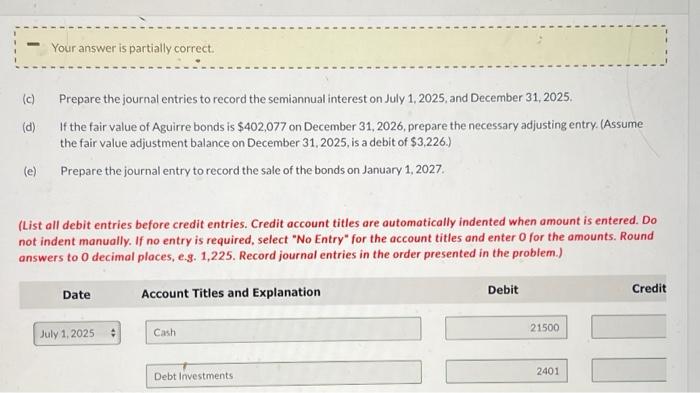

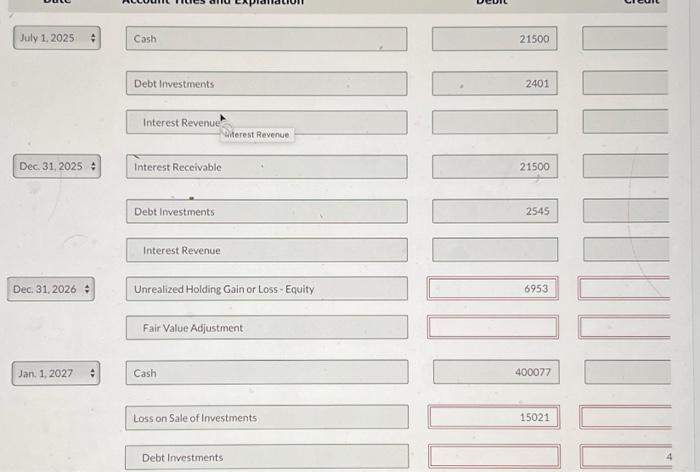

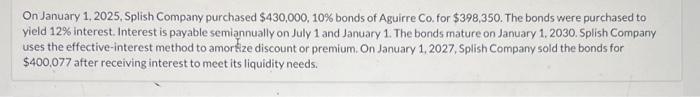

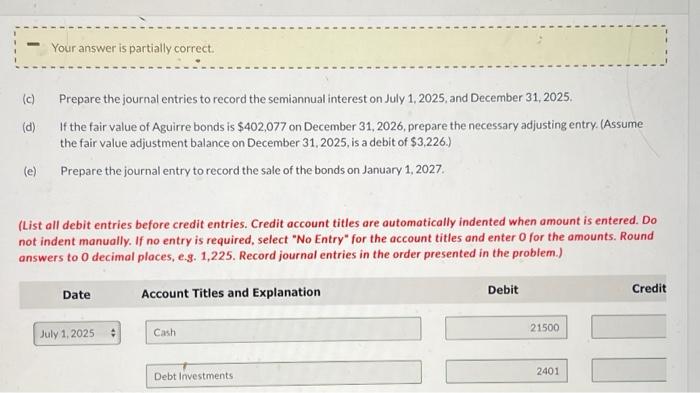

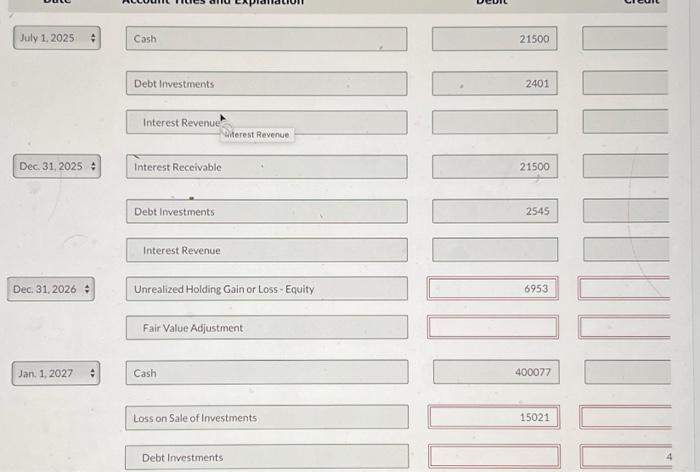

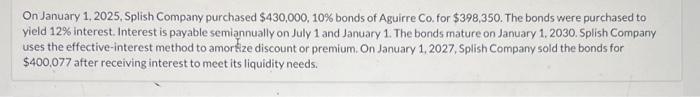

July 1,2025 Cash 21500 Debt Investments 2401 Interest Revenue Diterest Revenue Dec. 31,2025 * Interest Receivable 21500 Debt Investments Interest Revenue Dec. 31,2026 * Unrealized Holding Gain or Loss - Equity 6953 Fair Value Adjustment Jan. 1,2027 Cash 400077 Loss on Sale of Investments 15021 Debt Investments (c) Prepare the journal entries to record the semiannual interest on July 1,2025, and December 31, 2025. (d) If the fair value of Aguirre bonds is $402,077 on December 31, 2026, prepare the necessary adjusting entry. (Assume the fair value adjustment balance on December 31,2025 , is a debit of $3,226.) (e) Prepare the journal entry to record the sale of the bonds on January 1,2027. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round On January 1, 2025, Splish Company purchased $430,000,10% bonds of Aguirre Co. for $398,350. The bonds were purchased to yield 12% interest. Interest is payable semiannually on July 1 and January 1. The bonds mature on January 1, 2030. Splish Company uses the effective-interest method to amorkize discount or premium. On January 1,2027, Splish Company sold the bonds for $400,077 after receiving interest to meet its liquidity needs. July 1,2025 Cash 21500 Debt Investments 2401 Interest Revenue Diterest Revenue Dec. 31,2025 * Interest Receivable 21500 Debt Investments Interest Revenue Dec. 31,2026 * Unrealized Holding Gain or Loss - Equity 6953 Fair Value Adjustment Jan. 1,2027 Cash 400077 Loss on Sale of Investments 15021 Debt Investments (c) Prepare the journal entries to record the semiannual interest on July 1,2025, and December 31, 2025. (d) If the fair value of Aguirre bonds is $402,077 on December 31, 2026, prepare the necessary adjusting entry. (Assume the fair value adjustment balance on December 31,2025 , is a debit of $3,226.) (e) Prepare the journal entry to record the sale of the bonds on January 1,2027. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round On January 1, 2025, Splish Company purchased $430,000,10% bonds of Aguirre Co. for $398,350. The bonds were purchased to yield 12% interest. Interest is payable semiannually on July 1 and January 1. The bonds mature on January 1, 2030. Splish Company uses the effective-interest method to amorkize discount or premium. On January 1,2027, Splish Company sold the bonds for $400,077 after receiving interest to meet its liquidity needs