Answered step by step

Verified Expert Solution

Question

1 Approved Answer

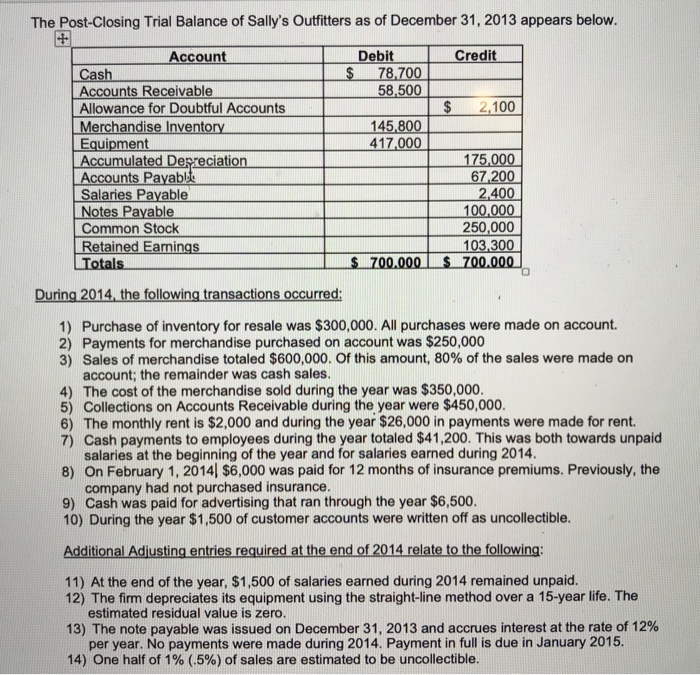

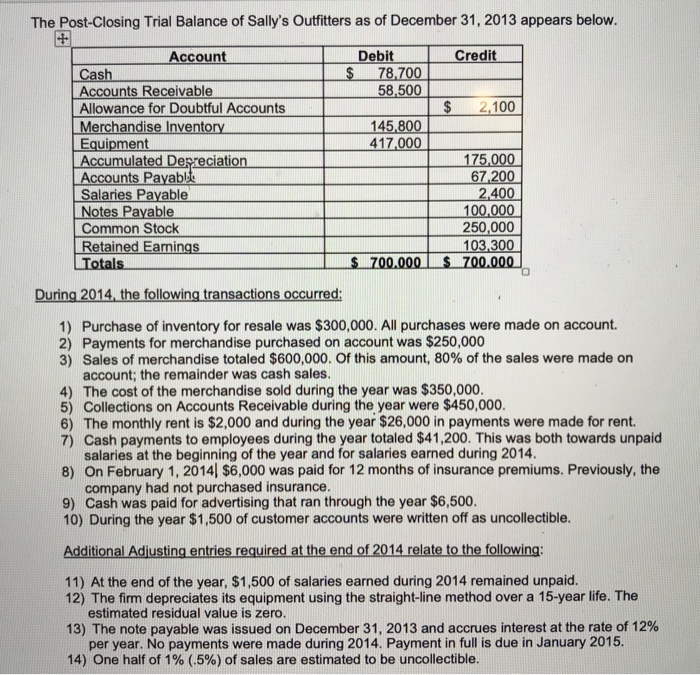

Please help I'm lost! The Post-Closing Trial Balance of Sally's Outfitters as of December 31, 2013 appears below. Credit Debit $ 78.700 58,500 $ 2,100

Please help I'm lost!

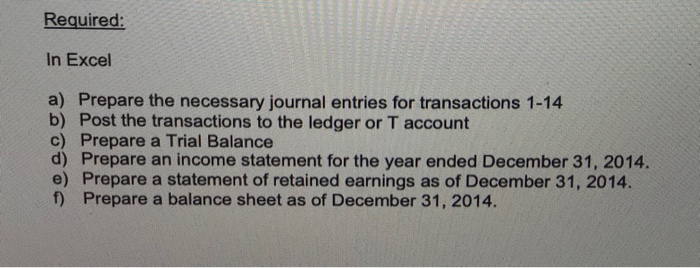

The Post-Closing Trial Balance of Sally's Outfitters as of December 31, 2013 appears below. Credit Debit $ 78.700 58,500 $ 2,100 145,800 417.000 Account Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Equipment Accumulated Depreciation Accounts Payable Salaries Payable Notes Payable Common Stock Retained Earnings Totals 175,000 67,200 2.400 100.000 250,000 103,300 $ 700.000 $ 700.000 During 2014, the following transactions occurred: 1) Purchase of inventory for resale was $300,000. All purchases were made on account. 2) Payments for merchandise purchased on account was $250,000 3) Sales of merchandise totaled $600,000. Of this amount, 80% of the sales were made on account; the remainder was cash sales. 4) The cost of the merchandise sold during the year was $350,000. 5) Collections on Accounts Receivable during the year were $450,000. 6) The monthly rent is $2,000 and during the year $26,000 in payments were made for rent. 7) Cash payments to employees during the year totaled $41,200. This was both towards unpaid salaries at the beginning of the year and for salaries earned during 2014. 8) On February 1, 2014 $6,000 was paid for 12 months of insurance premiums. Previously, the company had not purchased insurance. 9) Cash was paid for advertising that ran through the year $6,500. 10) During the year $1,500 of customer accounts were written off as uncollectible. Additional Adjusting entries required at the end of 2014 relate to the following: 11) At the end of the year, $1,500 of salaries earned during 2014 remained unpaid. 12) The firm depreciates its equipment using the straight-line method over a 15-year life. The estimated residual value is zero. 13) The note payable was issued on December 31, 2013 and accrues interest at the rate of 12% per year. No payments were made during 2014. Payment full is due in January 2015. 14) One half of 1% (.5%) of sales are estimated to be uncollectible. Required: In Excel a) Prepare the necessary journal entries for transactions 1-14 b) Post the transactions to the ledger or T account c) Prepare a Trial Balance d) Prepare an income statement for the year ended December 31, 2014. e) Prepare a statement of retained earnings as of December 31, 2014. f) Prepare a balance sheet as of December 31, 2014

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started