Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help ive tried multiple times ! please just answer as many as you can then please eBook Present and Future Values of Single Cash

please help ive tried multiple times !

please just answer as many as you can then please

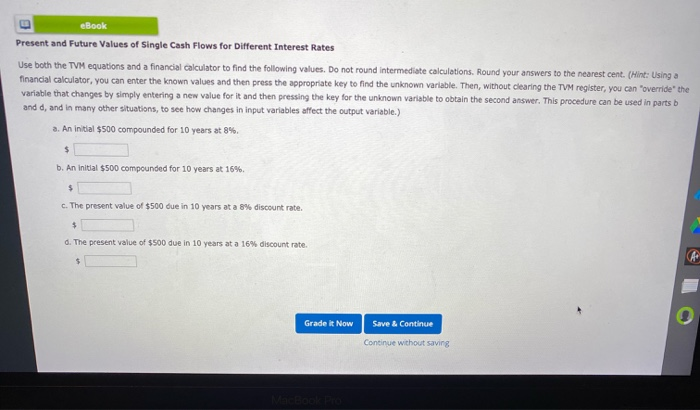

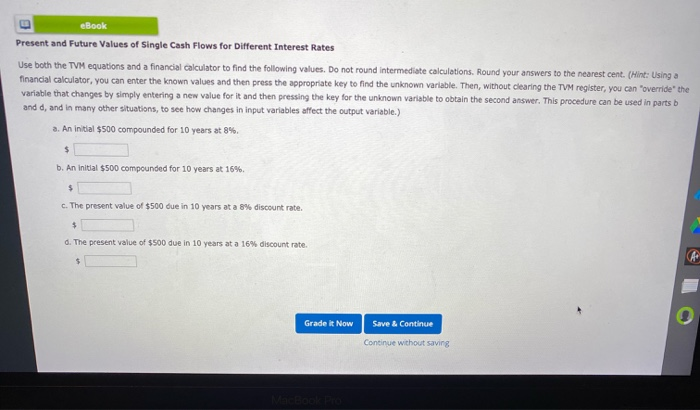

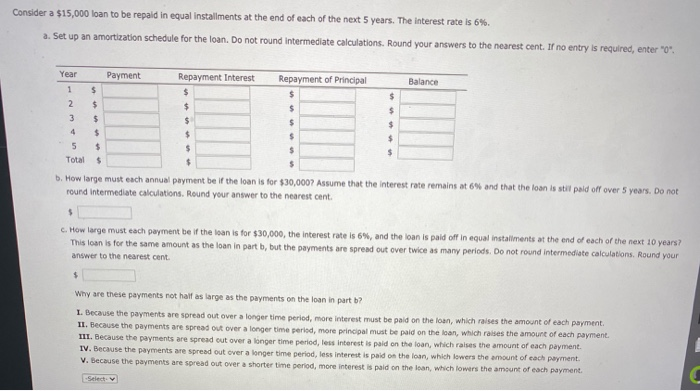

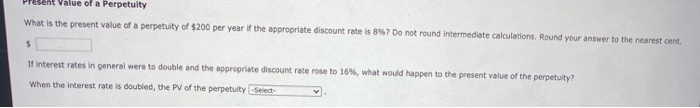

eBook Present and Future Values of Single Cash Flows for Different interest Rates Use both the TVM equations and a financial calculator to find the following values. Do not round intermediate calculations. Round your answers to the nearest cent. (Hint: Using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown varlable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in parts b and d, and in many other situations, to see how changes in input variables affect the output variable.) a. An initial $500 compounded for 10 years at 8%. $ b. An initial $500 compounded for 10 years at 16%. $ c. The present value of $500 due in 10 years at a 8% discount rate. $ d. The present value of $500 due in 10 years at a 16% discount rate. $ Grade it Now Save & Continue Continue without saving Effective Rate of Interest Find the Interest rate (or rates of return) in each of the following situations. Do not round intermediate calculations. Round your answers to the nearest whole number. a. You borrow $700 and promise to pay back $728 at the end of 1 year. b. You lend $700 and receive a promise to be paid $728 at the end of 1 year % c. You borrow $70,000 and promise to pay back $163,215 at the end of 11 years. d. You borrow $14,000 and promise to make payments of $3,693.20 at the end of each of the next 5 years. Consider a $15,000 loan to be repaid in equal installments at the end of each of the next 5 years. The interest rate is 6%. a. Set up an amortization schedule for the loan. Do not round Intermediate calculations. Round your answers to the nearest cent. If no entry is required, enter"0" Year Payment Repayment Interest Repayment of Principal Balance 1 $ $ $ $ 2. $ $ $ $ 3 $ $ $ $ $ $ $ $ 5 $ $ $ Total $ $ $ b. How large must each annual payment be if the loan is for $30,000? Assume that the interest rate remains at 6% and that the loan is still paid off over 5 years. Do not round Intermediate calculations. Round your answer to the nearest cent $ c. How large must each payment be if the loan is for $30,000, the interest rate is 6%, and the loan is paid off in equal installments at the end of each of the next 10 years? This loan is for the same amount as the loan in part b, but the payments are spread out over twice as many periods. Do not round intermediate calculations. Round your answer to the nearest cent $ Why are these payments not half as large as the payments on the loan in part b? I. Because the payments are spread out over a longer time period, more interest must be paid on the loan, which raises the amount of each payment. II. Because the payments are spread out over a longer time period, more principal must be paid on the loan, which raises the amount of each payment III. Because the payments are spread out over a longer time period, less interest is paid on the loan, which raises the amount of each payment. IV. Because the payments are spread out over a longer time period, less interest is paid on the loan, which lowers the amount of each payment. V. Because the payments are spread out over a shorter time period, more interest is paid on the loan, which lowers the amount of each payment Select ent Value of a Perpetuity What is the present value of a perpetuity of $200 per year if the appropriate discount rate is 8%? Do not round intermediate calculations. Round your answer to the nearest cent. $ If interest rates in general were to double and the appropriate discount rate rose to 16%, what would happen to the present value of the perpetuity? When the interest rate is doubled, the PV of the perpetuity Select Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started