Please help make with this question.

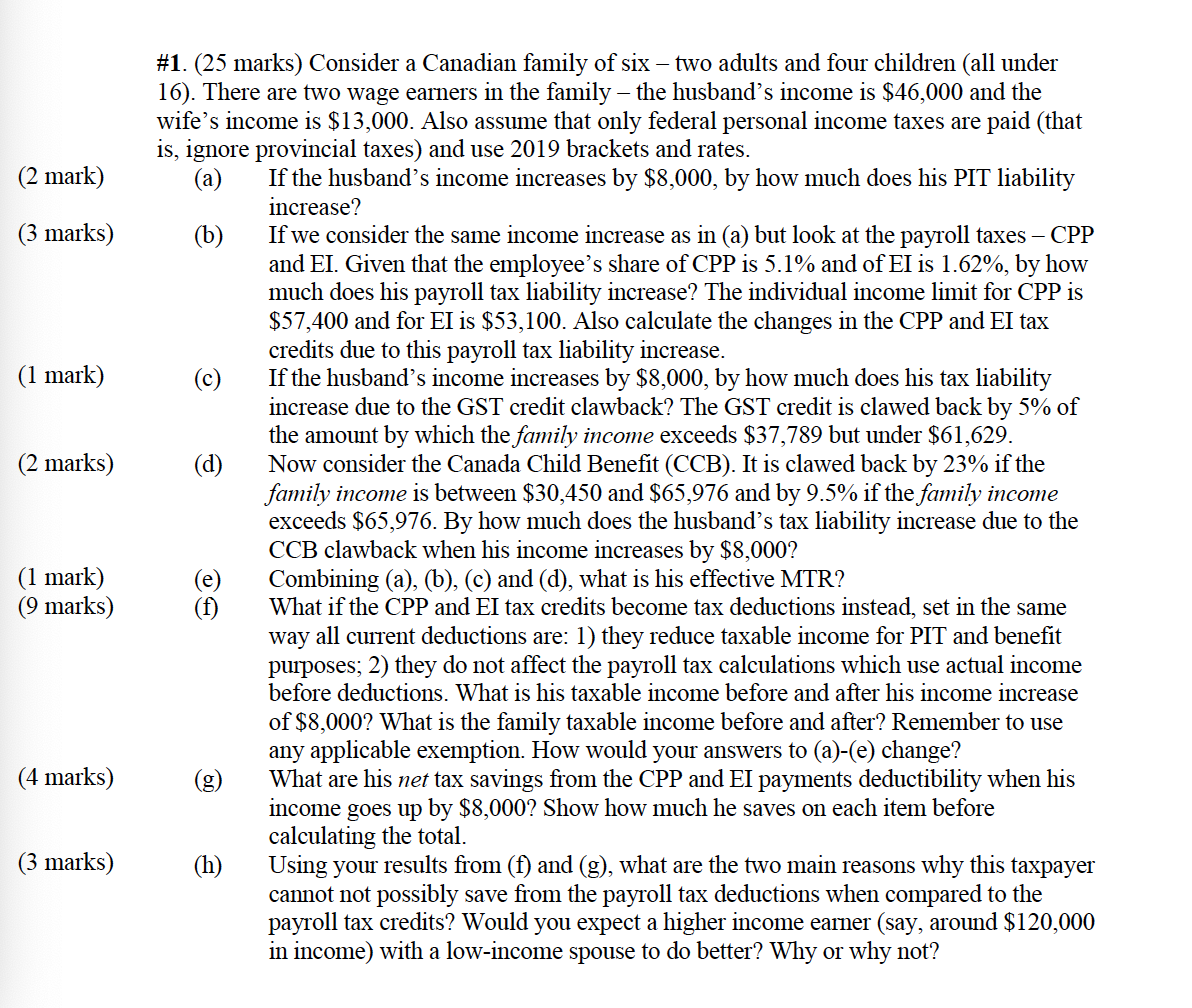

(2 mark) (3 marks) (1 mark) (2 marks) (1 mark) (9 marks) (4 marks) (3 marks) #1. (25 marks) Consider a Canadian family of six two adults and four children (all under 16). There are two wage earners in the family the husband's income is $46,000 and the wife's income is $13,000. Also assume that only federal personal income taxes are paid (that is, ignore provincial taxes) and use 2019 brackets and rates. (a) (b) (C) (d) (e) (f) (g) (11) If the husband's income increases by $8,000, by how much does his PIT liability increase? If we consider the same income increase as in (a) but look at the payroll taxes CPP and El. Given that the employee's share of CPP is 5.1% and of E1 is 1.62%, by how much does his payroll tax liability increase? The individual income limit for CPP is $57,400 and for E1 is $53,100. Also calculate the changes in the CPP and El tax credits due to this payroll tax liability increase. If the husband's income increases by $8,000, by how much does his tax liability increase due to the GST credit clawback? The GST credit is clawed back by 5% of the amount by which the family income exceeds $37,789 but under $61,629. Now consider the Canada Child Benet (CCB). It is clawed back by 23% if the family income is between $30,450 and $65,976 and by 9.5% if the famibz income exceeds $65,976. By how much does the husband's tax liability increase due to the CCB clawback when his income increases by $8,000? Combining (a), (b), (c) and (d), what is his effective MIR? What if the CPP and EI tax credits become tax deductions instead, set in the same way all current deductions are: 1) they reduce taxable income for PIT and benet purposes; 2) they do not affect the payroll tax calculations which use actual income before deductions. What is his taxable income before and after his income increase of $8,000? What is the family taxable income before and after? Remember to use any applicable exemption. How would your answers to (a)-(e) change? What are his net tax savings om the CPP and EI payments deductibility when his income goes up by $8,000? Show how much he saves on each item before calculating the total. Using your results from (t) and (g), what are the two main reasons why this taxpayer cannot not possibly save from the payroll tax deductions when compared to the payroll tax credits? Would you expect a higher income earner (say, around $120,000 in income) with a low-income spouse to do better? Why or why not