please help

please help

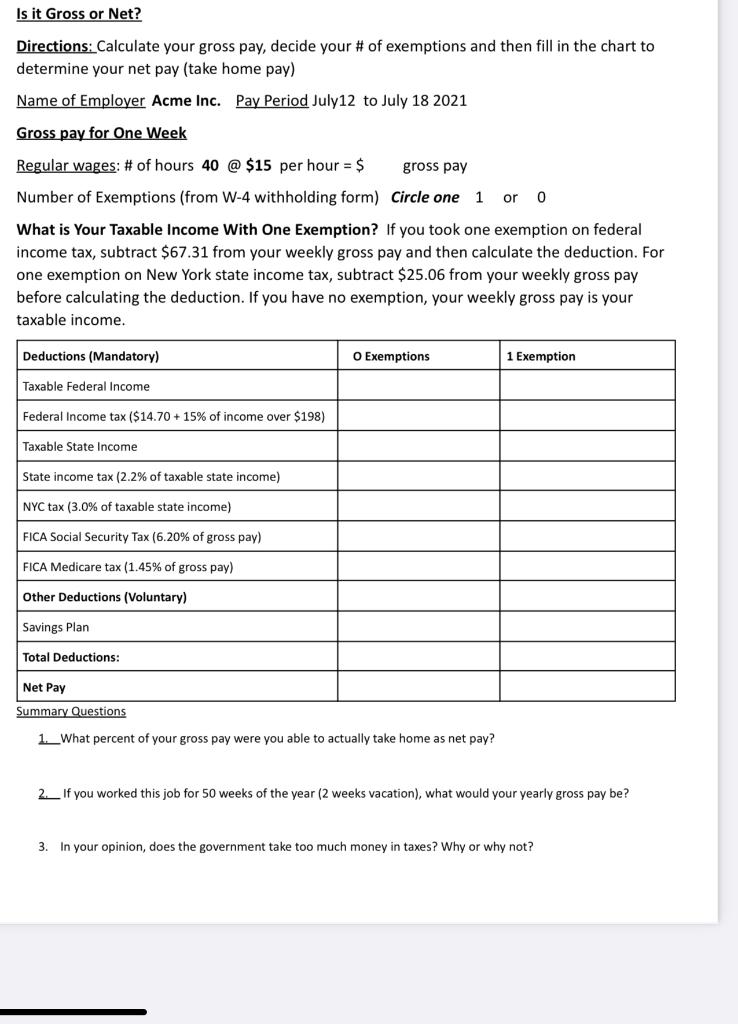

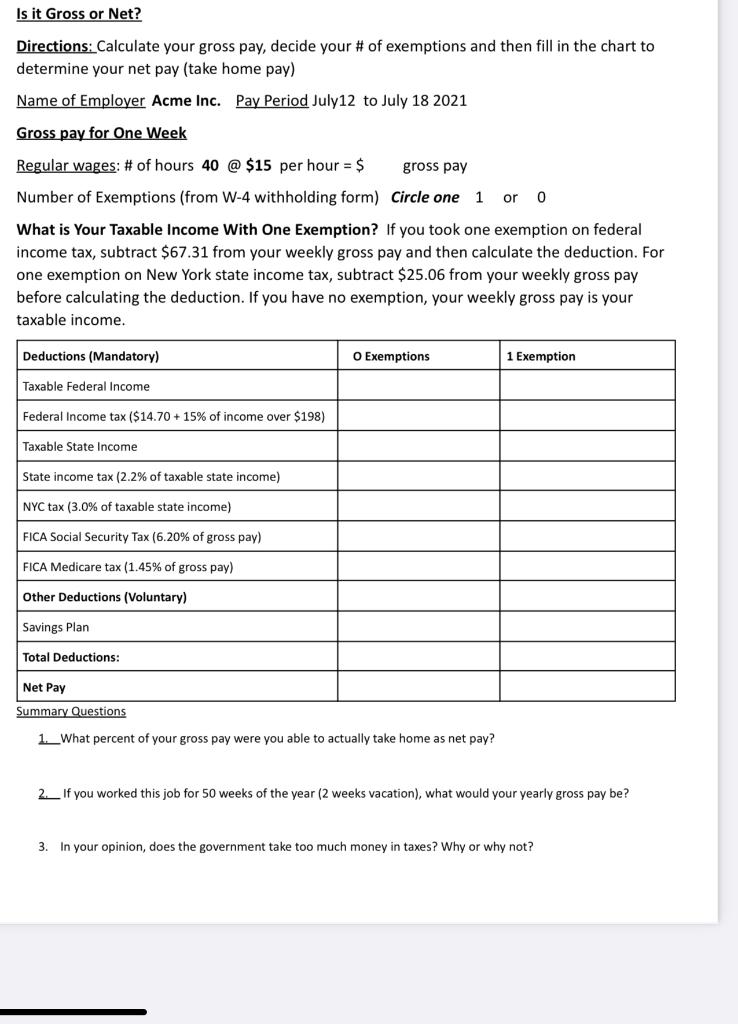

Is it Gross or Net? Directions: Calculate your gross pay, decide your # of exemptions and then fill in the chart to determine your net pay (take home pay) Name of Employer Acme Inc. Pay Period July12 to July 18 2021 Gross pay for One Week Regular wages: # of hours 40 @ $15 per hour = $ gross pay Number of Exemptions (from W-4 withholding form) Circle one 1 or 0 What is Your Taxable income With One Exemption? If you took one exemption on federal income tax, subtract $67.31 from your weekly gross pay and then calculate the deduction. For one exemption on New York state income tax, subtract $25.06 from your weekly gross pay before calculating the deduction. If you have no exemption, your weekly gross pay is your taxable income. Deductions (Mandatory) O Exemptions 1 Exemption Taxable Federal Income Federal Income tax ($14.70+ 15% of income over $198) Taxable State Income State income tax (2.2% of taxable state income) NYC tax (3.0% of taxable state income) FICA Social Security Tax (6.20% of gross pay) FICA Medicare tax (1.45% of gross pay) Other Deductions (Voluntary) Savings Plan Total Deductions: Net Pay Summary Questions 1._What percent of your gross pay were you able to actually take home as net pay? 2._ If you worked this job for 50 weeks of the year (2 weeks vacation), what would your yearly gross pay be? 3. In your opinion, does the government take too much money in taxes? Why or why not? Is it Gross or Net? Directions: Calculate your gross pay, decide your # of exemptions and then fill in the chart to determine your net pay (take home pay) Name of Employer Acme Inc. Pay Period July12 to July 18 2021 Gross pay for One Week Regular wages: # of hours 40 @ $15 per hour = $ gross pay Number of Exemptions (from W-4 withholding form) Circle one 1 or 0 What is Your Taxable income With One Exemption? If you took one exemption on federal income tax, subtract $67.31 from your weekly gross pay and then calculate the deduction. For one exemption on New York state income tax, subtract $25.06 from your weekly gross pay before calculating the deduction. If you have no exemption, your weekly gross pay is your taxable income. Deductions (Mandatory) O Exemptions 1 Exemption Taxable Federal Income Federal Income tax ($14.70+ 15% of income over $198) Taxable State Income State income tax (2.2% of taxable state income) NYC tax (3.0% of taxable state income) FICA Social Security Tax (6.20% of gross pay) FICA Medicare tax (1.45% of gross pay) Other Deductions (Voluntary) Savings Plan Total Deductions: Net Pay Summary Questions 1._What percent of your gross pay were you able to actually take home as net pay? 2._ If you worked this job for 50 weeks of the year (2 weeks vacation), what would your yearly gross pay be? 3. In your opinion, does the government take too much money in taxes? Why or why not

please help

please help