Answered step by step

Verified Expert Solution

Question

1 Approved Answer

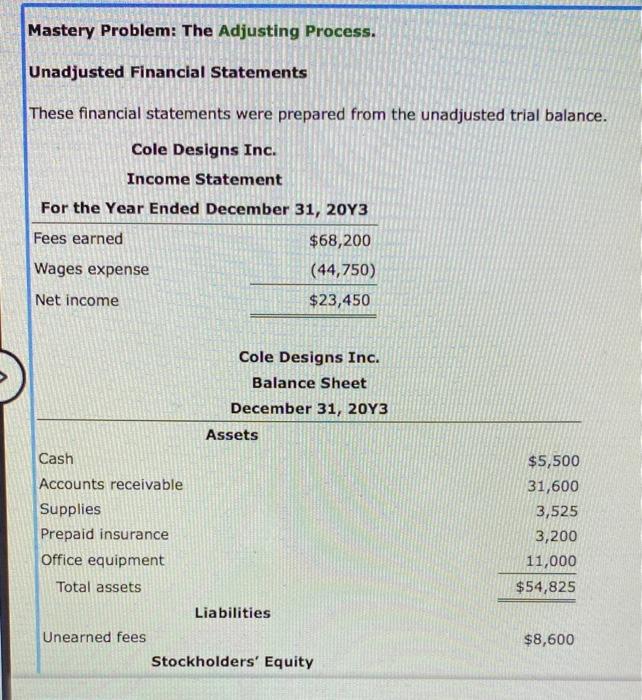

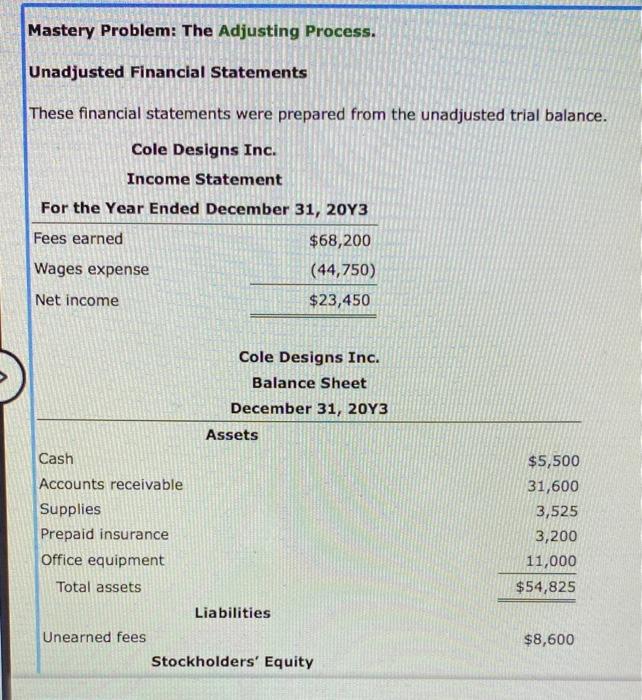

please help Mastery Problem: The Adjusting Process. Unadjusted Financial Statements These financial statements were prepared from the unadjusted trial balance. Cole Designs Inc. Income Statement

please help

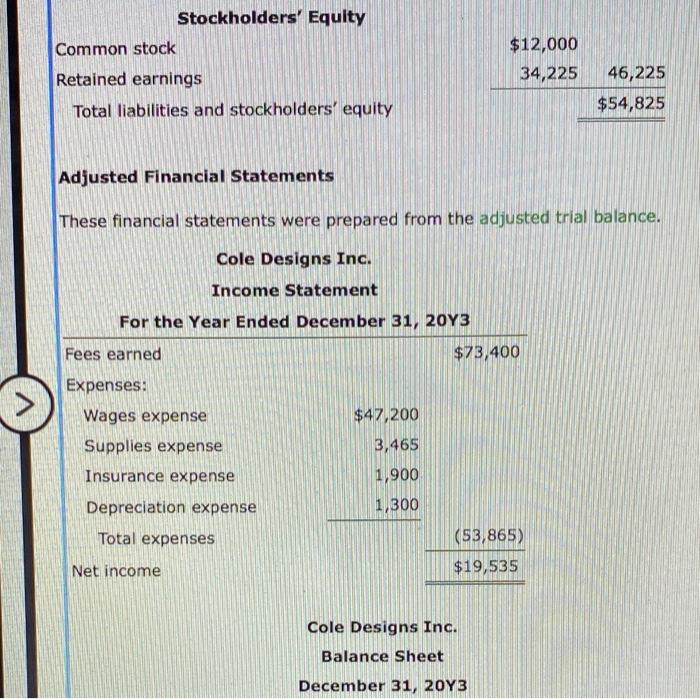

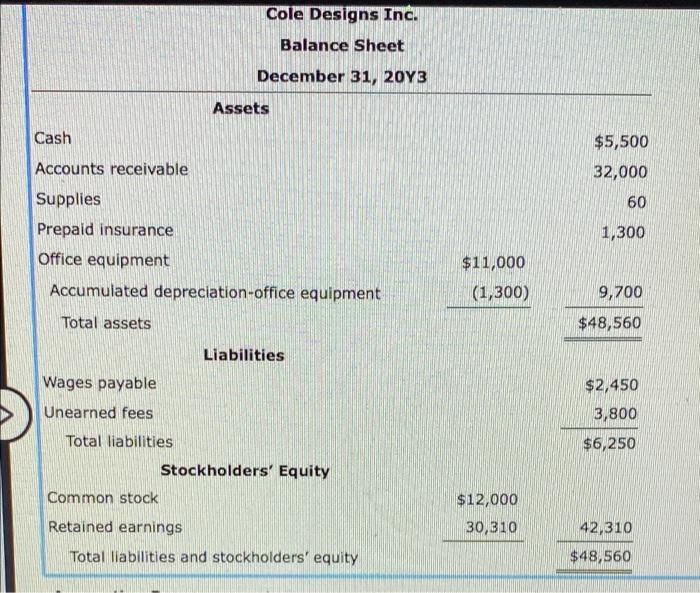

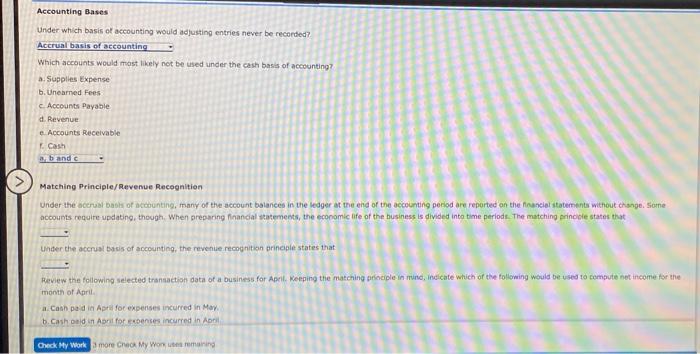

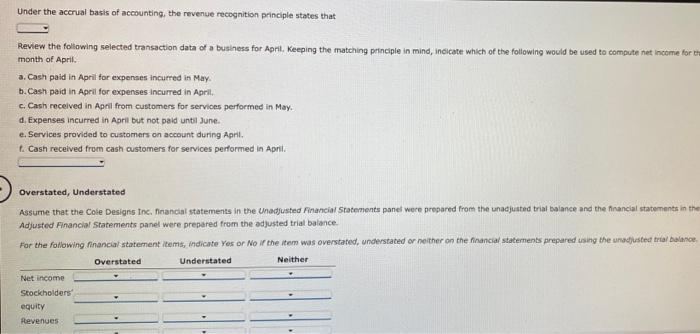

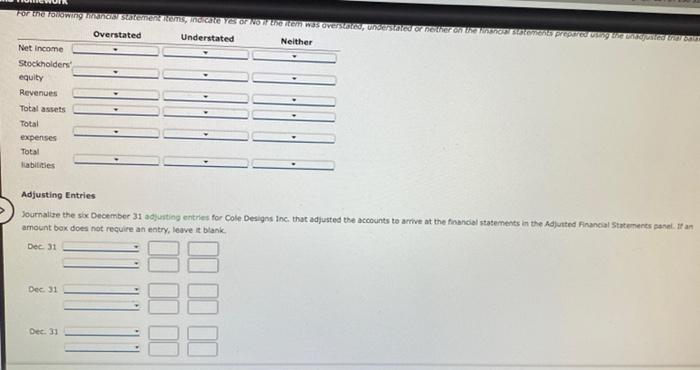

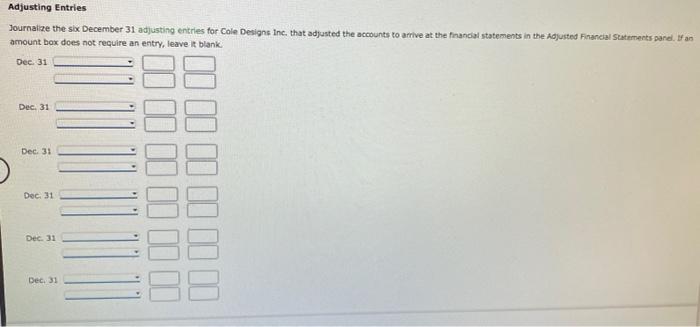

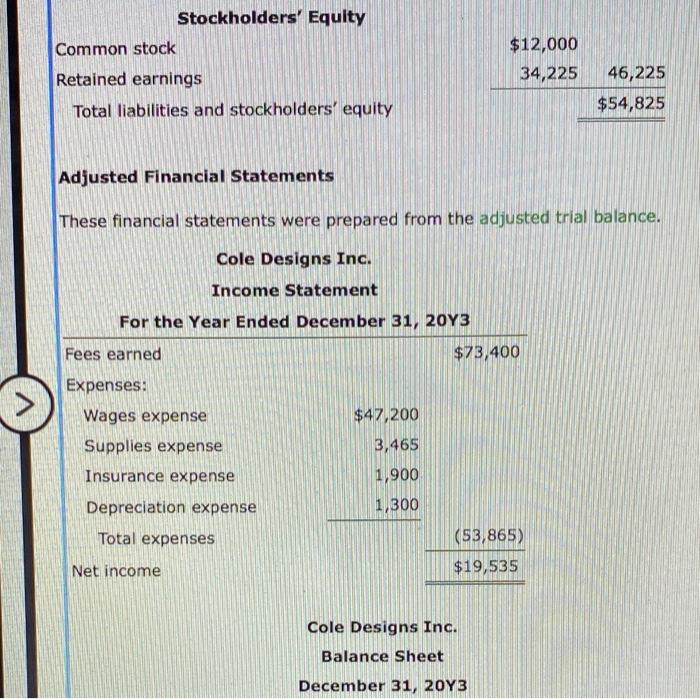

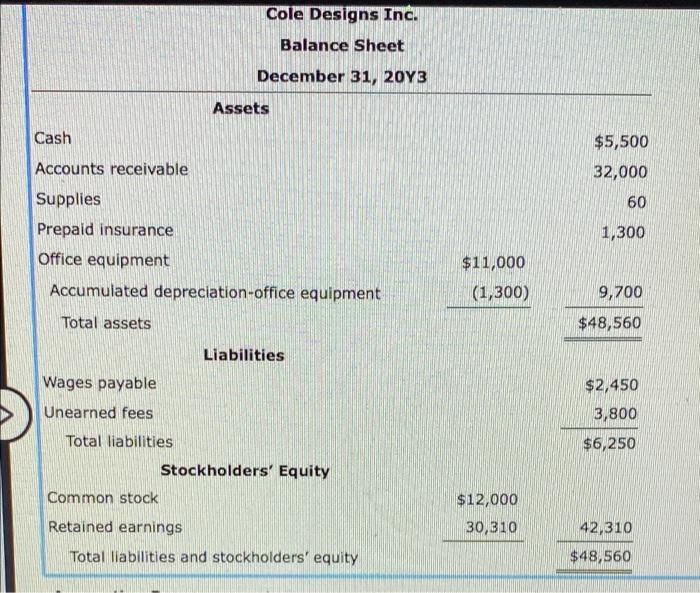

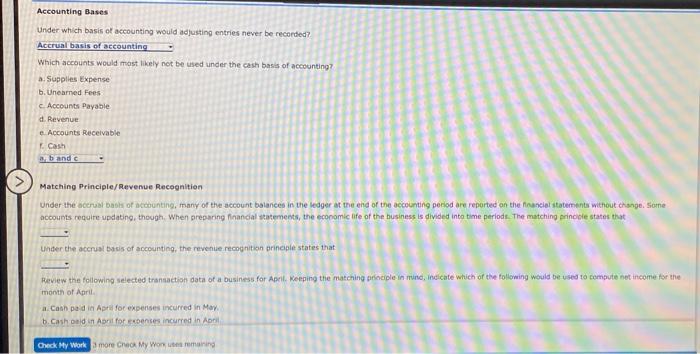

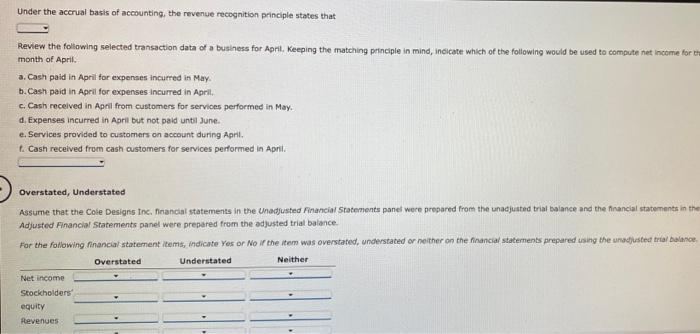

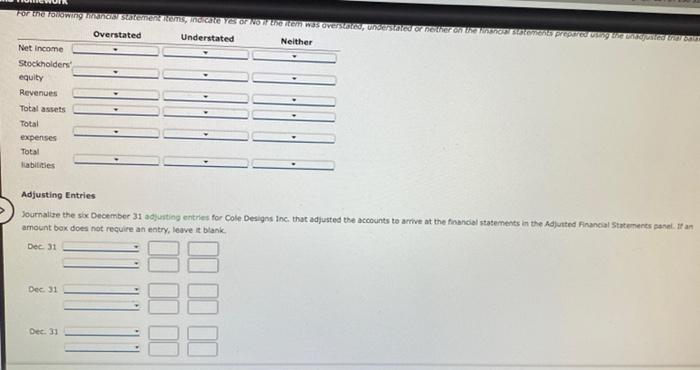

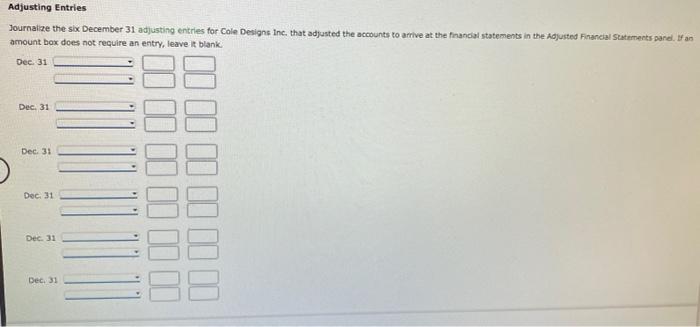

Mastery Problem: The Adjusting Process. Unadjusted Financial Statements These financial statements were prepared from the unadjusted trial balance. Cole Designs Inc. Income Statement For the Year Ended December 31, 20Y3 Fees earned $68,200 Wages expense (44,750) Net income $23,450 Cole Designs Inc. Balance Sheet December 31, 20Y3 Assets Cash Accounts receivable Supplies Prepaid insurance Office equipment Total assets Liabilities Unearned fees Stockholders' Equity $5,500 31,600 3,525 3,200 11,000 $54,825 $8,600 Stockholders' Equity Common stock Retained earnings Total liabilities and stockholders' equity $12,000 34,225 46,225 $54,825 Adjusted Financial Statements These financial statements were prepared from the adjusted trial balance. Cole Designs Inc. Income Statement For the Year Ended December 31, 20Y3 Fees earned $73,400 $47,200 3,465 Expenses: Wages expense Supplies expense Insurance expense Depreciation expense Total expenses 1,900 1,300 (53,865) Net income $19,535 Cole Designs Inc. Balance Sheet December 31, 20Y3 Cole Designs Inc. Balance Sheet December 31, 2013 Assets Cash $5,500 32,000 60 1,300 $11,000 Accounts receivable Supplies Prepaid insurance Office equipment Accumulated depreciation-office equipment Total assets Liabilities Wages payable Unearned fees (1,300) 9,700 $48,560 $2,450 3,800 $6,250 Total liabilities Stockholders' Equity Common stock $12,000 30,310 Retained earnings 42,310 $48,560 Total liabilities and stockholders' equity Accounting Bases Under which basis of accounting would adjusting entries never be recorded? Accrual basis of accounting Which accounts would most likely not be used under the cash basis of accounting? Supplies Expense b. Unearned Fees c Accounts Payable d. Revenue e Accounts Receivable Cash Brands Matching Principle/Revenue Recognition Under the accrual basis of accounting, many of the account balances in the ledger at the end of the accounting period are reported on the nuancial statement without change Store accounts require updating, though. When preparing financial statements, the economic life of the business is divided into time periods. The matching principle states that Under the accrual basis of accounting, the revenue recognition principle states that Review the following selected transaction data of a business for April. Keeping the matching principle in mind, indicate which of the following would be used to compute net income for the month of April a. Conn pa din April for expenses incurred in May b. Cashould in Art for senses incurred in Art Check My Work more Che My Worsmaning Under the accrual basis of accounting, the revenue recognition principle states that Review the following selected transaction data of a business for April, keeping the matching principle in mind, Indicate which of the following would be used to computer net income for ti month of April a. Cash paid in April for expenses incurred in May. b.Cash paid in April for expenses incurred in April. c. Cash received in April from customers for services performed in May. d. Expenses incurred in April but not paid until June. e. Services provided to customers on account during April 1. Cash received from cash customers for services performed in April. Overstated, Understated Assume that the Cole Designs Inc. financial statements in the unadjusted Financial Statements panel were prepared from the unadjusted trial balance and the financial statements in the Adjusted Financial Statements panel were prepared from the adjusted trial balance. For the following financial statement items, indicate Yes or No if the item was overstated, understated or neither on the financial statements prepared using the unadjusted trial balance Overstated Understated Neither Net income Stockholders equity Revenues For the StemCREYES OF He com osoves, Escope.com Overstated Understated Neither Net Income Stockholders equity Revenues Total assets Total expenses Total abilities Adjusting Entries Journalize the six December 31 adjusting entries for Cole Designs Inc. that adjusted the accounts to arrive at the floancial statements in the Adjusted Financial Statements senel. It an amount box does not require an entry, leave it blank Dec 31 Dec 31 Dec. 31 Adjusting Entries Journalize the six December 31 adjusting entries for Cole Designs Inc. that adjusted the accounts to arrive at the financial statements in the Adjusted Financial Statements panel. If an amount box does not require an entry, leave it blank Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 III Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started