Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help I`m having such a hard time. Thank you! [The following information applies to the questions displayed below.] Alanis Morgan owns White Mountain Assessments

Please help I`m having such a hard time. Thank you!

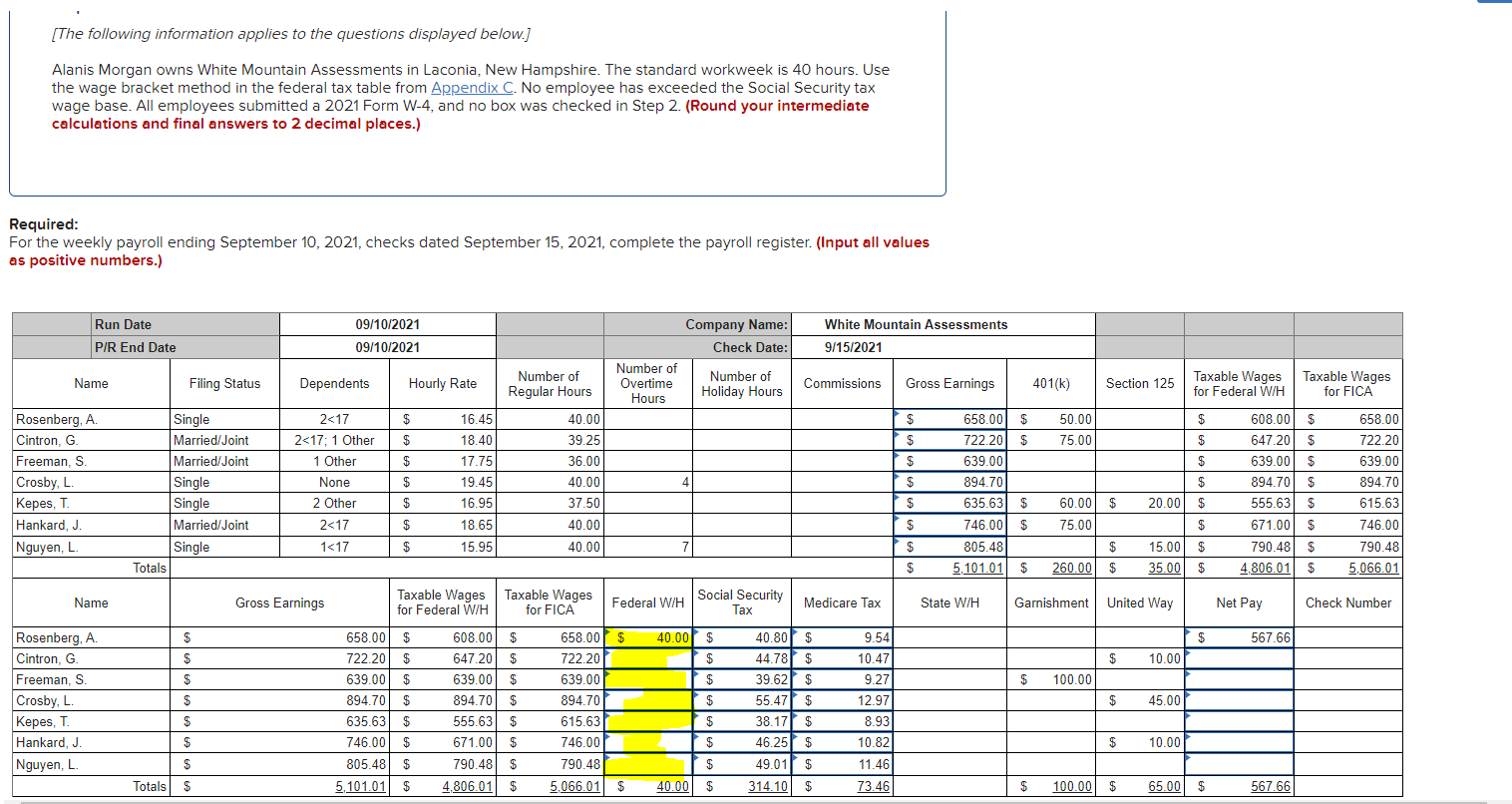

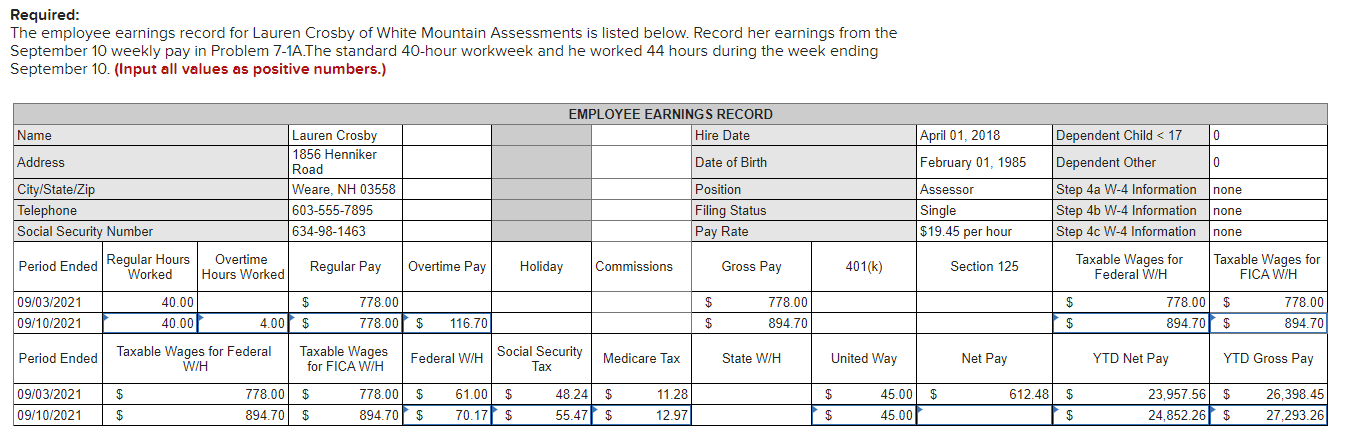

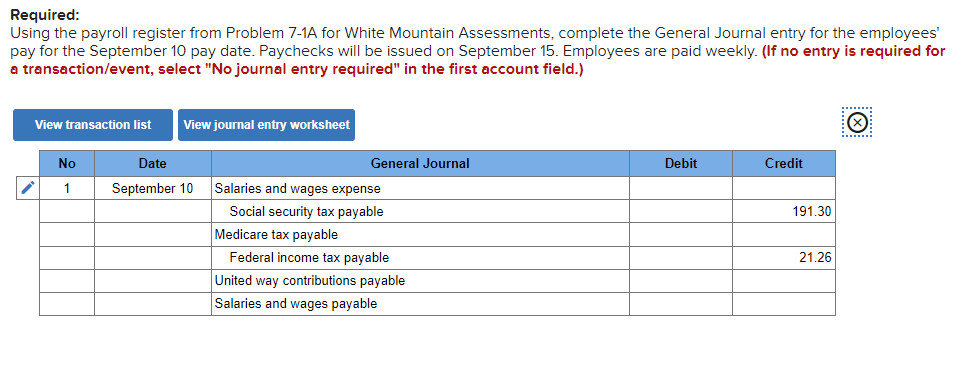

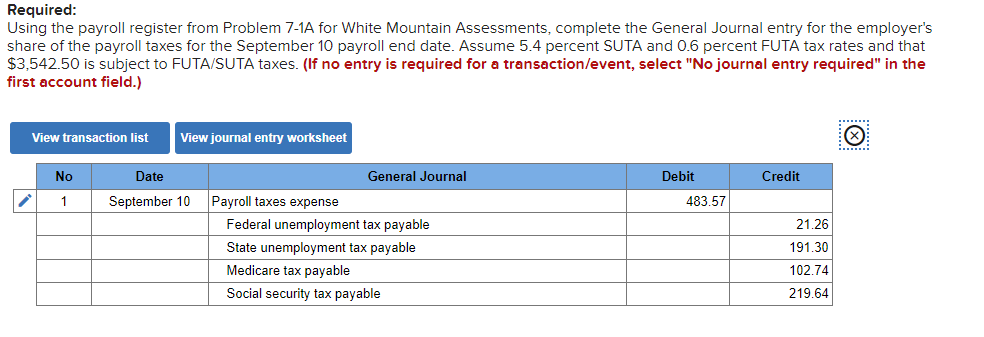

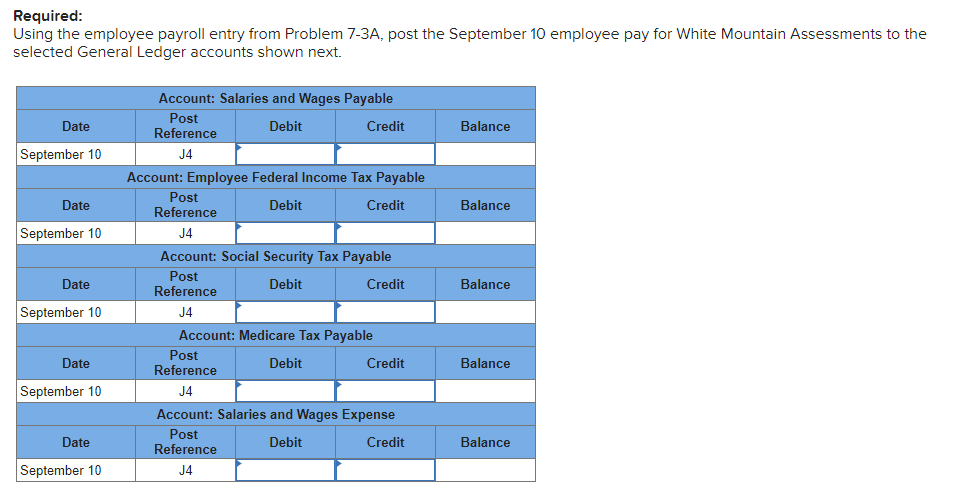

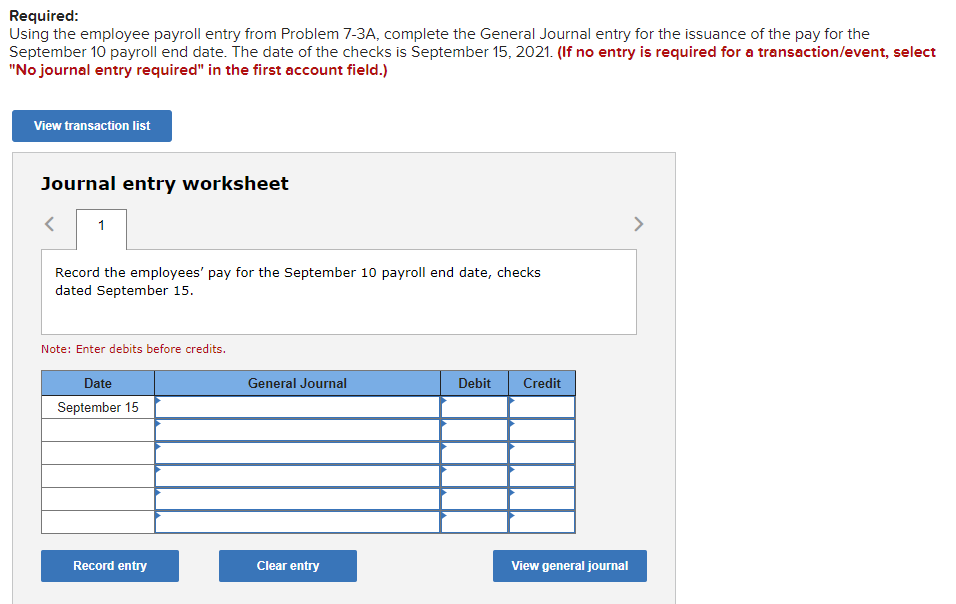

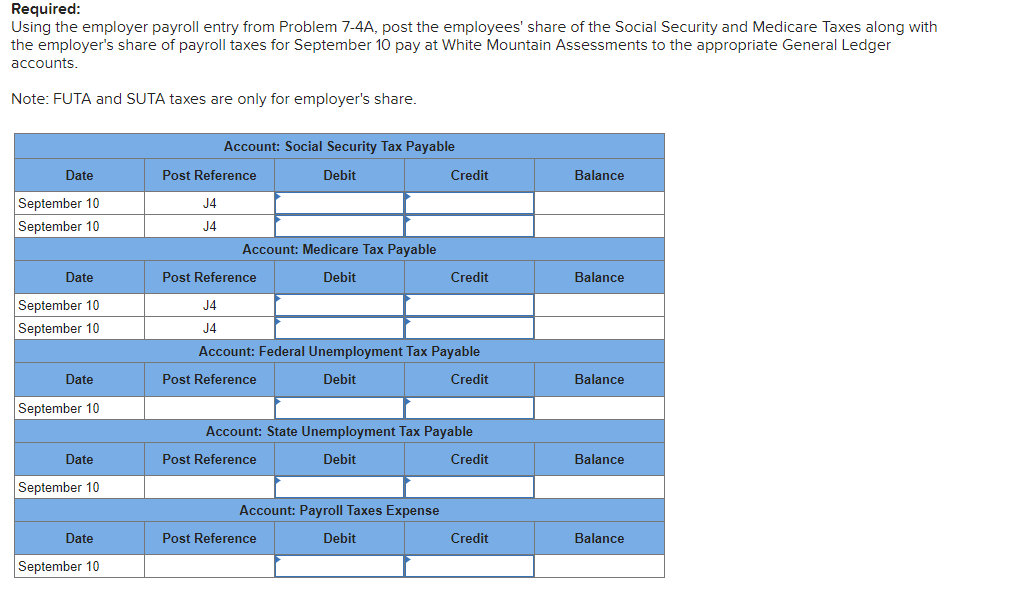

[The following information applies to the questions displayed below.] Alanis Morgan owns White Mountain Assessments in Laconia, New Hampshire. The standard workweek is 40 hours. Use the wage bracket method in the federal tax table from Appendix C. No employee has exceeded the Social Security tax wage base. All employees submitted a 2021 Form W-4, and no box was checked in Step 2. (Round your intermediate calculations and final answers to 2 decimal places.) Required: For the weekly payroll ending September 10, 2021, checks dated September 15,2021 , complete the payroll register. (Input all values as positive numbers.) Required: The employee earnings record for Lauren Crosby of White Mountain Assessments is listed below. Record her earnings from the September 10 weekly pay in Problem 7-1A.The standard 40-hour workweek and he worked 44 hours during the week ending September 10. (Input all values as positive numbers.) Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employees' pay for the September 10 pay date. Paychecks will be issued on September 15 . Employees are paid weekly. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employer's share of the payroll taxes for the September 10 payroll end date. Assume 5.4 percent SUTA and 0.6 percent FUTA tax rates and that $3,542.50 is subject to FUTA/SUTA taxes. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Using the employee payroll entry from Problem 7-3A, post the September 10 employee pay for White Mountain Assessments to the selected General Ledger accounts shown next. Required: Using the employee payroll entry from Problem 7-3A, complete the General Journal entry for the issuance of the pay for the September 10 payroll end date. The date of the checks is September 15, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the employees' pay for the September 10 payroll end date, checks dated September 15. Note: Enter debits before credits. Required: Using the employer payroll entry from Problem 7-4A, post the employees' share of the Social Security and Medicare Taxes along with the employer's share of payroll taxes for September 10 pay at White Mountain Assessments to the appropriate General Ledger accounts. Note: FUTA and SUTA taxes are only for employer's share. [The following information applies to the questions displayed below.] Alanis Morgan owns White Mountain Assessments in Laconia, New Hampshire. The standard workweek is 40 hours. Use the wage bracket method in the federal tax table from Appendix C. No employee has exceeded the Social Security tax wage base. All employees submitted a 2021 Form W-4, and no box was checked in Step 2. (Round your intermediate calculations and final answers to 2 decimal places.) Required: For the weekly payroll ending September 10, 2021, checks dated September 15,2021 , complete the payroll register. (Input all values as positive numbers.) Required: The employee earnings record for Lauren Crosby of White Mountain Assessments is listed below. Record her earnings from the September 10 weekly pay in Problem 7-1A.The standard 40-hour workweek and he worked 44 hours during the week ending September 10. (Input all values as positive numbers.) Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employees' pay for the September 10 pay date. Paychecks will be issued on September 15 . Employees are paid weekly. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employer's share of the payroll taxes for the September 10 payroll end date. Assume 5.4 percent SUTA and 0.6 percent FUTA tax rates and that $3,542.50 is subject to FUTA/SUTA taxes. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Using the employee payroll entry from Problem 7-3A, post the September 10 employee pay for White Mountain Assessments to the selected General Ledger accounts shown next. Required: Using the employee payroll entry from Problem 7-3A, complete the General Journal entry for the issuance of the pay for the September 10 payroll end date. The date of the checks is September 15, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the employees' pay for the September 10 payroll end date, checks dated September 15. Note: Enter debits before credits. Required: Using the employer payroll entry from Problem 7-4A, post the employees' share of the Social Security and Medicare Taxes along with the employer's share of payroll taxes for September 10 pay at White Mountain Assessments to the appropriate General Ledger accounts. Note: FUTA and SUTA taxes are only for employer's shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started