please help! im confused on how to solve

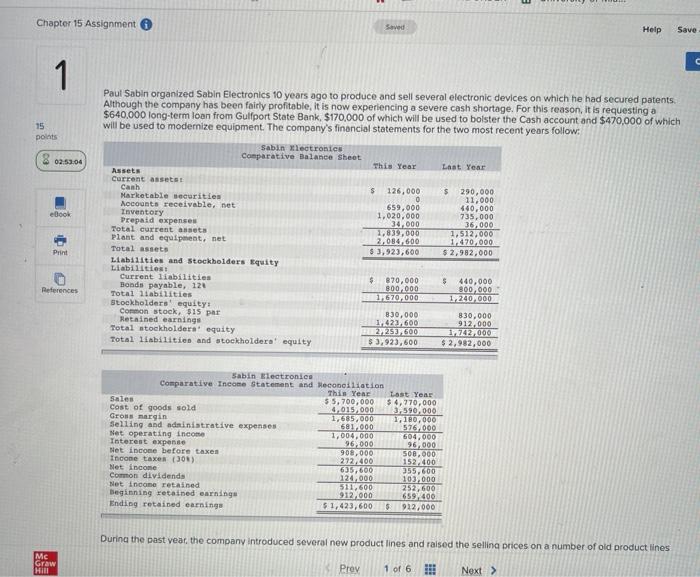

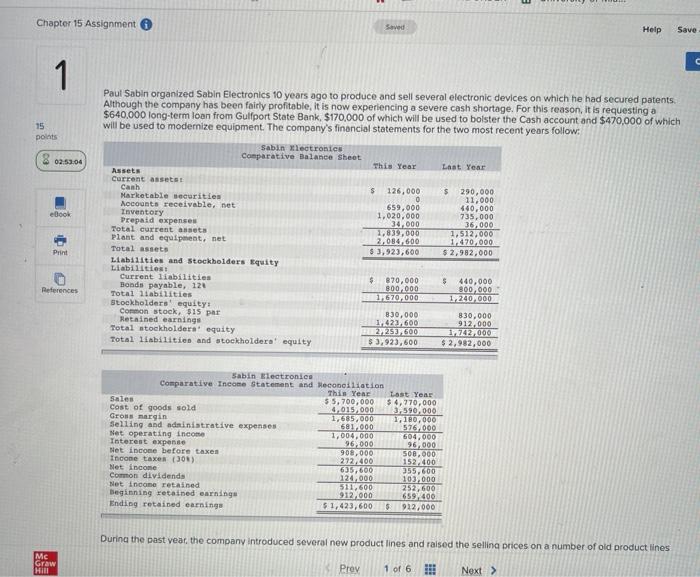

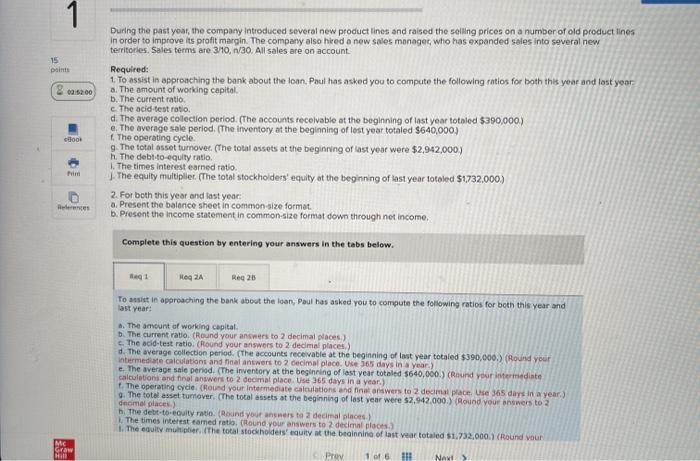

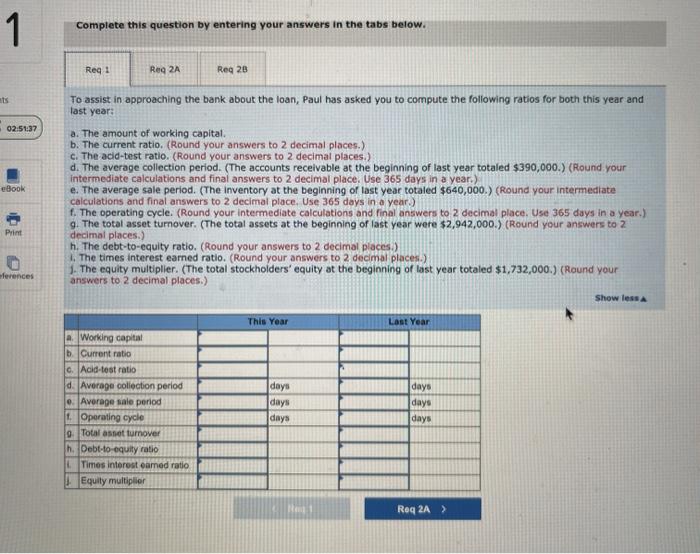

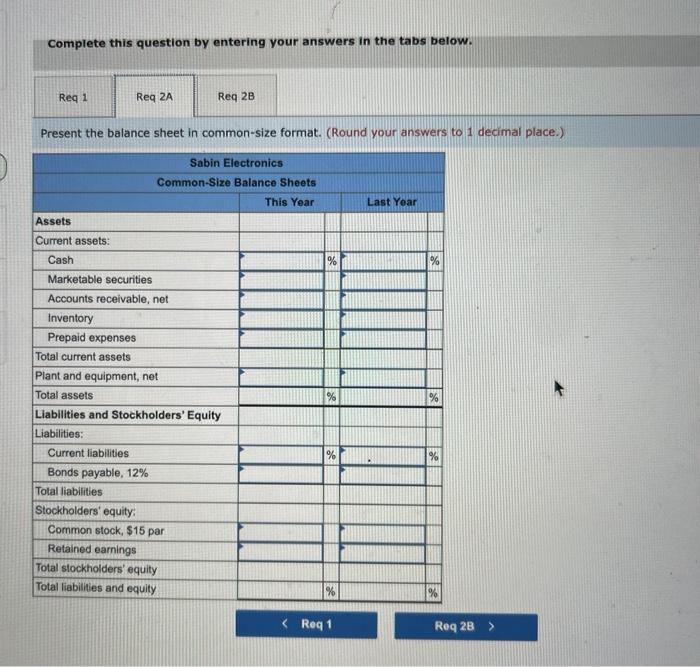

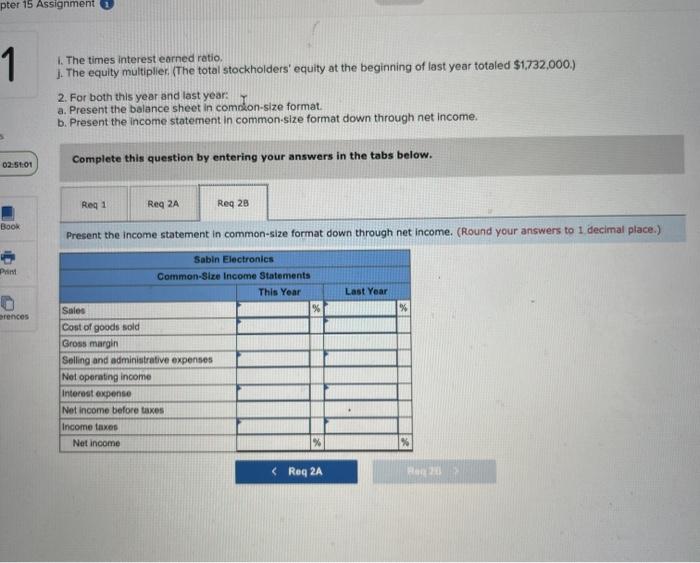

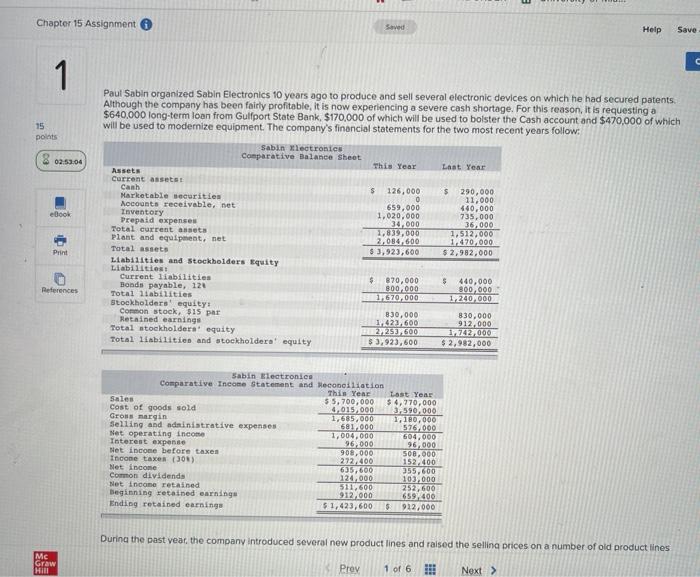

Chapter 15 Assignment Saved Help Save 1 Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $640,000 long-term loan from Gulfport State Bank. $170,000 of which will be used to bolster the Cash account and $470,000 of which will be used to modernize equipment. The company's financial statements for the two most recent years follow: 15 points Sabin lectronics Comparative Balance Sheet 02.53.00 This Year Last Year eBook $ 126,000 0 659,000 1.020,000 34.000 1,839,000 2,084,500 $ 3,923,600 Assets Current assets Canh Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets plant and equipment, net Total assets Liabilities and Stockholders Equity Liabilities: Current liabilities Bonds payable, 126 Total liabilities stockholders' equity: Common stock, $15 par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 290,000 11,000 440,000 735,000 35,000 1,512,000 1,470,000 $ 2,982,000 Print References 5 440,000 800.000 1,240.000 $ 870,000 800,000 1,670,000 830,000 11,423,600 2725360 $ 3,923,600 830,000 912,000 in 742,000 $ 2,982,000 Sabin Electronica Comparative Income Statement and Reconciliation This Year Last Year Sales 55,700,000 $ 4,170,000 Cost of goods sold 4,015,000 3.590,000 Gros margin 1,685,000 1,180,000 Selling and adainistrative expenses 581.000 576.000 Net operating income 1,004,000 604.000 Interest expense 96.000 95.000 Net income before taxes 900,000 500,000 Incone taxes (301) 272,400 152,400 Net income 635,600 355,600 Common dividends 124,000 103.000 Net Income retained 511,600 252,600 Beginning retained earnings 912.000 659,400 Ending retained earnings 51,423,600 $ 912,000 During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines MC Graw Hill Prev 1 of 6 8 Next > 1 1 15 Dit 09:52:00 During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines In order to improve its profit margin. The company also hired a new sales manager who has expanded sales into several new territories Sales terms are 3/10, 1/30. All sales are on account Required: 1. To assist in approaching the bank about the loan, Paul has asked you to compute the following intios for both this year and last year a. The amount of working capital b. The current ratio c. The acid-test ratio. d. The average collection period. (The accounts receivable at the beginning of last year totaled $390,000.) e. The average sale period. (The inventory at the beginning of last year totaled $640,000) g. The total asset turnover . (The total assets at the beginning of last year were $2,942,000) h. The debt-to-equity ratio 1. The times interest earned ratio The equity multipler (The total stockholders' equity at the beginning of tast year fotoled $1732.000) 2. For both this year and last year: a. Present the balance sheet in common size format. b. Present the income statement in common-size format down through net income door Complete this question by entering your answers in the tabs below. No 2A Reg 28 To use in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year: The amount of working capital The current ratio. (Round your answers to 2 decimal places) The add-test ratio. (Round your answers to 2 decimal places) d. The werage collection period. (The accounts receivable at the beginning of last year totaled $390,000.) (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year) e. The average sale period. (The inventory at the beginning of last year totaled $640,000.) (Round your intermediate calculations and tral answers to 2 decimal place. Ust365 days in a year.) 1. The operating cycle. (Round your intermediate calculations and finanswers to 2 decimal place. Use 365 days in a year) The total asset turnover. The total assets at the beginning of last year were 52.942,000.) (Round your newers to 2 dome places) h The debt-to-equity ratio. (Round your answers to 2 decimal places The times interest eamed ratio (Round your answers to 2 decimal places) 1. The equity multiplier (The total stockholders' equity at the beginning of last year totale $1.732,000. (Round vou Me Graw Prav 1 of 611 NANT 1 Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 26 To assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year: 02:51:37 eBook a. The amount of working capital. b. The current ratio. (Round your answers to 2 decimal places.) C. The acid-test ratio. (Round your answers to 2 decimal places.) d. The average collection period. (The accounts receivable at the beginning of last year totaled $390,000.) (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year.) e. The average sale period. (The inventory at the beginning of last year totaled $640,000.) (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year) f. The operating cycle. (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year.) 9. The total asset turnover. (The total assets at the beginning of last year were $2,942,000.) (Round your answers to 2 decimal places.) h. The debt-to-equity ratio. (Round your answers to 2 decimal places.) The times interest earned ratio. (Round your answers to 2 decimal places.) 1. The equity multiplier. (The total stockholders' equity at the beginning of last year totaled $1,732,000.) (Round your answers to 2 decimal places.) Show less Print ferences This Year Last Year days Working capital b. Current ratio c. Acid-test ratio d. Average collection period 0. Average sale period 1. Operating cycle o. Totalasne turnover h. Debt-to-equity ratio LTimos interest eamed ratio Equity multiplier days days days days days Req2A > Complete this question by entering your answers in the tabs below. Reg 1 Req ZA Req 28 Present the balance sheet in common-size format. (Round your answers to 1 decimal place.) Sabin Electronics Common-Size Balance Sheets This Year Last Year Assets Current assets: % % % Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 12% Total liabilities Stockholders' equity Common stock, $15 par Retained earnings Total stockholders' equity Total liabilities and equity % % pter 15 Assignment i 1 1. The times interest earned ratio, 1. The equity multiplier. (The total stockholders' equity at the beginning of last year totaled $1.732,000.) 2. For both this year and last year: a. Present the balance sheet in comoon-size format b. Present the income statement in common.size format down through net income. 02:51:01 Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Book Present the income statement in common-size format down through net income. (Round your answers to 1 decimal place.) Print Last Year rences Sabin Electronics Common-Size Income Statements This Year Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net Income before taxes Income taxes Net income 1 1 15 Dit 09:52:00 During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines In order to improve its profit margin. The company also hired a new sales manager who has expanded sales into several new territories Sales terms are 3/10, 1/30. All sales are on account Required: 1. To assist in approaching the bank about the loan, Paul has asked you to compute the following intios for both this year and last year a. The amount of working capital b. The current ratio c. The acid-test ratio. d. The average collection period. (The accounts receivable at the beginning of last year totaled $390,000.) e. The average sale period. (The inventory at the beginning of last year totaled $640,000) g. The total asset turnover . (The total assets at the beginning of last year were $2,942,000) h. The debt-to-equity ratio 1. The times interest earned ratio The equity multipler (The total stockholders' equity at the beginning of tast year fotoled $1732.000) 2. For both this year and last year: a. Present the balance sheet in common size format. b. Present the income statement in common-size format down through net income door Complete this question by entering your answers in the tabs below. No 2A Reg 28 To use in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year: The amount of working capital The current ratio. (Round your answers to 2 decimal places) The add-test ratio. (Round your answers to 2 decimal places) d. The werage collection period. (The accounts receivable at the beginning of last year totaled $390,000.) (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year) e. The average sale period. (The inventory at the beginning of last year totaled $640,000.) (Round your intermediate calculations and tral answers to 2 decimal place. Ust365 days in a year.) 1. The operating cycle. (Round your intermediate calculations and finanswers to 2 decimal place. Use 365 days in a year) The total asset turnover. The total assets at the beginning of last year were 52.942,000.) (Round your newers to 2 dome places) h The debt-to-equity ratio. (Round your answers to 2 decimal places The times interest eamed ratio (Round your answers to 2 decimal places) 1. The equity multiplier (The total stockholders' equity at the beginning of last year totale $1.732,000. (Round vou Me Graw Prav 1 of 611 NANT 1 Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 26 To assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year: 02:51:37 eBook a. The amount of working capital. b. The current ratio. (Round your answers to 2 decimal places.) C. The acid-test ratio. (Round your answers to 2 decimal places.) d. The average collection period. (The accounts receivable at the beginning of last year totaled $390,000.) (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year.) e. The average sale period. (The inventory at the beginning of last year totaled $640,000.) (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year) f. The operating cycle. (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year.) 9. The total asset turnover. (The total assets at the beginning of last year were $2,942,000.) (Round your answers to 2 decimal places.) h. The debt-to-equity ratio. (Round your answers to 2 decimal places.) The times interest earned ratio. (Round your answers to 2 decimal places.) 1. The equity multiplier. (The total stockholders' equity at the beginning of last year totaled $1,732,000.) (Round your answers to 2 decimal places.) Show less Print ferences This Year Last Year days Working capital b. Current ratio c. Acid-test ratio d. Average collection period 0. Average sale period 1. Operating cycle o. Totalasne turnover h. Debt-to-equity ratio LTimos interest eamed ratio Equity multiplier days days days days days Req2A > Complete this question by entering your answers in the tabs below. Reg 1 Req ZA Req 28 Present the balance sheet in common-size format. (Round your answers to 1 decimal place.) Sabin Electronics Common-Size Balance Sheets This Year Last Year Assets Current assets: % % % Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 12% Total liabilities Stockholders' equity Common stock, $15 par Retained earnings Total stockholders' equity Total liabilities and equity % % pter 15 Assignment i 1 1. The times interest earned ratio, 1. The equity multiplier. (The total stockholders' equity at the beginning of last year totaled $1.732,000.) 2. For both this year and last year: a. Present the balance sheet in comoon-size format b. Present the income statement in common.size format down through net income. 02:51:01 Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Book Present the income statement in common-size format down through net income. (Round your answers to 1 decimal place.) Print Last Year rences Sabin Electronics Common-Size Income Statements This Year Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net Income before taxes Income taxes Net income