please help. just provide the correct option

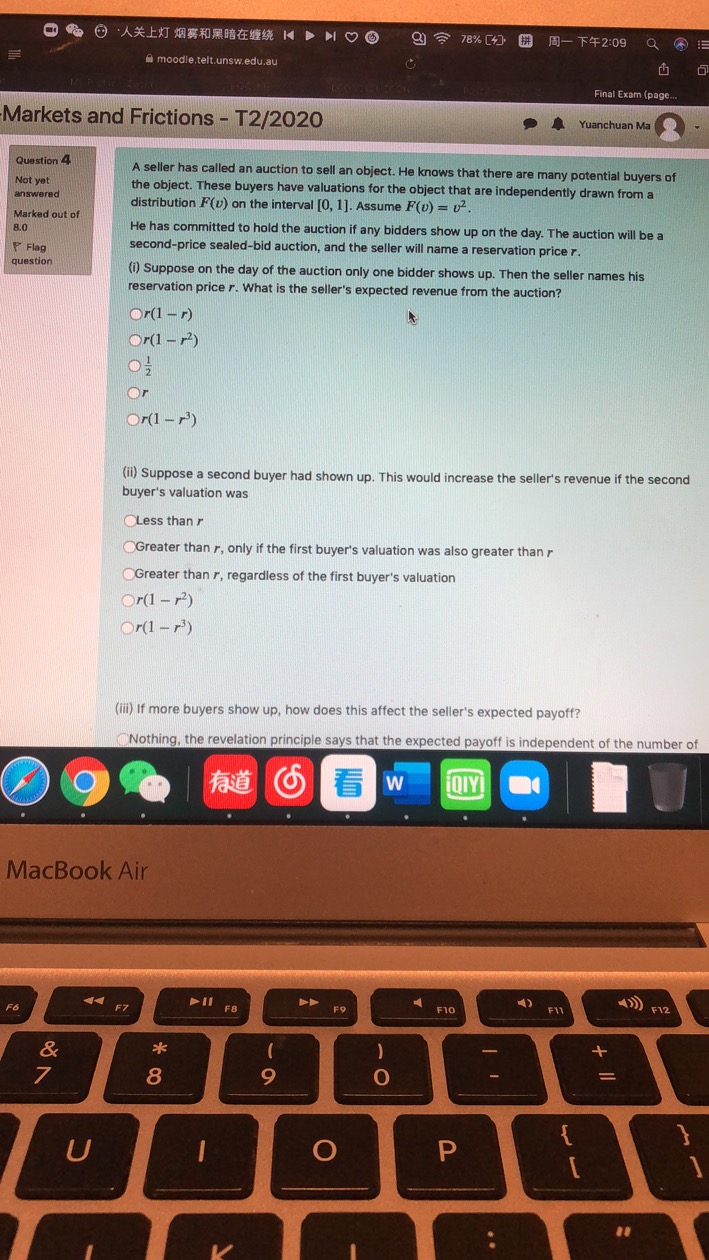

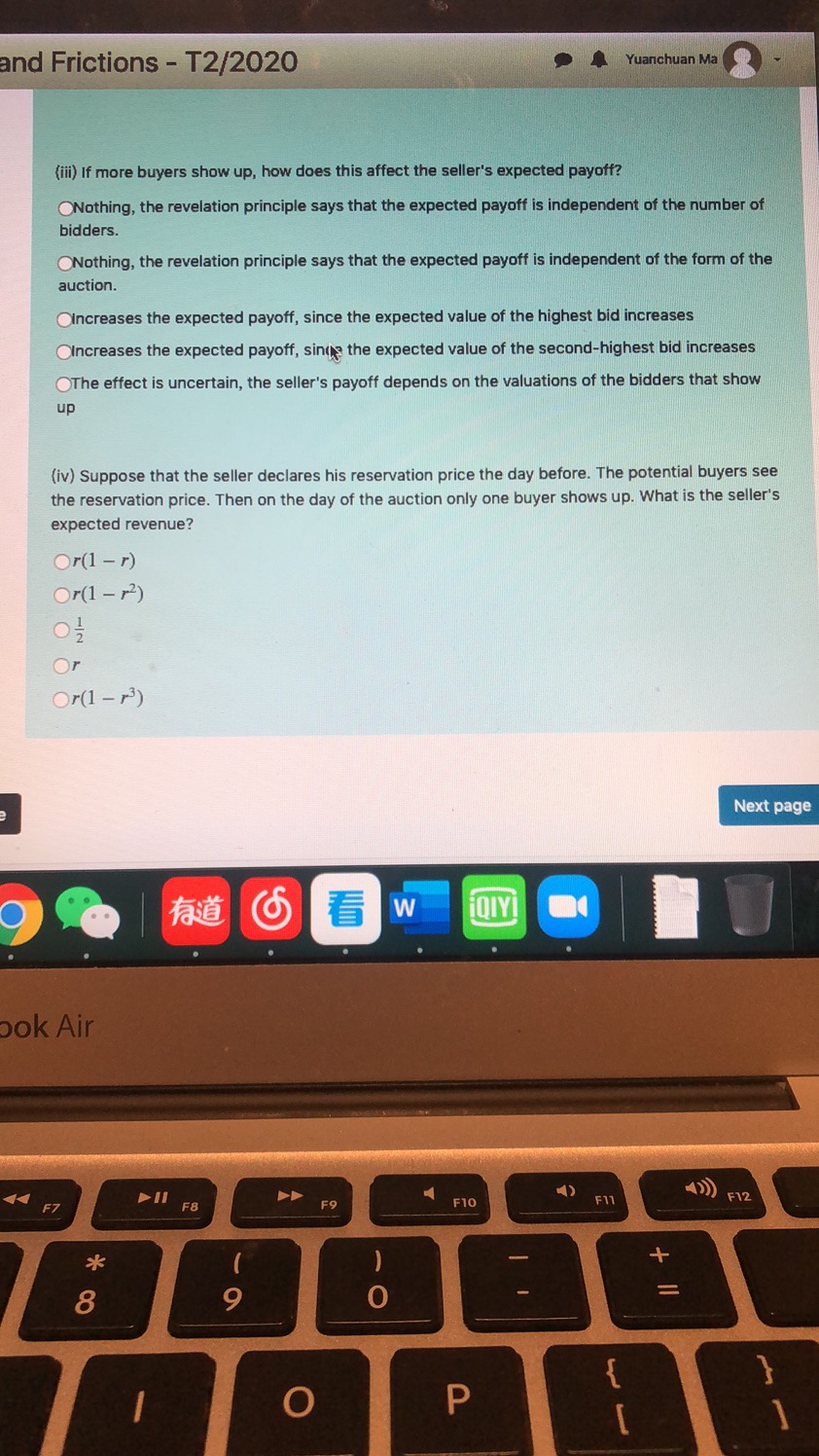

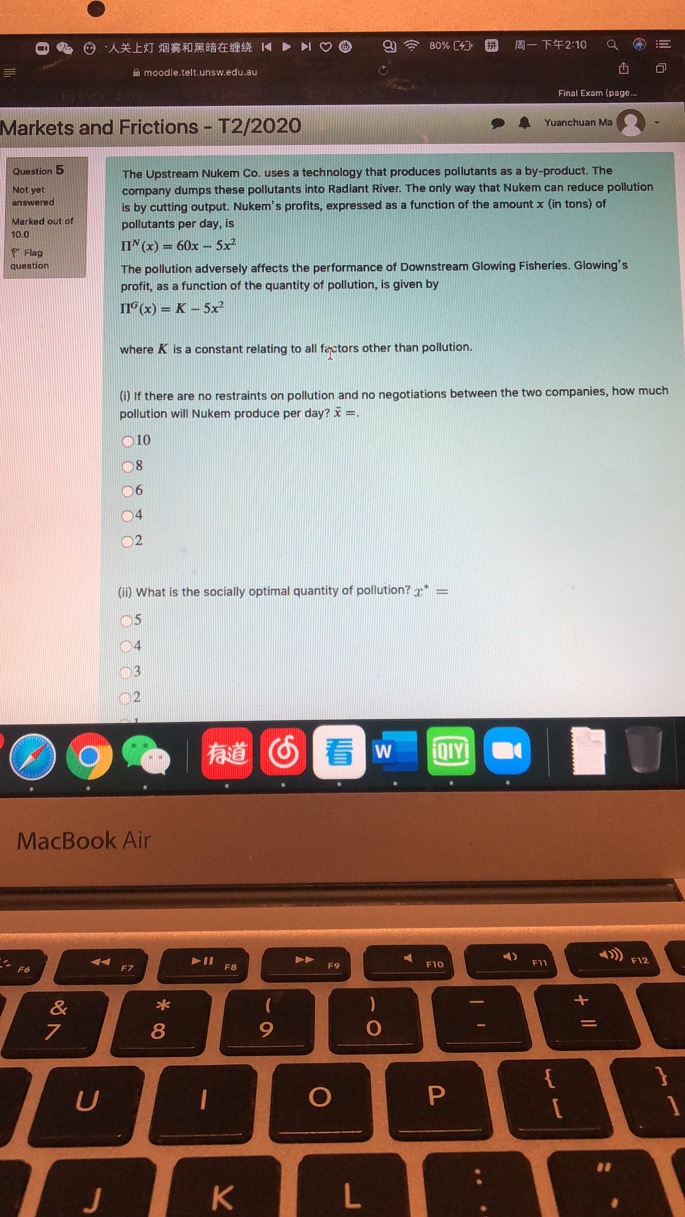

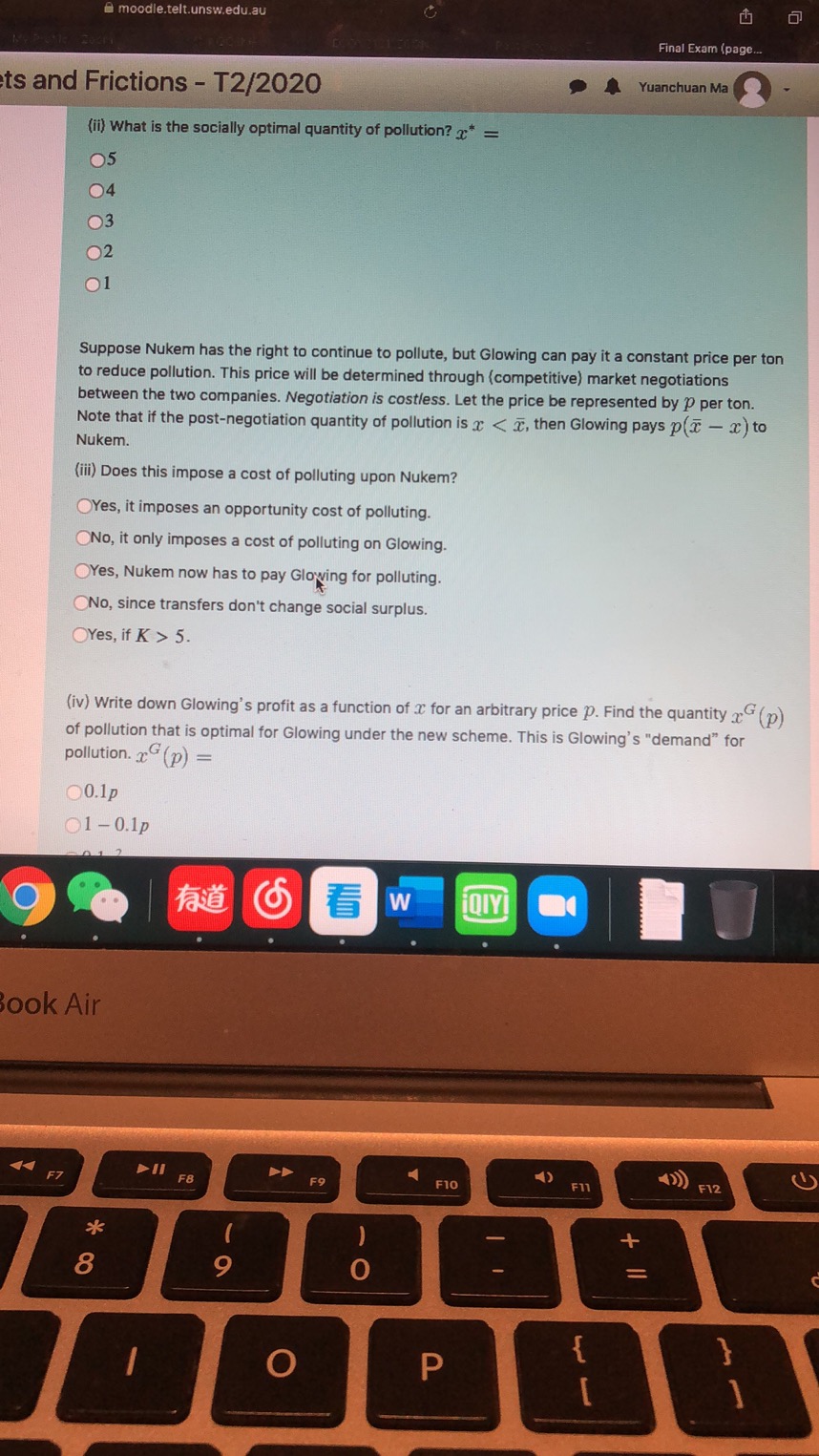

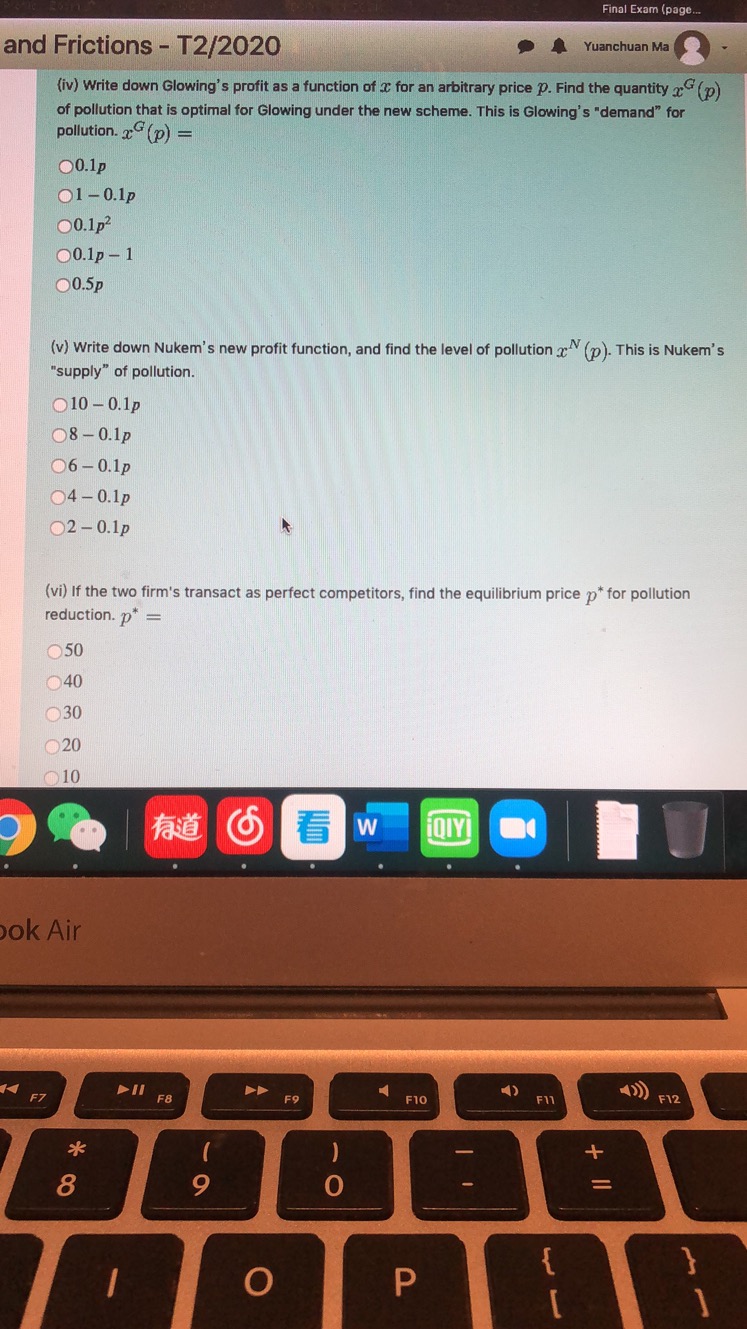

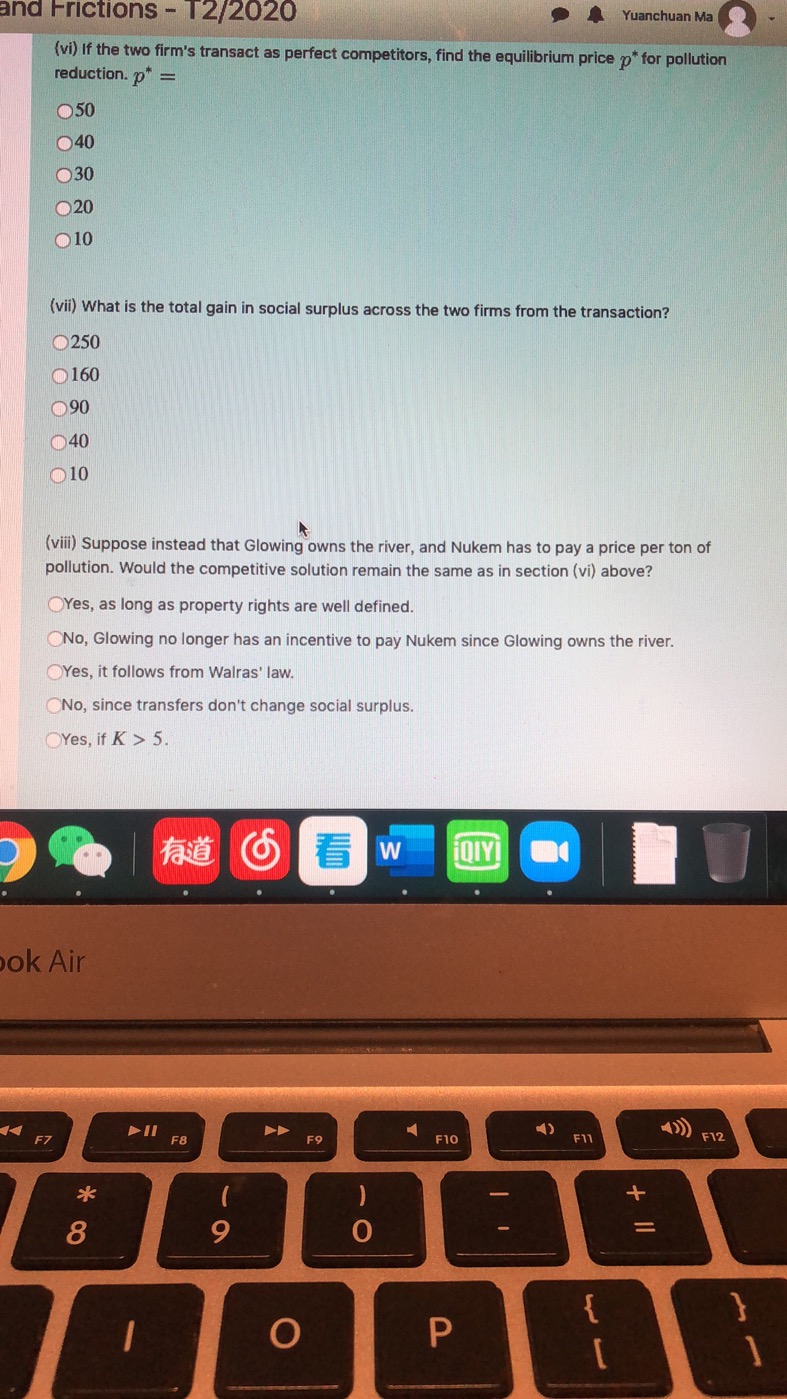

O AXEIT ABARBERS ND NOO 9 7 78% ( @ - F42:09 Q moodle.telt.unsw.edu.au Final Exam (page.. Markets and Frictions - T2/2020 Yuanchuan Ma Question 4 A seller has called an auction to sell an object. He knows that there are many potential buyers of Not yet answered the object. These buyers have valuations for the object that are independently drawn from a distribution F(v) on the interval [0, 1]. Assume F(v) = v2. Marked out of 8.0 He has committed to hold the auction if any bidders show up on the day. The auction will be a Flag second-price sealed-bid auction, and the seller will name a reservation price r. question (i) Suppose on the day of the auction only one bidder shows up. Then the seller names his reservation price r. What is the seller's expected revenue from the auction? Or(1 - r) Or(1 - 72) Or Or(1 - 73) (ii) Suppose a second buyer had shown up. This would increase the seller's revenue if the second buyer's valuation was OLess than r OGreater than r, only if the first buyer's valuation was also greater than r OGreater than r, regardless of the first buyer's valuation Or(1 - 72) Or(1 - 73) (iii) If more buyers show up, how does this affect the seller's expected payoff? Nothing, the revelation principle says that the expected payoff is independent of the number of 6 W iQIYI MacBook Air F6 44 F7 F8 F10 F11 F 8 9 O U O Pand Frictions - T2/2020 Yuanchuan Ma (iii) If more buyers show up, how does this affect the seller's expected payoff? ONothing, the revelation principle says that the expected payoff is independent of the number of bidders. Nothing, the revelation principle says that the expected payoff is independent of the form of the auction. OIncreases the expected payoff, since the expected value of the highest bid increases Oincreases the expected payoff, sings the expected value of the second-highest bid increases OThe effect is uncertain, the seller's payoff depends on the valuations of the bidders that show up (iv) Suppose that the seller declares his reservation price the day before. The potential buyers see the reservation price. Then on the day of the auction only one buyer shows up. What is the seller's expected revenue? Or(1 - r) Or(1 - 72) Or Or(1 -73) Next page 9 6 W QIYI ook Air 44 F7 DII F8 F9 F10 F11 F12 + 8 O - = O P9 80% [ M- F +2:10 # moodle.telt.unsw.edu.au Final Exam (page... Markets and Frictions - T2/2020 Yuanchuan Ma Question 5 The Upstream Nukem Co. uses a technology that produces pollutants as a by-product. The Not yet answered company dumps these pollutants into Radiant River. The only way that Nukem can reduce pollution Marked out of is by cutting output. Nukem's profits, expressed as a function of the amount x (in tons) of 10.0 pollutants per day, is Flag IIN(x) - 60x - 5x2 question The pollution adversely affects the performance of Downstream Glowing Fisheries. Glowing's profit, as a function of the quantity of pollution, is given by II"(x) = K - 5x2 where K is a constant relating to all factors other than pollution. (i) if there are no restraints on pollution and no negotiations between the two companies, how much pollution will Nukem produce per day? x -. 10 08 06 04 02 (ii) What is the socially optimal quantity of pollution? * = 04 W iQIYI MacBook Air F7 FB F9 F10 4) (CC F12 8 9 O U O P Kmoodle.telt.unsw.edu.au Final Exam (page.. ts and Frictions - T2/2020 Yuanchuan Ma (ii) What is the socially optimal quantity of pollution? x* = 05 04 01 Suppose Nukem has the right to continue to pollute, but Glowing can pay it a constant price per ton to reduce pollution. This price will be determined through (competitive) market negotiations between the two companies. Negotiation is costless. Let the price be represented by ? per ton. Note that if the post-negotiation quantity of pollution is x 5. (iv) Write down Glowing's profit as a function of T for an arbitrary price p. Find the quantity a(p) of pollution that is optimal for Glowing under the new scheme. This is Glowing's "demand" for pollution. x(p) = 10.1p 1 -0.1p W iQIYI ook Air 44 F7 DII F8 F9 F10 F11 F12 ** 8 O - O PFinal Exam (page. and Frictions - T2/2020 Yuanchuan Ma (iv) Write down Glowing's profit as a function of " for an arbitrary price p. Find the quantity x(p) of pollution that is optimal for Glowing under the new scheme. This is Glowing's "demand" for pollution. x(p) = 10.1p 1 -0.1p 10.1p 0.1p - 1 0.5p (v) Write down Nukem's new profit function, and find the level of pollution x (p). This is Nukem's "supply" of pollution. 10 - 0.1p 08 -0.1p 06 -0.1p 04-0.1p O2-0.1p (vi) If the two firm's transact as perfect competitors, find the equilibrium price p* for pollution reduction. p* = 50 40 30 20 10 6 W QIYI ok Air F7 DI F8 DD F9 F10 F11 F12 ** 8 O - F O Pand Frictions - T2/2020 Yuanchuan Ma (vi) if the two firm's transact as perfect competitors, find the equilibrium price p* for pollution reduction. p* = 050 040 030 20 10 (vii) What is the total gain in social surplus across the two firms from the transaction? 250 160 090 40 10 (vili) Suppose instead that Glowing owns the river, and Nukem has to pay a price per ton of pollution. Would the competitive solution remain the same as in section (vi) above? OYes, as long as property rights are well defined. No, Glowing no longer has an incentive to pay Nukem since Glowing owns the river. Yes, it follows from Walras' law. No, since transfers don't change social surplus. OYes, if K > 5. W QIYI ok Air F7 DII F8 DD F9 F10 F11 F12 8 O - + O P