Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! many thanks. will thumps up B1. An investment possibilities table with a group of portfolios that contains only two assets, Meta (M) and

please help! many thanks. will thumps up

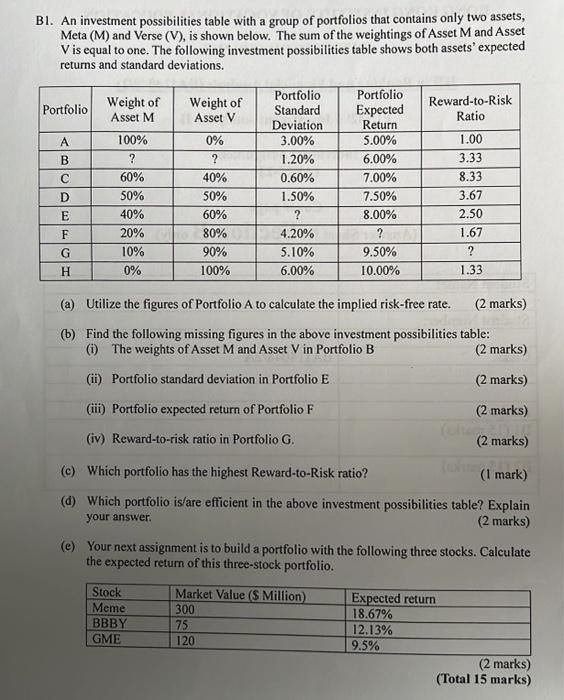

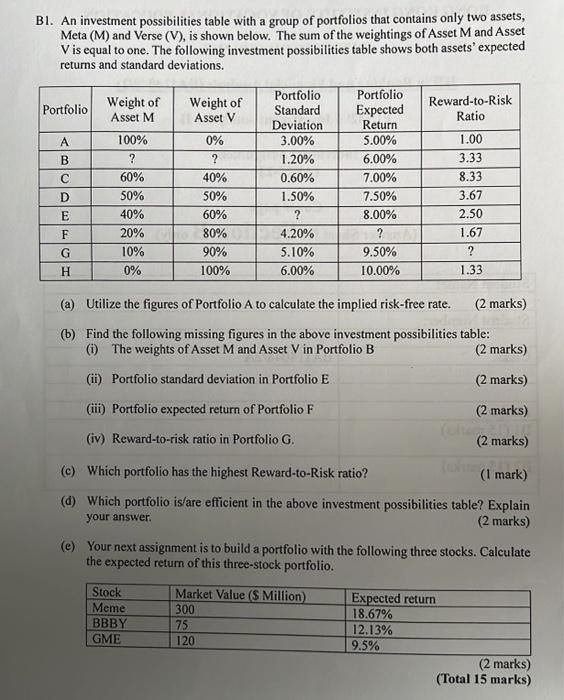

B1. An investment possibilities table with a group of portfolios that contains only two assets, Meta (M) and Verse (V), is shown below. The sum of the weightings of Asset M and Asset V is equal to one. The following investment possibilities table shows both assets' expected returns and standard deviations. (a) Utilize the figures of Portfolio A to calculate the implied risk-free rate. (2 marks) (b) Find the following missing figures in the above investment possibilities table: (i) The weights of Asset M and Asset V in Portfolio B (2 marks) (ii) Portfolio standard deviation in Portfolio E (2 marks) (iii) Portfolio expected return of Portfolio F (2 marks) (iv) Reward-to-risk ratio in Portfolio G. (2 marks) (c) Which portfolio has the highest Reward-to-Risk ratio? (1 mark) (d) Which portfolio is/are efficient in the above investment possibilities table? Explain your answer. (2 marks) (e) Your next assignment is to build a portfolio with the following three stocks. Calculate the expected return of this three-stock portfolio. (2 marks) (Total 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started