Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help in evaluating Plan C. Calculate the future worth of each plan A,B,C and Select the financing plan that has the largest amount of

Please help in evaluating Plan C. Calculate the future worth of each plan A,B,C and Select the financing plan that has the largest amount of money remaining after 10years; that is to find the largest Future worth value.

Please answer the Case Study Exercises 1 to 6

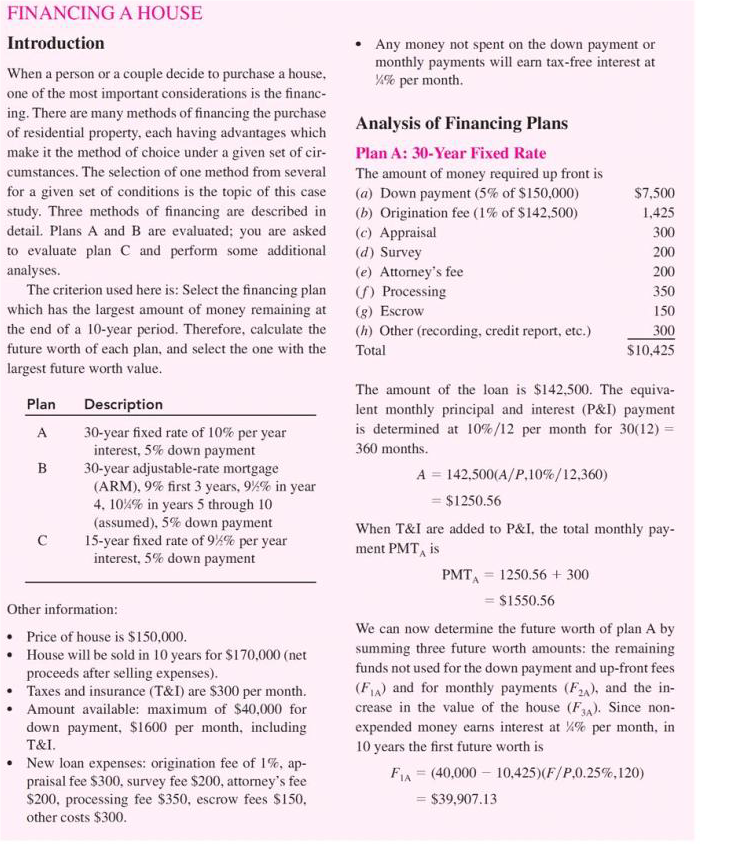

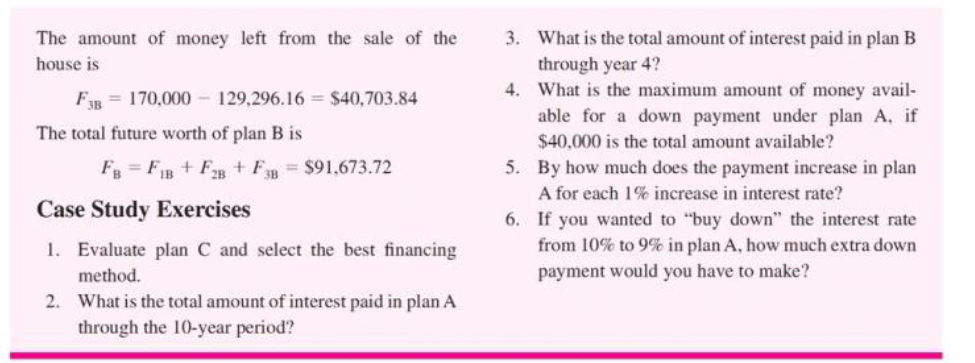

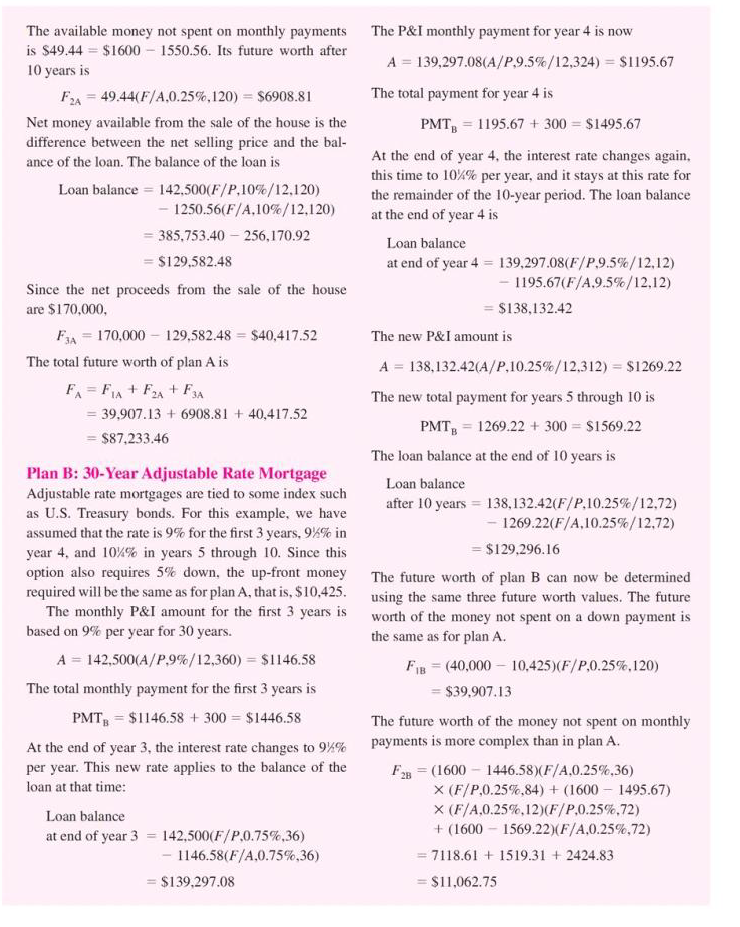

FINANCING A HOUSE Introduction Any money not spent on the down payment or monthly payments will earn tax-free interest at When a person or a couple decide to purchase a hous per month one of the most important considerations is the financ ing. There are many methods of financing the purchase Analysis of Financing Plans of residential property, each having advantages which make it the method of choice under a given set of cir Plan A: 30-Year Fixed Rate cumstances. The selection of one method from several The amount of money required up front is for a given set of conditions is the topic of this case (a) Down payment (5% of $150,000) $7.500 study. Three methods of financing are described in (b) ation fee (1% of $142,500) 1.425 detail. Plans A and B are evaluated; you are asked (c) Appraisal 300 to evaluate plan C and perform some additional (d) Survey 200 analyses (e) Attorney's fee 200 The criterion used here is: Select the financing plan f) Processing 350 which has the largest amount of money remaining at (g) Escrow 150 the end of a 10-year period. Therefore, calculate the (h) other (recording, credit report, etc.) 300 future worth of each plan, and select the one with the $10,425 Total largest future worth value. The amount of the loan is $142,500. The equiva- Plan Description lent monthly principal and interest (P&I payment is determined at 10%/12 per month for 30 (12) 30-year fixed rate of 10% per year 360 months interest, 5% down payment 30-year adjustable-rate mortgage A 142,500(A/P,10%/12,360) (ARM), 9% first 3 years, 9%% in year $1250.56 4. 10% in years 5 through 10 (assumed), 5% down payment When T&I are added to P&I, the total monthly pay 15-year fixed rate of 9%% per year ment PMT is interest, 5% down payment PMT 1250.56 300 $1550.56 Other information: We can now determine the future worth of plan A by Price of house is $150,000 summing three future worth amounts: the remaining House will be sold in 10 years for S170,000 (net funds not used for the down payment and up-front fees proceeds after selling expenses. (FIA) and for monthly payments (FA), and the in- Taxes and insurance T&D are $300 per month. crease in the value of the house (FRA). Since non Amount available: maximum of $40,000 for payment, $1600 per month, including expended money earns interest at M% per month, in down T&I 10 years the first future worth is New loan expenses: origination fee of 1%, apr FIA (40,000 10,425)(F/P,0.25%,120) praisal fee $300, survey fee $200, attorney's fee $200, processing fee $350, escrow fees $150 $39,907.13 other costs $300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started