 hour of direct labor Required: a. Determine the direct materials price variance, direct materials quantity sarlance, and total direct materials colt variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number Direct Materials Price variance 23,170 x Favorable Direct Materials Quantity Variance Eavorable Total Direct Materials Cast Variance Favorable capacity of 20,350 direct labor hrs.: Variable cost, $3.00 $57,920 variable cost Fixed cost, $4.70 $95,645 fixed cost Each unit requires 0.25 hour of direct labor Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Materials Price Variance 23,170 X Favorable Favorable Direct Materials Quantity Variance Total Direct Materials Cost Variance Favorable b. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Labor Rate Variance 17.00 X Direct Labor Time Variance Unfavorable Unfavorable Unfavorable Total Direct Labor Cost Variance c. Determine the variable factory overhead controllable varlance, fived factory overhead virumearance, and total factory overhead colvanarce Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number Fabia scrisan Check My Work eBook Direct Materials Quantity Variance Favorable Favorable Total Direct Materials Cost Variance b. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number, Direct Labor Rate Variance 17.80 X V Unfavorable Unfavorable Direct Labor Time Variance Total Direct Labor Cost Variance Unfavorable c. Determine the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Variable factory overhead controllable variance Favorable Fixed factory overhead volume variance Unfavorable Unfavorable Total factory overhead cost variance Feedbac Check My Work Unfavorable variances can be thought of as increasing costs (a debit). Favorable variances can be thought of as decreasing costs (a credit) The variable factory overhead controllable variance is the difference between the actual variable overhead costs and the budgeted variable Standard Cost Journal Entries Bellingham Company produced 6,500 units that require 15 standard pounds per unit at a $9 standard price per pound. The company actually used 93,600 pounds in production. Journalize the entry to record the standard direct materials used in production. If an amount box does not require an entry, leave it blank Work in Process 877.500 Direct Materials Quantity Variance 0 Materials X 842400 Check My Work A debit balance in the Direct Materials Quantity Variance account represents an unfavorable variance. Likewise, a credit balance in the Direct Materials Quantity Variance account represents a favorable variance