Please help. (in red)

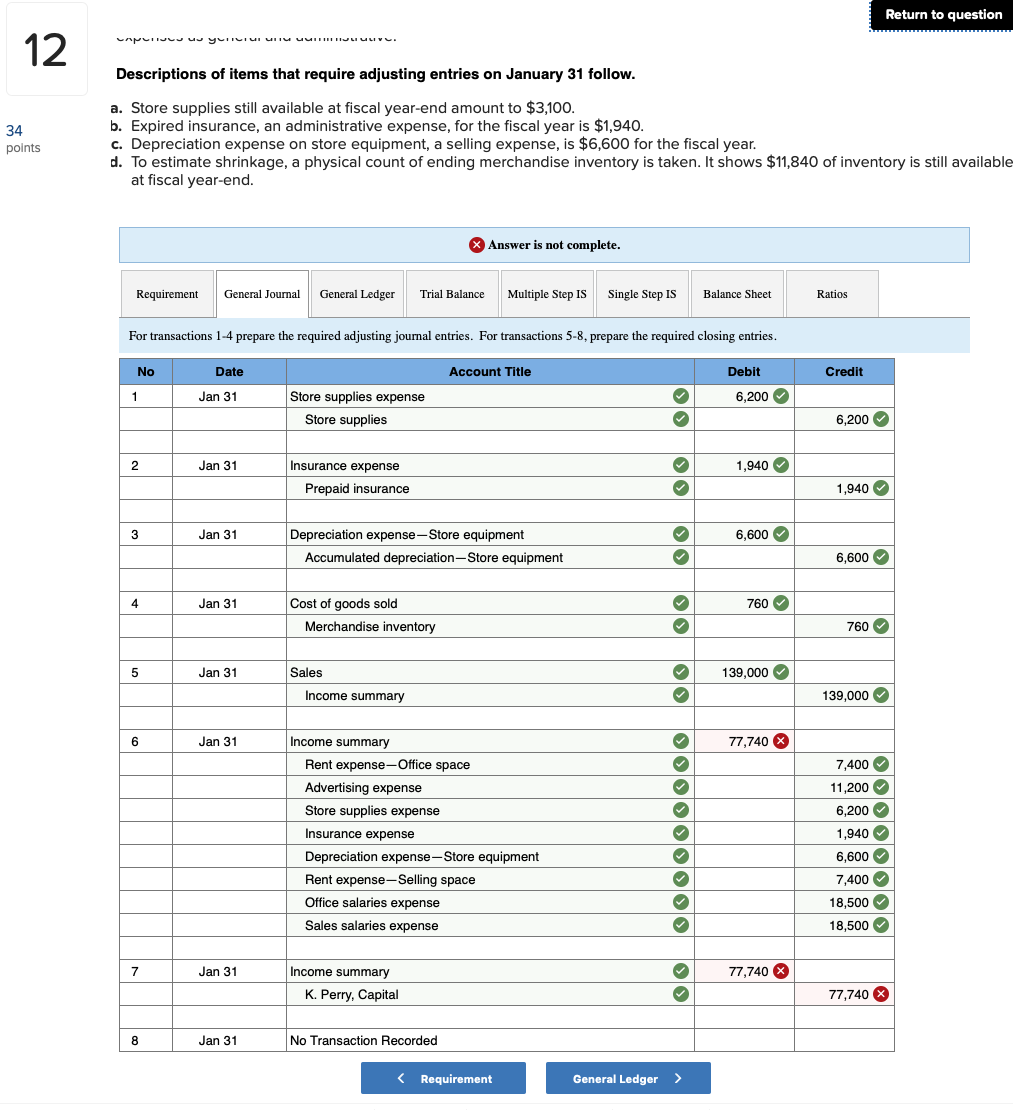

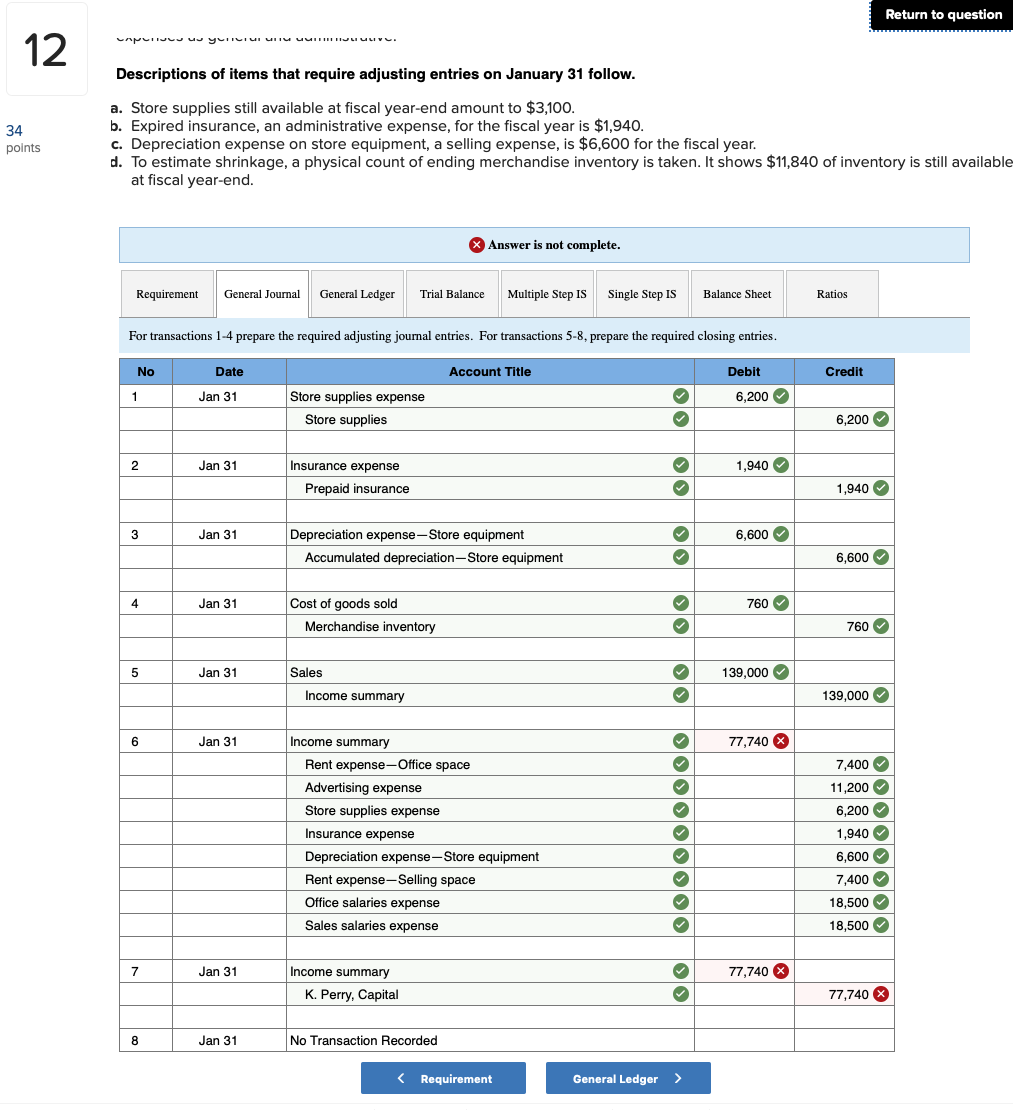

Return to question Caperuuuu yumuru un uu 12 Descriptions of items that require adjusting entries on January 31 follow. 34 points a. Store supplies still available at fiscal year-end amount to $3,100. b. Expired insurance, an administrative expense, for the fiscal year is $1,940. c. Depreciation expense on store equipment, a selling expense, is $6,600 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,840 of inventory is still available at fiscal year-end. Answer is not complete. Requirement General Journal General Ledger Trial Balance Multiple Step Is Single Step IS Balance Sheet Ratios For transactions 1-4 prepare the required adjusting journal entries. For transactions 5-8, prepare the required closing entries. Account Title Credit No 1 Date Jan 31 Debit 6,200 Store supplies expense Store supplies 6,200 Jan 31 1,940 Insurance expense Prepaid insurance 1,940 Jan 31 6,600 Depreciation expense-Store equipment Accumulated depreciation-Store equipment 6,600 Jan 31 760 Cost of goods sold Merchandise inventory 760 Jan 31 Sales 139,000 Income summary 139,000 Jan 31 77,740 X Income summary Rent expense-Office space Advertising expense Store supplies expense Insurance expense Depreciation expense-Store equipment Rent expense-Selling space Office salaries expense Sales salaries expense O O OOOO000 0 0 7,400 11,200 6,200 1,940 6,600 7,400 18,500 18,500 Jan 31 77,740 % Income summary K. Perry, Capital 77,740 X 8 Jan 31 No Transaction Recorded ( Requirement General Ledger > Return to question Caperuuuu yumuru un uu 12 Descriptions of items that require adjusting entries on January 31 follow. 34 points a. Store supplies still available at fiscal year-end amount to $3,100. b. Expired insurance, an administrative expense, for the fiscal year is $1,940. c. Depreciation expense on store equipment, a selling expense, is $6,600 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,840 of inventory is still available at fiscal year-end. Answer is not complete. Requirement General Journal General Ledger Trial Balance Multiple Step Is Single Step IS Balance Sheet Ratios For transactions 1-4 prepare the required adjusting journal entries. For transactions 5-8, prepare the required closing entries. Account Title Credit No 1 Date Jan 31 Debit 6,200 Store supplies expense Store supplies 6,200 Jan 31 1,940 Insurance expense Prepaid insurance 1,940 Jan 31 6,600 Depreciation expense-Store equipment Accumulated depreciation-Store equipment 6,600 Jan 31 760 Cost of goods sold Merchandise inventory 760 Jan 31 Sales 139,000 Income summary 139,000 Jan 31 77,740 X Income summary Rent expense-Office space Advertising expense Store supplies expense Insurance expense Depreciation expense-Store equipment Rent expense-Selling space Office salaries expense Sales salaries expense O O OOOO000 0 0 7,400 11,200 6,200 1,940 6,600 7,400 18,500 18,500 Jan 31 77,740 % Income summary K. Perry, Capital 77,740 X 8 Jan 31 No Transaction Recorded ( Requirement General Ledger >