Answered step by step

Verified Expert Solution

Question

1 Approved Answer

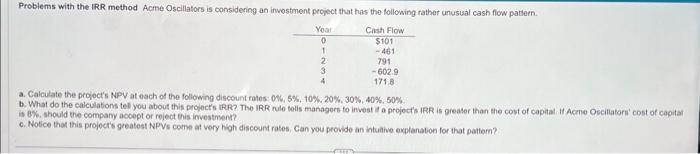

please help I will rate! thank you! a. Calculate the projoct's NPV at esch of the following discount fates: 0%,5%,10%,20%,30%,40%,50% b. What do the calculations

please help I will rate! thank you!  a. Calculate the projoct's NPV at esch of the following discount fates: 0%,5%,10%,20%,30%,40%,50% b. What do the calculations tel you about this projects IRRR? The IRR nule tolis managors to invest if a project's IRR is greater than the cost of capital it Acme Oscillatori' cost of cagital is B\%. should the company acoept or reject this investrnent? c. Notce that this projectis greatest NPVs come at very high discount rates. Can you provide an intuative explanation for that pattem

a. Calculate the projoct's NPV at esch of the following discount fates: 0%,5%,10%,20%,30%,40%,50% b. What do the calculations tel you about this projects IRRR? The IRR nule tolis managors to invest if a project's IRR is greater than the cost of capital it Acme Oscillatori' cost of cagital is B\%. should the company acoept or reject this investrnent? c. Notce that this projectis greatest NPVs come at very high discount rates. Can you provide an intuative explanation for that pattem

please help I will rate! thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started