Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me! (20 points) 2. As the Assistant to the V.P. of Commercial Loans at Moscow Tennessee's Buzzard's Breath Bank you have been approached

Please help me!

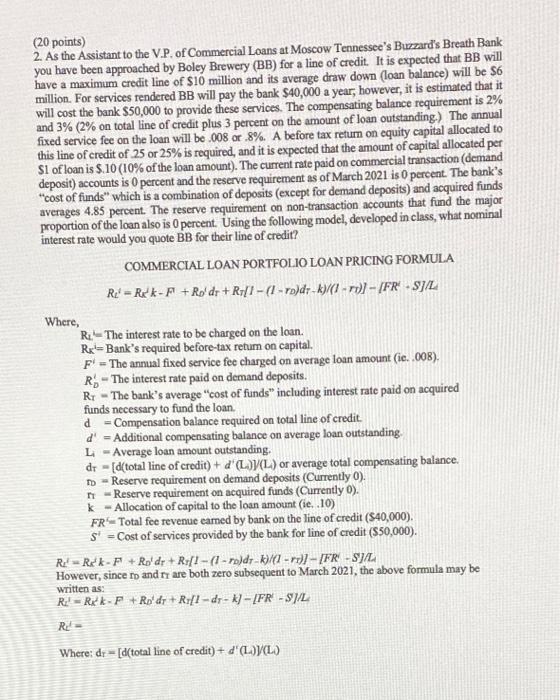

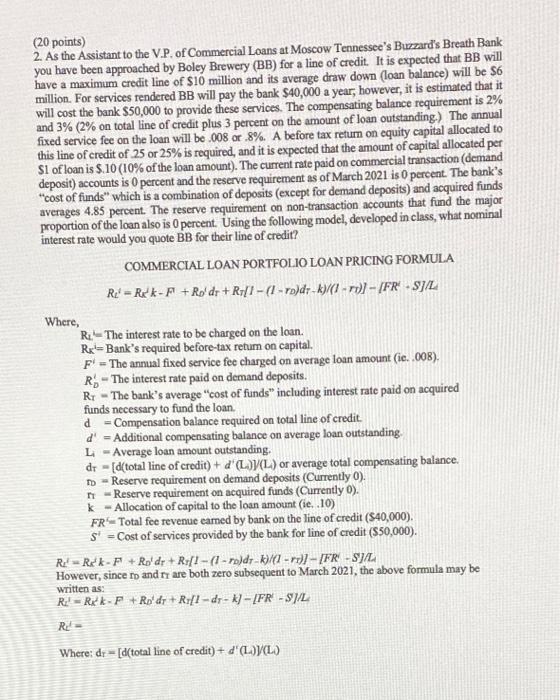

(20 points) 2. As the Assistant to the V.P. of Commercial Loans at Moscow Tennessee's Buzzard's Breath Bank you have been approached by Boley Brewery (BB) for a line of credit. It is expected that BB will have a maximum credit line of $10 million and its average draw down (loan balance) will be $6 million. For services rendered BB will pay the bank $40,000 a year, however, it is estimated that it will cost the bank $50,000 to provide these services. The compensating balance requirement is 2% and 3% (2% on total line of credit plus 3 percent on the amount of loan outstanding.) The annual fixed service fee on the loan will be .008 or 8%. A before tax return on equity capital allocated to this line of credit of 25 or 25% is required, and it is expected that the amount of capital allocated per Sl of loan is $.10 (10% of the loan amount). The current rate paid on commercial transaction (demand deposit) accounts is 0 percent and the reserve requirement as of March 2021 is 0 percent. The bank's "cost of funds" which is a combination of deposits (except for demand deposits) and acquired funds averages 4.85 percent. The reserve requirement on non-transaction accounts that find the major proportion of the loan also is O percent. Using the following model, developed in class, what nominal interest rate would you quote BB for their line of credit? COMMERCIAL LOAN PORTFOLIO LOAN PRICING FORMULA Re' - Rak-M + Rodr + Rr[1 - (1 - rp)dr. k)/(1 - 1)] - [FR'. SJ/L Where, R: The interest rate to be charged on the loan. Rxl-Bank's required before-tax return on capital. F - The annual fixed service fee charged on average loan amount (ie. .008), R- The interest rate puid on demand deposits. R1 - The bank's average "cost of funds including interest rate paid on acquired funds necessary to fund the loan. d - Compensation balance required on total line of credit d' - Additional compensating balance on average loan outstanding L - Average loan amount outstanding. dr - [d(total line of credit) + d'(L)(L) or average total compensating balance. To - Reserve requirement on demand deposits (Currently 0). 11 - Reserve requirement on acquired funds (Currently o). k - Allocation of capital to the loan amount (ie. 10) FR-Total fee revenue earned by bank on the line of credit (840,000). S' - Cost of services provided by the bank for line of credit (550,000). R: Ruk-Fi + Roldp+R:[1- (1-ro)dt-1)/() - r.)) - [FR-SJL However, since mo and I are both zero subsequent to March 2021, the above formula may be written as: R:! Rxk-F + Ro' dr + R {1-dr- k) - [FR - $J/L Re Where: dr [d(total line of credit) + d(L)(L) (20 points) 2. As the Assistant to the V.P. of Commercial Loans at Moscow Tennessee's Buzzard's Breath Bank you have been approached by Boley Brewery (BB) for a line of credit. It is expected that BB will have a maximum credit line of $10 million and its average draw down (loan balance) will be $6 million. For services rendered BB will pay the bank $40,000 a year, however, it is estimated that it will cost the bank $50,000 to provide these services. The compensating balance requirement is 2% and 3% (2% on total line of credit plus 3 percent on the amount of loan outstanding.) The annual fixed service fee on the loan will be .008 or 8%. A before tax return on equity capital allocated to this line of credit of 25 or 25% is required, and it is expected that the amount of capital allocated per Sl of loan is $.10 (10% of the loan amount). The current rate paid on commercial transaction (demand deposit) accounts is 0 percent and the reserve requirement as of March 2021 is 0 percent. The bank's "cost of funds" which is a combination of deposits (except for demand deposits) and acquired funds averages 4.85 percent. The reserve requirement on non-transaction accounts that find the major proportion of the loan also is O percent. Using the following model, developed in class, what nominal interest rate would you quote BB for their line of credit? COMMERCIAL LOAN PORTFOLIO LOAN PRICING FORMULA Re' - Rak-M + Rodr + Rr[1 - (1 - rp)dr. k)/(1 - 1)] - [FR'. SJ/L Where, R: The interest rate to be charged on the loan. Rxl-Bank's required before-tax return on capital. F - The annual fixed service fee charged on average loan amount (ie. .008), R- The interest rate puid on demand deposits. R1 - The bank's average "cost of funds including interest rate paid on acquired funds necessary to fund the loan. d - Compensation balance required on total line of credit d' - Additional compensating balance on average loan outstanding L - Average loan amount outstanding. dr - [d(total line of credit) + d'(L)(L) or average total compensating balance. To - Reserve requirement on demand deposits (Currently 0). 11 - Reserve requirement on acquired funds (Currently o). k - Allocation of capital to the loan amount (ie. 10) FR-Total fee revenue earned by bank on the line of credit (840,000). S' - Cost of services provided by the bank for line of credit (550,000). R: Ruk-Fi + Roldp+R:[1- (1-ro)dt-1)/() - r.)) - [FR-SJL However, since mo and I are both zero subsequent to March 2021, the above formula may be written as: R:! Rxk-F + Ro' dr + R {1-dr- k) - [FR - $J/L Re Where: dr [d(total line of credit) + d(L)(L)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started