Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help. Just need the answers 1. Which one of the following is a type of equity security that has a fixed dividend and a

Please help. Just need the answers

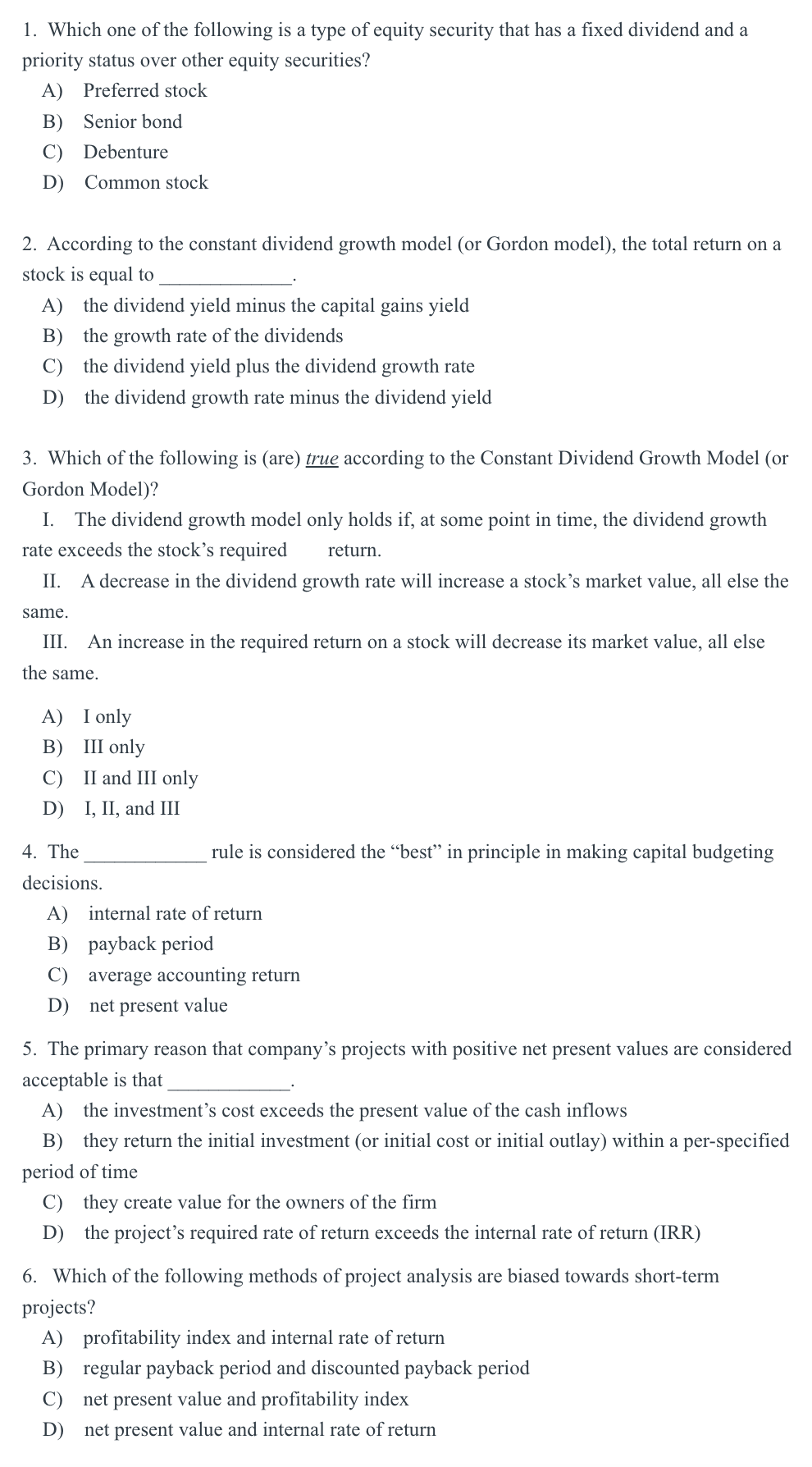

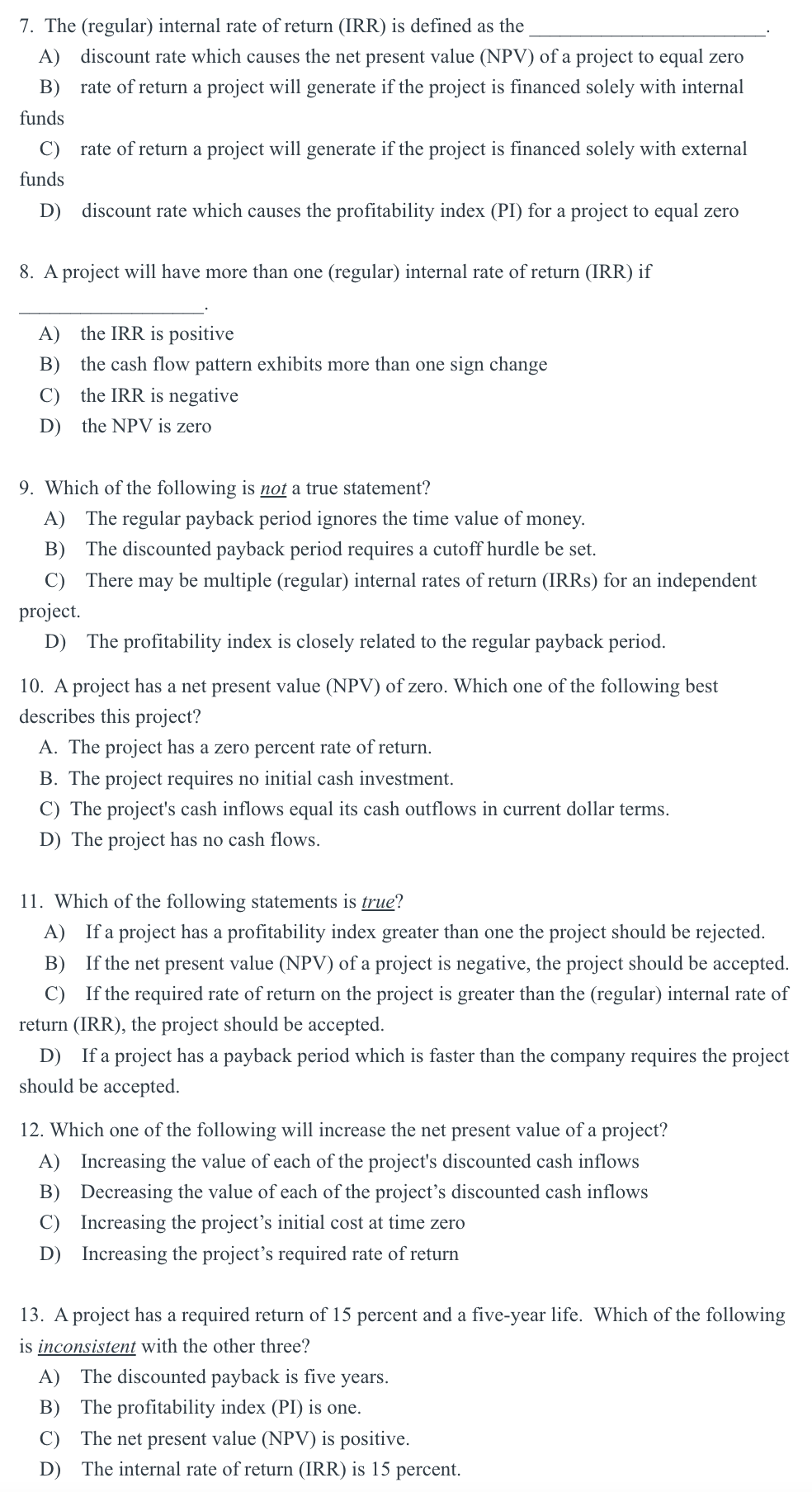

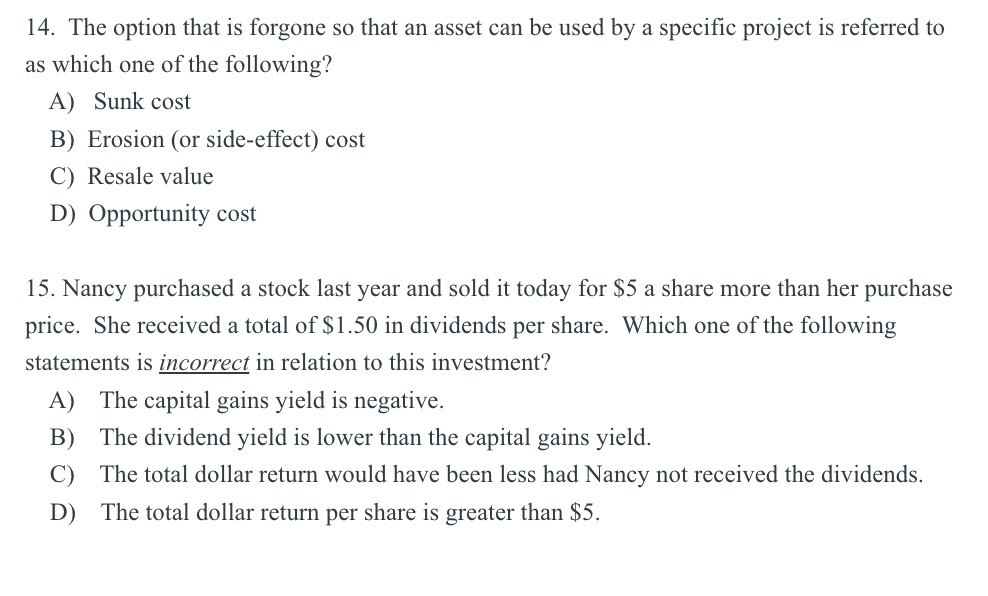

1. Which one of the following is a type of equity security that has a fixed dividend and a priority status over other equity securities? A) Preferred stock B) Senior bond C) Debenture D) Common stock 2. According to the constant dividend growth model (or Gordon model), the total return on a stock is equal to A) the dividend yield minus the capital gains yield B) the growth rate of the dividends C) the dividend yield plus the dividend growth rate D) the dividend growth rate minus the dividend yield 3. Which of the following is (are) true according to the Constant Dividend Growth Model (or Gordon Model)? I. The dividend growth model only holds if, at some point in time, the dividend growth rate exceeds the stock's required return. II. A decrease in the dividend growth rate will increase a stock's market value, all else the same. III. An increase in the required return on a stock will decrease its market value, all else the same. A) I only B) III only C) II and III only D) I, II, and III 4. The rule is considered the "best" in principle in making capital budgeting decisions. A) internal rate of return B) payback period C) average accounting return D) net present value 5. The primary reason that company's projects with positive net present values are considered acceptable is that A) the investment's cost exceeds the present value of the cash inflows B) they return the initial investment (or initial cost or initial outlay) within a per-specified period of time C) they create value for the owners of the firm D) the project's required rate of return exceeds the internal rate of return (IRR) 6. Which of the following methods of project analysis are biased towards short-term projects? A) profitability index and internal rate of return B) regular payback period and discounted payback period C) net present value and profitability index D) net present value and internal rate of return 7. The (regular) internal rate of return (IRR) is defined as the A) discount rate which causes the net present value (NPV) of a project to equal zero B) rate of return a project will generate if the project is financed solely with internal funds C) rate of return a project will generate if the project is financed solely with external funds D) discount rate which causes the profitability index (PI) for a project to equal zero 8. A project will have more than one (regular) internal rate of return (IRR) if A) the IRR is positive B) the cash flow pattern exhibits more than one sign change C) the IRR is negative D) the NPV is zero 9. Which of the following is not a true statement? A) The regular payback period ignores the time value of money. B) The discounted payback period requires a cutoff hurdle be set. C) There may be multiple (regular) internal rates of return (IRRs) for an independent project. D) The profitability index is closely related to the regular payback period. 10. A project has a net present value (NPV) of zero. Which one of the following best describes this project? A. The project has a zero percent rate of return. B. The project requires no initial cash investment. C) The project's cash inflows equal its cash outflows in current dollar terms. D) The project has no cash flows. 11. Which of the following statements is true? A) If a project has a profitability index greater than one the project should be rejected. B) If the net present value (NPV) of a project is negative, the project should be accepted. C) If the required rate of return on the project is greater than the (regular) internal rate of return (IRR), the project should be accepted. D) If a project has a payback period which is faster than the company requires the project should be accepted. 12. Which one of the following will increase the net present value of a project? A) Increasing the value of each of the project's discounted cash inflows B) Decreasing the value of each of the project's discounted cash inflows C) Increasing the project's initial cost at time zero D) Increasing the project's required rate of return 13. A project has a required return of 15 percent and a five-year life. Which of the following is inconsistent with the other three? A) The discounted payback is five years. B) The profitability index (PI) is one. C) The net present value (NPV) is positive. D) The internal rate of return (IRR) is 15 percent. 14. The option that is forgone so that an asset can be used by a specific project is referred to as which one of the following? A) Sunk cost B) Erosion (or side-effect) cost C) Resale value D) Opportunity cost 15. Nancy purchased a stock last year and sold it today for $5 a share more than her purchase price. She received a total of $1.50 in dividends per share. Which one of the following statements is incorrect in relation to this investment? A) The capital gains yield is negative. B) The dividend yield is lower than the capital gains yield. C) The total dollar return would have been less had Nancy not received the dividends. D) The total dollar return per share is greater than $5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started