Answered step by step

Verified Expert Solution

Question

1 Approved Answer

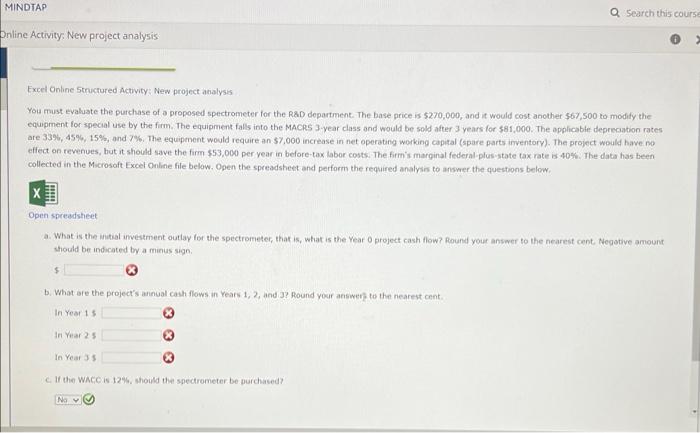

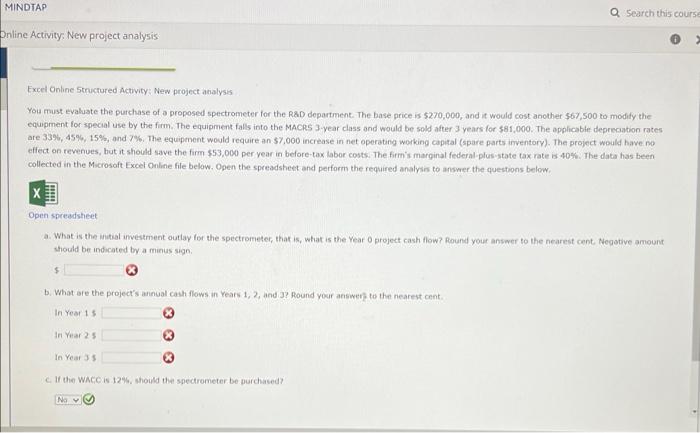

please help ill leave a like! Excel Online 5 tructured Activity; New project atalysis You mast evaluate the purchase of a proposed spectrometer for the

please help ill leave a like!

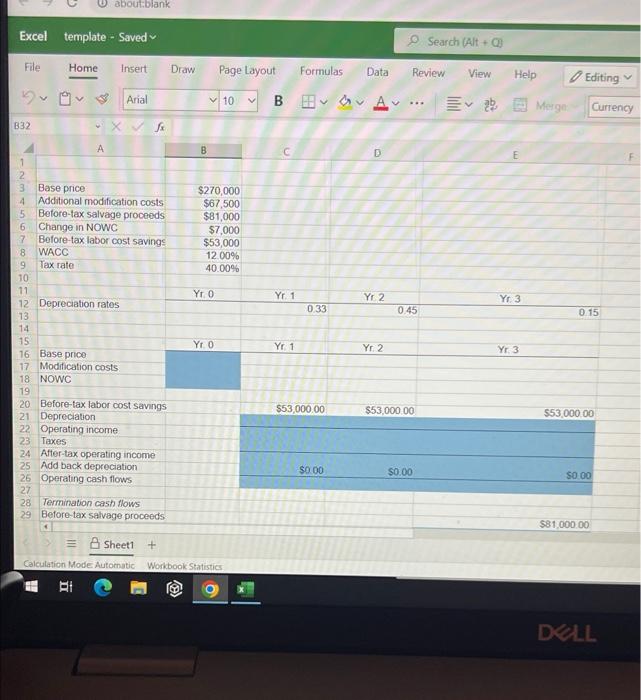

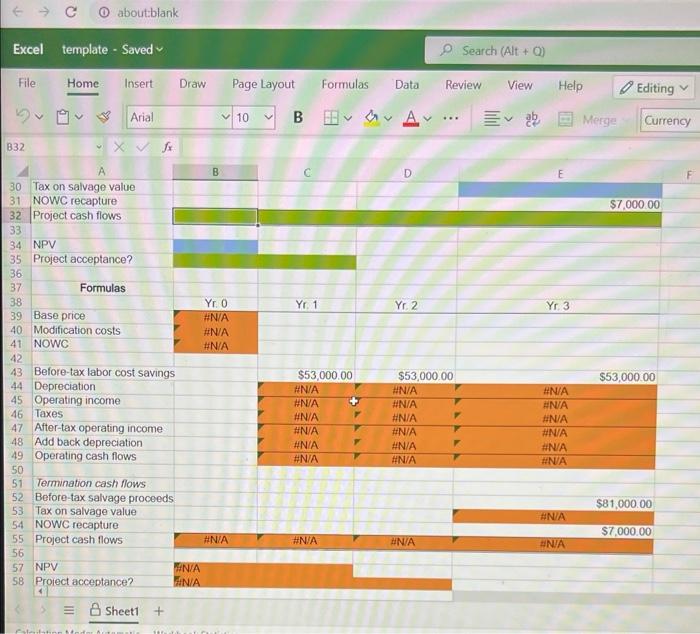

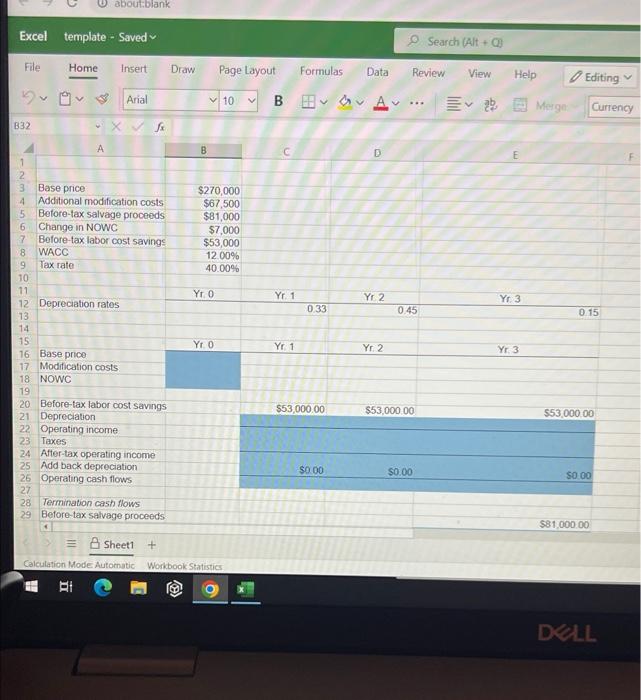

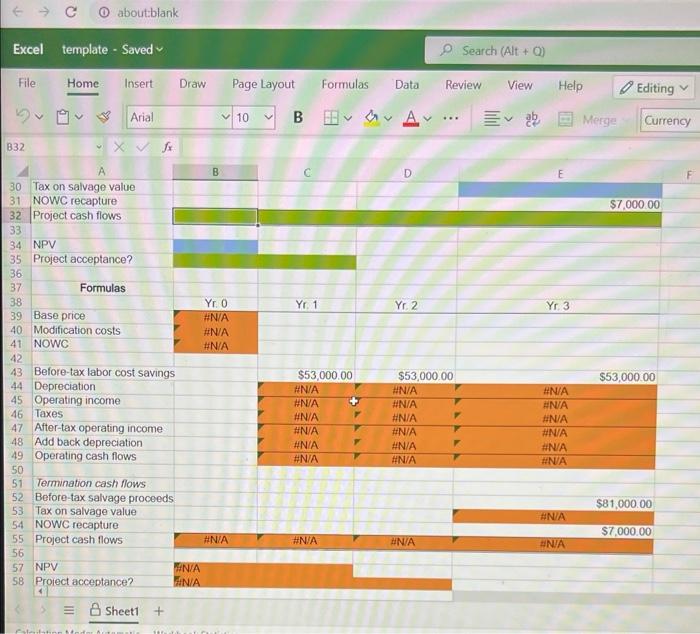

Excel Online 5 tructured Activity; New project atalysis You mast evaluate the purchase of a proposed spectrometer for the RaD department. The base price is 5270,000 , and it would cost another $67,500 to modify the equipment for special use by the firm. The equipment falls inte the MACR5 3 -year class and would be sold after 3 years for 581,000. The applicable deprecaation rates are 33\%, 45%,15%, and 7\%. The equipenent would require an $7,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $53,000 per year in before-tax labor costs. The firmis marginal federal-plusistate tax rate is 40%=. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below: Open spreedsheet a. What is the initial investment outlay for the spectrometer, that is, what is the Year o project cash flow? Round your answer to the nearest cent, Negative amount should be indicated by a minus sign. b. What are the project's aninual cash flows in Years 1, 2 , and I? found your answerp to the nearest cent. In Year 15 Ini Year 25 In Year 35 C. If the WACC is 12%, should tha spectrometer be purchased? Calculation Mode Automutic Wonbook Statistics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started