please help! I'm stuck on this last part.

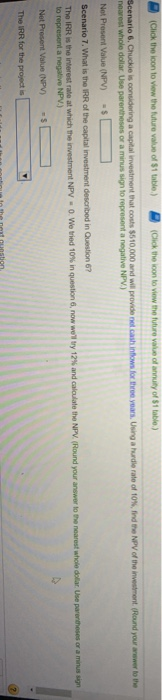

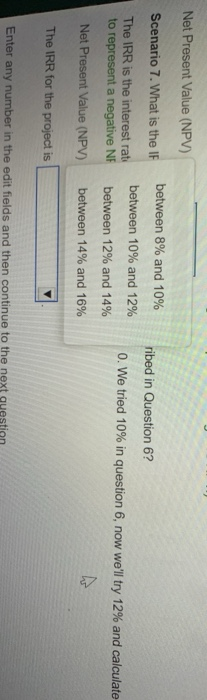

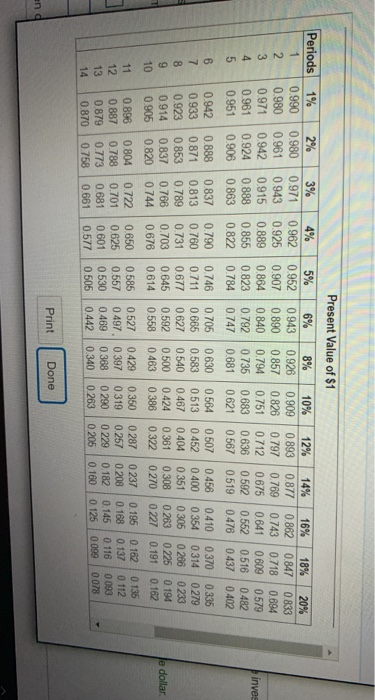

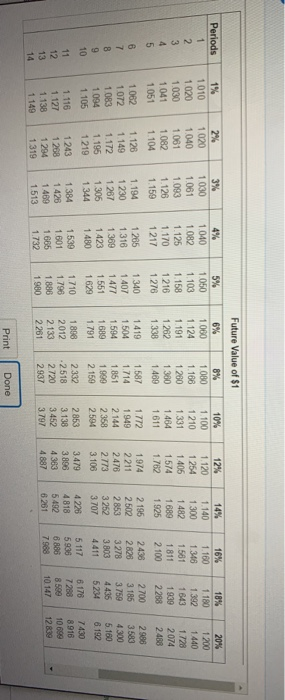

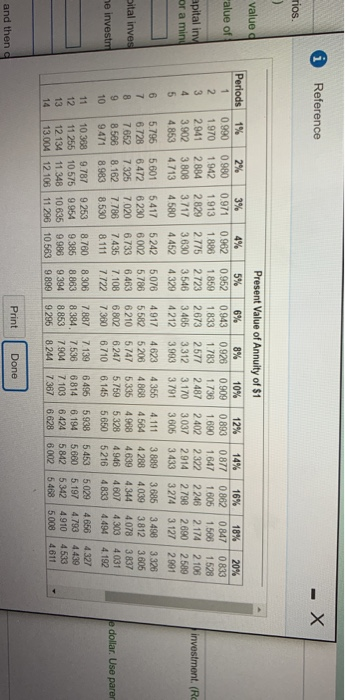

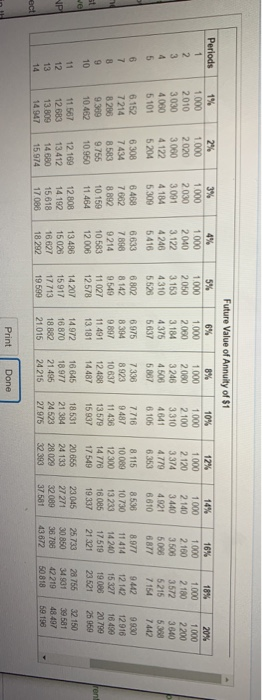

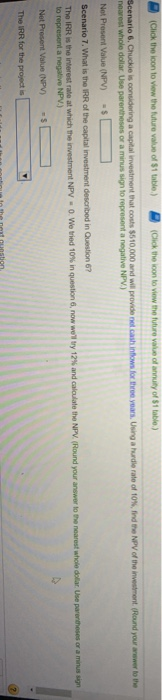

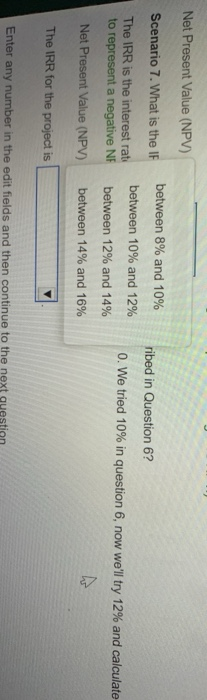

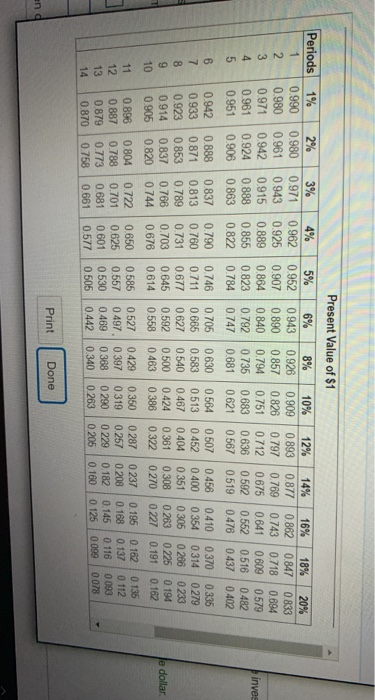

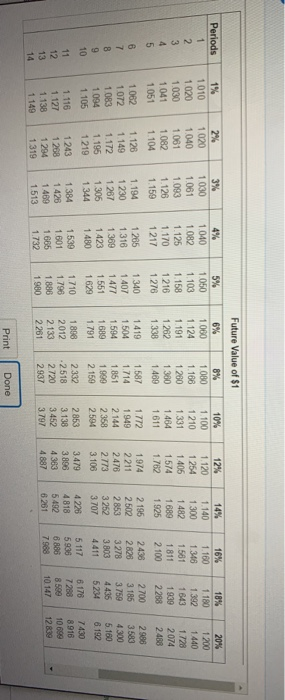

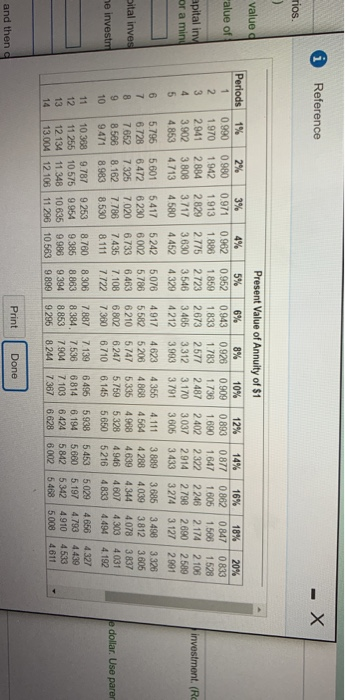

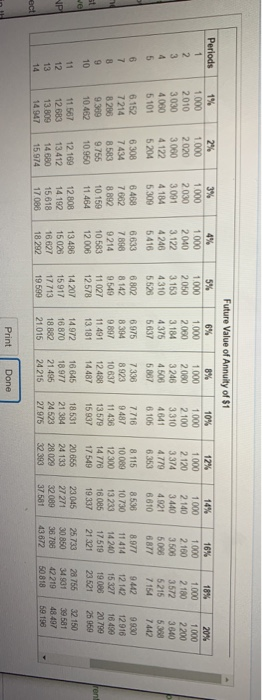

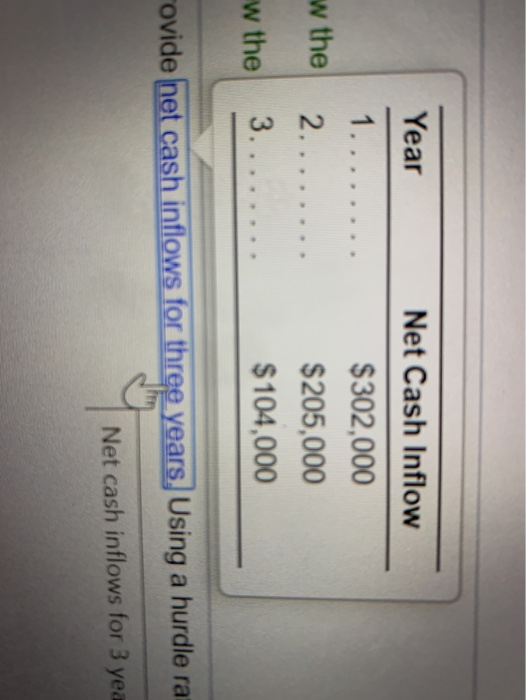

Click the icon to view the future value of $1 table.) Click the icon to view the future value of annuity of $1 table) flows for three years. Using a bude rate of 10%, find the NPV of the investment Round your answer to the Scenario 6. Chuckie is considering a capital investment that costs $510,000 and will provident cash nearest Whole dollar. Use parentheses or a minus sign to represent a negative NPV) Net Present Value (NPV) - Scenario 7. What is the IRR of the capital investment described in Question 67 The IRR is the interest rate at which the investment NPV = 0. We tried 10% in question, now we'll try 12% and calculate the NPV (Round your answer to the nearest whole dollar Use parentheses or a minus sign to represent a negative NPV.) Net Present Value (NPV) - The IRR for the project is Future Value of $1 Periods 1000 1.124 1 191 1 282 1338 1% 1010 1020 1030 1.041 1.051 1.062 1.072 1083 1094 1.105 1.116 1.127 1.138 1149 2% 1020 1040 1.081 1082 1.104 1.126 1.149 1.172 1.195 1219 1243 1 268 1 294 1319 3% 1030 1.061 1.093 1.126 1.159 1.194 1230 1.267 1306 1 344 1 384 1426 1.469 1.513 4% 1.040 1.082 1.125 1.170 1.217 1 265 1.316 1 369 1.423 1.480 1.539 1.601 1 685 1.732 5% 1.050 1.103 1.158 1216 1276 1340 1.407 1477 1.551 1 629 1.710 1.796 1.886 1980 8% 1080 1.168 1 260 1 380 1.469 1 587 1.714 1.851 1999 2.159 2332 .2518 2720 2.937 10% 1.100 1210 1 331 1 464 1.611 1.772 1949 2.144 2.358 2.594 2 853 3.138 3.452 3797 1419 1.504 1.594 1689 1.791 12% 1.120 1 254 1.405 1574 1.762 1.974 2 211 2476 2.773 3.106 3.479 3.896 4363 4887 14% 1.140 1300 1 482 1689 1925 2. 195 2502 2853 3252 3 707 4226 4818 5492 6.261 16% 1.160 1.346 1.561 1.811 2 100 2438 2826 3278 3.803 4.411 18% 1180 1.392 1 843 1939 2288 2700 3.185 3 759 4436 5234 6.176 7288 20% 1.200 1440 1.728 2074 2488 2988 3.583 4300 5.160 6.192 7430 8916 10699 12839 1898 5 117 5936 8886 2012 2.133 2 261 10 147 Print Done i Reference mios. valued Periods alue of 2 3 apital in or a mind investment (RO 4212 3983 3606 1% 2% 3% 4% 0.990 0.980 0.971 0.962 1.970 1942 1913 1886 2941 2884 2.829 2775 3.902 3.808 3.717 3.630 4.853 4.713 4580 4452 5.796 5.601 5.417 5 242 6.728 6.472 6230 6.002 7.652 7325 7020 6.733 8 588 8.162 7.786 7435 9.471 8.983 8.530 8.111 10.368 9.787 9 253 8.760 11 255 10.575 9.954 9.385 12.134 11.348 10.635 9.986 13.004 12 108 11 296 10.563 Present Value of Annuity of $1 5% 6% 8% 10% 12% 14% 16% 18% 20% 0 952 0943 0.926 0.909 0.893 0.877 0.862 0.847 0833 1859 1833 1783 1736 1.690 1647 1605 1506 1528 2723 2673 2577 2.487 2402 2322 2246 2174 2106 3546 3.465 3312 3.1703037 2 914 2.798 2.690 2589 4329 3791 3.433 3 274 3127 2 991 5,076 4 355 3 889 3.686 3.498 3326 5.786 5.582 4.868 4564 4.288 4.039 3812 3.605 6.463 4.344 4078 3837 7.108 5.328 4.607 4 303 4031 7.722 6.145 5650 5216 4833 4.494 4.192 8 306 7887 6.495 5938 5453 5.029 4656 4.327 8.863 8384 7.536 6814 6.194 5.660 5.197 4.798 4439 9 394 8.853 7 904 7.103 6424 5 842 5342 4.910 4533 9 899 9295 8.244 73676 628 6.002 5468 5008 4.611 4.111 Dital inves 6335 5.759 45146 he investm Je dollar. Use parer 14 Print Done and then Periods 1% 1.000 2010 3.030 4060 5 101 6.152 7214 8286 9389 10462 11 587 12583 13.809 14 947 2% 1.000 2020 3060 4122 5 204 6308 7434 8583 9.755 10.950 12.169 13.412 14680 15 974 1.000 2030 3091 4.184 5,309 6468 7.682 8 892 10.159 11.464 1.000 2040 3.122 4246 5416 6.633 7.898 9214 10.583 12.008 13 486 15026 16.627 18292 Future Value of Annuity of $1 10% 1.000 1.000 1000 1.000 2050 2.000 2080 2.100 3.153 3.184 3246 3310 4310 4375 4506 5520 5637 6867 8105 6802 6975 7336 7.716 8.142 8394 8923 9487 9.549 9897 10637 11 438 11 027 11.491 12488 13579 12578 13.181 14487 15.937 14 207 14.972 16.645 18 531 15.917 16.870 18 977 21 384 17713 18.882 21.495 24.523 19.599 21.015 24 215 27.975 12% 1000 2 120 3374 4779 6353 8.115 10.089 12 300 14778 17 549 20 856 24 133 28.029 32 393 1.000 2.140 3440 4921 6610 8.536 10.730 13 233 16 085 19337 23 045 27.271 32089 37581 16% 1.000 2. 160 3.506 5.006 6877 8.977 11414 14240 17519 21321 25.733 30.850 38 786 43 872 16% 20% 1.000 1.000 2180 2200 3572 3.840 5215 5369 7154 7412 9.42 9930 12142 12916 15327 18458 19.086 20.799 23 521 25 959 28756 32.150 39581 42219 48 497 50.8186 9.198 34 831 12.808 14 192 15.618 17.088 Print Done int Year 1. Net Cash Inflow $302,000 $ 205,000 $104,000 w the w the 2. ....... 3. . ovide net cash inflows for three years. Using a hurdle rai Net cash inflows for 3 yea