Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help Large Ltd. purchased 70% of Small Company on January 1, Year 6 , for $700,000, when the statement of financial position for Small

Please Help

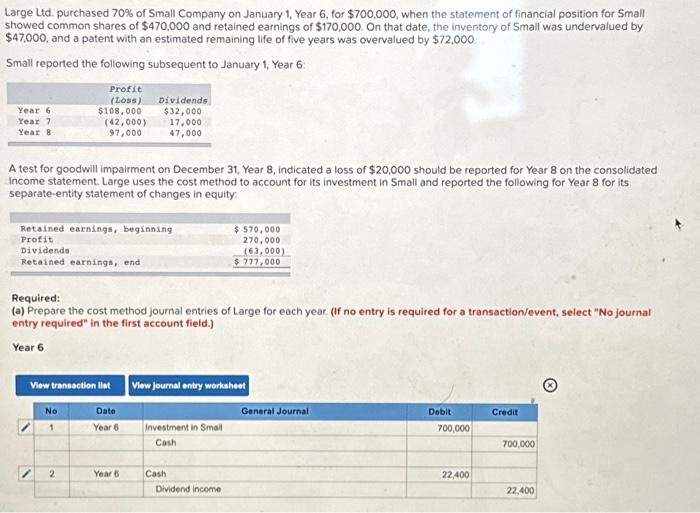

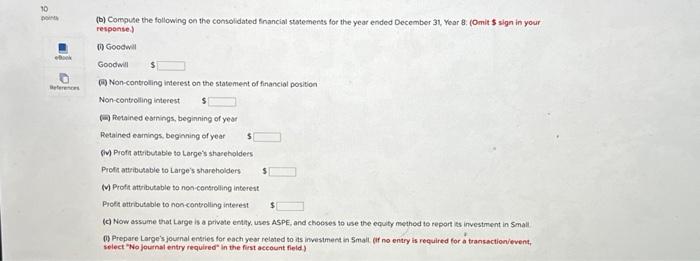

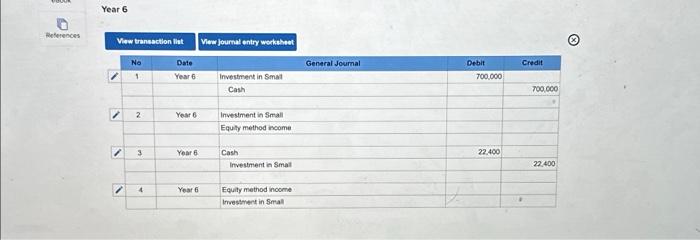

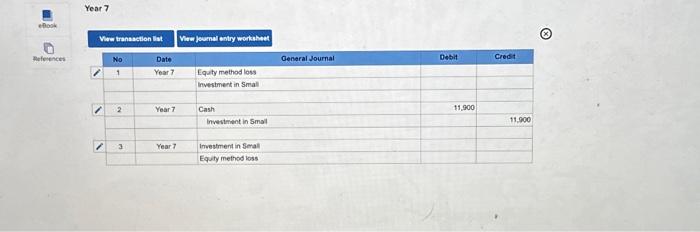

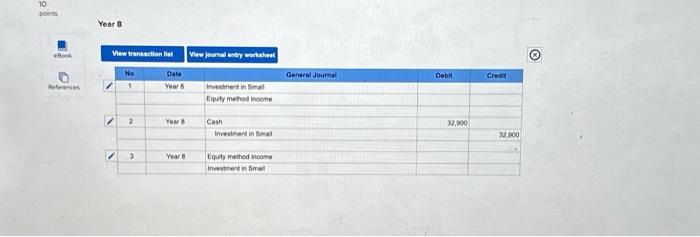

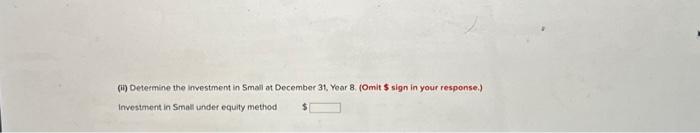

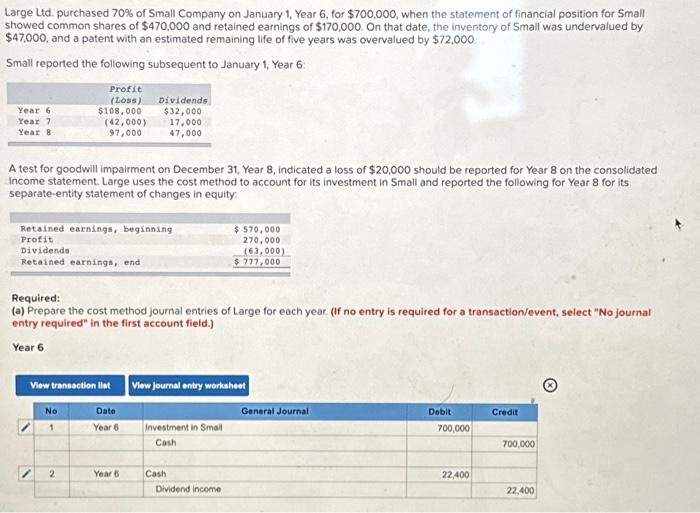

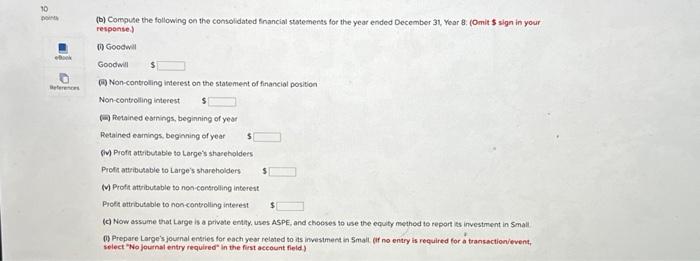

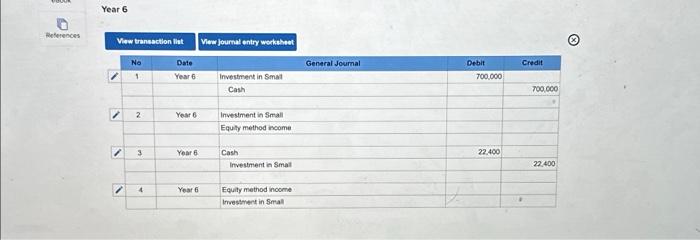

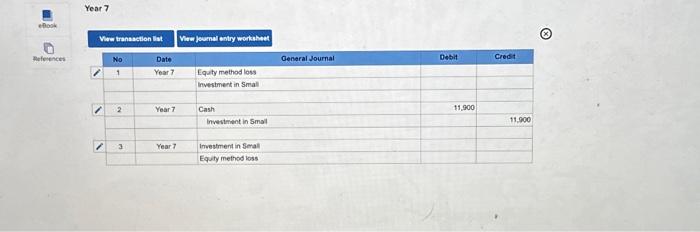

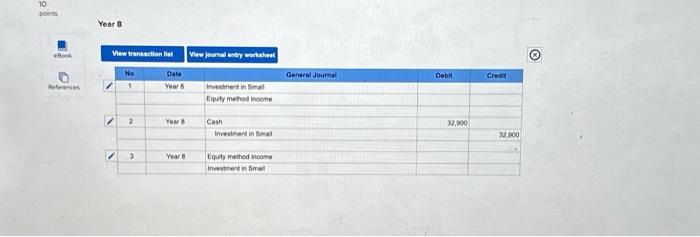

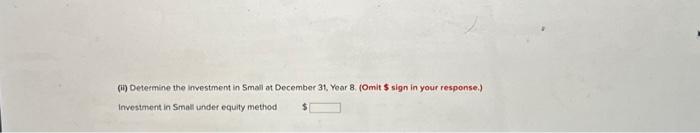

Large Ltd. purchased 70% of Small Company on January 1, Year 6 , for $700,000, when the statement of financial position for Small showed common shares of $470,000 and retained earnings of $170,000. On that date, the inventory of Small was undervalued by $47,000, and a patent with an estimated remaining life of five years was overvalued by $72,000. Small reported the following subsequent to January 1, Year 6 : A test for goodwill impairment on December 31, Year 8 , indicated a loss of $20,000 should be reported for Year 8 on the consolidated income statement. Large uses the cost method to account for its investment in Small and reported the following for Year 8 for its separate-entity statement of changes in equity: Required: (a) Prepare the cost method journal entries of Large for each year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) (b) Compuse the following on the consolidated frnancial statements for the year ended December 31, Year 8, (Omit $ sign in your response) (i) Goodwall Goodwil (i) Non-controlling interest on the statement of financial position Non-controling interest (in) Retained earnings, beginning of year Retained earnings, beginning of year (im) Profn ateribuable to Large's shareholders Profin atributable to Large's shareholders 5 (M) Profit attributable to non-controlling interest Piolit attributable to noncontroling interest $ (c) Now assume that Large is a private entity, uses ASPE, and chooses to use the equity methed to report is investment in Small 0) Prepare Large's journal entries for each year related to its investment in Smait af no entry is required for transactionievent. select "No joutnal entry required" in the first account field) Year6 \begin{tabular}{|c|c|c|c|c|c|} \hline & No & Date & Generai Journal & Debit & Credit \\ \hline \multirow[t]{3}{*}{/} & 1 & Year 6 & Investrent in Smat & 700,000 & \\ \hline & & & Cash & & 700000 \\ \hline & & & & & + \\ \hline & 2 & Year 6 & Investment in Small & & \\ \hline & & & Equity method noome & & 2 \\ \hline \multirow[t]{3}{*}{1} & 3 & Your 6 & Cash & 22,400 & \\ \hline & & & Investment in Smat & & 22,400 \\ \hline & & & & E & \\ \hline \multirow[t]{2}{*}{1} & 4 & Year 6 & Equity method inoome & 6 & \\ \hline & & & Imestrent in Smal & & \\ \hline \end{tabular} Year 7 \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{10}{*}{0Aeferences} & \multicolumn{3}{|c|}{ Vere tranasction lat } & \\ \hline & & No & Date & General Journal & Desil & Credst \\ \hline & & 1 & Year 7 & Equity method loss & & \\ \hline & & & & Investment in Smal & & \\ \hline & & & & & & \\ \hline &

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started