Please help, I will thumbs you up thank you!!

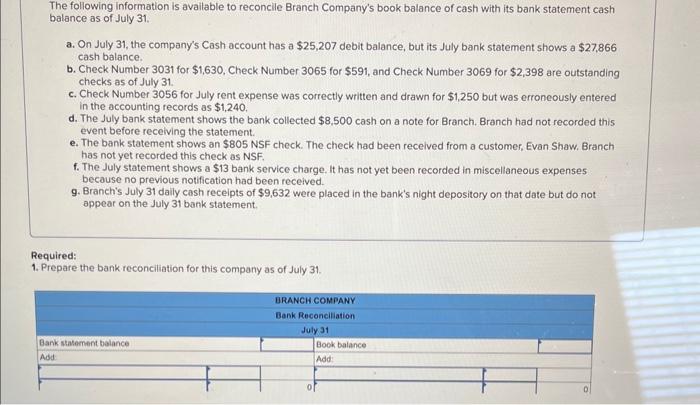

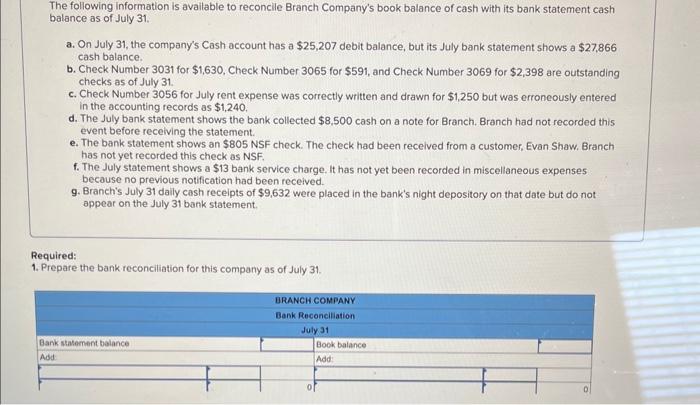

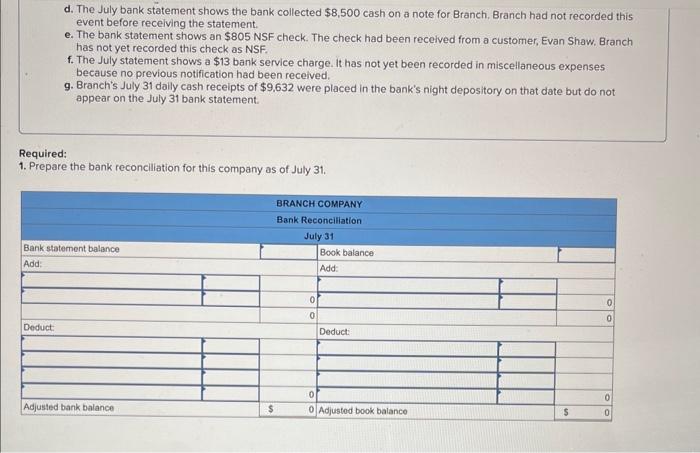

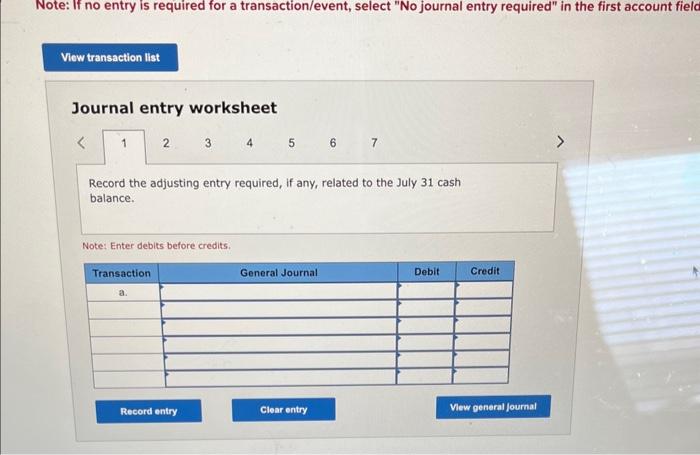

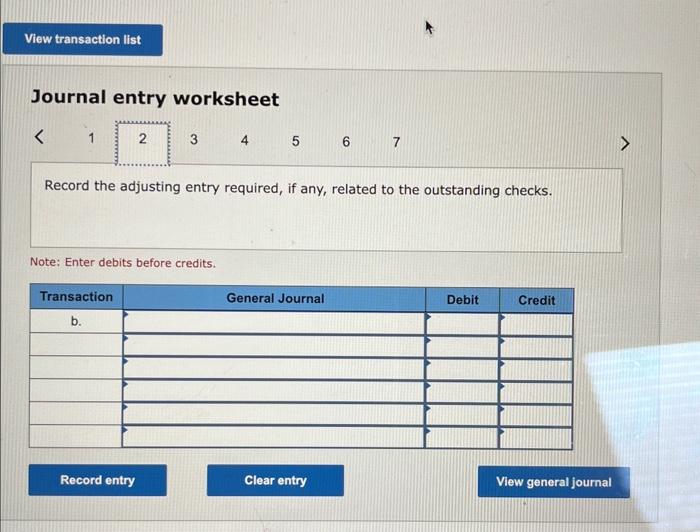

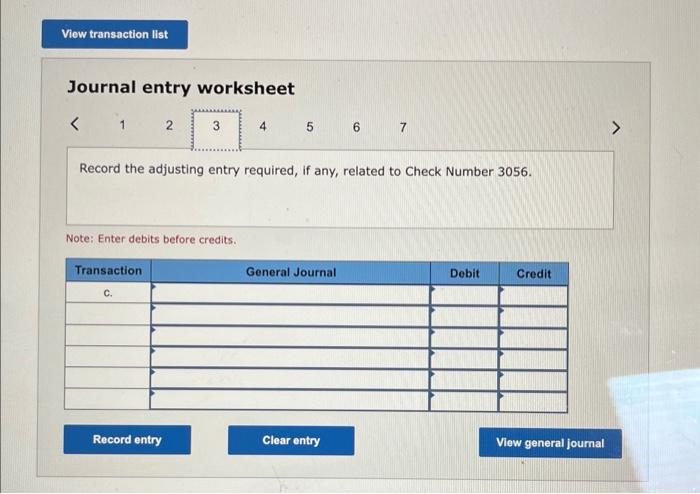

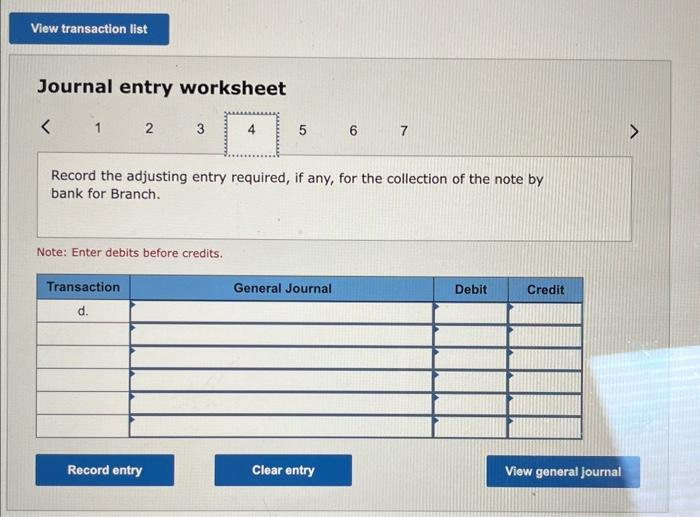

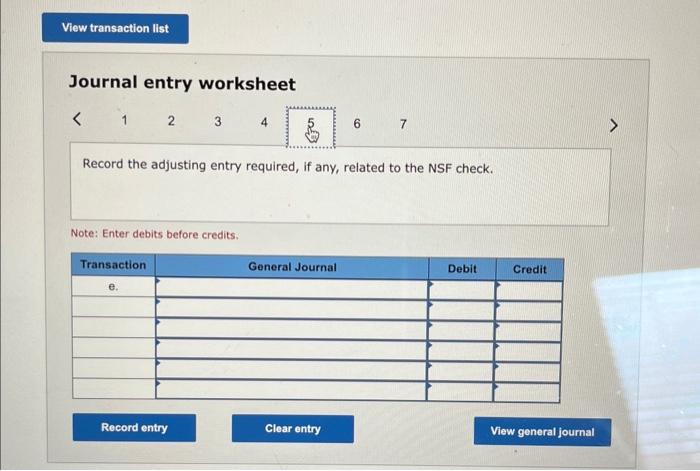

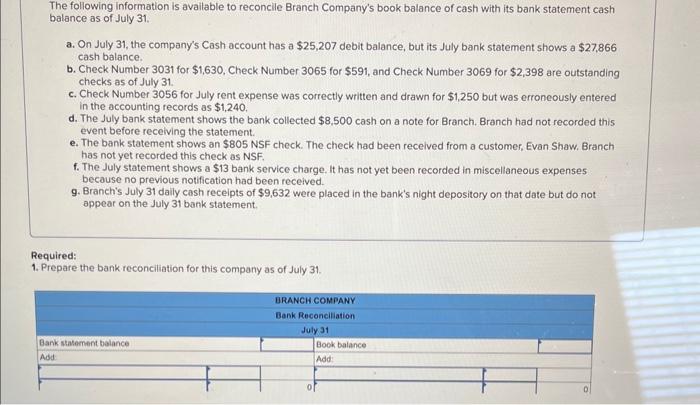

The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31 . a. On July 31, the company's Cash account has a $25,207 debit balance, but its July bank statement shows a $27,866 cash balance. b. Check Number 3031 for $1,630, Check Number 3065 for $591, and Check Number 3069 for $2,398 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,250 but was erroneously entered in the accounting records as $1,240. d. The July bank statement shows the bank collected $8,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been recelved from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $13 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received. 9. Branch's July 31 daily cash receipts of $9,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement. Required: 1. Prepare the bank reconciliation for this company as of July 31 . d. The July bank statement shows the bank collected $8,500 cash on a note for Branch. Branch had not recorded this event before recelving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw, Branch has not yet recorded this check as NSF. f. The July statement shows a $13 bank service charge. it has not yet been recorded in miscellaneous expenses because no previous notification had been received. 9. Branch's July 31 daily cash receipts of $9,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement. Required: 1. Prepare the bank reconciliation for this company as of July 31 . Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fielc Journal entry worksheet 22457 Record the adjusting entry required, if any, related to the July 31 cash balance. Note: Enter debits before credits. Journal entry worksheet 7 Record the adjusting entry required, if any, related to the outstanding checks. Note: Enter debits before credits. Journal entry worksheet Record the adjusting entry required, if any, related to Check Number 3056. Note: Enter debits before credits. Journal entry worksheet Record the adjusting entry required, if any, for the collection of the note by bank for Branch. Note: Enter debits before credits. Journal entry worksheet